Investment P&L Analysis

This document describes how to configure the Investment PL analysis using the Analysis Designer.

The Investment PL analysis is a light version of the Investment Indicators focusing on P&L only. It allows running just the Official P&L / Investment P&L part embedded in the Investment Indicators analysis without running the Pricing and Risk sub-analyses.

Before You Begin

In order to run an Investment PL analysis, you first need to configure the following:

| • | An "Official" P&L Configuration with Investment P&L measures, and an "Intraday" P&L Configuration. |

You also need to run the Official P&L analysis for the "Official" P&L Configuration.

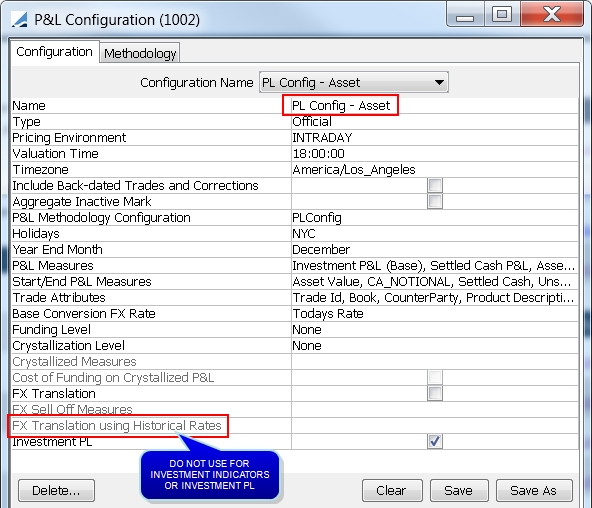

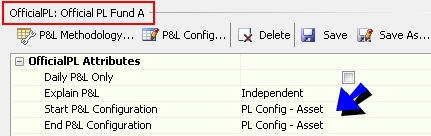

Sample configurations are shown below.

Please refer to Calypso Official P&L documentation for complete details.

Please refer to Calypso Official P&L documentation for complete details.

Sample "Official" P&L Configuration

Ⓘ [NOTE: Translation with historical FX rates is not used with Buy Side P&L - In order to ensure matching results between Official P&L and Investment Indicators, it is required that no measures be added to "FX Translation using Historical Rates".]

You can change the type to Intraday, and click Save As to create the "Intraday" P&L Configuration.

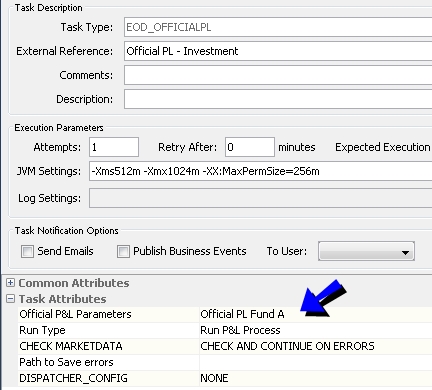

Sample Official P&L parameters for the "Official" P&L Configuration

Then run the scheduled task EOD_OFFICIALPL for the Official P&L parameters.

Ⓘ [NOTE: The position spec used to run the scheduled task (in the trade filter) should be the same as the position spec used to run the Portfolio Workstation analysis (in the Report Engine Configuration trade filter template).]

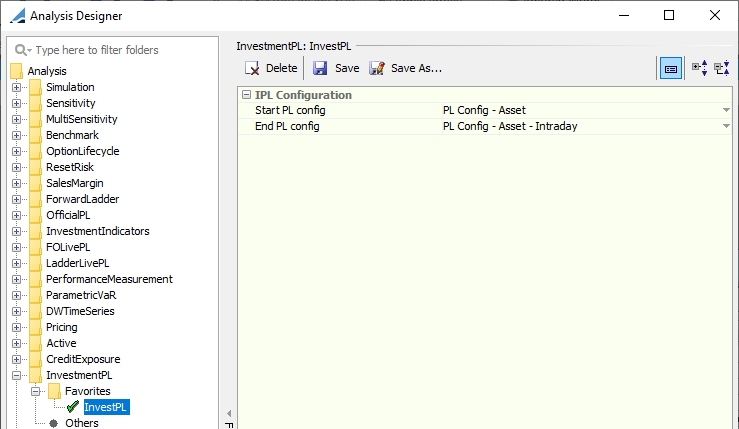

1. Configuring the Investment P&L Analysis

From the Calypso Navigator, navigate to Configuration > Reporting & Risk > Analysis Designer to configure an Investment PL analysis.

Right-click an Investment PL folder, and choose "New Analysis" to configure a parameter. You will be prompted to enter a configuration name.

| » | Enter the fields described below as needed, then click Save. |

| » | You can click P&L Config to define a P&L Configuration, as shown in the example above. |

Please refer to Calypso Official P&L documentation for complete details.

