Capturing Asset Backed Bond Trades

Navigate to Trade > Fixed Income > Bond to open the Bond Trade window, from the Calypso Navigator or from the Trade Blotter.

Prior to capturing an ABS bond trade, you need to define an ABS bond product.

See Defining Bond Products for details.

See Defining Bond Products for details.

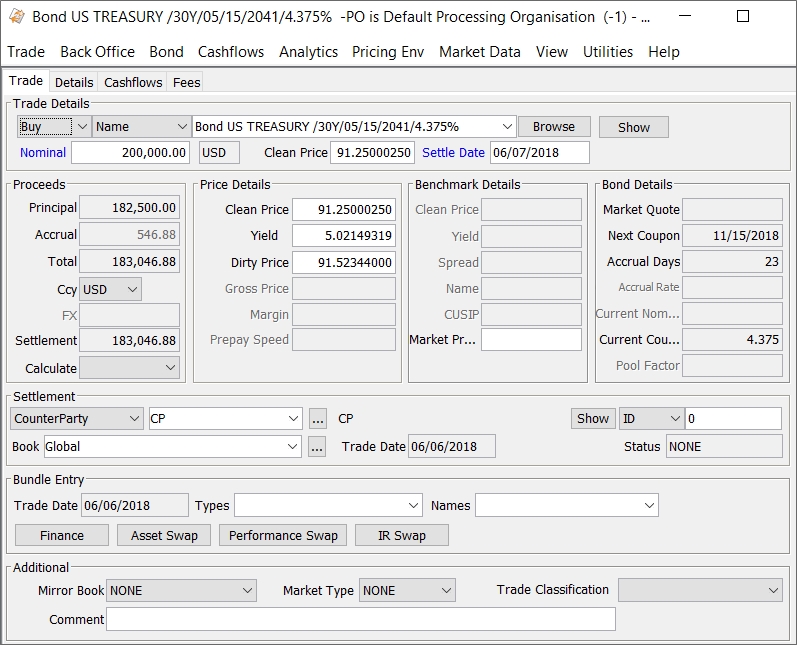

1. Sample Asset Backed Bond Trade

When trading an asset backed bond (ABS bond), the pool factor on the settlement date will appear on the window after pricing as shown below.

Bond Trade Window

See Capturing Bond Trades for complete details on capturing trades.

See Capturing Bond Trades for complete details on capturing trades.

For an ABS bond trade:

| • | The trade amount is the quantity multiplied by the pool factor on the settle date. |

| • | The Accrual (%) is expressed as a 100 basis. It represents the accrual value/pool factor. |

| • | The pricer measures are computed as follows: |

| – | NPV_NET: It computes the NPV without taking the accrual into account. (This can be considered as a “clean” NPV whereas the NPV is a “dirty” one.) |

The NPV calculation takes into account: the accrual with pool factor impact, the factored cost, and the market cost with current factor application.

NPV_NET = (Market Price * Quantity * Pool Factor) - Factored Cost

Where Factored Cost = Quantity * Trade Clean Price * Pool Factor

| – | NPV: The NPV calculation takes into account: the accrual with pool factor impact, the factored cost, and the market cost with current factor application. |

NPV = [(Market Price + Accrual) * Quantity * Pool Factor)] - Dirty Factored Cost

Where Dirty Factored Cost = Quantity * Trade Dirty Price * Pool Factor

| – | PREM_DISC: The Premium Discount calculation takes the Pool Factor into account. |

Premium/Discount = Trade Quantity * (Trade Price - Redemption Price) * Pool Factor

The accrual/amortization of the premium takes into account: the WAL date or the early redemption date, and the pool factor.

Amortization = Premium/Discount * (Val Date - Trade Settle Date) / (Maturity Date - Trade Settle Date)

Where the Maturity Date is calculated using either the WAL Date or the Early Redemption Date.

| – | ACCRUAL: The coupon amount is calculated with using the pool factor. However, if the pool factor is changing during the coupon period, the coupon is calculated by adding the different pool factor periods. All the accrual pricer measures are following the same rules. |

| – | WAL: Average time to receive the principal cashflows of the bond weighted by the individual principal payments. |

2. Book Attributes

By default, accretion (PREM_DISC_YIELD) is calculated using the Retrospective Method, where the original trade yield is retroactively recalculated due to prepayments. This behavior can be modified using book attributes (Calypso Navigator > Configuration > Books & Bundles > Trading Book > Attributes ...):

| • | FixedBondAccretion – Allows specifying how to calculate the yield and cashflows used for accretion for fixed rate BondAssetBacked products. If set to ContractualToMaturity, the original accretion trade yield is calculated based on the original trade price and trade settle date, and this original yield will not change over time. The projected accretion cashflows are calculated using the standard mortgage constant payment formula based on the original contractual maturity date and the coupon rate, ignoring all prepayment assumptions and external cashflows. |

