Capturing Variance Swap Trades

You can capture the following swaps using the Variance Swap worksheet: Variance, Volatility, Weighted Variance (Gamma), Conditional Variance.

A variance swap is an OTC contract whose value at maturity is based on the realized volatility experienced by the underlying. The underlying can be an Equity or an Equity Index. Pricing is based on implied volatility levels found in relevant listed option prices. There is no up-front premium for the Variance Swap and it is cash settled.

Typically, the investor specifies:

| • | The underlying security (e.g., S&P 500 Index) |

| • | The tenor of the swap (e.g., “1year” or “June 2004 listed options expiration”) |

| • | The desired amount of volatility exposure of the swap in currency units per volatility point (e.g., "$100,000 per volatility point”). This number represents the variance swap’s approximate sensitivity to volatility. This “Value per Volatility Point” is sometimes referred to as VEGA NOTIONAL or VEGA AMOUNT. |

The dealer makes a market in volatility terms (e.g., 22.5 bid, 24.0 ask).

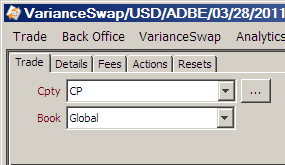

From the Trade Blotter or from Calypso Navigator, select Trade > Equity > Variance Swap to open the Variance Swap worksheet.

|

Variance Swap Quick Reference

When you open a worksheet, the Trade panel is selected by default. Underlying Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below, see Field Description. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also press F3 to save the current trade as a new trade, or choose Trade > Save As New. The title bar of the Trade Worksheet then changes to include the Trade Description and the assigned Trade ID, and trade's status is modified according to the workflow configuration. Pricing a Trade

Trade Lifecycle

You can fix prices that are specific to the current trade, only from the Resets tab in the trade window.

|

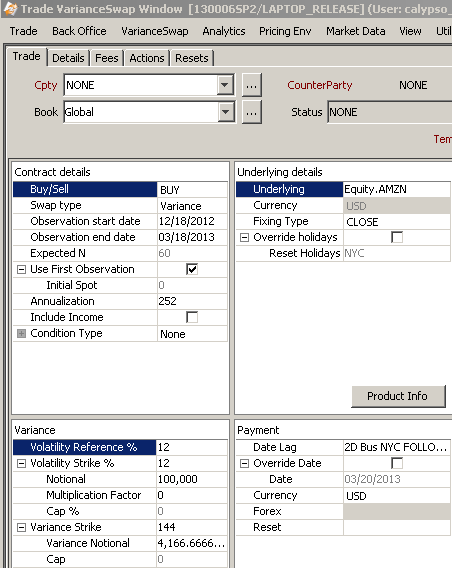

1. Sample Variance Swap Trade

Variance Swap Trade Window - Sample Trade

| » | Enter the fields described below as needed. |

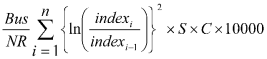

1.1 Payoff Formulas

The payoff for the following swaps equals:

Notional * ( Min ( Payoff, Cap ) -  ) * PO,

) * PO,

Notional equals Variance Notional for all swaps except Volatility

Kv = Variance Strike for all swaps except Volatility

Where PO (Percentage Occurrences) and Payoff equals the following:

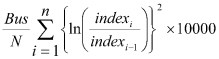

Variance Swap

A Variance Swap payoff is:

Where:

N = number of observations

n = number of returns

Bus = is the number of business days in the year (typically 252)

PO = 1

Volatility Swap

A Volatility Swap payoff equal to the sqrt(Variance Swap Payoff)

PO = 1

Notional = Volatility Notional

Strike = Volatility Strike

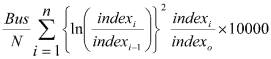

Weighted Variance (Gamma) Swap

A Gamma Swap payoff is:

Where,

= the value of the underlying at the outset of the swap.

= the value of the underlying at the outset of the swap.

PO = 1

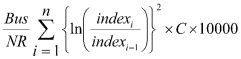

Conditional Variance Swap

A conditional Variance Swap payoff is:

Where:

C = 1 if Condition is met else 0

NR = number of returns that have a Condition of 1 (Condition Met)

PO = NR / N

All of these payoffs can be represented using a generalized Variance Payoff:

Where:

S = is a constant

Given this generalized payoff, a Vanilla Variance Swap can be represented with:

S = 1

C = 1

A Gamma Swap can be represented with:

S =

C = 1

A Conditional Variance Swap can be represented with:

S = 1

C = 1 if Lower <= indexi-1<= Upper, else zero.

1.2 Fields Description

Trade Details

| Fields | Description |

|---|---|

|

Role/Cpty |

The first two fields in the worksheet identify the trade counterparty. You can select a legal entity of specified role from the first field provided you have setup favorite counterparties. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Alternatively, double-click the Cpty label to set the list of favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. The second field identifies the trade counterparty’s role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. Alternatively, double-click the CounterParty label to change the role. |

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Alternatively, double-click the Book label to set the list of favorite books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

ID Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference of external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. The dates will be saved as relative in the trade template only if the dates were entered as tenors. Observation start date should be a tenor compared to the val date. Observation end date should be a tenor compared to the observation start date. Payment date should be a tenor compared to the observation end date (defined in date lag). An automatic roll convention of FOLLOWING will be applied on the Observation Start Date and Observation End Date. The calendar used for the roll is the same as the calendar of the underlying Exchange. |

