Future Option Contracts

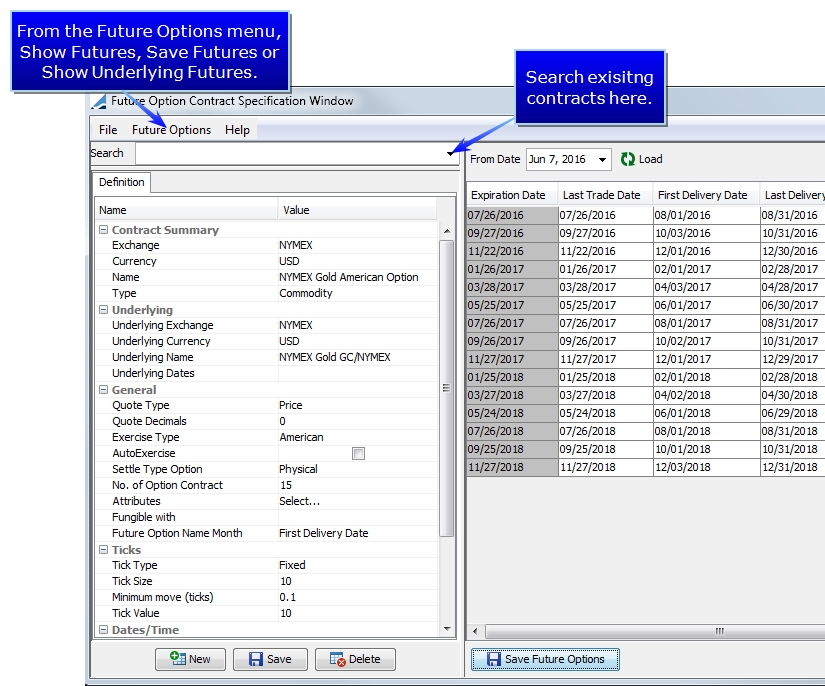

Define the commodity future option contracts by choosing Configuration > Listed Derivatives > Future Contracts Options from Calypso Navigator (menu action refdata.FutureOptionDefinitionWindow).

Date Time Definition

|

Field |

Description |

|||

|---|---|---|---|---|

|

Last Trading Time |

Enter the time of day that trading will end on the last trading day. Use twenty-four hour time notation (for example 16:30 is four-thirty in the afternoon). |

|||

|

Time Zone |

Select the time zone of the trade |

|||

|

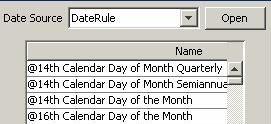

Expiration Date Schedule Last Trade Date Schedule First Delivery Date Schedule Last Delivery Date Schedule First Notification Date Schedule Last notification Date Schedule |

You can select a date rule to generate the schedule corresponding to each date, or you can select a manual date schedule.

Date rules are created by choosing Configuration > Definitions > Date Schedule Definitions > Date Rule from Calypso Navigator. Help is available from that window. Manual date schedules are created by choosing Configuration > Definitions > Date Schedule Definitions > Manual Date Schedule - Help is available from that window. |

Define the option products by choosing Configuration > Listed Derivatives > Future Optionsfrom Calypso Navigator (menu action product.FutureOptionWindow).

Note: Add the product type FutureOptionCommodity to the productType domain by choosing Configuration > System > Domain Values from Calypso Navigator so that you can select the products in the Product Chooser Window