If set to Default or not set, the default Calypso behavior is used. Note that pricing behavior is not affected by this book attribute.

| • | FloatingBondAccretion – Allows specifying how to calculate the yield and cashflows used for accretion for floating rate BondAssetBacked products. If set to ProspectiveToMaturity, the current accretion yield is calculated by setting the present values to match between the previous accretion yield and the new index rates. The projected accretion cashflows are calculated using the standard mortgage constant payment formula based on the original contractual maturity date and the index rate, ignoring all prepayment assumptions and external cashflows. |

If FloatingBondAccretion is set to Default or not set, the default Calypso behavior is used. Note that pricing behavior is not affected by this book attribute.

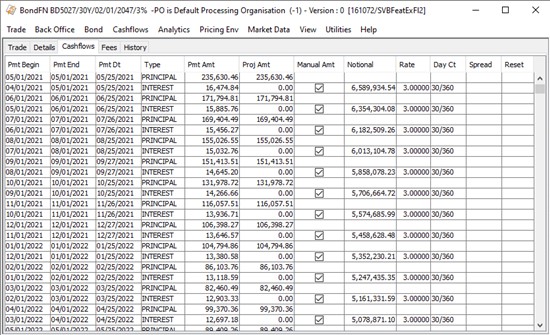

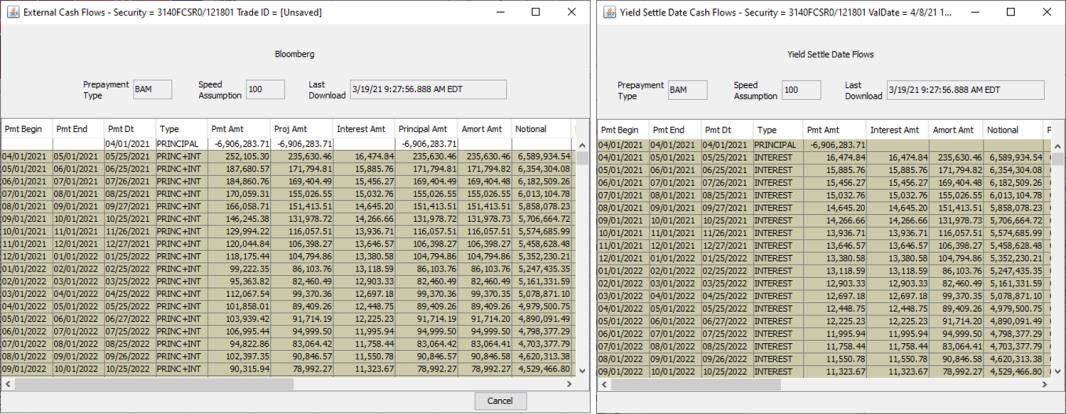

3. External Cashflows

When using external cashflows, the full forecasted Bloomberg cashflow schedule is integrated into Calypso. This includes future principal and interest payments based on the requested prepayment type and speed.

The trade cashflows, external flows and yield settle date flows will now display the same consistent cashflows (BAM 100 prepayments).

Additional updates based on later requests will update the cashflows to either the known (historical) cashflows and/or update the forecasted cashflows based on new prepay assumptions.

3.1 Analytics and Positions

When using external cashflows, analytics and downstream processes will use the external cashflows.

Pricer measures are calculated based on the forecasted external cashflows. This includes, but is not limited to, WAL, PV, NPV, BOOK_VALUE, MARKET_VALUE and PREM_DISC_YIELD.

Position based analyses and reports use forecasted external cashflows.

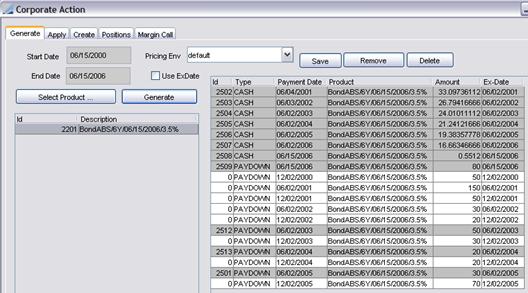

4. Paydown Corporate Actions

The Corporate Action type PAYDOWN renders the pool factor change. It is generated through the standard Corporate Action process. It impacts the position and generates realized P&L.

