Capturing Commodity Listed Future Trades

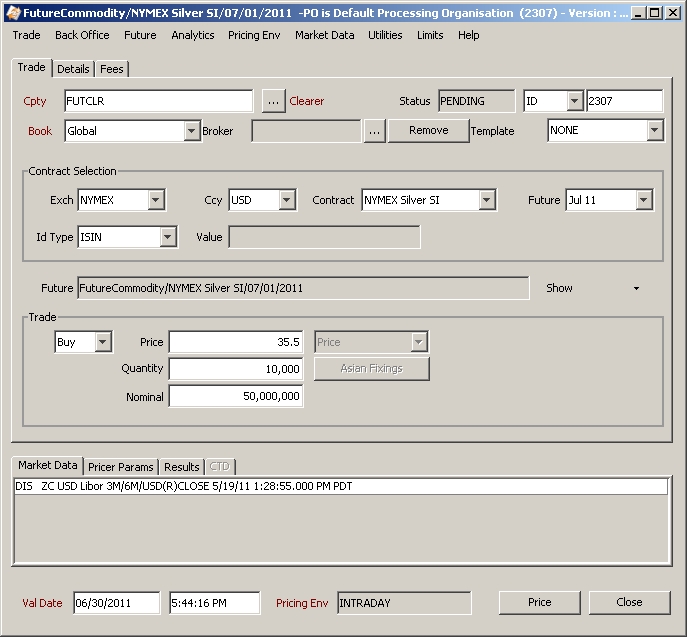

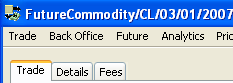

Choose Trade > Commodities > Listed Future to open the Future worksheet, from Calypso Navigator or from the Calypso Workstation.

|

Future Commodity Quick Reference

When you open a Future worksheet, the Trade panel is selected by default. Ⓘ [NOTE: The trade counterparty must be a clearer, so you must have defined a legal entity of role Clearer] Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below, see Field Description. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

Trade Lifecycle

|

1. Sample Future Commodity Trade

| » | Choose Help > Trade Help for complete details. |

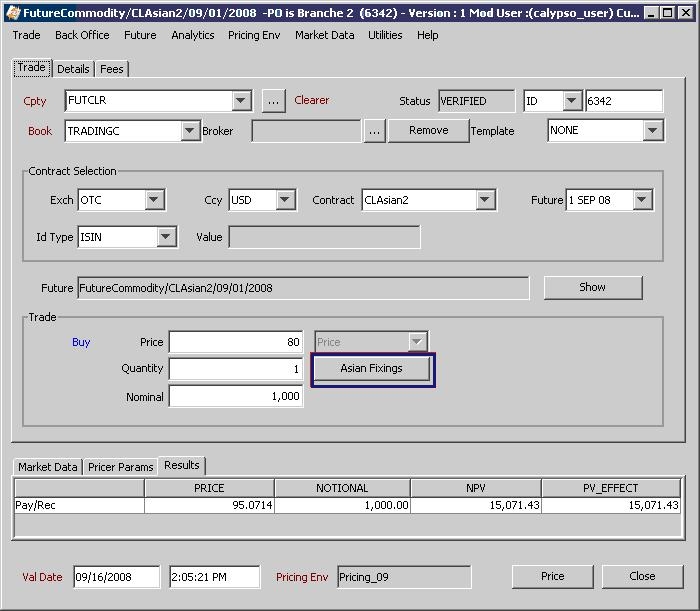

2. Sample Asian Future Commodity Trade

The current value (PRICE) of the future is the average of both the known and unknown fixings.

The NPV of the trade is: NPV = (Current Value – Unit Price) * Notional.

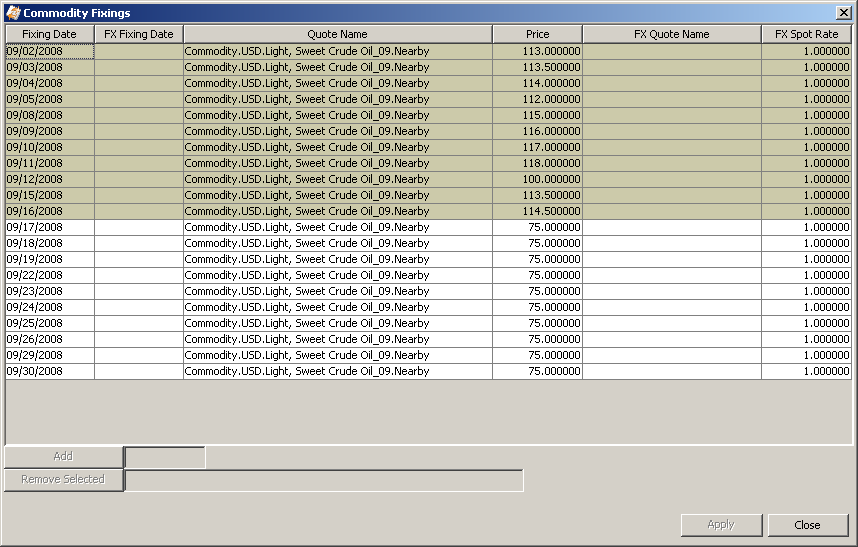

Click Asian Fixings to view the fixing details.

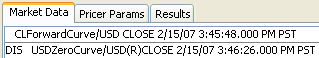

3. Future Contract Display - Time Zone

This section describes how the future contract is displayed in the trade window according to the time zone selected.

The Future trade window displays the first available contract based on the trade date defined in the Future trade window, and the Last Trading Date defined in the future contract. The contract display uses the following logic:

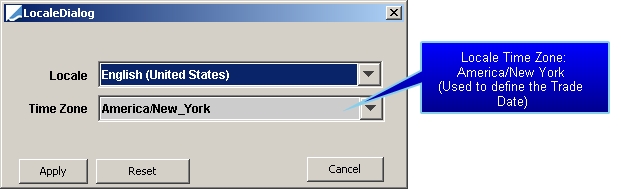

| » | The TradeDate of the Future trade is based on the TimeZone defined in the Locale window. From Calypso Navigator, choose Configuration > Definitions > Locale Configuration. |

| » | It converts the TradeDate to the TimeZone defined in FutureContract window, and then compares it to the LastTradingDate of the Future. |

| » | Choose Help > Trade Help for complete details |

See

See