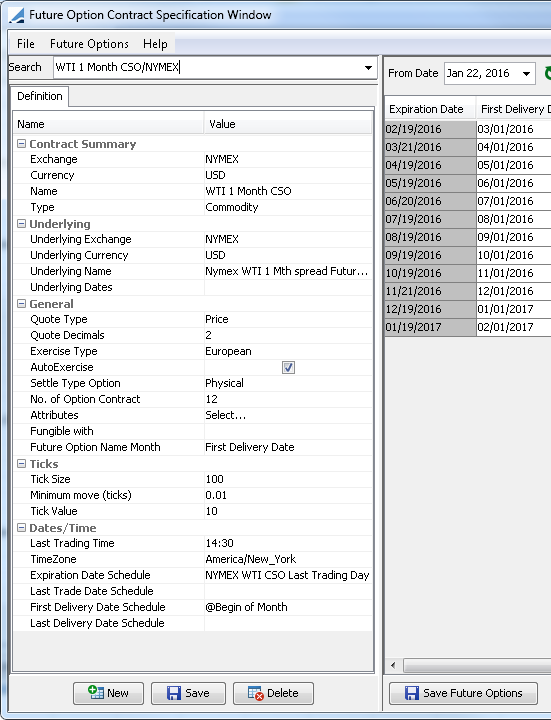

1. Spread Options

When the option's underlying future is a Calendar Spread or Market Spread, the option is called a Spread Option. An underlying future spread specification must be created for every spread option, even if the spread future is not listed on the exchange.

The option can be set up to settle either physically or financially. For financially settled options, the expiry logic is no different from any non-spread future option. For physically settled spread options, the expiry logic creates multiple futures upon exercising the option.

1.1 Spread Option Pricer

The FutureOptionCommodity pricer is used to price Calendar Spread Options. At this time, NPV is calculated but implied volatility and greeks are not. The volatility and underlying spot price of both the near and far expiry future can be overridden manually. The pricer uses the Kirk model to price Calendar Spread Options. The volatilities of the two underlying positions is not calculated and can be overridden as well.

The FutureOptionCommodityMarketSpread pricer is used to price Market Spread Options. At this time, NPV is calculated but implied volatility and greeks are not. The volatility and underlying spot price of both the futures can be overridden. The pricer uses the Kirk model to price Market Spread Options. the pricer looks for the correlation between the commodities of each future. The pricer limits the number of underlyings to two.

1.2 Spread Option Expiry

On expiry, an offsetting future option trade to close out the original expiring trade is created, using the close quote on the expiry process value date.

1.3 Spread Option Exercise

If an option is exercising into futures, the option exercise process creates new futures trades.

For Calendar Spreads, the exercise process creates a future trade for the near expiring contract, and a future trade for the far expiring contract.

For Market Spreads, the exercise process creates a future trade for the near expiry contract of each underlying.

| » | To determine the quantity and trade price of the new future trades, the logic is the same for Calendar Spreads and Market Spreads. If a Market Spread Future has multiple underlyings, each with a factor, then the calendar spread is considered as having two underlyings, the first with a factor = 1 and the second with a factor = -1. |

| » | Calculation of the quantity of a new future begins with the unsigned quantity of the option, multiplied b y the factor of the underlying. If the option is short, it should be multiplied by -1. Then, if the option is a put, it should be multiplied by -1. If the number is positive, the future is a buy. Otherwise, the future is a sell. |

| » | The trade price of each new future except the last one being created is the closing price for that future on the process date. The trade price of the last future must take into account the strike of the option. First, the expected closing quote of the last future, given the closing quote of the spread, is calculated as well as all other futures. For example, if the spread is expected to equal (future1 closing price * future 1 factor) +...+ (future n closing price * future n factor), then the expected closing quote of the last future = [closing spread - (future 1 closing price * future 1 factor) - ... - (future n-1 closing price * future n-1 factor)] ÷ future n factor. With the closing price of the last future, it can be adjusted for the strike. Therefore, the trade price of the last future is equal to the expected closing quote of the last future - option strike ÷ future n factor. |