Contract Details

| Fields | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Buy / Sell |

Select either Buy or Sell to indicate whether the book is the buyer or seller of the variance trade. |

||||||||||||

|

Swap Type |

Select the type of swap: Variance, Weighted Variance (Gamma), or Volatility. |

||||||||||||

|

Observation Start Date |

Enter the first date on which the underlying is observed or fixed. |

||||||||||||

|

Observation End Date |

Enter the last date on which the underlying is observed or fixed. |

||||||||||||

|

Expected N |

Displays the expected number of observation days. |

||||||||||||

|

Use First Observation |

By default, the price on the first observed date is used. You can clear the "Use First Observation" checkbox and enter the initial price in the Initial Spot field. |

||||||||||||

|

Annualization |

Enter the number of business days in a year to calculate the annualized volatility. Default is 252. |

||||||||||||

|

Include Income |

This checkbox only applies to Equity and Equity Index underlyings. When you check the “Include Income” checkbox, the dividends are included in the calculation of the daily return. The dividend, if any, is displayed in the Income column of the observation schedule. |

||||||||||||

|

Condition Type |

You can select a condition type to include observations.

|

Variance Details

| Fields | Description |

|---|---|

|

Volatility reference (%) |

The volatility reference is used to computed the vega notional (or volatility exposure). The amount of volatility exposure in currency units per volatility point. VEGA_NOTIONAL = NOTIONAL / 2 * Volatility Reference = 100 000 / 2*27 = 1851,85 |

|

Volatility Strike (%) |

The volatility strike is the fixed level against which the payout is computed: Payout = Notional Amount x (VOLRealised 2 – VOLStrike2) Volatility Strike (%) Enter the strike volatility. This is a percentage value. Notional Enter the notional – This number represents the variance swap’s approximate exposure to volatility. Expressed as currency units per volatility point. The number of decimal points depends on the payment currency. Multiplication Factor Enter the factor for arriving at the cap value. Cap % Volatility Cap = Volatility Strike * Multiplication Factor |

|

Variance |

Ⓘ [NOTE: Disabled for Volatility Swap] Variance Strike Displays the volatility strike squared. Modifying this field re-computes the Volatility Strike %. Variance Strike = (Volatility Strike)^2 Variance Notional Displays the notional amount for the variance swap. The payout is linked to this amount. Modify as needed and it will recompute the volatility notional. Variance Notional = Volatility Notional / (2 * Volatility Strike) Cap The volatility cap squared. Variance Cap = (Volatility Cap) ^2 |

Underlying Details

| Fields | Description |

|---|---|

|

Underlying |

Select the underlying: It can be an equity or an equity index. You can also type in the underlying's name. You can click Product Info to view the details of the underlying. |

|

Currency |

Displays the currency of the underlying. |

|

Fixing Type |

Select the fixing type. If the underlying allows special quotes, you can select the corresponding fixing type. |

|

Override Holidays |

Select to override the default reset holiday calendar. You can enter the reset holiday in the Reset Holidays field. |

Payment Details

| Fields | Description | ||||||

|---|---|---|---|---|---|---|---|

|

Date Lag |

Enter the number of days between the forward date and the actual payment date. |

||||||

|

Override Date |

Check to override the payment of the realized volatility. You can enter the date in the Date field. |

||||||

|

Currency |

Select the settlement currency. |

||||||

|

Forex FX Reset Fixed Rate |

Select the type of FX rate you want to use if the settlement currency is different from the underlying currency:

For Baskets, it is the type of FX rate set at the component level. FX Rate Definitions are created using Calypso Navigator > Configuration > Foreign Exchange > FX Rate Definitions. |

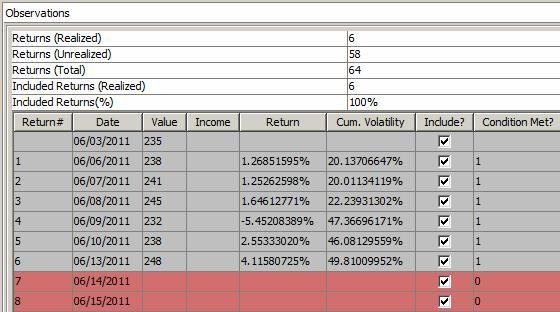

Observations Details

The observation schedule is generated between the observation start and end dates. It displays the observed prices of the underlying product and the values calculated from it.

Observations panel

| Fields | Description |

|---|---|

|

Returns (Realized) |

Number of realized returns (underlying quotes are fixed). |

|

Returns (Unrealized) |

Number of unrealized returns. |

|

Returns (Total) |

Total number of returns. |

|

Included Returns (Realized) |

Number of included realized returns. |

|

Included Returns(%) |

Percentage of included returns with respect to the total number of returns. |

|

Return# |

Return number given by the system. |

|

Date |

Observation date. |

|

Value |

Price / quote Prices are set using Calypso Navigator > Trade Lifecycle > Reset > Price Fixing or you can set prices on the trade using "product menu" > Specific Resets. The Value includes dividends if you select the “Include Income?” checkbox in the trade details. |

|

Income |

When you check the “Include Income” checkbox, the Income column displays any dividend amount attached to the underlying product. |

|

Return Weighted Return |

Percentage of return / weighted return over the initial price |

|

Cum. Volatility Weighted Cum. Volatility |

Cumulative volatility / weighted volatility to date |

|

Include? |

All dates are included by default. You can clear the Include? checkbox to remove an observation date. If an observation date is excluded and the valuation date equals the excluded observation date, when the trade is priced, the spot price is applied to the row immediately preceding the excluded date. |

|

Condition Met? |

1 if there is no condition or the condition is met, or 0 otherwise. |

2. Actions Panel

In the Actions panel, you can view the implications of split corporate actions that are applied to the underlying Equity or Equity Index.

| » | You can select an action and click Details to view the details of the Corporate Action. |

| » | You can select an action and click Following to view the trade version after the selected action. The corresponding trade window will be opened. |

Please refer to Calypso Analytics Library (Calib) documentation for details.

Please refer to Calypso Analytics Library (Calib) documentation for details.