Capturing Variance Option Trades

A variance option is an option on a variance swap.

You can capture options on Variance swaps using the Variance Option worksheet.

The payoff of a Variance Option is:

| • | Call = max ( min (Variance Cap,Realized Variance) - Strike Variance , 0 ) * Notional |

| • | Put = max ( Strike Variance – min(Realized Variance,cap), 0 ) * Notional |

Variance Options:

| • | Are always cash-settled. |

| • | The payment can lag from the observation end date. |

| • | Have an initial premium typically paid to the option seller. |

The option premium can be entered as follows:

| • | Absolute amount. |

| • | In units of variance or volatility notional, example 3.1% volatility notional equals 3.1 * the volatility notional. |

Choose Trade > Equity > Variance Option to open the Variance Option worksheet, from Calypso Navigator or from the Trade Blotter.

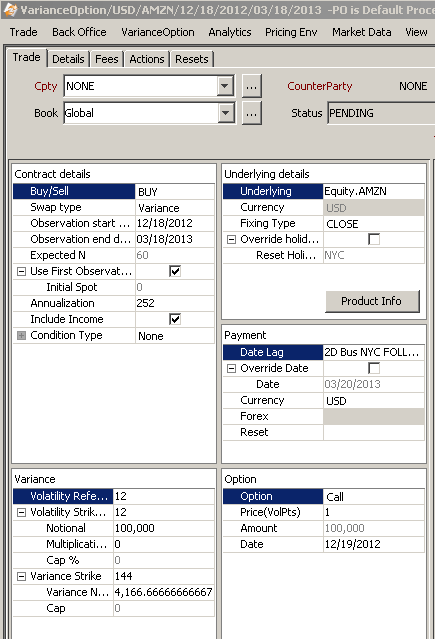

Variance Option Trade Window - Sample Trade

| » | Enter the variance swap details as needed. |

See Variance Swap for details.

See Variance Swap for details.

| » | Then specify the option details described below as needed. |

Option Details

| Fields | Description |

|---|---|

|

Option |

Select a Put or a Call on the realized variance over some time period T. The maturity date of the option is aligned with the end date of the variance period since the final payoff is known at that time. |

|

Price (VolPts) |

Enter the units of variance or volatility notional. For example, enter 3.1 for 3.1% volatility notional. The premium amount is 3.1 * the volatility notional. |

|

Amount |

Trade notional. |

|

Date |

Premium date. |