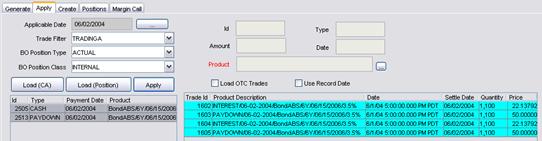

To generate the Corporate Actions, navigate to Trade Lifecycle > Corporate Action > Corporate Action.

| » | Enter a start date and end date. |

| » | Click Select Product to select a product. |

| » | Click Generate to generate the corporate actions for the selected dates and product. |

PAYDOWN corporate actions are generated for the notional and CASH corporate actions are generated for the coupons.

| » | Then select the Apply panel to apply the corporate actions to the product position. |

The generated CA trades have an impact on both the realized P&L (see the Position report) and the cashflows (see the Back Office Position report, Cash panel).

When the position of an ABS bond is sold after the CA has been run for paydown and coupon, the paydown is incorrectly reversed. In order to consider the CA paydown record date as inclusive, you need to add the following value to the domain CA_PAYDOWN_RECORD_DATE_INC:

Value = recordDateInclusive

Comment = true

In this case, the CA paydown is not reversed as the record date is inclusive. The domain is empty by default (CA paydown record date is not inclusive).

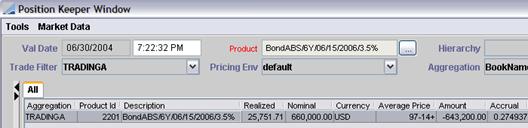

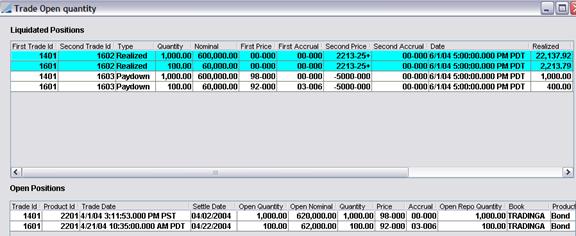

4.1 Position Report

If you double-click a row, you can see the details of the realized P&L as shown below.

You can see that the paydowns actually impact the realized P&L.

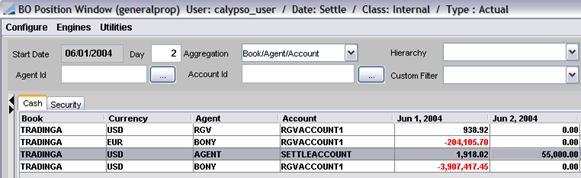

4.2 Back Office Position Report

| » | Double-click a cell to see the details. |

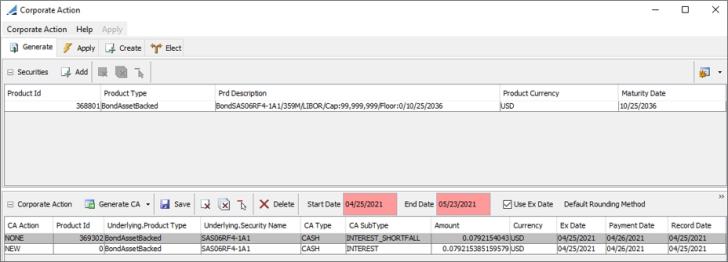

5. Shortfall Reimbursement Corporate Actions

The Corporate Action types PRINCIPAL_REIMBURSE, PRINCIPAL_SHORTFALL, INTEREST_REIMBURSE, and INTEREST_SHORTFALL are generated through the standard Corporate Action process.

To generate the Corporate Actions, navigate to Trade Lifecycle > Corporate Action > Corporate Action.

| » | Enter a start date and end date. |

| » | Click Add to select a product. |

| » | Click Generate CA to generate the corporate actions for the selected dates and product. |

The corporate actions produced by the Shortfalls and Reimbursements are as follows:

INTEREST_SHORTFAL: MODEL=CASH | SUBTYPE=INTEREST_SHORTFALL

INTEREST_REIMBURSE: MODEL=CASH | SUBTYPE=INTEREST_REIMBURSE

PRINCIPAL_SHORTFAL: MODEL=CASH | SUBTYPE=PRINCIPAL _SHORTFALL

PRINCIPAL_REIMBURSE: MODEL=CASH | SUBTYPE=PRINCIPAL _REIMBURSE

| » | Then select the Apply panel to apply the corporate actions to the product position. |

6. Accounting Events

The accounting event PAYDOWN_PL renders the realized P&L on paydowns.