Future Contracts

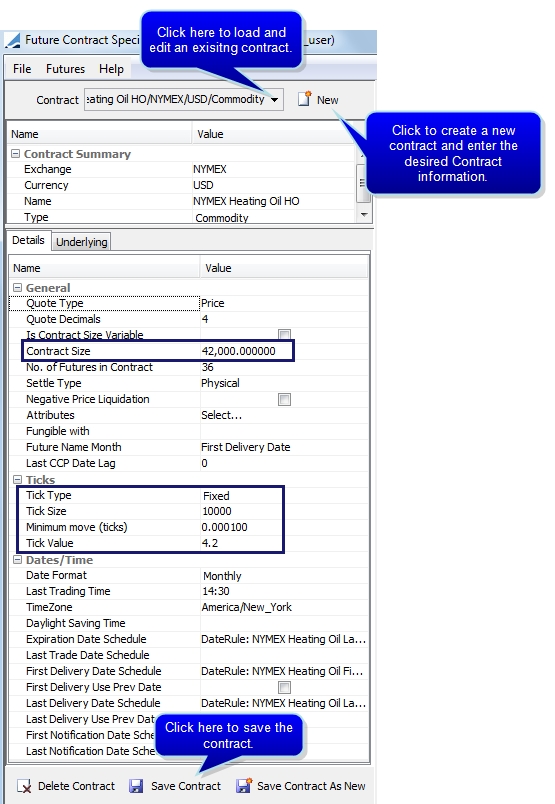

Define the commodity future contracts by choosing Configuration > Listed Derivatives > Future Contracts from Calypso Navigator (menu action refdata.FutureDefinitionWindow).

Contents

- Creating & Editing Future Commodity Contracts

- Commodity Spread Futures Contract Definition

- Physical Commodity Contract Definition

- Asian Future Contract Definition

- Electricity Future Contract Definition

- FX Future Contract Definition

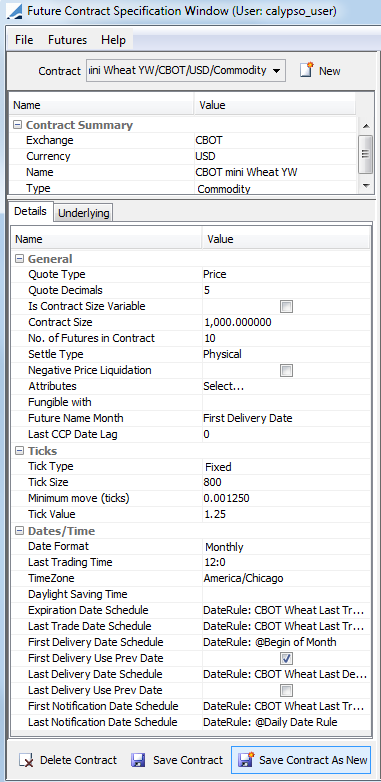

1. Creating & Editing Future Commodity Contracts

| » | Contract size must equal Tick Value * Tick Size. |

Tick size must equal 1/Min Move (Ticks). To extend the Tick Size list, add new values to the tickSize domain by choosing Configuration .> System > Domain Valuesfrom Calypso Navigator.

Tick Value should be the absolute price change for one contract subject to the minimum price fluctuation as defined by the exchange.

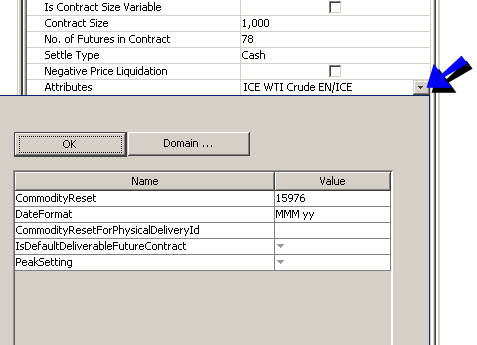

| » | You can define how the Future and Future Option trade windows display the list of available contracts. Click Attributes and set the Date Format attribute to 'MMM yy' (the value is case sensitive) . to specify that the windows display a list of contracts by delivery month using the month and year format. |

| » | The Last CCP Date is a reference date that indicates the last day the Clearinghouse will have any exposure to the future position. This date is represented by the Last CCP Date Lag, as a number of days after the expiration date. If you set a CCP Lag, the future maturity date is the last CCP date instead of the expiration date. |

| » | You are able to select a Daylight Savings rule to be applied for electricity future contracts. |

