Capturing Precious Metal Deposit Lease Trades

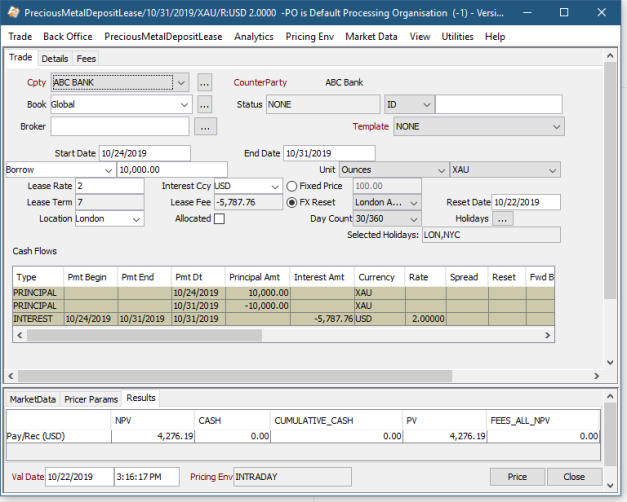

Choose Trade > Commodities > Precious Metal Deposit Lease to open the Precious Metal Deposit Lease worksheet, from Calypso Navigator or from the Calypso Workstation.

|

Precious Metal Deposit Lease Quick Reference

When you open a Precious Metal Deposit Lease worksheet, the Trade panel is selected by default. Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below, see Field Description. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

Trade Lifecycle

|

1. Sample Precious Metal Deposit Lease Trade

1.1 Field Description

| Fields | Description |

|---|---|

|

Role/Cpty |

The first two fields of the worksheet identify the trade counterparty. The first field identifies the trade counterparty’s role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. You can select a legal entity of specified role from the second field provided you have setup favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. You can also type [Ctrl-F] to invoke the Legal Entity Chooser, or directly enter a Legal Entity short name. |

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|

Id Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference of external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

Broker |

Displays the broker if a broker fee is captured in the Fees panel. |

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. |

|

Precious Metal Details |

|

|

Start Date |

Enter the start date of the trade, the value date of the lease. - If you enter the spot date, then the trade is a lease. - If you enter a date in the future, then the trade is a forward lease. |

|

End Date |

Enter the maturity date of the trade. |

|

Borrow / Lend |

Set the direction of the trade, whether the processing organization is borrowing or lending the quantity of the precious metal. |

|

Notional |

Enter the notional amount of the precious metal. The decimal places used and stored in the database are the Decimals defined in the currency defaults for the selected precious metal currency. |

|

Unit / Currency |

Select the currency that represents the precious metal and choose the unit. The units of precious metal are populated in the PreciousMetalUnits.XAU domain. A currency default attribute called PreciousMetalBaseUnit can be used to designate the base unit for the precious metal. If not designated, Ounces is the base unit. The currencies available are those that are designated as Precious Metal in the currency definition. |

|

Lease Rate |

Enter the lease rate in percentage to fix on the trade. You can enter as many decimal places as needed to get the desired amount. There is no rounding of the lease rate when calculating the interest amount. |

|

Interest Ccy |

Select the currency in which the interest will be paid at maturity. |

|

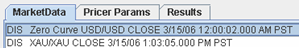

Fixed Price / FX Reset |

Enter the fixed price for the precious metal. Alternatively, select FX Reset, select the FX reset definition, and enter the date to reset the FX price. Create the FX Reset definition by choosing Configuration > Foreign Exchange > FX Rate Definitions from Calypso Navigator. Fix the FX rates using the FX_RATE_RESET scheduled task. |

|

Lease Term |

The pricer calculates the lease term and displays it in this field. The lease term is the number of days in the lease (End Date – Start Date). |

|

Lease Fee |

The pricer calculates the lease fee and displays it in this field. Lease Fee = Notional amount in Ounces * Basis Price * Lease Rate * (Lease Term/360) |

|

Location |

Select the location where the precious metal will be delivered and quoted. |

|

Allocated |

Select if the precious metal is allocated, meaning that it is physically segregated, with a list of bar weights and assays (purity tests). Each bar has an identification code against which its details are recorded and the client holds full title of this bar. It is merely held in custody. The allocated spread will be used. |

|

Day Count |

Select a day count method to use in calculating the interest. The day count methods are described by choosing Help > Day-Count Conventions from Calypso Navigator. |

|

Selected Holidays |

Displays the holiday calendars used to determine the business days during the lease. The holiday calendars default to the calendars set in the Currency Defaults for the precious metal currency (and interest currency if it is different than the precious metal currency). Click ... to change the holiday calendar list. |

Click here for more information on the business background of precious metals.

Click here for more information on the business background of precious metals.

See also -

See also -