Pricer Measures

This document describes the pricer measures provided by Calypso out-of-the-box.

You can find a mapping between products, models, pricers and pricer measures available out-of-the-box in the Calypso Analytics Library documentation.

For details on pricer measures calculations, please refer to the Calypso Analytics guides by asset class.

|

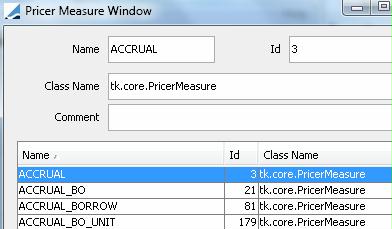

If a pricer measure is not available for selection, you can add it using Configuration > System > Add Pricer Measure from the Calypso Navigator.

Make sure to respect the proper name, ID and class name. The default class name is tk.core.PricerMeasure unless otherwise specified.

Legend

- Additive pricer measure - Y (Yes) or N (No) - Additive pricer measures can be summed in a "Total" row in CWS.

- Additive pricer measure - Y (Yes) or N (No) - Additive pricer measures can be summed in a "Total" row in CWS.

- Convertible pricer measure - Y (Yes) or N (No) - Convertible pricer measures are associated with a currency and can be converted to another currency. The Check Ccy function in CWS only applies to convertible pricer measures. It allows checking that all the amounts of a given formula are in the same currency so that they can be added.

- Convertible pricer measure - Y (Yes) or N (No) - Convertible pricer measures are associated with a currency and can be converted to another currency. The Check Ccy function in CWS only applies to convertible pricer measures. It allows checking that all the amounts of a given formula are in the same currency so that they can be added.

Pricer Measures

|

Pricer Measures |

|

|

Description |

|||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

<pricer measure> |

Y |

Y |

You can define any pricer measure with the class In this case, this pricer measure is priced using PricerFromDB, regardless of the pricer associated with the product. PricerFromDB has two modes of operation:

Example: You are pricing Swaps with PricerSwap, and computing ACCRUAL, NPV, and NPV_CPTY. If NPV_CPTY is defined with the class This pricer measure is convertible by default unless it is added to domain "PricerMeasureFromDB_NOCONVERT". When using PricerFromDB for allocated trades, you can create a custom pricer measure that uses the class name tk.pricer.PricerMeasureAllocatedFromDB to automatically allocate the NPV of the parent trade to the child trades based on the allocation percentage. Example: NPV_EXTERNAL, ID = 6101, Class Name = tk.pricer.PricerMeasureAllocatedFromDB If NPV_EXTERNAL on parent trade is 100,000, and the allocation created Child Trade 1 for 60% and Child Trade 2 for 40% - EXTERNAL_TRADE is set to 60,000 on Child Trade 1 and 40,000 on Child Trade 2. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL ID = 3 |

Y |

Y |

Accrued interest, which is the proportion of interest or coupon earned on an investment from the previous coupon payment date until the value date. This does not require a quote in order to be calculated. For Swaps, the computation method depends on the pricing parameter ACCRUAL_BOND_CONVENTION. For uneven FX swaps, see pricing parameter IS_UNEVENFXSWAP_ACCRUAL_QUOTING. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_BO ID = 21 |

Y |

Y |

Except for Bonds, ACCRUAL_BO is the same as Accrual. For Bonds, ACCRUAL_BO is the accrual computed on Valuation Date for same date (as opposed to the accrual of the Bond that computes the value adjusted for the settle days). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_BORROW ID = 81 |

Y |

Y |

Accrual based on the borrow rate, for repo and security lending trades. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_BO_UNIT ID = 179 |

Y |

N |

Accrual calculated based on the valuation date, without any adjustment such as spot settlement days and ACCRUAL_FIRST. Ⓘ [NOTE: This pricer measure is for internal use only] |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_BS ID = 316 |

Y |

Y |

Interest Bought-Sold on a trade. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_DIFFERENCE ID = 82 |

Y |

Y |

JGB Repo Trades The sum of ACCRUAL and ACCRUAL_BORROW (amounts are in opposite directions). Security Lending Trades = INDEMNITY_ACCRUAL - ACCRUAL + REINVESTMENT_ACCRUAL |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_DRAWN ID = 159 |

Y |

Y |

For Revolver bonds, the value of the drawn part of the coupon on valuation date. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_EIR ID = 454 |

Y |

Y |

Class Structured Flows, Swaps, SwapCrossCurrency, and SwapNonDeliverable For the products listed here with two legs, results are split by ACCRUAL_EIR_PAYLEG and ACCRUAL_EIR_RECLEG, their sum being ACCRUAL_EIR. Valuation at amortized cost using pricer measure IRR. The pricing parameters EIR_FORECAST_RATES, EIR_USE_RESET_DATE and EIR_INCLUDE_FEE impact the computation of ACCRUAL_EIR. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_EIR_PAYLEG ID = 488 |

N |

Y |

Accrual EIR for the Pay leg. | |||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_EIR_RECLEG ID = 487 |

N |

Y |

Accrual EIR for the Receive leg. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_FINANCING ID = 926 |

Y |

N |

Class Calculates the accrual for the finance leg of an IOS Index trade. Calculated as Notional * Index * Price * Period (Factor/100/Daycount). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_FIRST ID = 4 |

Y |

Y |

Accrual from the last coupon payment end date (Pmt End Date) until the valuation date plus one business day. On inflation indexed bonds, ACCRUAL_FIRST takes into account one extra day of inflation adjustment. When trading book attribute EODWeek = True, ACCRUAL_FIRST is until Monday. When trading book attribute EODWeek = False, ACCRUAL_FIRST is until Friday + 1 Day if pricing parameter FIRST_ACCRUAL = True, or until Friday if pricing parameter FIRST_ACCRUAL = False. For Swaps, the computation method depends on the pricing parameter ACCRUAL_BOND_CONVENTION. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_FIRST_PAYLEG ID = 49 |

Y |

Y |

Same as ACCRUAL_FIRST on the pay leg (mainly used for swaps). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_FIRST_PAYLEG_TERM ID = 471 |

Y |

N |

For Swap trades. ACCRUAL_FIRST of Pay Leg of a terminated Swap as of the Termination Date. Zero for Swap trades with status not equal to TERMINATED. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_FIRST_RECLEG ID = 50 |

Y |

Y |

Same as ACCRUAL_FIRST on the receive leg (mainly used for swaps). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_FIRST_RECLEG_TERM ID = 472 |

Y |

N |

For Swap trades. ACCRUAL_FIRST of Rec Leg of a terminated Swap as of the Termination Date. Zero for Swap trades with status not equal to TERMINATED. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_IB ID = 304 |

Y |

Y |

Retrieves Interest Bearing and sums the daily interest for a report val date. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_INDEX ID = 927 |

Y |

Y |

Class Calculates accrual for the performance leg of an IOS Index trade. Calculated as Notional * Coupon Rate * Period * (Factor/Daycount). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_PAYLEG ID = 47 |

Y |

Y |

Same as ACCRUAL on the pay leg (mainly used for swaps). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_PAYLEG_TERM ID = 473 |

Y |

N |

For Swap and Performance Swap trades. ACCRUAL of Pay Leg of a terminated Swap as of the Termination Date. Zero for Swap trades with status not equal to TERMINATED. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_PAYMENT ID = 51 |

Y |

Y |

To calculate accrual on flows from the payment date of the previous flow (or its start date if it is the first) to the payment date of the current flow rather than using the start and end dates of the flow. PA: projected amount PDt: payment date of previous period PDn: payment date of current period ACCRUAL_PAYMENT = PA * (Val date - PDt)/(PDn - PDt) On a Call Notice, it will compute the Accrual without taking into account the interest capitalization. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_PAYMENT_FIRST ID = 52 |

Y |

Y |

ACCRUAL_PAYMENT including the day of the calculation. PA: projected amount PDt: payment date of previous period PDn: payment date of current period ACCRUAL_PAYMENT_FIRST = PA * (Val date - PDt+1)/(PDn - PDt) |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_PAYMENT_FIRST_PAYLEG ID = 55 |

N |

Y |

Same as ACCRUAL_PAYMENT_FIRST on the pay leg (mainly used for swaps). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_PAYMENT_FIRST_RECLEG ID = 56 |

N |

Y |

Same as ACCRUAL_PAYMENT_FIRST on the receive leg (mainly used for swaps). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_PAYMENT_PAYLEG ID = 53 |

N |

Y |

Same as ACCRUAL_PAYMENT on the pay leg (mainly used for swaps). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_PAYMENT_RECLEG ID = 54 |

N |

Y |

Same as ACCRUAL_PAYMENT on the receive leg (mainly used for swaps). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_RATE ID = 933 |

N |

N |

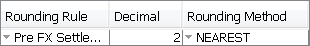

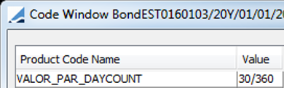

Fixed Income: Applies to fixed income trades using a daily compounded RFR index. Displays the current period calculated accrual rate based on observations until the settlement date for calculation of the current accrual. Note that it will not display when the settlement date is before the value date. Currently only applicable for Bloomberg Data License imported bonds. Interest Rate Derivatives (Swaps, CapFloor) and Structured Flows:

The accrual rate is backcalculated based on the below formula:

Rounding of ACCRUAL_RATE pricer measure will be as below:

|

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_REAL_TD ID = 529 |

Y |

Y |

For Swap and CDS trades. Interest accrual from pay leg + interest accrual from receive leg on val date = trade date (for the upfront). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_REAL_TD_PAY ID = 530 |

Y |

Y |

For Swap trades. Interest accrual from pay leg on val date = trade date (for the upfront). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_REAL_TD_REC ID = 531 |

Y |

Y |

For Swap trades. Interest accrual from receive leg on val date = trade date (for the upfront). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_REALIZED ID = 323 |

