Capturing Equity Forward Trades

An Equity Forward transaction is an Over-the-Counter (OTC) trade between two parties to buy or sell an asset at a specified price on a forward date. The underlying can be an equity, an equity index, or a basket.

An Equity Forward can be settled in cash or physical:

| • | Cash settlement requires the user to specify a “fixing” to determine the settlement amount. The fixing is observed on the forward date. |

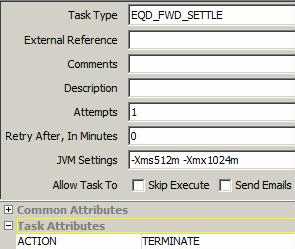

| • | Physical settlement requires the exchange of securities, versus cash, on the payment date. The physical settlement is computed through the scheduled task EQD_FWD_SETTLE which creates the actual equity trade. |

Choose Trade > Equity > Equity Forward to open the Equity Forward worksheet, from Calypso Navigator or from the Trade Blotter.

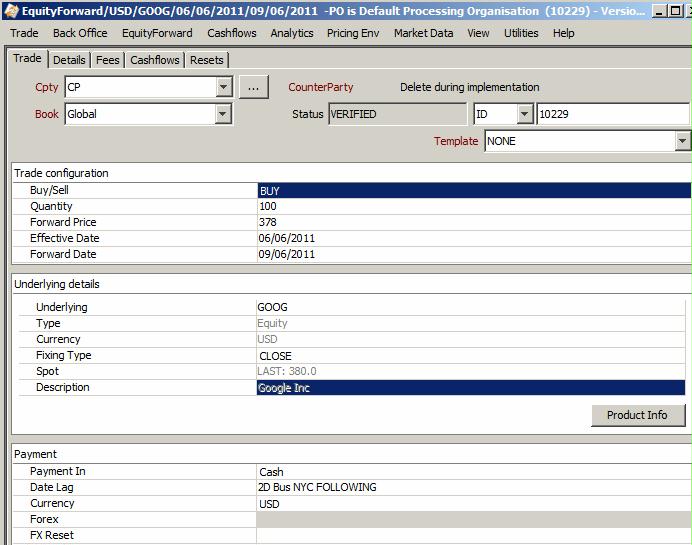

|

Equity Forward Quick Reference

When you open a trade worksheet, the Trade panel is selected by default. Underlying Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below, see Field Description. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also press F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

Trade Lifecycle

|

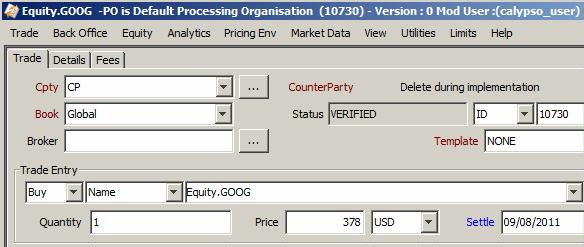

1. Sample Trade

Equity Forward Trade Window - Sample Cash Trade

| » | Enter the fields described below to capture an equity forward trade. |

1.1 Fields Details

Trade Details

| Fields | Description |

|---|---|

|

Role/Cpty |

The first two fields in the worksheet identify the trade counterparty. You can select a legal entity of specified role from the first field provided you have setup favorite counterparties. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Alternatively, double-click the Cpty label to set the list of favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. The second field identifies the trade counterparty’s role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. Alternatively, double-click the CounterParty label to change the role. |

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Alternatively, double-click the Book label to set the list of favorite books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

ID Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference of external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. |

Trade Configuration Details

| Fields | Description |

|---|---|

|

Buy/Sell |

Select the direction of the trade from the book's perspective: BUY or SELL. |

|

Quantity |

Enter the number of units of the underlying. For Baskets, it is the quantity specified at the component level. |

|

Forward Price |

Enter the agreed upon forward price. For Baskets, the Forward Price is set at the component level. Click Product Info to set the Forward Price for each component.