Please refer to Calypso Official P&L documentation for complete details.

|

Indicators |

Description |

|---|---|

|

Start P&L Configuration |

Select an "Official" P&L configuration with Investment P&L measures. |

|

End P&L Configuration |

Select an "Intraday" P&L configuration to be used on the end date. This configuration must have the same parameters as the "Official" P&L configuration with type "Intraday". You can also select an “Official” P&L configuration to view EOD P&L. |

2. Excluding Canceled Trades

You can exclude canceled trades from the analysis using the following setup.

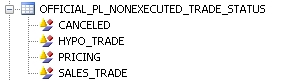

| » | Add the CANCELED status to the list of statuses excluded from Official P&L in the domain OFFICIAL_PL_NONEXECUTED_TRADE_STATUS. |

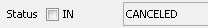

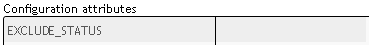

| » | Exclude the CANCELED status in the trade filter template used in the Report Engine Configuration. |

See Portfolio Workstation for details on Report Engine Configuration.

See Portfolio Workstation for details on Report Engine Configuration.

| » | Ensure that the Liquidation engine does not exclude the CANCELED status. |

3. Running the Investment P&L Analysis

You can view the results of the Investment PL analysis in the Portfolio Workstation.

See Portfolio Workstation for information on running the Portfolio Workstation.

See Portfolio Workstation for information on running the Portfolio Workstation.

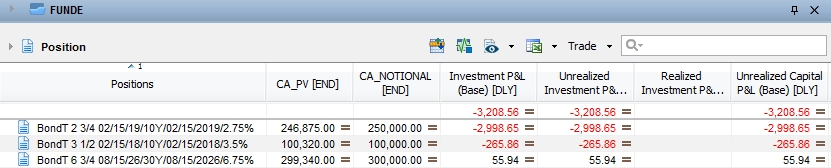

Sample Investment PL Results

Investment P&L = Realized Investment P&L + Unrealized Investment P&L

Realized Investment P&L = Realized Capital P&L + Realized FX P&L + Realized Cross P&L

Unrealized Investment P&L = Unrealized Capital P&L + Unrealized FX P&L + Unrealized Cross P&L

Realized Capital P&L = Realized P&L from the asset revaluation

Realized Capital Base(t) = Realized Capital Base(t-1) + Realized P&L * fx_buy

Realized Cross P&L = P&L due to the cross effect of capital appreciation and FX movement

| • | OTC Products |

Realized Cross Base(t) = Realized(t) * [fx(t) - Funding Average FX(t-1)]

| • | Position Based Products |

Realized Cross Base(t) = Realized P&L * (fx_sell - fx_buy)

Realized FX P&L = Realized P&L from the FX revaluation

| • | OTC Products |

Realized FX Base(t) = Realized FX Base(t-1) + Decreases in Funding * [fx(t) - Funding Average FX(t-1)]

| • | Position Based Products |

Realized FX Base(t) = [Change in 'Unrealized P&L(t) - Asset Value(t)'] * (fx_sell - fx_buy)

Unrealized Capital P&L = Unrealized P&L from the asset revaluation

Unrealized Capital Base(t) = Unrealized(t) * Funding Average FX(t)

Unrealized Cross P&L = P&L due to the cross effect of capital appreciation and FX movement

| • | OTC Products |

Unrealized Cross Base(t) = Unrealized(t) * [fx(t) - Funding Average FX(t)]

| • | Position Based Products |

Unrealized Cross Base(t) = Unrealized(t) * [fx(t) - Funding Average FX(t)]

Unrealized FX P&L = Unrealized P&L from the FX revaluation

| • | OTC Products |

Unrealized FX Base(t) = Funding Balance(t) * [fx(t) - Funding Average FX(t)]

| • | Position Based Products |

Unrealized FX Base(t) = -[Unrealized(t) - Asset Value(t)] * [fx(t) - Funding Average FX(t)]

Funding Balance

Funding Balance(t) = Settled Cash(t) + Unsettled Cash(t) - Realized(t)

Funding Average FX = Average FX rate of the funding balance

Funding Average FX(t) = [Funding Balance(t-1) * Funding Average FX(t-1) + Increases In Funding * fx(t)] / Funding Balance(t)

Asset Value = CA_PV + Accrual (for bonds)

Settled Cash = CUMULATIVE_CASH

For OTC products, Settled Cash = Settled Proceeds

Unsettled Cash = (Unrealized MTM + Unrealized Accrual + Unrealized Accretion + Unrealized Other + Realized MTM + Realized Accrual + Realized Accretion + Realized Other) - Asset Value - Settled Cash

Please refer to Calypso Official P&L for Buy Side for more details on these measures.

Please refer to Calypso Official P&L for Buy Side for more details on these measures.