Y |

Y |

Applies to Fixed Income, Structured Flows, Swaps, SwapNonDeliverable, and SwapCrossCurrency. Accrual B/S + Total Interest paid/received on the position (also available for Day, Month, Year, etc). Use the “ACCRUAL_BO” or ACCRUAL_SETTLE_DATE” pricer measures to get the current accrual amount. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_REALIZED_PAYLEG ID = 456 |

Y |

Y |

Same as ACCRUAL_REALIZED on the payment leg. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_REALIZED_RECLEG ID = 457 |

Y |

Y |

Same as ACCRUAL_REALIZED on the receive leg. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_RECLEG ID = 48 |

Y |

Y |

Same as ACCRUAL on the receive leg (mainly used for swaps). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_RECLEG_TERM ID = 474 |

Y |

N |

For Swap and Performance Swap trades. ACCRUAL of Rec Leg of a terminated Swap as of the Termination Date. Zero for Swap trades with status not equal to TERMINATED. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_SETTLE_DATE ID = 72 |

Y |

Y |

Accrual from the later of the last coupon payment date or the trade settlement date until the valuation date (if pricing parameter FIRST_ACCRUAL = false or is not specified), or the valuation date plus one business day (if pricing parameter FIRST_ ACCRUAL = true). |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_SETTLE_DATE_WHT ID = 919 |

Y |

N |

Class ACCRUAL_SETTLE_DATE_WHT = ACCURAL_SETTLE_DATE * WHT Rate WHT Rate comes from the Withholding Tax Configuration. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_TERM_REAL ID = 526 |

Y |

Y |

For Swap, Performance Swap, CDS, CDS Index, Cap, Floor, Collar trades. Calculated if trade keyword TerminationTradeDate is not empty, or if trade status = TERMINATED. Otherwise returns 0. Interest accrual from receive leg + interest accrual from pay leg on val date = TerminationTradeDate |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_TERM_REAL_PAY ID = 527 |

Y |

Y |

For Swap and Performance Swap trades. Calculated if trade keyword TerminationTradeDate is not empty, or if trade status = TERMINATED. Otherwise returns 0. Interest accrual from pay leg on val date = TerminationTradeDate |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_TERM_REAL_REC ID = 528 |

Y |

Y |

For Swap and Performance Swap trades. Calculated if trade keyword TerminationTradeDate is not empty, or if trade status = TERMINATED. Otherwise returns 0. Interest accrual from receive leg on val date = TerminationTradeDate |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_TRADE_TERM ID = 618 |

Y |

N |

For CDS, CDS Index, Cap, Floor, Collar trades: ACCRUAL at termination effective date For CIRS and Performance Swap: ACCRUAL_PAYLEG_TERM + ACCRUAL_RECLEG_TERM |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_UNDRAWN ID = 160 |

Y |

Y |

For revolver bonds, the value of the undrawn part of the coupon on valuation date. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_UNIT ID = 176 |

Y |

N |

Accrual calculated based on the later of trade settle date and theoretical/spot settle date (calculated from the valuation date). It is calculated as ACCRUAL per one unit of notional. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_WHT ID = 918 |

Y |

N |

Class ACCRUAL_WHT = ACCURAL * WHT Rate WHT Rate comes from the Withholding Tax Configuration. |

|||||||||||||||||||||||||||||||||||||||

|

ACCRUAL_YIELD ID = 23 |

Y |

Y |

Calculates the interest on the Security, based on the YIELD implied by the trade price. For example, if a 6% Bond is bought at a price of 103, the expected YIELD would be 5.6%. ACCRUAL_YIELD is computed on a daily basis. |

|||||||||||||||||||||||||||||||||||||||

|

<accrual measure>_PIK <accrual measure>_NOPIK <interest>_PIK <paydown>_PIK |

Y |

Y |

Accrual / interest / paydown pricer measures for Brady bonds - They must be added manually. The class is <pricer measure>_NOPIK = <pricer measure> - <pricer measure>_PIK The <accrual>_PIK and <interest>_PIK pricer measures compute the PIK accrual / interest, based on the capitalization rate. The <paydown>_PIK pricer measure is the paydown of the capitalized PIK interest. For example, ACCRUAL_FIRST_PIK and ACCRUAL_FIRST_NOPIK. ACCRUAL_FIRST_NOPIK = ACCRUAL_FIRST - ACCRUAL_FIRST_PIK |

|||||||||||||||||||||||||||||||||||||||

|

ACCUMULATED_ACCRUAL ID = 273 |

Y |

Y |

For Call Notice and Loan & Deposit. Interest for life of trade, i.e. from trade start date to valuation date. |

|||||||||||||||||||||||||||||||||||||||

|

ACTUAL_POS ID = 302 |

Y |

Y |

Shows actual inventory position for Call Account ID on val date. Only available in the Trade Browser. |

|||||||||||||||||||||||||||||||||||||||

|

AGGREGATE_SPREAD ID = 123 |

N |

N |

Sum of the break-even spreads of the un-defaulted reference assets. |

|||||||||||||||||||||||||||||||||||||||

|

ANNUALIZED_FEE_RATE |

N

|

N

|

The pricer measure is calculated for a given fee when the Fee Definition attribute AnnualizedFeeRate is set to true. ANNUALIZED_FEE_RATE is calculated as: Annualized Fee Rate = Sum of absolute value of fees/ (tenor based on position start date * sum of absolute notional of all trades) |

|||||||||||||||||||||||||||||||||||||||

|

ASSET_SWAP_SPREAD ID = 94 |

N |

N |

The spread over the floating Leg in a 'Par/Par' Asset swap which will result in a 0 NPV. The Floating Index should be user specified in the Pricing Environment. When a call schedule is defined, it is calculated up to next call date rather than trade maturity date. |

|||||||||||||||||||||||||||||||||||||||

|

ASSET_SWAP_SPREAD_PROC ID = 166 |

N |

N |

Asset swap spread computed using the Proceeds method. The Proceeds method involves the adjusted notional value of IR swap (for the fixed side, the coupon is adjusted accordingly so in the end it still consists of the same cashflow). At maturity the bond is returned to the asset swap seller for the initial proceeds. |

|||||||||||||||||||||||||||||||||||||||

|

ASSET_SWAP_SPREAD_REF ID = 143 |

N |

N |

Asset swap spread relative to a given reference index specified in the pricing parameter ASSET_SWAP_SPREAD_REF_INDEX. When the pricing parameter ASSET_SWAP_SPREAD_REF_INDEX contains a reference index in a currency different from which of the bond, the pricer measure ASSET_SWAP_SPREAD_REF models a cross currency swap. |

|||||||||||||||||||||||||||||||||||||||

|

AVG_MONTHLY_PRICE ID = 151 |

N |

Y |

Average monthly price for one unit of the commodity. |

|||||||||||||||||||||||||||||||||||||||

|

AVG_PRICE ID = 150 |

N |

Y |

Average price for one unit of the product. |

|||||||||||||||||||||||||||||||||||||||

|

AVG_PRICE_CLEAN ID = 324 |

N |

N |

Used in PLPosition and EOD_WAC. Clean average price of the position taken directly from the position (unit price). The display is based on the bond's quote type and number of decimals. |

|||||||||||||||||||||||||||||||||||||||

|

AVG_PRICE_DIRTY ID = 325 |

N |

N |

Used in PLPosition. Dirty average price of the position taken directly from the position (unit price) plus accrual . The display is based on the bond's quote type and number of decimals. |

|||||||||||||||||||||||||||||||||||||||

|

AVG_RECOVERY ID = 288 |

N |

N |

For Nth Loss CDS pricers: Notional-weighted average recovery of all the non-defaulted assets in the basket. For CDS pricers: Recovery rate used for pricing the trades. For CDS option pricers: It is calculated for the option’s underlying CDS. For basket CDS, it is the weighted average of the recovery rates of the curves used in pricing. For single-name CDS or CDS Index from quote, it shows the one recovery rate used in pricing. |

|||||||||||||||||||||||||||||||||||||||

|

AVG_SPREAD ID = 124 |

N |

N |

Index valued as a Basket. The B/E Rate is obtained for each underlying and then averaged. Weighted average of the spreads of the un-defaulted reference assets. |

|||||||||||||||||||||||||||||||||||||||

|

AVG_YIELD ID = 455 |

N |

N |

Average Yield computed from the Average Price for Bond positions. The Average Yield is rounded as per the Yield Decimals of the Bond Definition. |

|||||||||||||||||||||||||||||||||||||||

|

B/E_AMOUNT ID = 100 |

N |

Y |

Break Even price for commodities that solves for NPV = 0. |

|||||||||||||||||||||||||||||||||||||||

|

B/E_Rate ID = 25 |

N |

N |

The Break Even rate is the average interest rate at which a zero profit is recorded. It is represented by NPV = 0 and it is the price of the underlying that solves for the target product NPV. |

|||||||||||||||||||||||||||||||||||||||

|

B/E_Rate (Diff) |

Only used on the Pricing Grid. Uses a valid tenor or a specific date to find the baseline val date. Diff values are displayed as base points and represent the difference between the current value and the value for the given baseline val date and time. |

|||||||||||||||||||||||||||||||||||||||||

|

B/E_Ratio ID = 415 |

N |

N |

Break-even ratio for a BMA swap, which is characterized as float vs. float and one index is a factor index. The system solves for the factor rather than the additive spread. |

|||||||||||||||||||||||||||||||||||||||

|

B/E Spot ID = 482 |

N |

N |

Used for Swap and European Swaption Represents the Spot B/E Rate for a Swap or the swap underlying a European Swaption for the remaining maturity of the swap. |

