Capturing Correlation Swap Trades

A Correlation Swap is an OTC transaction between two parties to exchange the difference between a “Strike Correlation” and the “Realized Correlation”. The Correlation is calculated based on the period including the Observation Start Date and Observation End Date.

Correlation is a statistical function relating how the changes between the returns of two assets are related. A correlation is between -1 and 1, where 1 means perfect correlation and -1 means perfect negative correlation. For example, if the correlation of IBM and GE is 1, then a 1% move in IBM would imply a 1% move in GE.

The historic, or calculated correlation, is over a period. The correlation will vary based on the calculation start and end date.

A Correlation Swap can be transacted on N assets. In this case the pair-wise correlations are averaged against the “Correlation Average Strike”.

Correlation Swaps can be transaction on any type of Asset. For example, a Correlation Swap can be between IBM and BRENT Crude Oil.

The correlation amount payment occurs as follows:

If > 0, Seller shall be the Equity Amount Payer and shall pay the Correlation Buyer the Equity Amount on the Cash Settlement Payment Date.

If < 0, Correlation Buyer shall be the Equity Amount Payer and shall pay the Correlation Seller the absolute value of the Equity Amount on the Cash Settlement Payment Date.

If = 0, there will be no Equity Amount Payer and neither party shall be required to make any payment to the other party.

For the buyer of the Correlation Swap, the trade is settled based on the following formula:

Choose Trade > Equity > Correlation Swap to open the Correlation Swap worksheet, from Calypso Navigator or from the Trade Blotter.

|

Correlation Swap Quick Reference

When you open a worksheet, the Trade panel is selected by default. Underlying Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below, see Field Description. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

Trade Lifecycle

|

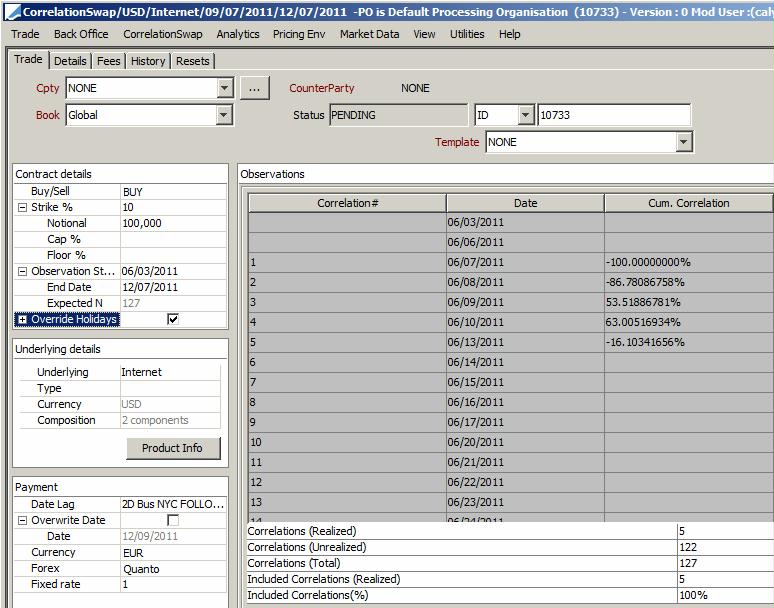

1. Sample Correlation Swap Trade

Correlation Swap Trade Window - Sample Trade

| » | Enter the fields described below as needed. |

2. Fields Description

Trade Details

| Fields | Description |

|---|---|

|

Role/Cpty |

The first two fields in the worksheet identify the trade counterparty. You can select a legal entity of specified role from the first field provided you have setup favorite counterparties. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Alternatively, double-click the Cpty label to set the list of favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. The second field identifies the trade counterparty’s role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. Alternatively, double-click the CounterParty label to change the role. |

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Alternatively, double-click the Book label to set the list of favorite books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

ID Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference of external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. |