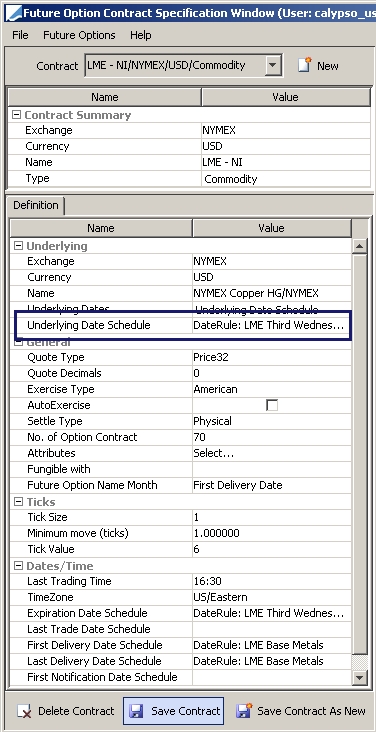

2. Sample LME Option Contract

The convention for LME Vanilla Exchange Traded Options is for monthly option expiration occurring on the first Wednesday of the month with physical exercise into the Future with a delivery date of the Third Wednesday of the month. For most future option contracts, this is no problem, because the monthly option expirations match the monthly future expiries. However, due to the fact that the LME base metal future contracts have daily expirations, while the options have the monthly exercise described above, there needs to be a link between the future option to the correct underlying future.

You can associate a date rule with the underlying future contract. Double-click in the Underlying Date Schedule field to select the date schedule.

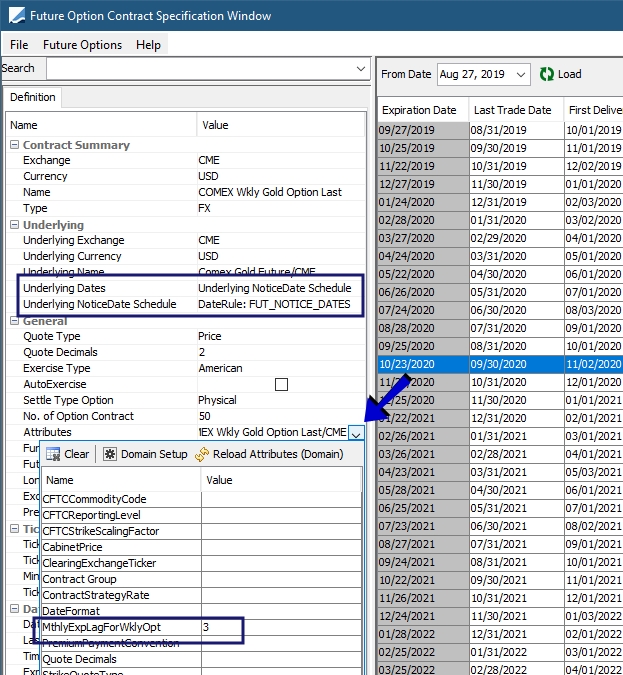

3. Weekly COMEX Future Options

It is possible to map a COMEX Gold weekly future option to its underlying future in the Future Option commodities contract. This logic is based on mapping the weekly future option expiry to the underlying future based on the expiration date of the future option and the first notice date of the underlying future series.

In the Future Option contract window, in the Underlying Dates field, the option Underlying NoticeDate Schedule should be chosen to generate futures for COMEX future contracts.

| » | The date schedule selected in the Underlying NoticeDate Schedule field should be that of the underlying Future Notice Dates. |

| » | An additional attribute called MthlyExpLagForWklyOpt should be defined for weekly option mapping. A setting of 3 is suggested for COMEX weekly options. |

| » | If the weekly expiry of the future option is mapped to a future with the First Notice Date greater and nearest to the Weekly Option Expiry, or greater than the First Notice Date of a future, it would map to the First Notice Dated future. |

Logic is in place to prevent both the weekly and monthly gold options from mapping to the same underlying future:

| • | The nearest notice date that is greater than the Weekly Option Expiry is retrieved from the Future Notice Dates date rule (Date B) |

| • | The MthlyExpLagForWklyOpt days attribute is subtracted from Notice Date B (this is Date A) |

| • | If Date A >= the Weekly Option Expiry < Date B, then the Weekly Option Expiry maps to the next date in the Future Notice Dates date rule, greater than Date B |

| • | I f the Weekly Option Expiry is < Date A, then the Weekly Option Expiry maps to Date B, First Notice Dated future from the Future Notice Dates date rule |