Capturing Equity Trades

Choose Trade > Equity > Equity/ADR to open the Equity worksheet, from Calypso Navigator or from the Trade Blotter.

|

Equity Quick Reference

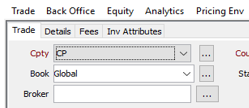

When you open a trade worksheet, the Trade panel is selected by default. Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also press F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

Trade Lifecycle

|

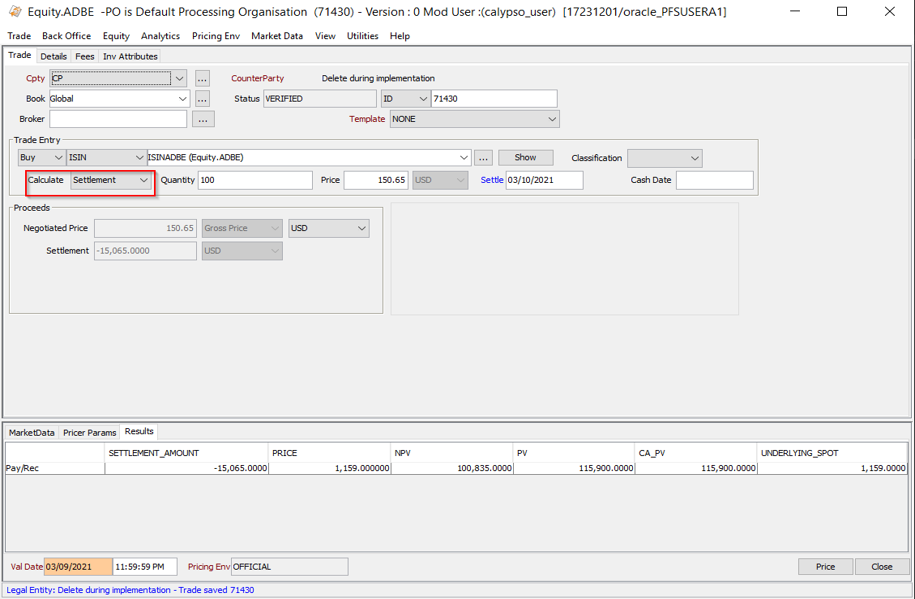

1. Sample Equity Trade

| » | Enter the fields described below as needed. |

Trade Details

| Fields | Description |

|---|---|

|

Role/Cpty |

The first two fields in the worksheet identify the trade counterparty. You can select a legal entity of specified role from the first field, provided you have setup favorite counterparties. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Alternatively, double-click the Cpty label to set the list of favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. The second field identifies the trade counterparty's role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. Alternatively, double-click the Counterparty label to change the role. |

| Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Alternatively, double-click the Book label to set the list of favorite books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

ID Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference or external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panels of the trade worksheet. |

|

Template |

You can select a Template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. |

|

Broker |

Select a legal entity of role Broker as needed. It adds a fee of type BRK to the Fees panel. Please select the Fees panel to modify the fee as needed. |

Trade Entry Details

| Fields | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Buy / Sell |

Select Buy or Sell, the direction of the trade from the book’s perspective. |

|||||||||

|

Product code Product description |

You can select an equity using one of the following methods:

The system searches all the equities defined in the system, and those that satisfy the request are displayed in a list. Select an equity from the list. Note that the product code defaults to the Security Code selected in the User Defaults.

Once you have selected an equity, you can click Show to view the equity product details in the Equity Product window. Disabling the Product Code Search You can disable the product code search for performance reasons. To do so, add domain “EquityAttributes” with: Value = NOT_LOAD_EQUITY_SELECTOR_CACHE In this case, you need to use the Product Chooser Window to select a product. |

|||||||||

| Classification |

You can select a classification for the trade as applicable. This classification is for information purposes only. It is stored in the trade keyword "TradeClassification", and available values can be set in domain keyword.TradeClassification. It can be used in filters to filter trades for various processes, and can be viewed in reports throughout the system. |

|||||||||

|

Quantity |

Enter the quantity that is traded. |

|||||||||

|

Price |

Displays the price from the pricing environment if any. You can modify the price as needed. |

|||||||||

|

Calculate |

The dropdown consists of below 3 values to choose from. Default would be 'Settlement':

|

|||||||||

|

Trade Currency |

Defaults to the equity’s currency. |

|||||||||

|

Settle |

The settlement date defaults to the trade date. If you change the trade date, double-click the Settle Date label to update the settlement date accordingly. |

|||||||||

|

Cash Date |

This field is used for certain markets, like the Russian market, where the settle date of the cash can be different from the delivery date of the stock. Two situations are possible:

Defining a cash date on the trade will impact the transfers but no other areas of the trade. Settle date and Cash Date are not synchronized. |