Out of the Box Attributes

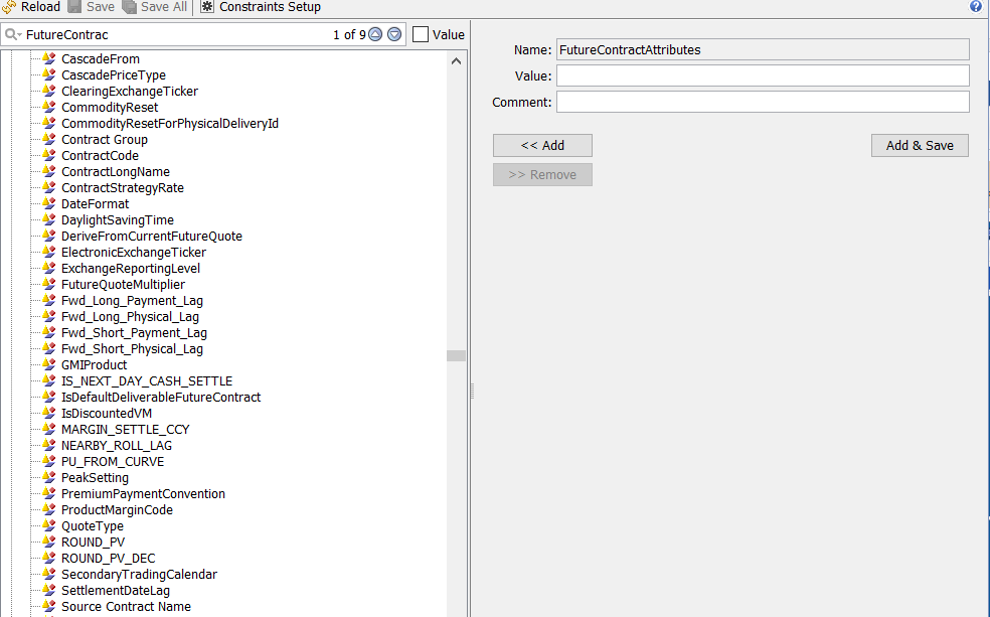

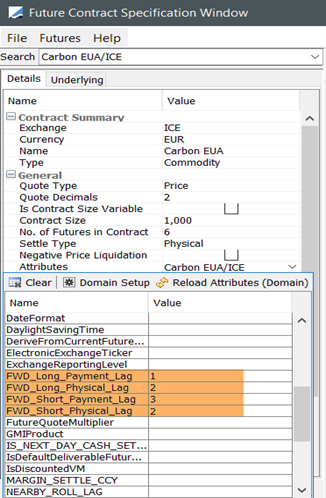

Added out of the box Attribute in Future contract specification window with 4 attributes; 2 attributes for long direction for Payment & Physical, similarly 2 attributes for short direction for Payment & Physical.

Ex., FWD_Long_Payment_Lag, FWD_Long_Physical_Lag, FWD_Short_Payment_Lag, FWD_Short_Physical_Lag.