Contract Details

| Fields | Description |

|---|---|

|

Buy/Sell |

Select the direction of the trade from the perspective of the book: BUY or SELL. |

|

Strike % |

Enter the level at which the investor buys or sells the correlation swap. This is quoted in %. |

|

Notional |

Enter the notional amount. |

|

Cap % |

Enter the cap % as needed - |

|

Floor % |

Enter the floor % as needed - |

|

Observation Start Date |

Enter the start date of the observation period. |

|

Observation End Date |

Enter the end date of the observation period. |

|

Expected N |

Displays the expected number of observations in the period. |

|

Override Holidays |

By default, the holiday calendars assigned to the currency will be used. Check to define the holiday calendars used to calculate the business days in the observation period. You can select the holiday calendars in the Reset Holidays field. |

Underlying Details

| Fields | Description |

|---|---|

|

Underlying |

Select the underlying basket. You can also type in the underlying's name. Ⓘ [NOTE: Only baskets weighted in quantity are supported] You can click Product Info to view the basket components. |

|

Type |

Displays the type of underlying. |

|

Composition |

Displays the number of components in the basket. |

Payment Details

| Fields | Description | ||||||

|---|---|---|---|---|---|---|---|

|

Date Lag |

Define the payment lag from the Observe End date.

Days lag “D” can be business days or calendar days. Double-click the Bus label to switch to Cal as needed. The “No Tenor” checkbox only applies to days lag, when you enter more than 31 days. If you check the “No Tenor” checkbox, the offset will not be converted to a tenor. |

||||||

|

Overwrite Date |

By default, the payment date calculated by the Date Lag from the Observation End Date is displayed in the Date field and used. Check the Overwrite Date checkbox to specify a different payment date in the Date field. Double-click the Date field to select a date from the calendar. |

||||||

|

Currency |

Select the settlement currency from the drop-down menu. The settlement currency defaults to the notional currency. |

||||||

|

Forex FX Reset Fixed Rate |

Type of FX rate set at the component level: fixed rate (Quanto) or FX Reset (Compo). FX Rate Definitions are created using Calypso Navigator > Configuration > Foreign Exchange > FX Rate Definitions. |

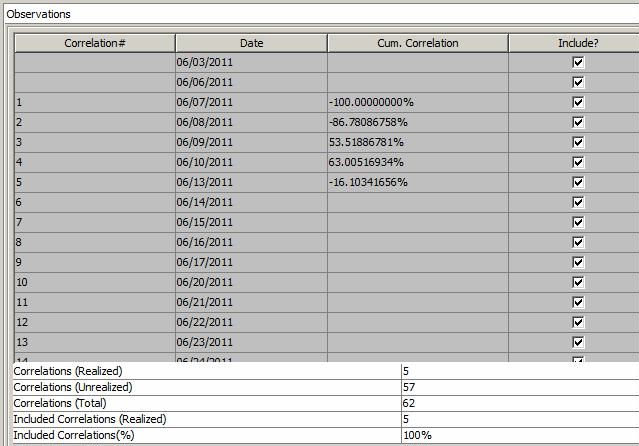

Observations Details

The observation schedule is generated between the observation start and end dates. It displays the cumulative correlation of the underlying products for each date in the observation period.

Correlation Swap - Observation details

| Fields | Description |

|---|---|

|

Correlation# |

Correlation number set by the system. |

|

Date |

Observation date. |

|

Cum. Correlation |

Cumulative correlation to date – This requires price fixings / quotes for the components of the basket for each correlation date, and a correlation surface. Prices are set using Calypso Navigator > Trade Lifecycle > Reset > Price Fixing or you can set prices on the trade using Correlation Swap > Specific Resets. |

|

Include? |

All dates are included by default. You can clear the Include? checkbox to remove an observation date. If an observation date is excluded and the valuation date equals the excluded observation date, when the trade is priced, the spot price is applied to the row immediately preceding the excluded date. |

|

Correlations (Realized) |

Number of realized correlations (underlying quotes are fixed). |

|

Correlations (Unrealized) |

Number of unrealized correlations. |

|

Correlations (Total) |

Total number of correlations. |

|

Included Correlations (Realized) |

Number of included realized correlations. |

|

Included Correlations(%) |

Percentage of included correlations with respect to the total number of correlations. |

Please refer to Calypso Analytics Library (Calib) documentation for details.

Please refer to Calypso Analytics Library (Calib) documentation for details. is capped at this level.

is capped at this level.