Proceeds Details

| Fields | Description |

|---|---|

|

Negotiated Price |

Enter the negotiated price, and select the type of negotiated price from the adjacent field. The field adjacent to the price type is the trade currency. It defaults to the product currency. You can select a different trade currency. In this case, you can enter the FX rate between the product currency and the trade currency. See Settlement below. |

|

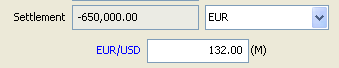

Settlement |

Displays the settlement amount and the settlement currency. The settlement currency defaults to the trade currency. If the trade currency is different from the product currency, you cannot modify the settlement currency. If the trade currency is the same as the product currency, you can select a different settlement currency. In this case, you can enter the FX rate between the trade currency and the settlement currency. You can double-click the currency pair label to get the rate from the quote set if any.

|

2. Trading ADRs

ADRs are traded as standard equities using Trade > Equity > Equity.

The specificity of ADR trades though is that the ADR product can be transformed into the underlying equity, and switched back to the ADR. This is done using a specific corporate actions window.

The ADR Corporate Actions window is not enabled by default.

2.1 Enabling ADR Corporate Actions

If not already enabled, do the following to enable the ADR Corporate Actions window.

1. Add CAADR to the productType domain.

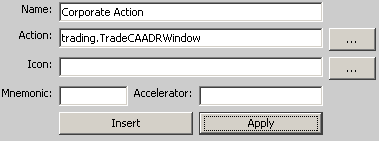

2. Choose Calypso Navigator > Utilities > Main Entry Customizer and insert the following menu item under the Trade > Equity menu as shown below.

| » | The Action is “trading.TradeCAADRWindow” and the Name “Corporate Action”. |

| » | Click Apply, then click Save, and restart Calypso Navigator. |

2.2 Transforming ADR Trades

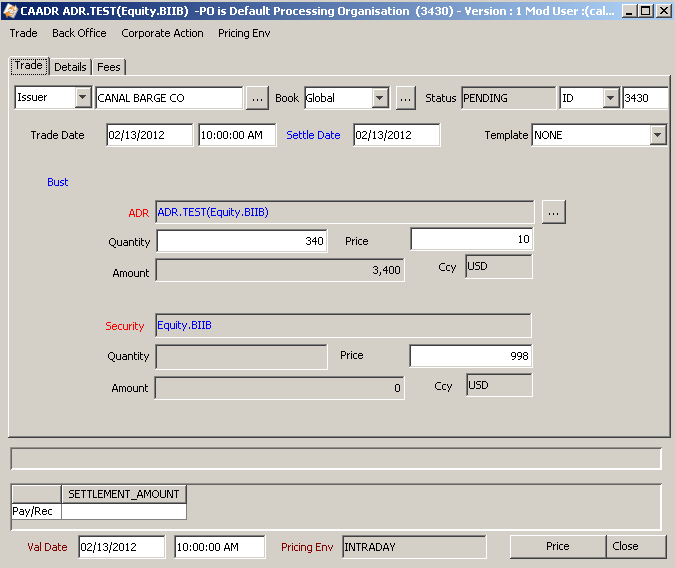

Choose Trade > Equity > Corporate Action to transform ADR trades as shown below.

ADR Corporate Action Window

| » | Enter the fields described below as needed, then choose Trade > Save. |

Fields Details

| Fields | Description | ||||||

|---|---|---|---|---|---|---|---|

|

Role |

Select a legal entity role; "Issuer" is selected as the default role. Additional legal entity roles can be defined in the ADR.conversion.AgentRole domain.

|

||||||

|

Legal Entity |

Select a Legal Entity of the selected role. |

||||||

|

Book |

Select a Book. Click ... to configure the books available in the drop-down menu. |

||||||

|

Status |

Current status of the trade. |

||||||

|

ID Ext Ref Int Ref |

You can enter an ID, external reference, or internal reference to load a trade. |

||||||

|

Trade Date |

Enter the trade date. |

||||||

|

Settle Date |

Enter the settle date. |

||||||

|

Template |

You can select a temple from the drop-down menu. |

||||||

|

Create / Bust |

Direction of the transformation. Double-click the Create label to change to Bust as applicable.

|

||||||

|

ADR |

Click ... to open the Product Chooser window for selecting an ADR. Help is available from that window. You can double-click the ADR label to display the ADR's details. |

||||||

|

Quantity |

Enter the quantity of ADR that you are transforming. |

||||||

|

Price |

Enter the unit price of the ADR. |

||||||

|

Amount |

The amount is calculated as quantity * price. |

||||||

|

Ccy |

Displays the currency of the selected ADR. |

||||||

|

Security |

The underlying equity of the selected ADR is displayed. |

||||||

|

Quantity |

The quantity is calculated based on the ADR’s ratio and quantity. |

||||||

|

Price |

Enter the unit price of the underlying equity. |

||||||

|

Amount |

The amount is calculated as quantity * price. |

||||||

|

Ccy |

Displays the currency of the underlying equity. |

See also -

See also -