|||||||||||||||||||||||||||||||||||||||

|

BASE_CORR_ATT ID = 136 |

N |

N |

The attachment correlation used to price the tranche. |

|||||||||||||||||||||||||||||||||||||||

|

BASE_CORR_DET ID = 137 |

N |

N |

The detachment correlation used to price the tranche. |

|||||||||||||||||||||||||||||||||||||||

|

BASKET_FORWARD ID = 345 |

Y |

N |

The basket forward rate calculated by the Basket Approximation model. |

|||||||||||||||||||||||||||||||||||||||

|

BASKET_SPOT ID = 344 |

Y |

N |

The basket spot rate calculated by the Basket Approximation model. |

|||||||||||||||||||||||||||||||||||||||

|

BASKET_VOLATILITY ID = 346 |

N |

N |

The basket volatility calculated by the Basket Approximation model. |

|||||||||||||||||||||||||||||||||||||||

|

BENCHMARK_SPREAD ID = 104 |

N |

N |

For a bond trade where the underlying issue is defined as being priced as a spread, this is the spread (it should be the same as the Quote). When a call schedule is defined, it is calculated up to next call date rather than trade maturity date. |

|||||||||||||||||||||||||||||||||||||||

|

BETA ID = 307 |

N |

N |

The Beta between the Stock and Reference Index for the Valuation Date. |

|||||||||||||||||||||||||||||||||||||||

|

BETA_ADJUSTED_DELTA ID = 308 |

Y |

Y |

The DELTA pricer measure adjusted for Beta (pm.DELTA * pm.BETA). |

|||||||||||||||||||||||||||||||||||||||

|

BETA_INDEX ID = 343 |

Y |

N |

The specified index to be used to calculate the beta. |

|||||||||||||||||||||||||||||||||||||||

|

BE_CORRELATION ID = 135 |

N |

N |

The implied correlation which will result in 0 NPV. |

|||||||||||||||||||||||||||||||||||||||

|

BE_PCT_OF_AGG ID = 125 |

N |

N |

Ratio of the break-even rate to the AGGREGATE_SPREAD, expressed as a percentage (obtained by pricing the index as a 0-100% basket). |

|||||||||||||||||||||||||||||||||||||||

|

BID_ASK_SPREAD ID = 245 |

N |

N |

Applies to bond pricing. The spread between bid and ask quotes. |

|||||||||||||||||||||||||||||||||||||||

|

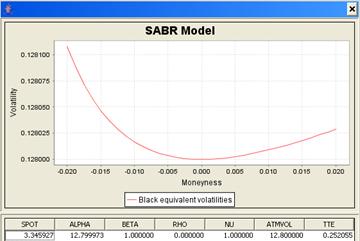

BLACK_EQUIV_VOL ID = 235 |

N |

N |

The Black equivalent volatility. |

|||||||||||||||||||||||||||||||||||||||

|

BOOK_VALUE ID = 68 |

Y |

Y |

The BOOK_VALUE is intended to reflect the cost of obtaining a given position or open trade. Where this applies, P&L can be calculated as the difference between BOOK_VALUE and MARKET_VALUE. Standard Method - Pricing parameter BV_ALTERNATE = False

BOOK_VALUE = (nominal * purchase price) + accretion to date + accrued coupon to date Settle date positions are used. Long positions give a positive result, and short positions give a negative result.

BOOK_VALUE = start cash + accrued interest to date All open trades. Reverse repos and buy-sell backs give a positive result; repos and sell-buy backs give a negative result; loans give a positive result and deposits give a negative result.

BOOK_VALUE = NPV

BOOK_VALUE = Number of shares * Average trade price

BOOK_VALUE = Number of shares * Option premium average trade price

BOOK_VALUE = Average trade price in ticks * Value per tick

BOOK_VALUE = Number of contracts * Option premium average trade price

BOOK_VALUE = Notional amount in base currency * Option premium average trade price Alternate Method - Pricing parameter BV_ALTERNATE = True (Only applies to Bond and MMSimple, for other products, see Standard Method.) BOOK_VALUE = Notional * Factor * (Average clean price + Accrued coupon to date) Trade date positions are used. |

|||||||||||||||||||||||||||||||||||||||

|

BORROW_SPREAD ID = 230 |

N |

N |

Displays the borrow spread used in pricing the equity derivatives trade, either from the borrow curve or enter manually in the BORROW_SPREAD transient pricing parameter. |

|||||||||||||||||||||||||||||||||||||||

|

BP_VOL ID = 234 |

N |

N |

The equivalent basis point (annualized) volatility. |

|||||||||||||||||||||||||||||||||||||||

|

BRAESS_FANG_YIELD ID = 8 |

N |

N |

Calculates the Yield of a bond, similar to the Moosmueller method, but in the case of bonds that pay coupons more frequently than annually, it uses a mixture of annual and less than annual compounding. Out-of-the-box, no pricer calculates this pricer measure. |

|||||||||||||||||||||||||||||||||||||||

|

BREAK_EVEN_DEFAULT_RATE ID = 9997 |

Y |

N |

Intex pricers to price ABS bonds. Default rate for a tranche's first writedown. |

|||||||||||||||||||||||||||||||||||||||

|

BREAK_EVEN_REAL_RATE ID = 461 |

N |

N |

For a Real Rate swap using calculation type Inflation Indexation, this pricer measure will display the break even fixed rate. Typically, one leg of a real rate swap pays a floating interest rate like LIBOR and the other leg pays a fixed rate and is inflation indexed. |

|||||||||||||||||||||||||||||||||||||||

|

BREAK_EVEN_REAL |

Y |

N |

Fixed rate on the inflation indexed leg of a real rate swap. |

|||||||||||||||||||||||||||||||||||||||

|

BREAK_EVEN_RATE_PAYLEG ID = 264 BREAK_EVEN_RATE_RECLEG ID = 265 |

N |

N |

Break-even rate for the pay leg and break-even rate for the receive leg. |

|||||||||||||||||||||||||||||||||||||||

|

BREAK_EVEN_RATIO_PAYLEG ID = 422 BREAK_EVEN_RATIO_RECLEG ID = 423 |

N |

N |

Same as B/E_Ratio for the rec leg and the pay leg for solving for index factor. |

|||||||||||||||||||||||||||||||||||||||

|

CA_COST ID = 437 |

N |

Y |

Class Cross asset cost.

|

|||||||||||||||||||||||||||||||||||||||

|

CA_MARKET_PRICE ID = 439 |

N |

Y |

Class Cross asset market price.

|

|||||||||||||||||||||||||||||||||||||||

|

CA_NOTIONAL ID = 429 |

Y |

Y |

Class Cross asset notional.

|

|||||||||||||||||||||||||||||||||||||||

|

CA_PV ID = 438 |

Y |

Y |

Class CA_PV is the net present value ignoring all fees and upfront costs. When CA_PV is computed, NPV_INCLUDE_COST = False, regardless of its setting in the pricing parameters set. If INCLUDE_FEES=True, CA_PV = NPV - FEES_NPV Else CA_PV = NPV Ⓘ [NOTE: The CA_PV pricer measure is not currently implemented for ETOs and Future Options] Bond Trades For bond trades, the pricer measure NPV_DISC is used instead of NPV. CDS Trades CA_PV includes projected fees, irrespective of INCLUDE_FEES, on CreditDefaultSwap, CDSNthDefault, CDSNthLoss, CDSIndex, and CDSIndexTranche trades. Commodity Forward Trades If Cash Settle Date <= Val Date < Physical Settle Date Cumulative_Cash = Price from Commodity flow * Quantity NPV_INCLUDE_COST = True, NPV_INCLUDE_COST_AFTER_SETTLE = True, NPV_INCLUDE_CASH = True CA_PV = Projected Price from Security Flows * Quantity When valuation date is on or after the security cashflow settle date (i.e. the physical settle date), then the CA_PV calculation shifts to position. Commodity Spot Trades CA_PV (before/on/after settlement) = Price (Spot/forward price depends on pricing parameter "NPV_FROM_QUOTE")*Quantity

|

|||||||||||||||||||||||||||||||||||||||

|

CA_PV_NET_COST ID = 929 |

Y |

Y |

Class CA_PV (computed with INCLUDE_FEES = FALSE)+ UPFRONT + PREMIUM. |

|||||||||||||||||||||||||||||||||||||||

|

CA_PV_NET_COST_AM ID = 930 |

Y |

Y |

Class CA_PV (where INCLUDE_FEES = FALSE) - ACCRUAL + UPFRONT_FEE_REMAIN + PREMIUM_REMAIN. Now, CA_PV_NET_COST_AM pricer measure is only supported by: - CreditDefaultSwap - CDSIndex |

|||||||||||||||||||||||||||||||||||||||

|

CA_QUANTITY ID = 413 |

N |

N* |

Class Cross asset quantity. *This pricer measure is convertible if a currency is set on the pricer measure.

|

|||||||||||||||||||||||||||||||||||||||

|

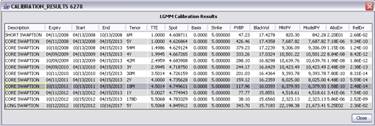

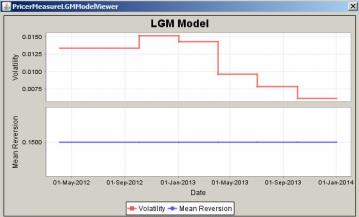

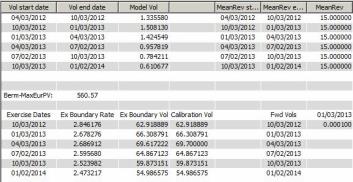

CALIBRATION_RESULTS ID = 223 |

N |

N |

Class OFM generator results of the calibration. Double-click the pricer measure to open a window summarizing which swaptions were used for the calibration of the model volatilities and the two swaptions, marked SHORT and LONG, for calibrating the mean reversion.