|

|

Effective Date |

Enter the effective date. |

|

Forward Date |

Enter the forward date. |

Underlying Details

| Fields | Description |

|---|---|

|

Underlying |

Select the underlying: It can be an equity, an equity index or a basket. You can also type in the underlying's name. Ⓘ [NOTE: Only baskets weighted in quantity are supported] You can click Product Info to view the details of the underlying. |

|

Type |

Displays the type of underlying. |

|

Currency |

Displays the currency of the underlying. |

|

Fixing Type |

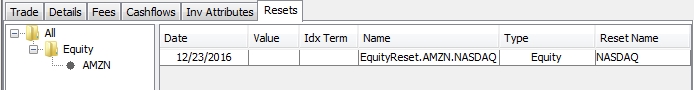

Select an equity reset as needed. Equity resets are defined in the Equity Definition or Equity Index Definition. If not selected, the default is CLOSE, indicating that the fixing is done using the spot quote. You can view details about equity resets in the Resets panel.

Ⓘ [NOTE: For baskets, the only supported fixing type is "CLOSE"] |

|

Spot |

Displays the spot price retrieved from real-time quotes. |

|

Description |

Displays the name of the underlying. For a baskets, it displays the number of components in the basket. |

Payment Details

| Fields | Description | ||||||

|---|---|---|---|---|---|---|---|

|

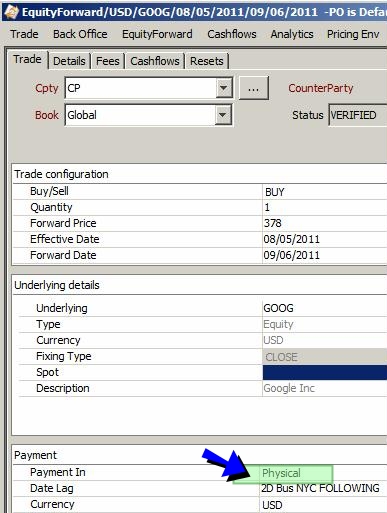

Payment In |

Select the settlement type: Cash or Physical. Ⓘ [NOTE: Physical can only be selected for Equity underlyings]

|

||||||

|

Date Lag |

Enter the number of days between the forward date and the actual payment date. |

||||||

|

Currency |

Select the settlement currency for cash settlement. |

||||||

|

Forex FX Reset Fixed Rate |

Select the type of FX rate you want to use if the settlement currency is different from the underlying currency:

For Baskets, it is the type of FX rate set at the component level. FX Rate Definitions are created using Calypso Navigator > Configuration > Foreign Exchange > FX Rate Definitions. |

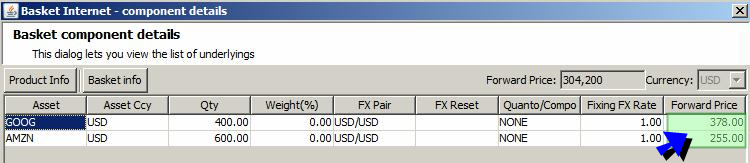

1.2 Basket Components

When you select a basket as the underlying instrument, you can click Product Info to view the basket components.

Basket Components Details

| » | You can set the forward price for each component. |

| » | You can click Basket info to bring up the Basket Definition window - Help is available from that window. |

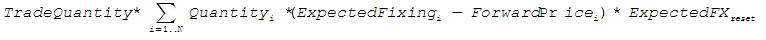

1.3 Pricing

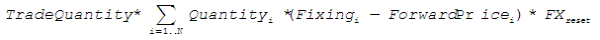

A MTM methodology based on the Underlying Stock/Basket’s theoretical Forward level is used. The final payoff is equal to:

In a MTM approach, the NPV is equal to the discounted present value of such payment, which is equal to:

where,

| • | ExpectedFixingi – Forward level of the of the ith component to the Fixing Date. |

| • | ExpectedFXreset – Forward level of the FXreset to the Fixing Date (if any). |

2. Settlement Process

The settlement process depends on the type of settlement: Cash or Physical.

