Commodity Reset Definition

The commodity reset represents the reference price against which a financial transaction is settled.

It designates which Forward Price Method will be used to project forward prices, and it is used to set the floating price for a commodity fixing that should have occurred.

You can select the commodity reset definition during trade capture, and define additional fixing details in the trade. The actual prices for commodity resets are set using Trade Lifecycle > Reset > Price Fixing from Calypso Navigator, or the PRICE_FIXING scheduled task.

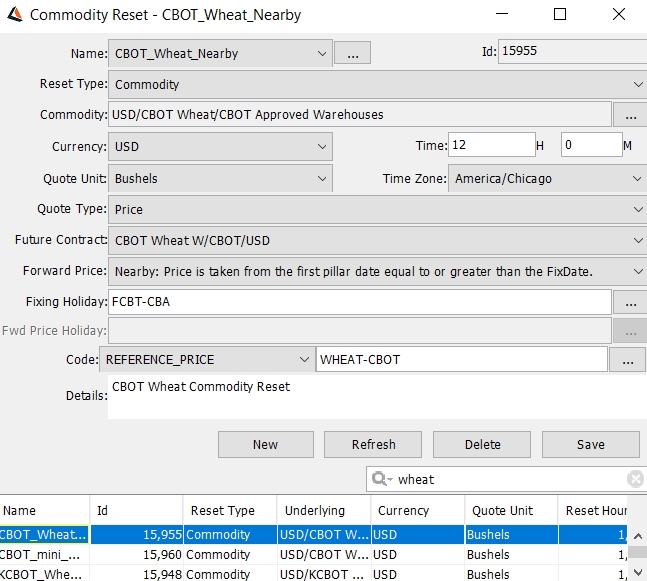

Create the Commodity Reset Definition using Configuration > Commodities > Commodity Reset from Calypso Navigator (refdata.CommodityResetFrame).

| » | Existing commodity reset definitions are loaded by default. Select a reset to view the details. You can modify the details and click Save as needed. |

| » | To create a new commodity reset definition, click New, complete the details described in the table below, and click Save. |

Note that if the Authorization mode is enabled, an authorized user must approve your entry, provided that "CommodityReset" has been added to the "classAuthMode" domain. Click Show Pending to display any commodity reset definitions pending authorization.

| » | Commodity Reset quotes are saved as Commodity.<currency>.<commodity reset>. |

The following table describes the fields to complete in the commodity reset definition.

| Field | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Name |

Unique user defined name. Name should be descriptive to allow the selection of the proper reset without having to refer to the reset definition. Click ... to add a new commodity reset name to the drop-down menu. |

|||||||||

|

Id |

When you save the commodity reset definition, the system automatically assigns it an id and displays it in this field. |

|||||||||

|

Reset Type |

Select either Commodity or Emission. With the Emission reset type, you are able to specify multiple possible commodity underlyings, allowing for the capture of a trade where several different allowances are eligible for delivery. |

|||||||||

|

Commodity |

Link to the underlying commodity of the reference price. Click ... to select the underlying commodity product. The commodity reset definition requires a commodity product that you can create by choosing Configuration > Commodities > Commodities from Calypso Navigator. |

|||||||||

|

Allowance Criteria |

When Emission is selected as a Reset Type, select an allowance criteria for the reset. This criteria defines what type of allowances are designated in the commodities used for the reset. Only commodities using the selected allowance type are eligible. This list is populated from the EmissionAllowanceType domain.

After you have selected the Allowance Criteria, select the appropriate compliance and vintage information to further define the commodities contained in the reset. |

|||||||||

|

Currency |

The currency in which the reference price is quoted, i.e. USD/Barrel. |

|||||||||

|

Quote Unit |

The commodity unit in which the reference price is quoted, i.e. USD/Barrel. |

|||||||||

|

Quote Type |

The type of quote used, in most cases this will be Price. |

|||||||||

|

Time / Time Zone |

The global time that the commodity reset is expected to be known. This can be, but doesn't have to be, the time zone of the actual exchange or publication. |

|||||||||

|

Future Contract |

The future contract that is associated with this commodity. This information is used to determine the available futures for the forward price lookup logic described below. You can create future contracts by choosing Configuration > Listed Derivatives > Future Contracts. You can also create a commodity reset without an associated future contract. This allows creating resets for commodities that are traded OTC, and creating resets if not trading on an exchange. |