|

|||||||||||||||||||||||||||||||||||||||

|

CALIBRATION_TIME_MS ID = 295 |

Y |

N |

The time taken, in milliseconds, by the analytics routine to calibrate the model. |

|||||||||||||||||||||||||||||||||||||||

|

CARRY ID = 356 |

Y |

Y |

Credit Derivatives pricers. CARRY = ACCRUAL_BO (t+1 business day) - ACCRUAL_BO (t) If t+1 is a coupon period start date then add the last coupon amount. |

|||||||||||||||||||||||||||||||||||||||

|

CASH ID = 5 |

Y |

Y |

Sum of all the cashflows occurring on the Valuation Date. |

|||||||||||||||||||||||||||||||||||||||

|

CASH_BASE ID = 361 |

Y |

N |

Class Currency type of cashflow. |

|||||||||||||||||||||||||||||||||||||||

|

CASH_DELTA ID = 202 |

Y |

Y |

FX Options. Displays the delta for cash (premiums and fees on the options). |

|||||||||||||||||||||||||||||||||||||||

|

CASH_RATE ID = 182 |

Y |

N |

PricerBondAssetBackedAUD. Floating benchmark rate to the next interest rate reset date. |

|||||||||||||||||||||||||||||||||||||||

|

CASH_RATE_01 ID = 958 |

Y |

N |

Class The SWAP_RATE and CASH_RATE are derived from the forecast curve and not the discount curve. CASH_RATE_01 is the sensitivity to a 1 bp increase of the CASH_RATE. CASH_RATE_01 = PV_AFMA (〖Cash_Rate〗+1bp)-PV_AFMA (〖Cash_Rate〗) |

|||||||||||||||||||||||||||||||||||||||

|

CASH_YIELD ID = 24 |

Y |

Y |

CASH_YIELD, like ACCRUAL_YIELD, returns the interest on the security, computed based on the Yield implied by the Trade Price. For example, when a 6% Bond is purchased for a price of 103, the Yield expected is 5.6%. CASH_YIELD is computed on the Interest Date. |

|||||||||||||||||||||||||||||||||||||||

|

CDS_BASIS_ADJ ID = 142 |

N |

N |

The CDS Index basis (obtained by pricing the Index as a 0-100% basket). This is calculated by adjusting the probability curves and so that the BE_RATE is equal to the IMPLIED_SPREAD. |

|||||||||||||||||||||||||||||||||||||||

|

CDS_PREMIUM ID = 326 |

Y |

N |

CDS premium amount. |

|||||||||||||||||||||||||||||||||||||||

|

CDS_QUOTE ID = 145 |

N |

N |

Applies only to Risky Bonds. CDS quote taken from the probability curve for a given tenor. The tenor is set in the pricing parameter CDS_QUOTE_TENOR. |

|||||||||||||||||||||||||||||||||||||||

|

CDS_SPREAD ID = 126 |

N |

N |

Applies only to Risky Bonds. This used to calculate the CDS level if the Bond is to be hedged with a CDS. If the bond uses a probability curve generated from CDS spreads, it calculates the break-even spread for the (hypothetical) CDS underlying the curve with the same maturity date as the bond. The CDS is priced using the probability curve in the PricerConfig associated with that CDS, which is usually (but not forced to be) the same as the probability curve of this bond. |

|||||||||||||||||||||||||||||||||||||||

|

CIS_TERM_1 ID = 219 |

Y |

Y |

Applies to early termination of Commodity Index Swaps. Returns the results using the discounting method. Discount the net cashflow at the original termination date back to the early termination date using the LIBOR curve. |

|||||||||||||||||||||||||||||||||||||||

|

CIS_TERM_2 ID = 220 |

Y |

Y |

Applies to early termination of Commodity Index Swaps. Returns the results using the P&L method. Net the P&L at the early termination date without discounting. Index amount is calculated using the index level at the early termination date. Fixed amount and interest amount are calculated, up to and including the unwind termination date. The unwind P/L is the net of all these 3 amounts. |

|||||||||||||||||||||||||||||||||||||||

|

CLEAN_BOOK_VALUE ID = 376 |

Y |

Y |

Book Value of a position based on Clean Price. |

|||||||||||||||||||||||||||||||||||||||

|

CLEAN_REALIZED ID = 327 |

Y |

Y |

Position clean realized. |

|||||||||||||||||||||||||||||||||||||||

|

CLEAN_UNREALIZED ID = 328 |

Y |

Y |

Position clean unrealized. |

|||||||||||||||||||||||||||||||||||||||

|

COL_TAX ID = 923 |

Y |

N |

Class Specific to the Colombian market. Linear daily accrual of the tax amount. |

|||||||||||||||||||||||||||||||||||||||

|

COL_TAX_BASIS ID = 922 |

Y |

N |

Class Specific to the Colombian market. Linear daily accrual of the tax basis. It is set to zero when the val date is less than or equal to the settle date. |

|||||||||||||||||||||||||||||||||||||||

|

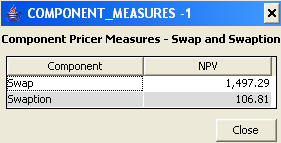

COMPONENT_MEASURES ID = 310 |

N |

Y |

PricerSwapLGMM1F – Pricing of cancelable swaps with Bermudan schedule. It allows viewing the NPV of the swap and the NPV of the swaption separately.

|

|||||||||||||||||||||||||||||||||||||||

|

CONVERSION_FACTOR ID = 350 |

N |

N |

Returns the conversion rate needed to go from pricing currency (NPV) to base currency as defined in the pricing environment. Product and Static Data details are taken into account For FX Forward and FX NDF trades, the Pricing Currency trade attribute value is used as the "from currency" for the pricing environment base currency conversion factor when the environment property CONVERSION_FACTOR_MSR_FROM_PRICING_CURRENCY is set to true. |

|||||||||||||||||||||||||||||||||||||||

|

CONVEXITY ID = 13 |

N |

N |

Measures the curvature of a bond's price/yield curve. Mathematically, it is the ratio of the second derivative of the price with respect to the interest and the dirty price, or, (d2 P/d i2)/dirty price. |

|||||||||||||||||||||||||||||||||||||||

|

CORRELATION_01 ID = 347 |

N |

Y |

Calculated by PricerCorrelationSwap. Numerically shift the Correlation Matrix by 1% up and return the difference in NPV from this shift and the central case. |

|||||||||||||||||||||||||||||||||||||||

|

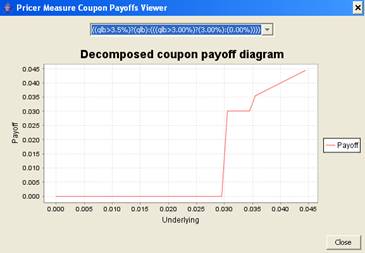

COUPON_PAYOFFS ID = 242 |

N |

Y |

When pricing an exotic single swap, you can examine the coupon payoff using the pricer measure COUPON_PAYOFFS. The coupon payoffs are held in client data.

|

|||||||||||||||||||||||||||||||||||||||

|

CUMULATIVE_CASH ID = 309 CUMULATIVE_CASH_PRINCIPAL ID = 314 CUMULATIVE_CASH_INTEREST ID = 311 CUMULATIVE_CASH_FEES ID = 312 CUMULATIVE_CASH_SL_FEE (SecLending fees) ID = 2006 |

Y |

Y |

Position cash. Class New pricer measures can be added as CUMULATIVE_CASH_CashFlowType (e.g. CUMULATIVE_CASH_INCOME) using Configuration > System > Add Pricer Measure, which would calculate the Cash component due to the particular cashflow type. |

|||||||||||||||||||||||||||||||||||||||

|

CUR_NOTIONAL_PAY ID = 353 CUR_NOTIONAL_REC ID = 354 |

N |

Y |

In case of amortized schedules - Current notional of the pay leg and receive leg respectively. |

|||||||||||||||||||||||||||||||||||||||

|

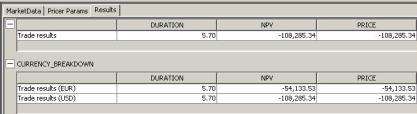

CURRENCY_BREAKDOWN ID = 263 |

Class Can be added to all CRD trades - Allows a break-down of the results per currency.

|

|||||||||||||||||||||||||||||||||||||||||

|

CURRENT_ACCRUAL ID = 913 |

Y |

N |

Class Shows the rate used to calculate bond accrued interest for the current period. Generally, CURRENT_ACCRUAL = CURRENT_COUPON, except for Mexican BONDES. |

|||||||||||||||||||||||||||||||||||||||

|

CURRENT_COUPON ID = 162 |

N |

N |

Shows the effective rate for a floating rate bond. If the rate has not been reset, it is empty. For a fixed rate bond, it shows the fixed rate. For Margin Call products it returns: - The effective rate of the underlying bond, including spread for floating flat rate bonds. If the rate has not been set, only the spread is returned. - The effective fixed rate of the bond for fixed rate bonds. |

|||||||||||||||||||||||||||||||||||||||

|

CURRENT_COUPON_PAYLEG ID = 493 CURRENT_COUPON_RECLEG ID = 494 |

N |

N |

For PricerSwap These measures display the forward rate + spread from the coupon period on which the valuation date falls. For PricerAssetSwap On the Asset Leg of an Asset Swap, the pricer pulls results from the CURRENT_COUPON pricer measure used with PricerBond. On the Funding Leg, the pricer gets results for either the PAYLEG or RECLEG as described above for Swaps. |

|||||||||||||||||||||||||||||||||||||||

|

CURRENT_NOTIONAL ID = 269 |

Y |

Y |

For call notices:

For equity stocks:

For OTC:

For ETO:

For Future Equity and Future Equity Index:

Current Notional(T) = Tick Size * Tick Value * Future Price(T) * Trade Quantity

Current Notional(T) = Tick Size * Tick Value * Future Price(T) * Trade Quantity Where:

For Structured Flows:

For commodity products:

|

|||||||||||||||||||||||||||||||||||||||

|

CURRENT_RATE ID = 262 |

Y |

N |

It is the rate from the daily cashflow according to the valuation date (valDate = cashflow start date). |

|||||||||||||||||||||||||||||||||||||||

|

CURR_EFF_ATT ID = 393 CURR_EFF_DET ID = 394 |

N |

N |

Applies to CRD Tranche trades - Current Effective Attachment point of the tranche, expressed as a percentage of the original notional of the basket. Applies to CRD Tranche trades - Current Effective Detachment point of the tranche, expressed as a percentage of the notional of the basket. |

|||||||||||||||||||||||||||||||||||||||

|

DDELTA_DVOL ID = 155 |

Y |

Y |

The cross-derivative (dDelta/dVol) of option price with respect to the spot rate and the volatility; also known as dVega/dSpot, "stability ratio," and "vanna." |

|||||||||||||||||||||||||||||||||||||||

|

DEFAULT_ACCRUAL ID = 404 |

Y |

Y |

The PV of the default compensation of the credit events applied to the trade. They are discounted from the settle dates. |

|||||||||||||||||||||||||||||||||||||||

|

DEFAULT_COMP ID = 403 |

Y |

Y |

The PV of the accrual or rebate payment of the credit events applied to the trade, discounted from the settle dates. |

|||||||||||||||||||||||||||||||||||||||

|

DEFAULT_EXPOSURE ID = 86 |

Y |

Y |

Measures the amount of money lost in case of default. The definition of Default Exposure is for Bonds: NPV (Market Value), and for CDS: NPV (Market Value) + Notional. The Default Exposure takes NPV, Notional, Recovery and Accrual into account. For Basket trades, it calculates the Per Name Default Exposure, which takes the change in NPV and Cash Settlement into account. |

|||||||||||||||||||||||||||||||||||||||

|

DEFAULT_NPV ID = 121 |

Y |

Y |

PricerCreditDefaultSwap The NPV of the trade after a hypothetical default of the reference entity at the valuation time. The trade value will be non-zero if coupons or principal are protected from default. This is particularly useful in modeling credit-linked notes. |

|||||||||||||||||||||||||||||||||||||||

|

DEFAULT_SETTLEMENT ID = 120 |

Y |

Y |

PricerCreditDefaultSwap The net payment if a hypothetical default happened on the valuation date, combining the protection payment with any accrued premium that is due (if PAY_ACCRUAL type). The value is zero if the valuation date is before the settlement date of the trade (default before start date). |

|||||||||||||||||||||||||||||||||||||||

|

DEF_EXPOSURE_TIGHT ID = 300 |

Y |

Y |

Measures the amount of money lost in case of default of the safest assets too. A positive number indicates a loss and a negative number indicates a profit. Rest of the definition is exactly same as the DEFAULT_EXPOSURE pricer measure. |

|||||||||||||||||||||||||||||||||||||||

|

DELTA ID = 14 |

Y |

Y |

Change in NPV for 1% change in spot. The DELTA measures how the options' value (which is the same as the current premium) varies with changes in the underlying price. Mathematically, DELTA is the first partial derivative of the option price with respect to the underlying. Equity Derivatives Trades Change in NPV for 1% change in spot * 100. FX & FX Option Trades DELTA is the ratio of the change in PV to the change in spot. The PV used in the calculation is expressed in Quoting Currency. The resulting ratio is the DELTA in Primary Currency, not including the premium. The DELTA in Quoting Currency follows from the relationship: DELTA (Quoting Currency, Premium Not Included) = (-1) * Spot Rate * DELTA (Primary Currency, Premium Not Included) The currency pair parameter "Delta Display Ccy" determines the currency in which DELTA is displayed by default. You can include the premium in DELTA. The DELTA with premium included follows from the relationship: DELTA(Primary Currency, Premium Included) = DELTA(Primary Currency, Premium Not Included) – PV(Primary Currency) Also, expressed in Quoting Currency: DELTA(Quoting Currency, Premium Included) = (-1) * Spot Rate * DELTA (Primary Currency, Premium Included) = DELTA(Quoting Currency, Premium Not Included) + PV(Quoting Currency) The inclusion of the premium in DELTA is determined by the pricing parameter USE_DELTA_TERM_B as well as the currency pair parameter “Risky Ccy”, obeying the next rules: If USE_DELTA_TERM_B is unset or set to false: DELTA does not include the premium If USE_DELTA_TERM_B is set to true then:

DELTA does not include the premium. It matches DELTA_RISKY_PRIM

DELTA includes the premium. It matches DELTA_RISKY_SEC The pricer measure DELTA always means Spot DELTA and hence the DELTA is unaffected by the setting of the Pricing Parameters ADJUST_FX_RATE and ZD_PRICING. Commodity Option Trades For Commodity Options, the system calculates the Delta of each optionlet and sums them together to give the deal delta. This term will be in the commodity "deal units" which are the units deal of the deal quantity. |

|||||||||||||||||||||||||||||||||||||||

|

DELTA_01 ID = 69 |

Y |

Y |

Measures the parallel shift of yield curve sensitivity. DELTA_01 shifts the quotes of the underlying instruments of the market data. Ⓘ [NOTE: This pricer measure is not for use in conjunction with Horizon or Risk reports that shift Points (Simulation, Scenario)] |

|||||||||||||||||||||||||||||||||||||||

|

DELTA_01_INFLATION ID = 405 |

Y |

Y |

Class Applies to inflation swaps and inflation bonds. Change in NPV for 1bp change in underlying quotes of the inflation curves. Ⓘ [NOTE: This pricer measure is not for use in conjunction with Horizon or Risk reports that shift Points (Simulation, Scenario)] |

|||||||||||||||||||||||||||||||||||||||

|

DELTA_AT_DOWN_BARRIER ID = 225 |

Y |

Y |

Delta at the down barrier / low trigger. Payout fee if in risky currency. |

|||||||||||||||||||||||||||||||||||||||

|

DELTA_AT_UP_BARRIER ID = 224 |

Y |

Y |

Delta at the up barrier / high trigger. Payout fee if in risky currency. |

|||||||||||||||||||||||||||||||||||||||

|

DELTA_B4_DOWN_BARRIER ID = 247 DELTA_B4_UP_BARRIER ID = 246 |

Y |

Y |

Difference in PV by shifting spot where the spot equals to the barrier (up barrier or down barrier). |

|||||||||||||||||||||||||||||||||||||||

|

DELTA_IN_UNDERLYING ID = 78 |

Y |

N |

For commodity options and equity structured options. Option delta displayed in the units of the commodity being traded (barrels, tones, etc). The delta represents the expected change in NPV for the deal based on a shift of the forward curve by 1 ccy unit per commodity unit. |

|||||||||||||||||||||||||||||||||||||||

|

DELTA_PCT ID = 76 |

N |

N |

Percent change of NPV for 1% change in spot (this is used for FX options, equity options, CDS options, and swaptions). |

|||||||||||||||||||||||||||||||||||||||

|

DELTA_RISKY_PRIM ID = 244 |

Y |

Y |

= Primary amount * dfPrimary * spot |

|||||||||||||||||||||||||||||||||||||||

|

DELTA_RISKY_SEC ID = 243 |

Y |

Y |

FX Trades = Quoting amount * dfQuoting FX Option Trades DELTA (change in NPV for 1% change in spot) including the premium. DELTA_RISKY_SEC (Quoting Currency) = (-1) * Spot Rate * DELTA_RISKY_SEC (Primary Currency) |

|||||||||||||||||||||||||||||||||||||||

|

DELTA_W_PREMIUM ID = 73 |

Y |

Y |

Not used - Use DELTA_RISKY_SEC instead. |

|||||||||||||||||||||||||||||||||||||||

|

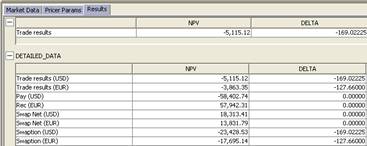

DETAILED_DATA ID = 250 |

N |

N |

Class Defines a tabular pricer measure that displays pricer measure results in multiple currencies (base, pay, and receive currencies) when pricing cancelable cross-currency swaps.

You can configure the format of the pricer measure by defining the following 'User Defaults' attributes:

This applies to the Results area of all trade windows. |

|||||||||||||||||||||||||||||||||||||||

|

DIGITAL ID = 228 |

Y |

N |

|

|||||||||||||||||||||||||||||||||||||||

|

DIRTY_PRICE ID = 22 |

N |

Y |

Clean price plus accrued coupon. The price generally quoted in the market, however, is the clean price. |

|||||||||||||||||||||||||||||||||||||||

|

DIRTY_PRICE_SCALED ID = 931 |

Y |

N |

Class Used in Taiwanese bills. Per local market practice, the face value for a TWN bill should set up with 100,000, while the price base for the same bill should be in 10,000. The base is controlled by the Issue Price Base product code. If Issue Price Base = 10,000, then: DIRTY_PRICE_SCALED = DIRTY_PRICE * 100

|

|||||||||||||||||||||||||||||||||||||||

|

DIRTY_PRICE_UNDERLYING ID = 552 |

Y |

N |

Class For Bond Forward trades. If the value date is less than the fixing date, it is the projected forward dirty price of the underlying, otherwise, it is the spot dirty price of the underlying. |

|||||||||||||||||||||||||||||||||||||||

|

DISCOUNT ID = 208 |

Y |

N |

PricerBondMMDiscount. Discount rate. |

|||||||||||||||||||||||||||||||||||||||

|

DISCOUNT_FACTOR ID = 287 |

N |

N |

Used to discount the payment when calculating PV. |

|||||||||||||||||||||||||||||||||||||||

|

DISC_MARGIN ID = 102 |

N |

N |

The discounted margin for a floating-rate note is calculated similarly to that of the Z_SPREAD. Each cashflow is projected using a forward curve and then discounted with a discount curve and a fixed spread m to find the NPV. The discounted margin is the value of mfor which this NPV is equal to the market-quoted dirty price. |

|||||||||||||||||||||||||||||||||||||||

|

DURATION ID = 11 |

N |

N |

Macaulay Duration, implemented based on the following relationship: Macaulay Duration = (1 + y/n) * MODIFIED_DURATION, where y is the yield to maturity, n is the number of periods per year, and MODIFIED_DURATION is the percentage change to price with respect to change in yield. |

