Capturing Commodity Listed Future Option Trades

Choose Trade > Commodities > Listed Future Options to open the Future Option worksheet, from Calypso Navigator or from the Calypso Workstation.

|

Future Option Commodity Quick Reference

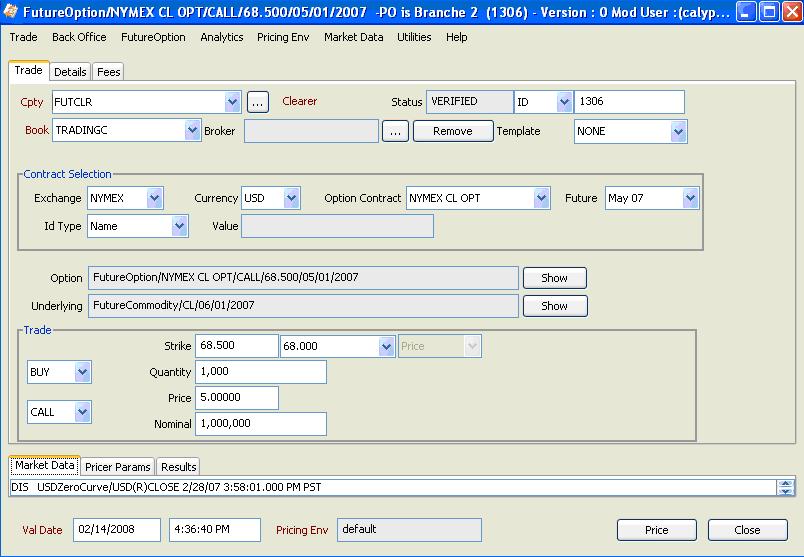

When you open a Future Option worksheet, the Trade panel is selected by default. [NOTE: The trade counterparty must be a clearer, so you must have defined a legal entity of role Clearer] Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below, see Field Description. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

The future price quote is not used in pricing when the FUTURE_FROM_QUOTE pricing parameter is set to false.

Trade Lifecycle

|

Sample Future Option Commodity Trade

| » | Choose Help > Trade Help for complete details. |

See

See