Capturing Commodity Index Swap Trades

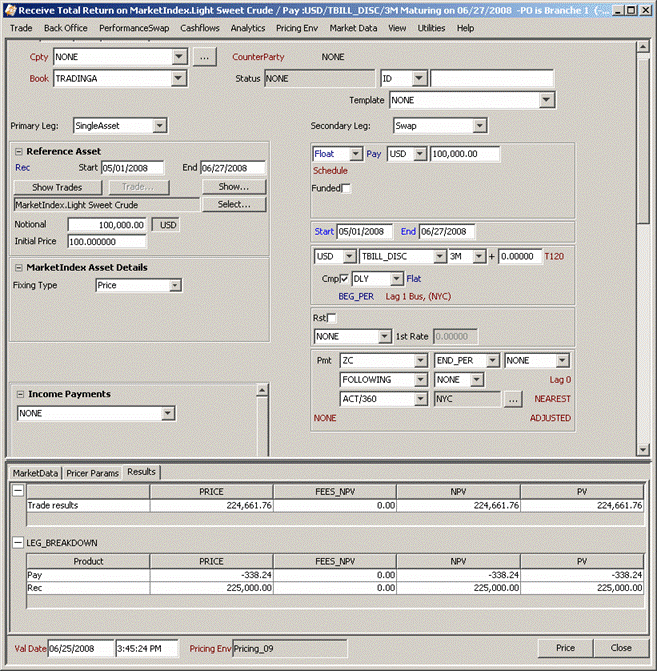

Choose Trade > Commodities > Index Swap to open the Performance Swap worksheet, from the Calypso Navigator.

Two types of Total Return Swap on Market Index can be captured:

| • | Index level - the Fixing Type is Price. Performance is calculated as (end index level/start index level -1)*notional. |

| • | Index spread – the Fixing Type is Spread. Performance is calculated as (end spread- start spread)*start modified duration*notional. |

Commodity Market Index Level will be either calculated using its constituents or from quote.

Index Level depends upon Pricing parameter 'USE_BASKET_COMPONENT_PRICING' in conjunction with pricing parameters 'NPV_FROM_QUOTE' & 'FUTURE_FROM_QUOTE'.

When USE_BASKET_COMPONENT_PRICING (default = false) is set to False, Market index level is equal to MarketIndex Quote from Quoteset.

When USE_BASKET_COMPONENT_PRICING is set to True, Market index level is calculated using sum of weighted price of the constituent and divided by divisor set on Market Index definition. Index level is calculated using latest effective date’s constituents’ weight as per Value Date.

-

NPV_FROM_QUOTE (default = false)

Applicable when MarketIndex constitutes a Commodity Spot, if the Parameter is set to true, spot quote from Quoteset will be used, else price from commodity forward curve will be used.

-

FUTURE_FROM_QUOTE (default = false)

Applicable when MarketIndex constitutes a Commodity Future, if the Parameter is set to true, future quote from QuoteSet will be used, else price from commodity forward curve will be used.

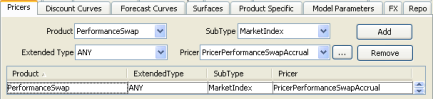

Note: Recommended pricer is PerformanceSwapAccrual for Swap on Commodity Market Index.

|

Commodity Index Swap Quick Reference

When you open a Performance Swap worksheet, the Trade panel is selected by default. Configuration

Entering Trade Details

Or you can enter the trade fields directly. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

- The funding leg NPV as the accrual of interest from last payment date to today. - The performance leg: On Index level: (Valuation dates index level/period start index level -1)*notional On Index spread: (Valuation dates index spread/period start index spread -1)*period start modified duration*notional

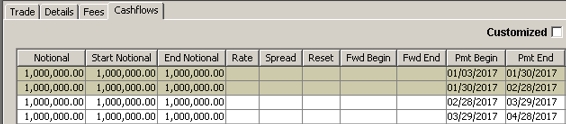

Trade Lifecycle

|

1. Sample Commodity Index Swap Trade

It is to be noted that, the check to ensure weights of all constituents amounts to 100%, is accurate upto 10 decimal places for weight type as ‘Percentage’.