|||||||||||||||||||||||||||||||||||||||

|

DV01 ID = 408 |

Y |

Y |

Average of prices due to change of +1bp and -1bp to the yield-to-maturity. The yield-to-maturity is computed from the bond quote when BOND_FROM_QUOTE is true, or from the theoretical price otherwise. Then the yield-to-maturity is shifted by +1bp and -1bp, and the new price is computed as the average of both prices. DV01 is the price change multiplied by the trade notional. |

|||||||||||||||||||||||||||||||||||||||

|

DV01_SPREAD ID = 426 |

Y |

Y |

Applies to swap trades. It is the change in NPV for a 1bp (absolute) increase in the spread of the floating side. DV01_SPREAD = NPV(with spread+1Bp) - NPV(original) |

|||||||||||||||||||||||||||||||||||||||

|

DVEGA_DRD ID = 410 |

Y |

Y |

Vega sensitivity to quoting currency interest rate. |

|||||||||||||||||||||||||||||||||||||||

|

DVEGA_DRF ID = 411 |

Y |

Y |

Vega sensitivity to the primary currency interest rate. |

|||||||||||||||||||||||||||||||||||||||

|

DVEGA_DSPOT ID = 156 |

Y |

Y |

The cross-derivative (dVega/dSpot) of option price with respect to the spot rate and the volatility; also known as dDelta/dVol, "stability ratio," and "vanna." Although in the continuous limit this is theoretically the same as DDELTA_DVOL, numerical implementations can lead to different results. |

|||||||||||||||||||||||||||||||||||||||

|

DVEGA_DSPOT_WB_E ID = 197 |

Y |

Y |

FX Option Window Barriers. The sensitivity to the changes in VEGA_WB_E when the spot shifts. |

|||||||||||||||||||||||||||||||||||||||

|

DVEGA_DSPOT_WB_M ID = 198 |

Y |

Y |

FX Option Window Barriers. The sensitivity to the changes in VEGA_WB_M when the spot shifts. |

|||||||||||||||||||||||||||||||||||||||

|

DVEGA_DSPOT_WB_S ID = 196 |

Y |

Y |

FX Option Window Barriers. The sensitivity to the changes in VEGA_WB_S when the spot shifts. |

|||||||||||||||||||||||||||||||||||||||

|

DVEGA_DVOL ID = 157 |

Y |

Y |

The change of vega with volatility, which is the second derivative of option price with respect to volatility; also known as "vomma" or "kappa." |

|||||||||||||||||||||||||||||||||||||||

|

DVEGA_DVOL_WB_E ID = 200 |

Y |

Y |

FX Option Window Barriers. The sensitivity to the changes in VEGA_WB_E when the barrier end volatility shifts. |

|||||||||||||||||||||||||||||||||||||||

|

DVEGA_DVOL_WB_M ID = 201 |

Y |

Y |

FX Option Window Barriers. The sensitivity to the changes in VEGA_WB_M when the option maturity volatility shifts. |

|||||||||||||||||||||||||||||||||||||||

|

DVEGA_DVOL_WB_S ID = 199 |

Y |

Y |

FX Option Window Barriers. The sensitivity to the changes in VEGA_WB_S when the barrier start volatility shifts. |

|||||||||||||||||||||||||||||||||||||||

|

D_CEV_ALPHA ID = 280 |

Y |

N |

For swaptions using PricerSwaptionCEV. Sensitivity of the PV to alpha. |

|||||||||||||||||||||||||||||||||||||||

|

D_CEV_BETA ID = 281 |

Y |

N |

For swaptions using PricerSwaptionCEV. Sensitivity of the PV to beta. |

|||||||||||||||||||||||||||||||||||||||

|

EFFECTIVE_CALL_DATE ID = 495 |

Y |

N |

Used for callable bond pricing, it uses the Effective Call Method defined on the bond product and provides the matching cashflows based on the Effective Call Date. You can also use the pricing parameter EFFECTIVE_CALL_METHOD in the pricing env to override the product value with a specific value for all callable bonds. EFFECTIVE_CALL_DATE will then display based on the pricing parameter value. |

|||||||||||||||||||||||||||||||||||||||

|

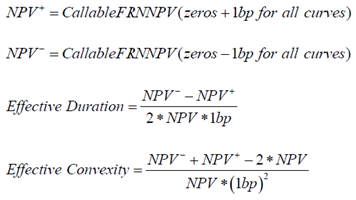

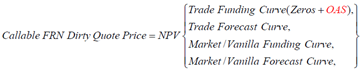

EFFECTIVE_CONVEXITY ID = 491 EFFECTIVE_DURATION ID = 490 |

N |

N |

For callable FRN bonds using PricerLGMM1FSaliTree.

NPV = NPV_UNDERLYING + NPV_CANCEL |

|||||||||||||||||||||||||||||||||||||||

|

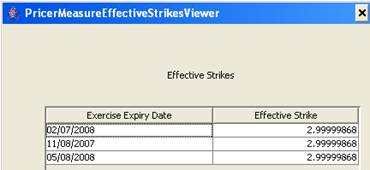

EFFECTIVE_STRIKE ID = 215 |

N |

N |

Strike of a swaption. For a Bermudan swaption or cancelable swap, you can double-click to see the whole adjusted strike schedule. Note that the pricing parameter ADJUST_FOR_EXERCISE_FEES must be set to true.

|

|||||||||||||||||||||||||||||||||||||||

|

EFF_ATT ID = 172 |

N |

N |

For Nth Loss and CDS Index Tranches. Re-calibrated attachment points after the credit event has been applied to the trade. The base correlations used in the calculation also correspond to the new re-calibrated points. |

|||||||||||||||||||||||||||||||||||||||

|

EFF_DET ID = 173 |

N |

N |

For Nth Loss and CDS Index Tranches. Re-calibrated detachment points after the credit event has been applied to the trade. The base correlations used in the calculation also correspond to the new re-calibrated points. |

|||||||||||||||||||||||||||||||||||||||

|

EXDIV_PRICE ID = 951 EXDIV_DIRTY_PRICE ID = 952 EXDIV_ACCRUAL ID = 953 EXDIV_TRADE_PRICE ID = 954 EXDIV_TRADE_ACCRUAL_PROCEEDS ID = 955 EXDIV_TRADE_DIRTY_PRICE ID = 956 |

N |

N |

|

|||||||||||||||||||||||||||||||||||||||

|

EXPECTED_LOSS ID = 163 |

Y |

N |

For Nth Loss and CDS Index Tranches. Expected loss displayed as a percent between 0 and 100, this is: (expected loss amount) / (remaining notional of basket). The “expected loss amount” is the present value of the expected future termination payments. It does not include past losses if the default payments have already been received. |

|||||||||||||||||||||||||||||||||||||||

|

EXPECTED_LOSS_RATIO ID = 164 |

Y |

N |

For Nth Loss and CDS Index Tranches. Expected loss displayed as a fraction between 0 and 1, this is: (expected loss amount of tranche) / (expected loss amount of entire basket). The “expected loss amount” is the present value of the expected future termination payments. It does not include past losses if the default payments have already been received. |

|||||||||||||||||||||||||||||||||||||||

|

EXPECTED_TIME_TO_MATURITY ID = 934 |

N |

N |

Class Expected time to maturity in years for LGMM1F pricers. |

|||||||||||||||||||||||||||||||||||||||

|

EXPECTED_TIME_TO_REDEMPTION ID = 296 |

N |

N |

Applies to TARN pricing - the expected time until redemption of the note, given the assumptions of the model and the pricing parameter. |

|||||||||||||||||||||||||||||||||||||||

|

EXPLODE_PV_PRIM_CCY ID = 402 |

Y |

Y |

For FX trades. EXPLODE_PV_PRIM_CCY = primary currency amount * primary currency discount factor |

|||||||||||||||||||||||||||||||||||||||

|

EXPLODE_PV_QUOTE_CCY ID = 401 |

Y |

Y |

For FX trades. EXPLODE_PV_QUOTE_CCY = quoting currency amount * quoting currency discount factor |

|||||||||||||||||||||||||||||||||||||||

|

EXPOSURE_CURRENT ID = 148 |

Y |

Y |

For repo collaterals. = (Par amount * Current inflation factor * Current pool factor * Dirty market price) * (1 - Haircut / 100) - [(Value + Current repo interest) * -1] Where Current repo interest (receivable/payable) is the interest accrued up to today on this repo trade since the later of the last interest cleanup or the Repo start date, but pro-rated for this collateral piece's money amount. Current repo interest = ACCRUAL_CLEANUP * Collateral money amount / Repo trade money amount |

|||||||||||||||||||||||||||||||||||||||

|

EXPOSURE_ORIGINAL ID = 147 |

Y |

Y |

For repo collaterals. = (Par amount * Current inflation factor * Current pool factor * Dirty market price) * (1 - Haircut / 100) - (Value * -1) |

|||||||||||||||||||||||||||||||||||||||

|

FACE_VALUE ID = 329 |

Y |

N |

Position face value. |

|||||||||||||||||||||||||||||||||||||||

|

<fee name> <fee name>_AM <fee name>_CASH <fee name>_NPV <fee name>_REC <fee name>_REMAIN |

Y |

Y |

Fee pricer measures are added manually. The class is

You can then use these pricer measures for any trade. |

|||||||||||||||||||||||||||||||||||||||

|

<fee name>_EXCLUDED <fee name>_EXCLUDED_AM <fee name>_EXCLUDED_CASH <fee name>_EXCLUDED_NPV <fee name>_EXCLUDED_REC <fee name>_EXCLUDED_REMAIN |