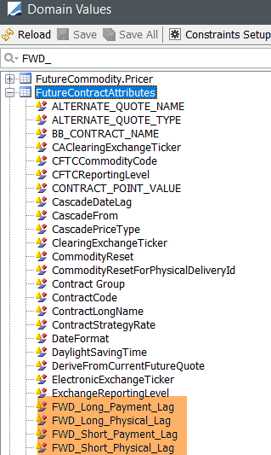

Attributes should be added in Domain value > FutureContractAttributes out of the box as can be seen in thebelow image:

The values will be available as shown below:

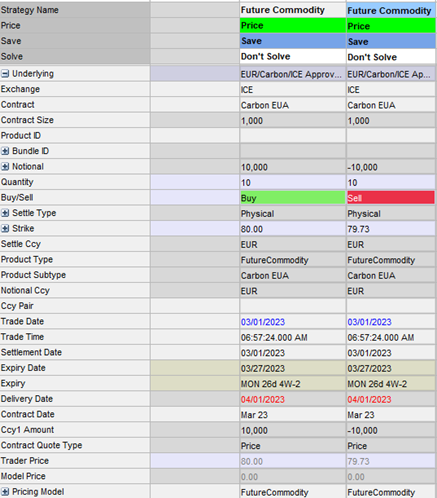

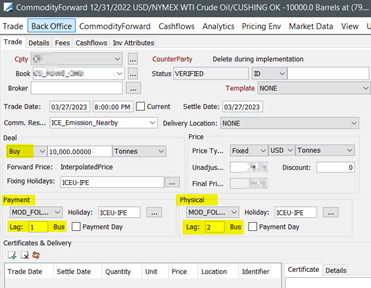

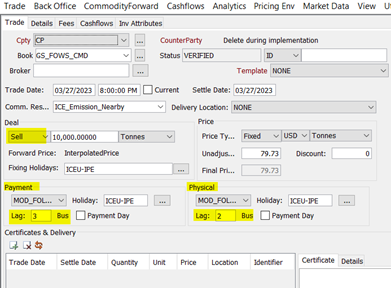

Values in these attributes should be used only while creating a commodity forward resulting out of expiration process of physical settling futures. Manual as well as via ST FUTURE_EXPIRY must use the values in attributes. E.g., of the Attribute, Future trade as well as resultant commodity forward trade with direction wise lag as below:

Contract Attribute Setup

Buy & Sell Trade

Below are examples of resultant commodity forward trade with different lags (Long and Short respectively) based on direction of future trade:

Ⓘ Note: All existing contracts physically settling are migrated with blank values in the attribute. For existing migration contract new attribute value will be reflected on trade window only after clearing cache of commodity reset from webadmin.

Ⓘ The solution may need one time setup in contract attributes which must be set by user manually as a one time process.

2. Commodity Index Futures

Complete the following steps to create a future contract based on a commodity index:

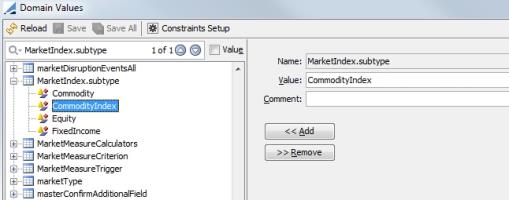

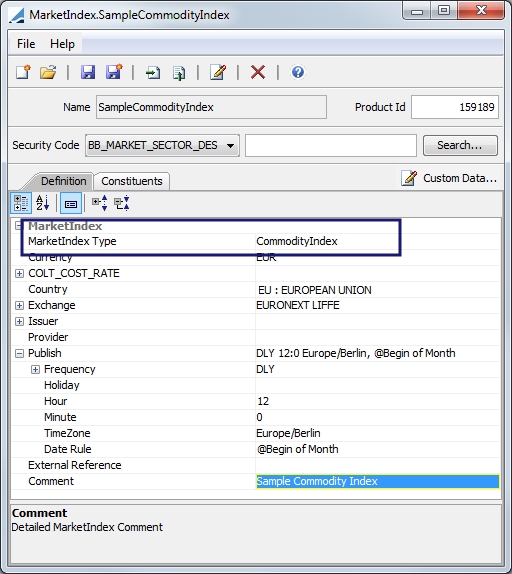

Step 1 - Add CommodityIndex to the MarketIndex.subtype domain value.