|||||||||

|

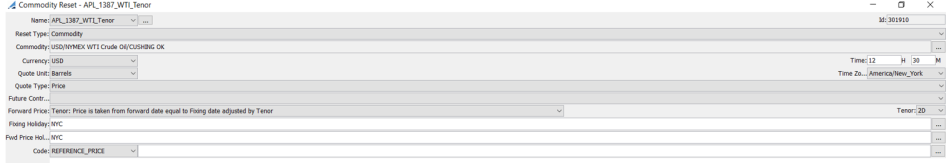

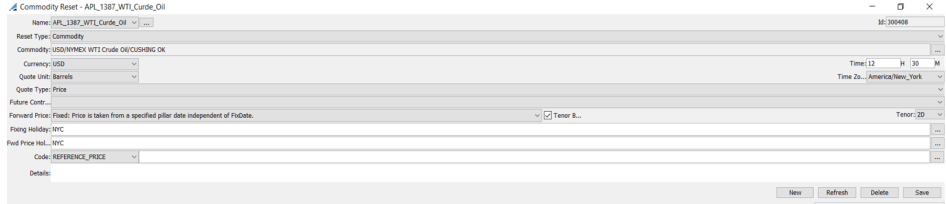

Forward Price |

Select a method for finding the forward price. For forward price methods intended to reference a futures contract price, the price method finds a single date. The logic looks for the expiry date of the next expiring future (using the future contract specified on the Commodity Reset), and requests a forward price from the curve. The curve logic then looks up a price on the curve for the requested date. For those price methods, it is necessary to specify the future contract series on the commodity reset. These methods are: Nearby, IceNearby, SecondNearby, NearbyNonDelivered, FirstAndSecondNearby and Fixed. If no future contract is selected on the Commodity Reset for any of these forward price methods, the curve will return prices for each of the fixing dates. The default interpolator on the Commodity Forward Curve is NONE. For all other methods, the forward price is retrieved from the forward curve. Calypso out-of-the-box provides the following forward price methods: Nearby — The Nearby (aka Prompt) future is the future in a given contract listing which is closest to expiration on a specified date. This future is typically the most liquid and contains the highest open interest, making it the primary choice for a derivative reference price. In Calypso, the projected price returned by the Nearby method is equal to the the price of the first sequentially available curve point on or after the fixing date. Lme3M — The LME 3 Month price is similar in concept to the LmeCash price. In Calypso, the projected price returned by the LME3M method is equal to the value on the curve which corresponds to the date 3 calendar months after the fixing date according to the Fixing Holiday Calendar subject to the Forward Price Holiday Calendar. Note: this value may correspond to an actual curve point, or may be interpolated using the interpolation method specified in the forward curve. LmeCash — Futures listed on the London Metals Exchange (LME) have daily expiries, whereas most other commonly traded commodity futures have monthly listings. Because of this, LME products tend to be quoted in terms of tenor-based futures such as Copper Cash Buyer's Price or Lead 3 Month Buyer's Price. In keeping with this convention, derivatives settled using the LME Cash reference price require a method which can project the price of the official cash settlement price on a given fixing date. In Calypso, the projected price returned by the LMECash method is equal to the value on the curve which corresponds to the date 2 business days after the fixing date according to the Fixing Holiday Calendar subject to the Forward Price Holiday Calendar. Note: this value may correspond to an actual curve point, or may be interpolated using the interpolation method specified in the forward curve. SecondNearby — The Second Nearby future on a given date is the future which is next to expire after the prompt. In Calypso, the projected price returned by the Second Nearby method is equal to the price of the second sequentially available curve point on or after the fixing date. NearbyNonDelivered — The projected price for a fixing date will be equal to the value of the chronologically closest point on the forward curve which is equal to or greater than the fixing date subject to the restriction that the fixing date is not after that underlying's first delivery date, or for commodity forward points, the pillar date. If the fixing date falls after the nearby underlying's first delivery (or pillar) date, but before the underlying's last trading date, the value of the next (chronologically) curve point will be used. Many agriculture future contracts have first delivery dates which fall BEFORE the last trading day, meaning that if you hold a short position in one of these contracts, even if the future is still trading, you may be notified by the exchange that you are required to deliver the physical commodity. Therefore, financial players in the agriculture markets always make sure that they exit future positions before the first delivery date to avoid that scenario. Likewise, financial derivatives, such as swaps and options, take a similar approach and will typically fix off of the nearest future which has not already passed its first delivery date. For example, look at 2 consecutive CBOT Wheat futures:

For a commodity fixing on March 1, you would expect the NEARBY forward price method to use the LTD of 3/14/19 from the curve to project the price, and for a commodity fixing on March 5, you would STILL expect the NEARBY forward price method to use March 14, as the fixing has not passed the last trade date (aka the MAR08 curve date on the forward curve). In terms of the above example, for a commodity fixing on March 1, you would expect the NearbyNonDelivered forward price method to use the LTD of 3/14/19 from the curve to project the price since it is before the MAR19 future's first delivery date. For a commodity fixing on March 5, you would expect the NearbyNonDelivered forward price method to use May 14 as the curve date from which to project the price as it is after the first delivery date of the nearby curve point. Fixed — In some cases, derivatives are traded which agree upon a specific future as the reference price, regardless if that future is prompt, second prompt, etc. For these situations, we offer the Fixed forward price method. Using this method, the user must specify a date which corresponds to the date on the forward curve whose price will be used for all fixing dates for any derivative which uses that Commodity Reset. Any example would be a 3 month averaging swap over the months of Jan - Mar 2008 which references the Dec 2008 future. Each day of this swap will settle off of the price of the Dec 2008 future, therefore the projected price of all future fixing dates will be the same, based on the curve date chosen in the reset definition. IceNearby — The convention of many swaps traded on the The Intercontinental Exchange (ICE) is to fix off of the prompt future up to, but not including, that future's last trading day. On that day, the price will fix off of the second prompt contract. The theory behind this is that there is uncharacteristic volatility associated with a future on it's last trading day due to market forces trying to reconcile positions before the future ceases trading. In Calypso, the projected price returned by the ICENearby method is equal to the price of the first available curve point after, but not equal to, the fixing date. InterpolatedPrice — The forward price calculation is delegated to the interpolation method set on the underlying Market Data item, of which only curves are currently supported. If there is no interpolator set on the underlying market data item, "Nearby" forward price lookup method is used. FirstAndSecondNearby — Finds the expiry dates of the first and second nearby future contracts specified on the commodity reset, and request forward prices from the forward curve for both of these dates. The arithmetic average of the two prices is used as the fixing price. NearbyThirdWednesday — The forward price date one is the first curve point, which is the 3rd Wednesday after the fixing date. NearbyAndSecondNearby — The forward price is the average of the first and second expiries, equal to or greater than the fixing date. LmeCashToday - Specific to LME futures contracts. Price is taken on same day. LmeCashTom - Specific to LME futures contracts. Price is taken one business day ahead. Note: You can add custom methods by creating a class named Type:Tenor Based - For the tenor based method, forward date will be equal to fixing date + tenor specified on the CMD Reset. On CMD reset, if the tenor based method is selected, a dropdown is provided where one can select the tenor such as - 0D, 1D, 2D etc. instead of dates. Tenor in the dropdown will be populated from the domain.

Tenor Based under Type: Fixed - If Fixed Method is selected and if tenor based checkbox is ticked, a dropdown is provided where one can select the tenor such as - 0D, 1D, 2D etc. instead of dates. Tenor in the dropdown will be populated from the domain. The Forward Date in this case would be the valuation date plus the tenor provided in the CM Reset.

|

|||||||||

|

Fixing Holiday |

The default calendar used to determine eligible commodity fixing dates for a derivative using the specified commodity reset. You can select a different calendar in the trade worksheet. |

|||||||||

|

Fwd Price Holiday |

For use with LMECash and LME3M fixing methods to determine the US holidays to be used to determine if a LME business day is also a good NY business day. Required since LME products are quoted in USD. Click ... to select a holiday calendar(s) for the forward price method. |

|||||||||

|

Code |

Select a Reset Code and a value for that code in this field. The reset code is used to generate confirmation keywords in the confirmation templates. These keywords are directly associated with a specific reset.

You can create a reset code by clicking on the You can also add a reset code based on a confirmation keyword in the confirmation template by prepending the name of the reset with "COMMODITY_RESET_". This works the same way as the functionality for using trade keywords in a confirmation by appending KEYWORD_ to the beginning. |

|||||||||

|

Details |

Enter a description of the commodity reset to be used in confirmations. |

NOTE: Commodity Linear pricers are able to price on the reset date without a reset.

If a commodity quote for the valuation date and fixing date is present, and if the valuation date is the same as the reset date then Calypso is taking that quote for further calculations from the environment, irrespective of time. If the commodity quote is not present in the environment, it is forecasted from the curve.

If the FX Reset quote for the valuation date and fixing date are present and if the valuation date is the same as the fixing date, Calypso takes that quote for further calculations, irrespective of time. If the FX Reset quote is not present in the environment, then the quote from the FX spot quote is used.

and then adding a code name. This code is then added as a domain value in the "CommodityResetCode" domain.

and then adding a code name. This code is then added as a domain value in the "CommodityResetCode" domain.