Y |

Y |

Class Same as <fee name> pricer measures for <fee name>_EXLUDED: Combines all the fees attached to a trade into one pricer measure, except for the <fee name>. Example: You have a trade with PREMIUM, COMMISSION, and ADJUST fees. Pricer measure PREMIUM_EXLUDED will combine COMMISSION and ADJUST fees. |

|||||||||||||||||||||||||||||||||||||||

|

<fee name>_AM_EIR |

Y |

Y |

Class Amortization of <fee name>: ACCRUAL_EIR with <fee name> – ACCRUAL_EIR without <fee name>. Currently only available for Structured Flows. Impacted by pricing parameter EIR_INCLUDE_FEE. |

|||||||||||||||||||||||||||||||||||||||

|

FEES_ALL ID = 362 FEES_ALL_AM ID = 363 FEES_ALL_CASH ID = 366 FEES_ALL_NPV ID = 365 FEES_ALL_REMAIN ID = 364 |

Y |

Y |

Class Same as <fee name> pricer measures for FEES_ALL: Combines all the fees attached to a trade into one pricer measure. |

|||||||||||||||||||||||||||||||||||||||

|

FEES_ALL_AM_EIR |

Y |

Y |

Class Amortization of all "EIR" fees: ACCRUAL_EIR with fees – ACCRUAL_EIR without fees. Currently only available for Structured Flows. Impacted by pricing parameter EIR_INCLUDE_FEE. Fees marked with attribute "Exclude from EIR = true" are always excluded from ACCRUAL_EIR computation, regardless of EIR_INCLUDE_FEE. |

|||||||||||||||||||||||||||||||||||||||

|

FEES_NPV ID = 37 |

Y |

Y |

Denotes the PV of the applicable fees (expressed in the PE base currency) for inclusion in the NPV pricer measure. |

|||||||||||||||||||||||||||||||||||||||

|

FEES_NPV_CURRENCY |

Y |

N |

Denotes the PV of the applicable fees (expressed in the fee currency) for inclusion in the NPV pricer measure. This is a custom pricer measure available under |

|||||||||||||||||||||||||||||||||||||||

|

FEES_SETTLED ID = 331 |

Y |

Y |

These amounts will appear provided fee positions have been created. Refer to the Calypso Position Management User Guide for information on generating fee positions. |

|||||||||||||||||||||||||||||||||||||||

|

FEES_TOTAL ID = 330 |

Y |

Y |

These amounts will appear provided fee positions have been created. Refer to the Calypso Position Management User Guide for information on generating fee positions. |

|||||||||||||||||||||||||||||||||||||||

|

FEES_UNSETTLED ID = 332 |

Y |

Y |

Class These amounts will appear provided fee positions have been created. Refer to the Calypso Position Management User Guide for information on generating fee positions. |

|||||||||||||||||||||||||||||||||||||||

|

FEES_UNSETTLED_SD ID = 388 |

Y |

Y |

Class Same as FEES_NPV. |

|||||||||||||||||||||||||||||||||||||||

|

FINAL_PRINCIPAL ID = 139 |

Y |

Y |

For a buy sell back, INITIAL_PRINCIPAL + Interest as of the maturity date. |

|||||||||||||||||||||||||||||||||||||||

|

FORWARD_MTM ID = 128 |

Y |

Y |

The difference between the projected price and the fixed price multiplied by the quantity of the commodity being sold or bought discounted back to the date for which the trade is being priced. Same as the NPV of the trade. If the valuation date is the same as the settlement date, we use the quote on the settlement date. If the quote is not available, we project the price. If the valuation date is between the settlement date and the payment date, we look for the quote on the settlement date. If the valuation date in on the payment date, and NPV_INCLUDE_CASH is true, we do not calculate FORWARD_MTM. If NPV_INCLUDE_CASH is false, we use the quote on the settlement date. |

|||||||||||||||||||||||||||||||||||||||

|

FORWARD_PRICE ID = 140 |

N |

Y |

For a buy sell back, price as of the maturity date. For a swaption, it gives the forward premium of the swaption. |

|||||||||||||||||||||||||||||||||||||||

|

FUNDING_BV ID = 64 |

Y |

Y |

Funding based on the Book Value on a last day basis. Last day basis — The funding is computed from the previous business date to the current date (which may cross weekends and holidays). For example, on a Friday the charge should be for one day and on a Monday the charge should be for 3 days (to include Saturday and Sunday). No split month ends adjustment is necessary. The [days in year] variable is either 360 or 365 depending on the currency basis. Ⓘ [NOTE: You can set the INCLUDE_FEES parameter to true to include fees in the book value calculation] Position Based Products Sum of book values for all positions by book, by currency, and by CUSIP. Calculates cost of carry by net position as: Cost of Carry = [Book Value] * [Funding Rate] * [number of days] / [days in year] See BOOK_VALUE for Book Value calculation. Open Trades Calculates cost of carry by open trade as: Cost of Carry = [Book value] * [Funding Rate] * [number of days] / [days in year] See BOOK_VALUE for Book Value calculation. |

|||||||||||||||||||||||||||||||||||||||

|

FUNDING_BV_FIRST ID = 65 |

Y |

Y |

Funding based on the Book Value on a first day basis. The funding is computed from the current date to the next date. For example, on a Friday, the number of funding days is 3 (it includes Saturday and Sunday). If Monday is a holiday, then the number of funding days on Friday is 4 (it also includes Monday). The first day basis calculation takes split month ends into account. If Saturday is the last day of the month, the Friday charge will include 2 days of funding, and the Monday charge will include 2 days of funding. The [days in year] variable is either 360 or 365 depending on the currency basis. Ⓘ [NOTE: You can set the INCLUDE_FEES parameter to true to include fees in the book value calculation] Position Based Products Sum of book values for all positions by book, by currency, and by CUSIP. Calculates cost of carry by net position as: Cost of Carry = [Book Value] * [Funding Rate] * [number of days] / [days in year] See BOOK_VALUE for Book Value calculation. Open Trades Calculates cost of carry by open trade as: Cost of Carry = [Book value] * [Funding Rate] * [number of days] / [days in year] See BOOK_VALUE for Book Value calculation. |

|||||||||||||||||||||||||||||||||||||||

|

FUNDING_COST ID = 32 |

Y |

Y |

The cost of funding, as the spread plus the rate index value, applied on the Trade Value (Quantity * Trade Price). |

|||||||||||||||||||||||||||||||||||||||

|

FUNDING_MTM ID = 66 |

Y |

Y |

Funding based on the MTM Value on a last day basis. The funding is computed from the previous business date to the current date (which may cross weekends and holidays). For example, on a Friday the charge should be for one day and on a Monday the charge should be for 3 days (to include Saturday and Sunday). No split month ends adjustment is necessary. The [days in year] variable is either 360 or 365 depending on the currency basis. Ⓘ [NOTE: You can set the INCLUDE_FEES parameter to true to include fees in the book value calculation] Position Based Products Sum of MTM position values by book, by currency, and by CUSIP. Calculates cost of carry by net position as: Cost of Carry = [net MTM position] * [Funding Rate] * [number of days] / [days in year] with: net MTM position = quantity * dirty closing price * pool factor Trade date positions should be used. Mid prices should be used. Long positions give a positive result, and short positions give a negative result. Open Trades Calculates cost of carry by open trade as: Cost of Carry = [MTM value] * Funding rate * [number of days] / [days in year] with MTM value = Calypso calculated MTM value of cash side of the trade All open trades. Reverse repos and buy-sell backs give a positive result; repos and sell-buy backs give a negative result; loans give a positive result and deposits give a negative result. |

|||||||||||||||||||||||||||||||||||||||

|

FUNDING_MTM_FIRST ID = 67 |

Y |

Y |

Funding based on the MTM Value on a first day basis First day basis — The funding is computed from the current date to the next date. For example, on a Friday, the number of funding days is 3 (it includes Saturday and Sunday). If Monday is a holiday, then the number of funding days on Friday is 4 (it also includes Monday). The first day basis calculation takes split month ends into account. If Saturday is the last day of the month, the Friday charge will include 2 days of funding, and the Monday charge will include 2 days of funding. The [days in year] variable is either 360 or 365 depending on the currency basis. Ⓘ [NOTE: You can set the INCLUDE_FEES parameter to true to include fees in the book value calculation] Position Based Products Sum of MTM position values by book, by currency, and by CUSIP. Calculates cost of carry by net position as: Cost of Carry = [net MTM position] * [Funding Rate] * [number of days] / [days in year] with: net MTM position = quantity * dirty closing price * pool factor Trade date positions should be used. Mid prices should be used. Long positions give a positive result, and short positions give a negative result. Open Trades Calculates cost of carry by open trade as: Cost of Carry = [MTM value] * Funding rate * [number of days] / [days in year] with MTM value = Calypso calculated MTM value of cash side of the trade All open trades. Reverse repos and buy-sell backs give a positive result; repos and sell-buy backs give a negative result; loans give a positive result and deposits give a negative result. |

|||||||||||||||||||||||||||||||||||||||

|

FUNDING_RATE ID = 63 |

N |

N |

The funding rate. |

|||||||||||||||||||||||||||||||||||||||

|

FWD_DELTA ID = 74 |

Y |

Y |

Change in NPV for 1% change in forward rate. Based on the expiry date. In FX trades, FWD_DELTA = FX trade’s primary amount. In FX/FX Option trades, FWD_DELTA (Quoting Currency) = (-1) * Forward Rate * FWD_DELTA (Primary Currency). For Commodity Swap / Swaptions, it calculates the undiscounted Delta. It is the sum of the Fwd Delta cashflow column. The DELTA measure gives how may futures are needed to hedge the option. FWD_DELTA gives how many forward contracts are needed to hedge the option. For multiple payments, the DELTA and FWD_DELTA measures aggregate numbers of futures/forward contracts with a different maturity (each corresponding to a payment maturity.) |

|||||||||||||||||||||||||||||||||||||||

|

FWD_DELTA_PCT ID = 75 |

N |

N |

Percentage of change in NPV for 1% change in forward rate. Based on the expiry date. |