Step 2 - Create a new market index in the Market Index window (Configuration > Product > Market Index) using CommodityIndex as the Market Index Type.

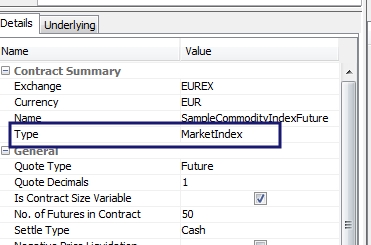

Step 3 - Create a Futures contract, setting the Type to MarketIndex.

Commodity Index Future contracts can be traded using the Future trade window or the Pricing Sheet. When using the Pricing Sheet, us the FutureMarketIndex strategy. The only pricing implemented for Commodity Index Futures is FROM_QUOTE, therefore, the futures quote will need to be entered to get an NPV and generate numbers in Risk and PL.

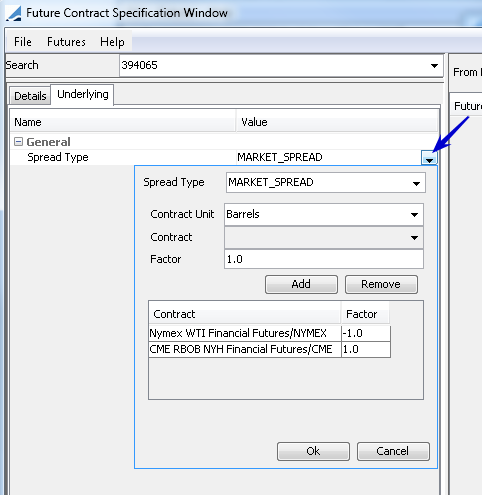

3. Commodity Spread Futures Contract Definition

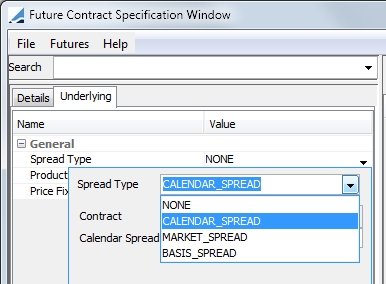

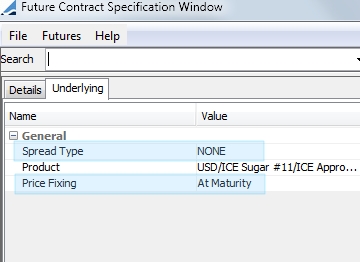

Futures contracts can be configured for Market and Calendar spreads. These spreads are only applicable for futures contracts of Type Commodity. In the Underlying panel, designate which type of spread to use in the Spread Type field. The default setting is NONE.

NOTE: The BASIS_SPREAD option is informational only.

For MARKET_SPREAD and CALENDAR_SPREAD, an underlying futures contract must be specified rather than an underlying commodity or product. Price fixing for spread futures is always At Maturity, though the underlying futures contract can have Price Fixing set to Asian.

3.1 Market Spread

When a future contract is a Market Spread, it settles either physically by generating multiple future contracts on expiry, or financially by calculating a price based on the price of multiple future contracts on expiry.

For example, the most common market spreads in the commodities markets are crack spreads, where the settlement is based on the price of the underlying crude future contract. The market spread functionality allows for multiple contracts, each with its own factor. This makes up a formula for calculating the price of the future.

| » | The Contract Unit is the unit in which the price will be calculated. The Contract Unit must be the Quote Unit of one of the underlying future contracts that have been chosen in the Market Spread selection window. All chosen future contracts must be in the same currency. |

| » | The price will be calculated as the sum of the prices for each row of the of the prices for each row of the formula. Where the price for each row of the formula will be calculated by: |

| – | Getting the market price for the underlying future contract |

| – | Converting the Unit of Measurement of the price into the Contract Unit |

| – | Multiplying the resulting price by the Factor |

| » | The underlying future in each row is determined using the expiry date of the Market Spread Future. The underlying futures with an expiry date on or after the expiry date of the Market Spread Future will be used. |

Curve Underlyings

Commodity Future curve underlyings cannot be created for Market Spread Futures.