Important Note

The notional is fixed at trade inception and does not change when the index is reset.

If you want the notional to change based on the index reset, you may want to consider Equity Swaps instead (and define an Equity Index rather than a Market Index).

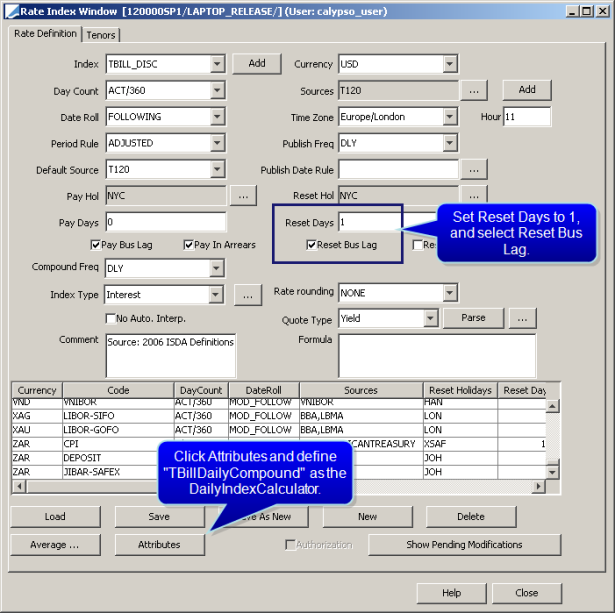

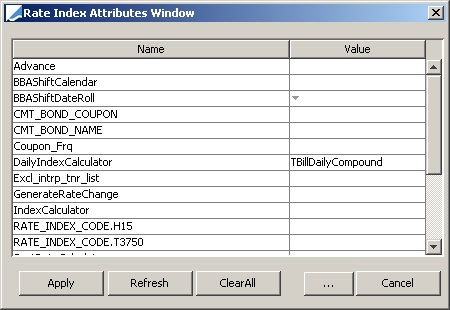

2. Sample TBILL Index - TBillDailyCompound Calculator

From Calypso Navigator, choose Configuration > Interest Rates > Rate Index Definitions.

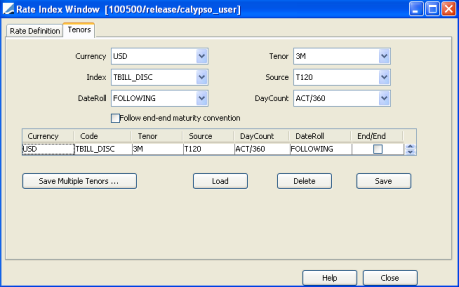

3. Sample TBILL Index - LiborDailyDecompound Calculator

From Calypso Navigator, choose Configuration > Interest Rates > Rate Index Definitions.

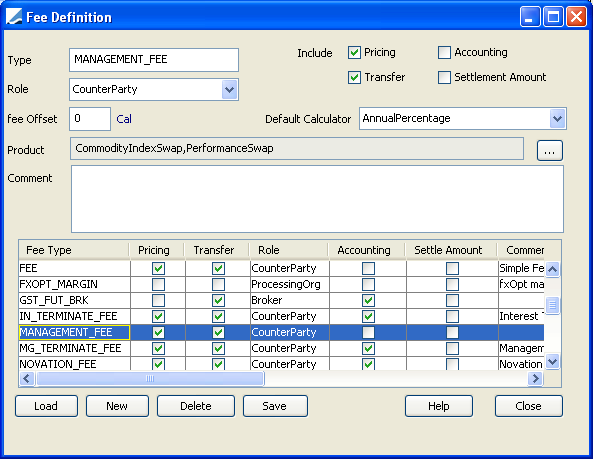

4. Sample Management Fee

The fee calculator AnnualPercentage can be used with the management fee accrual in Performance Swap pricing. The fee amount is nominal * (fee percentage * daycount/365). The fee percentage is entered in the trade.

Add the calculator to the feeCalculator domain in Domain Values.

Add the MANAGEMENT_FEE to the defaultCISManagementFeeType domain in Domain Values.

To set up the fee definition, choose Configuration > Fees, Haircuts & Margin Calls > Fee Definition from Calypso Navigator.

See

See