|||||||||||||||||||||||||||||||||||||||

|

FWD_DELTA_RISKY_PRIM ID = 252 |

Y |

Y |

= Primary amount * forward price |

|||||||||||||||||||||||||||||||||||||||

|

FWD_DELTA_RISKY_SEC ID = 251 |

Y |

Y |

= Quoting amount * trade price |

|||||||||||||||||||||||||||||||||||||||

|

FWD_POS ID = 303 |

Y |

Y |

Expected theoretical balance on a call account. |

|||||||||||||||||||||||||||||||||||||||

|

FX ID = 293 |

N |

N |

Foreign currency exchange. |

|||||||||||||||||||||||||||||||||||||||

|

FX_RATE ID = 339 |

N |

N |

Class The current FX Rate - Uses the pricing parameter Quote Usage. |

|||||||||||||||||||||||||||||||||||||||

|

FX_PL ID = 499 |

Y |

N |

Class Used in FX Average Price function. Please refer to Calypso Positions documentation for details. |

|||||||||||||||||||||||||||||||||||||||

|

GAMMA ID = 15 |

Y |

Y |

GAMMA measures how much the DELTA of an option changes with changes in the underlying price. Mathematically this is the second partial derivative of the option price with respect to the underlying price. Equity Derivatives Trades Change in GAMMA for 1% change in spot * 100. FX Option Trades [NOTE: In FX Option pricing, you can include the hedge gamma in the GAMMA pricer measure. In the Pricer Configuration in the Pricing Environment, set the Model Parameter USE_DELTA_TERM_B (PricerFXOption) to true. GAMMA returns the following values based on how you define the delta currency in the currency pair definition. Choose Configuration > Definitions > Currency Definitions.

|

|||||||||||||||||||||||||||||||||||||||

|

GAMMA_IN_UNDERLYING ID = 79 |

N |

N |

For an equity option, equity note or commodity option, this is the Gamma (second order sensitivity to the underlying stock/index) expressed as a number of shares. |

|||||||||||||||||||||||||||||||||||||||

|

GAMMA_PCT ID = 77 |

N |

N |

Percent change of DELTA_PCT for 1% change in spot (this is used for FX options and equity options to keep the original behavior). |

|||||||||||||||||||||||||||||||||||||||

|

GAT_NOMINAL ID = 904 |

Y |

N |

Class GAT stands for ganancia anual total, or annual effective rate. Only applies to Mexican bonds (yield type = MXN). GAT_NOMINAL = [(1 + r/m)m] - 1 Where r is the nominal coupon rate and m is the number of periods in year. BondMMDiscount For BondMMDiscount only, if (bond maturity date - trade settle date) < 1 year, then GAT_NOMINAL = Trade Yield. Otherwise GAT_NOMINAL is blank. |

|||||||||||||||||||||||||||||||||||||||

|

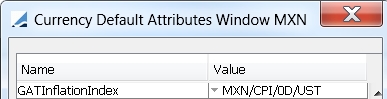

GAT_REAL ID = 905 |

Y |

N |

Class GAT stands for ganancia anual total, or annual effective rate. Only applies to Mexican bonds (yield type = MXN). GAT_REAL = [(1 + GAT_NOMINAL) / (1 + Pi)] - 1 Where Pi is the inflation rate. The currency attribute 'GATInflationIndex' must be set with the inflation index name, and a quote must be provided for the index on the val date.

|

|||||||||||||||||||||||||||||||||||||||

|

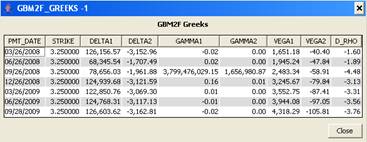

GBM2F_GREEKS ID = 268 |

N |

Y |

For spread cap floors priced with SpreadCapFloorGBM2FHagan. Double-click to display various Greeks per flow.

|

|||||||||||||||||||||||||||||||||||||||

|

HEDGE_DELTA ID = 149 |

Y |

Y |

No longer used. |

|||||||||||||||||||||||||||||||||||||||

|

HEDGE_GAMMA ID = 186 |

Y |

Y |

No longer used. |

|||||||||||||||||||||||||||||||||||||||

|

IMPLIEDVOLATILITY ID = 27 |

N |

N |

Volatility implied by the price quoted. Commodity Swaption Trades Actual Volatility used in pricing commodity swaption. It is supported for European swaption only. |

|||||||||||||||||||||||||||||||||||||||

|

IMPLIED_CORRELATION ID = 92 |

N |

N |

Gives the constant correlation that reproduces the NPV of the trade, so it is an "average pair wise correlation." The Parameter CORRELATION can be manually entered by the user, and this will override the correlation matrix from the market data; it will be used to find the NPV. (This is analogous to entering a manual volatility on an option trade to override a volatility surface.) |

|||||||||||||||||||||||||||||||||||||||

|

IMPLIED_IN_RANGE ID = 315 |

Y |

N |

Define the expected number of days that will meet variance swap condition. |

|||||||||||||||||||||||||||||||||||||||

|

IMPLIED_SPREAD ID = 122 |

N |

N |

The Price Quote converted to a spread. For a spread based index this is equal to the Quotes value of index. For a price based index, the price is converted to an implied spread. If the Price is PAR i.e 100, this will be equal to the Inception spread (the fixed coupon on the index definition). |

|||||||||||||||||||||||||||||||||||||||

|

IMPLIED_TRADING_VOL ID = 207 |

N |

N |

FX Options. Implied trading day volatility. Adjust IMPLIEDVOLATILITY by TRADING_DAYS. |

|||||||||||||||||||||||||||||||||||||||

|

INDEMNITY ID = 34 |

Y |

Y |

Amount of coupon on a collateral. |

|||||||||||||||||||||||||||||||||||||||

|

INDEMNITY_ACCRUAL ID = 35 |

Y |

Y |

Accrued coupon on a collateral. |

|||||||||||||||||||||||||||||||||||||||

|

INDEPENDENT_AMOUNT ID = 170 |

Y |

Y |

Class For margin calls. Evaluation of the independent amount fee of type IND_<fee type>. |

|||||||||||||||||||||||||||||||||||||||

|

INDEX_FWD_RATE ID = 306 |

Y |

N |

Calculated by obtaining the CDS index (whose start date is the expiry date of the CDS Index Option). So when solved for the break-even rate of this CDS Index, it is solved for a future break-even rate. |

|||||||||||||||||||||||||||||||||||||||

|

INFLATION_ACCRUAL ID = 132 |

Y |

Y |

Total inflation adjustment since a trade settlement date, up to the next business day (same rules as for PREM_DISC when dealing with month-ends). |

|||||||||||||||||||||||||||||||||||||||

|

INITIAL_MARGIN ID = 118 |

Y |

Y |

For margin calls. Initial margin. |

|||||||||||||||||||||||||||||||||||||||

|

INITIAL_PRINCIPAL ID = 138 |

Y |

Y |

For a buy sell back, Trade Nominal * Dirty Price. |

|||||||||||||||||||||||||||||||||||||||

|

INSTRUMENT_SPREAD ID = 108 |

N |

N |

Used for bonds. This is the spread over the Risk free curve which ensures that the Theoretical Price of the Bond matches the Quoted Price. When added to Performance Swap trades, it will display the INSTRUMENT_SPREAD if APPLY_INST_SPREAD=true and BOND_FROM_QUOTE=false. The calculated spread will be 0 if no quote for the bond exists in the quote set. |

|||||||||||||||||||||||||||||||||||||||

|

IRR ID = 10 |

N |

Y |

Class Structured Flows, Swaps, SwapCrossCurrency, and SwapNonDeliverable The Internal Rate of Return (IRR) is the interest rate that is used to discount a given series of cashflows to achieve a given net present value (NPV) of zero. Swaps, SwapCrossCurrency, and SwapNonDeliverable make use of IRR_PAYLEG and IRR_RECLEG. The pricing parameters EIR_FORECAST_RATES, EIR_USE_RESET_DATE and EIR_INCLUDE_FEE impact the computation of ACCRUAL_EIR. |

|||||||||||||||||||||||||||||||||||||||

|

IRR_PAYLEG ID = 486 |

N |

N |

IRR for the Pay leg in a Swap. | |||||||||||||||||||||||||||||||||||||||

|

IRR_RECLEG ID = 484 |

N |

N |

IRR for the Receive leg in a Swap. | |||||||||||||||||||||||||||||||||||||||

|

ISMA_YIELD ID = 7 |

N |

N |

The ISMA_YIELD is similar to Yield, but it forces the computation of the Yield based on the ISMA Methodology. The ISMA Methodology is the standard in the USA. The difference between the ISMA methodology and other Yield calculation methods arises in the computation of the Yield in the last period of Bond. |

|||||||||||||||||||||||||||||||||||||||

|

LEG_BREAKDOWN ID = 291 |

Class For Performance Swaps. Returns the results for each leg separately. |

|||||||||||||||||||||||||||||||||||||||||

|

LEVERAGE ID = 161 |

Y |

N |

For CDS index tranches. = Abs(PV01_CREDIT this trade) / (PV01_CREDIT whole index trade) |

|||||||||||||||||||||||||||||||||||||||

|

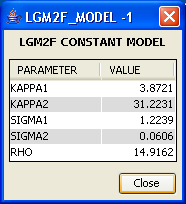

LGM2F_MODEL ID = 305 |

N |

Y |

Bonds using PricerBondLGMM2F. Sows the calibrated model used to value the trade.

|

|||||||||||||||||||||||||||||||||||||||

|

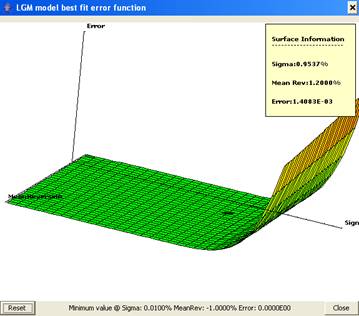

LGMM_BESTFIT_ERROR ID = 270 |

N |

Y |

For swaptions using PricerSwaptionLGMM1F. It allows plotting the calibration error function and get a sense of the mean reversion.