Market Data Required to Price

If the future is priced with FUTURE_FROM_QUOTE = False, the pricer looks for forward price curves for each of the underlying future contracts in the market spread.

Futures Expiry

On expiry, an offsetting future trade to close out the original expiring trade is created using the closing quote on the value date for the fixed price. The logic for creating the offsetting future is no different from any other non-spread future.

On expiry, if Settlement Type of the market spread future is Physical, in addition to creating the offsetting future trade to close out the original expiring trade, futures trades are created for each o the underlying futures contracts.

The additional futures are created with a fixed price equal to the closing quote price for the future being created on the value date.

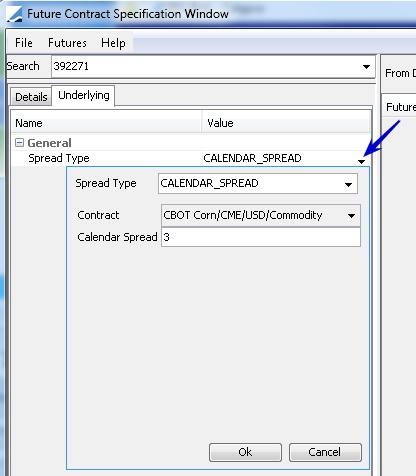

3.2 Calendar Spread

When a future contract is a Calendar Spread, it settles either physically by generating two future contracts on expiry, or financially by calculating a price based on the price of two future contracts on expiry. The two futures contracts will have the same contract specification, but different delivery dates.

Calendar Spread Futures are not very common in commodities. However, in order to create Calendar Spread Options wich are much more common, Calendar Spread Futures need to be created to define the underlying.

The Market Spread functionality, together with a Calendar Spread, which is an integer that determines the delivery period offset, allows for a single underlying future contract. This makes up a formula for calculating the price of the future.

So, if the Calendar Spread is 1, the price will be calculated as the price of the nearby future minus the price of the second nearby future.

Curve Underlyings

Commodity Future curve underlyings can be created for market spread futures, and forward curves can be created using these Calendar Spread underlyings.

Market Data Required to Price

If the future is priced with FUTURE_FROM_QUOTE = False, the price looks for forward price curves for both underlying future contracts in the market spread.

Futures Expiry

On expiry, an offsetting future trade to close out the original expiring trade is created. The logic for creating the offsetting future is no different from any other non-spread future.

On expiry, if the Settlement Type of the market Spread Future is Physical, in addition to creating the offsetting future trade to close out the original expiring trade, futures trades are created for both underlying futures contracts.

The additional futures are created with a quantity equal to the quantity of the original future trade. The nearest expiring future is in the same direction as the original future, and the second future is in the opposite direction.

The additional futures are created with a fixed price equal to the closing quote price for the future being created on the Value Date.

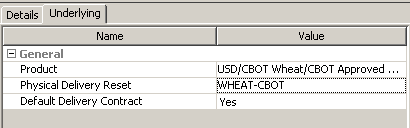

4. Physical Commodity Contract Definition

In the Underlying panel, set the Default Delivery Contract attribute to Yes if this contract should be used as the default contract for delivery for valuing the commodity certificate. The nearby future will be used to value the certificate if a future not specifically associated with the certificate is available.

See Future Delivery Sets for details.

See Future Delivery Sets for details.

5. Asian Future Contract Definition

Examples include the First Line Brent and WTI Asian Swaps traded on the InterContinentalExchange (ICE). They are all cash settled, typically based on the average of a market price over a calendar month.

In the Underlying panel of the Future Contract Definition, when you select the “Commodity” type of future, you may select when the price fixing occurs: At Maturity (Vanilla) or Asian.