2.1 Cash Settlement

Enter the fixing on the forward date using Calypso Navigator > Trade Lifecycle > Reset > Price Fixing.

Price Fixing Window - Prices panel

| » | Set the price in the Prices panel, then click Save. |

| » | Then select the Trade Flows panel to apply the fixing to the cashflows. |

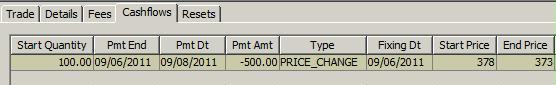

Equity Forward Trade Window - "Fixed" cashflow

The settlement amount is computed using the following formulas:

Forward Payment for equity and equity index = Trade Quantity * (Fixing - Forward Price) * FX rate

The FX rate only applies if the underlying currency is different from the payment currency, on the fixing date.

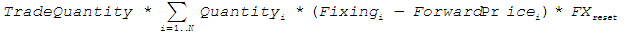

Forward Payment for basket =

where,

| • | TradeQuantity – Number of baskets in the trade. |

| • | Quantityi – Number of shares of the ith component. |

| • | Fixingi – Observed level of the the ith component. |

| • | Forward Pricei – Agreed upon price of the ith component. |

| • | FXreset – FX rate between the component currency and payment currency on the fixing date if any. |

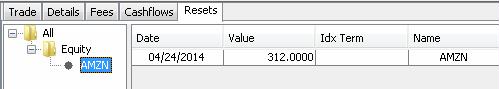

You can view the price fixing, if any, in the Resets panel of the trade.

2.2 Physical Settlement

You need to run the scheduled task EQD_FWD_SETTLE to perform the physical settlement.

The scheduled task terminates the equity forward trade on the payment date (forward date + payment lag) and generates an equity trade.

Sample Physical Trade

Equity Forward Trade Window - Sample Physical Trade

Scheduled Task EQD_FWD_SETTLE

| » | Make sure to select a trade filter that contains the equity forward trades, a pricing environment, and an action to be applied. |

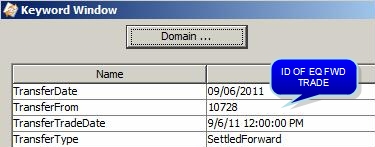

| » | When you run the scheduled task, the equity forward trade is terminated – The trade keyword "TransferTo" contains the ID of the equity trade generated by the scheduled task. |

The new equity trade is booked at the forward price.

The settlement date is the forward date plus the payment lag.

The following trade keywords are set on the equity trade:

3. Termination

To terminate an Equity Forward with a basket underlying, the system will request the quotes of all the components of the basket on the termination date.

An Equity Forward trade can also be terminated using the Scheduled Task EQD_FWD_SETTLE. This Scheduled Task only settles when the task execution date is the same as the trade's forward date. The Scheduled Task then changes the trade status to Terminated and applies the following trade keywords:

| • | TransferType: SettledForward |

| • | TradeTransferDate: valDateTime (same as forwardDate & currTime) |

| • | TransferTo: New Equity trade's Id (considered as child trade) |

After executing this Scheduled Task, pricing an Equity Forward trade on forward date has the following use-cases / possibilities:

| • | valDate > forwardDate, NPV should be 0 |

| • | valDate < forwardDate, a valid NPV should be computed and shown |

| • | valDate = forwardDate |

| – | valDateTime > fowardDateTime, NPV should be 0 |

| – | valDateTime < fowardDateTime, a valid NPV should be computed and shown |

| – | valDateTime = fowardDateTime, NPV should be 0 |

4. Resets Details

You can select the Resets panel to display Resets details for the various legs.

You can select an equity reset from the Reset Name field. The fixing quote should be set for the quote name in the form "EquityReset.<equity name>.<reset name>". If you do not select an equity reset, CLOSE is selected by default. The fixing quote is the spot quote in that case.

You can also select "Specific Reset" and enter a manual fixing quote in the Value field.

Equity resets are defined in the Equity Definition or Equity Index Definition.

See also -

See also -