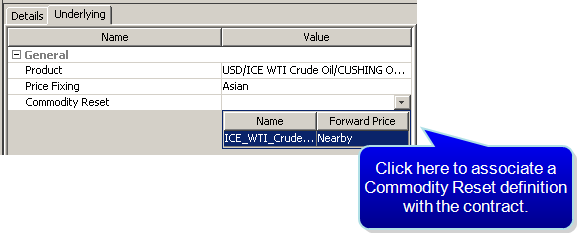

When you select the Asian price fixing, you can then double-click the Commodity Reset attribute value field to associate a Commodity Reset Definition with the contract.

Note that in the Underlying panel, the Commodity Reset attribute displays the name of the Commodity Reset Definition. However, in the Definition panel, if you click Attributes to open the future contract Attributes Window, the CommodityReset attribute displays the Commodity Reset Id.

Asian Averaging Period

The averaging period for an Asian settled future is determined by the First Delivery Date and Last Delivery Date of each future. These dates are set through the use of date rules, and can be further customized by overwriting the dates in the Future Definition if needed. The Averaging Period is inclusive of the first and last delivery dates.

Asian Fixing Calendar

The determination of business days during the Averaging Period of the future is based on the holiday calendar(s) associated with the commodity reset specified in the future contract definition. Daily observations will be expected on the business days according to that calendar.

6. Electricity Future Contract Definition

The commodity product should be defined as the Electricity commodity type. Cash and Physical settlement are now supported for electricity futures. Peak setting option along with delivery interval frequency is used to determine the contract size of the trade as per below.

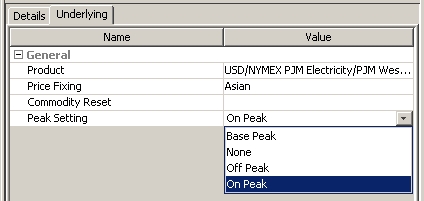

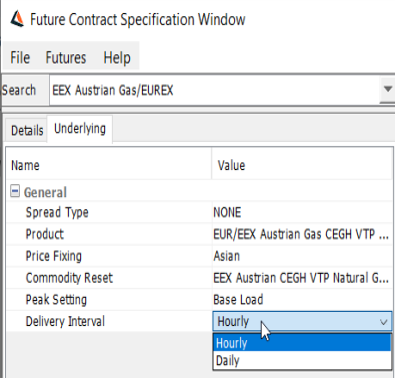

When setting up the Future Contract Definition, check the Variable contract size, and define the PeakSetting attribute with one of the following: On Peak, Off Peak, Base Load.

In the Underlying panel:

| » | Click ... to select the underlying commodity electricity product. |

| » | Set the Peak Setting attribute to define the contract size. For Hourly delivery frequency, the following calculations are used to define the contract size: |

On Peak - Contract Size = Hourly MWh Quantity * peak hours per bus day * No of bus day in Future Delivery Period (Hourly MWh Quantity is taken from Commodity Definition)

Off Peak - Contract Size =Hourly MWh Quantity * Total Off Peak Hours in the Future Delivery Period. (To calculate off peak hours we use 24*(holiday and weekends) + (24-no of peak hours)*no of bus days.

Base Load Contract Size = Hourly MWh Quantity * 24 * No of days in future delivery period.

| » | For Daily delivery frequency, only base load peak setting is supported as of now. The calculation method of quantity with base load peak setting and daily delivery interval is as follows: |

Base Load Contract Size = Daily MWh Quantity * No of days in future delivery period.

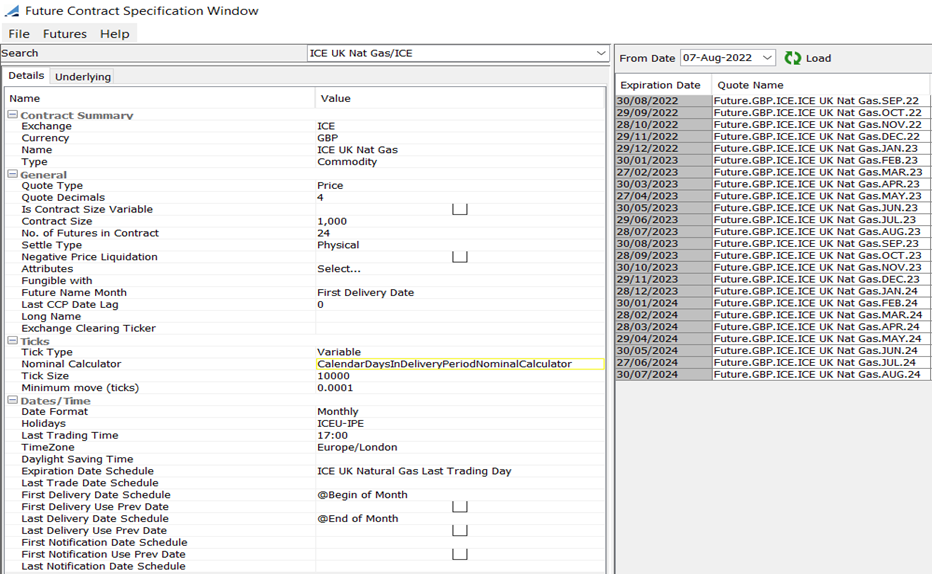

Sample Natural Gas Contract

7. FX Future Contract Definition

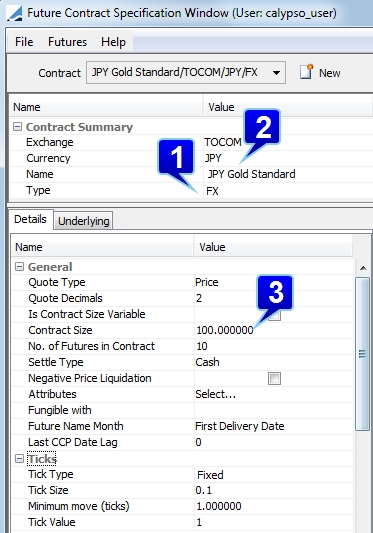

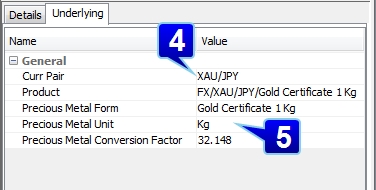

The Standard convention for precious metals around the world is to quote a price in US dollars per Troy Ounce. However, it is not uncommon to quote metals in other currencies and units. Calypso gives you the ability to capture and price FX Future trades based on various quoting units and currency.

Described below are required fields in the precious metal future contract definition.

Step 1 - You must define all precious metal future contracts with the FX product type and with a currency pair as the underlying asset.

Step 2 - The settlement currency of the future contract can be either the quoting currency of the currency pair, or possibly a third currency. I can never be the precious metal currency.

Step 3 - The contract size of the FX future is denoted in the primary currency unites of the metal and is equal to the value entered into the contract size field in the future contract definition.

Step 4 - The currency pair used as an underlying in an FX future contract is the standard precious metal currency (i.e. XAU, XAG, XPT, etc...) along with any quoting currency.

Step 5 - Select the Precious Metal Unit in which the primary currency is to be measured. The conversion factor will automatically populate when the unit is selected.

NOTE: The price of the future is derived from the forward price of the underlying currency pair (in Troy Ounces) and then converted using the provided conversion factor. In cases where the secondary currency is not USD, the forward price is triangulated based on the Triangulation Currency Rule defined in the pricing environment.

8. LME Contracts

To distinguish between Forward and Future style contracts using LME, the contract attribute isDiscountedVM can be set to True. when this is set, the Pricer FutureCommodity will discount the VM using the native pricer from the imported Discount Curve.

Discounting will only take place if the FUTURE_FROM_QUOTE pricing parameter is set to True. In this case, Calypso uses prices from the exchange and discounts using the Discount Factors (DF) from the curve. (The curve is not used to price, only to apply the discount.)

For the above logic to take effect, in the Legal Entity Attributes window for LME, the attribute MIC must be set to XLME.