Stubs Handling

Detailed description of how the system handles stub periods.

1. Environment Property

You may choose the default tolerance for when stub periods are created using environment property STUB_TOLERANCE. This is a number of days.

Ⓘ [NOTE: There are other settings described below that affect default stub handling]

Example: If STUB_TOLERANCE = 5, no stub would is created for a period less than 5 days in length.

2. Default Interpolation and Curve Selection

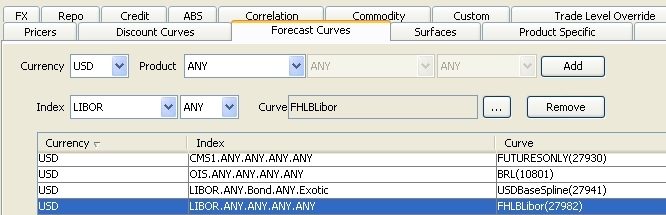

You can of multiple curves for stubs, based on the tenor of the stub periods. For example, suppose the trade is based on LIBOR 3M, the period is quarterly and there is a stub period of 6 weeks. You can interpolate the rate for this period between 1M and 3M rates using the LIBOR 3M curve set up in the Pricing Environment, or you can use the declared LIBOR 1M and the declared LIBOR 3M curve. This difference depends on the setup described below.

2.1 Rate Index Settings

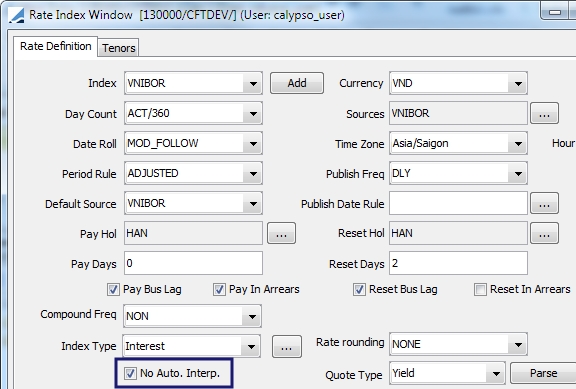

This checkbox is not related to the interpolation method of inflation indices. When checked, there is no automatic interpolation applied to stub periods. Otherwise, stub periods are automatically interpolated. The Rate Index Window can be viewed from the Calypso Navigator by selecting Configuration > Interest Rates > Rate Index Definition.

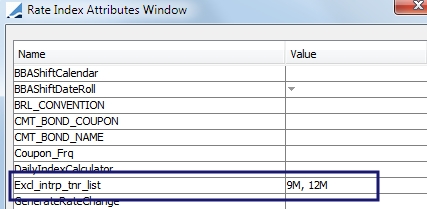

Rate Attribute - Excl_intrp_tnr_list

The Rate Attribute, Excl_intrp_trn_list is used to exclude tenors from being included in stubs. The tenors should be in the list separated by commas.

2.2 Pricing Parameters

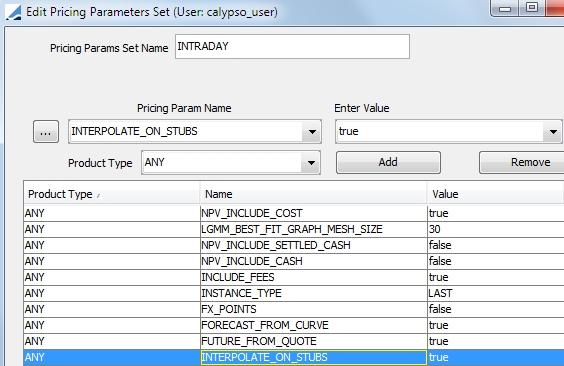

You may turn on or off usage of multiple curves with the INTERPOLATE_ON_STUBS pricing parameter. When this parameter is set to false, the curves used for interpolation do not depend on the interpolation tenor, they depend on the rate index tenor.

In addition, you can set STUB_FORECAST_ADJ=true to utilize two forecast curves when a curve for the stub period ccy/index/tenor cannot be found in the pricing environment. One curve is built around a tenor shorter than the actual stub period and the second is built around a tenor greater than the actual stub period. The rate implied from each curve is weighed according to the proximity of the curve tenor to the tenor of the stub period.

To edit the pricing parameter set, from the Calypso Navigator, select Market Data > Pricing Environment > Pricing Parameter Set.

3. Swap Window Settings

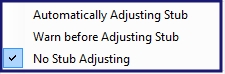

You are able to set the Swap window to automatically calculate stub periods from the Swap menu.

|

Selection |

Description |

|---|---|

|

Automatically Adjusting Stub |

Select to automatically create stub periods without warning, when changes to the trade require stub periods. You may override the stub period settings in the Swap window. This cannot be selected if Warn before Adjusting Stub or No Stub Adjusting is selected. |

|

Warn before Adjusting Stub |

When selected, you are prompted to create stub periods when changes are made to the trade that require stub periods. You may override the settings in the Swap window. This cannot be selected if Automatically Adjusting Stub or No Stub Adjusting is selected. |

|

No Stub Adjusting |

This is the default setting. The system will not create the stub periods even when changes to the trade require stub periods. You may override the settings in the Swap window. This cannot be selected if Warn before Adjusting Stub or Automatically Adjusting Stub is selected. |

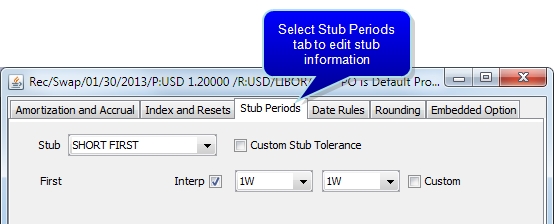

3.1 Swap Details Panel

You can set up a stub period in the Swap details area. You can select the type of stub period, custom tolerance (days) and the index or indices used in interpolating the rate for that period.

The stub periods take into account date roll conventions, holidays and accrual methods. The stub periods use the ISDA interpolation methodology to interpolate stub rates. These are described below:

| • | FIRST / LAST indicates whether the stub is the first period or the last period |

| • | SHORT / LONG indicates whether the stub is shorter or longer than the payment frequency |

| • | SPECIFIC FIRST means you can enter the end date of the first period |

| • | SPECIFIC LAST means you can enter the start date of the last period |

| • | SPECIFIC BOTH means that you can enter the end date of the first period, and the start date of the last period |

| • | FULL COUPON allows you to enter the full coupon date |

Example

Suppose the following:

| – | QTR interest frequency |

| – | trade start date of 03/01 |

| – | trade end date of 10/15 |

Ⓘ [NOTE This example does not take into account holidays, date roll conventions and accrual methods. The sole purpose is to demonstrate how stub periods are created]

|

SHORT FIRST |

Creates three periods: 03/01 - 04/15, 04/15 - 07/15, 07/15 - 10/15 |

|

LONG FIRST |

Creates two periods: 03/01 - 07/15, 07/15 - 10/15 |

|

SHORT LAST |

Creates three periods: 03/01 - 06/01, 06/01 - 09/01, 09/01 - 10/15 |

|

LONG LAST |

Creates two periods: 03/01 - 06/01, 06/01 - 10/15 |

|

SPECIFIC FIRST |

(end date of first period is 03/15) Creates four periods: 03/01 - 03/15, 03/15 - 06/15, 06/15 - 09/15, 09/15 - 10/15 |

|

SPECIFIC LAST |

(start date of last period is 10/01) Creates four periods: 03/01 - 04/01, 04/01 - 07/01, 07/01 - 10/01, 10/01 - 10/15 |

|

SPECIFIC BOTH |

(end date of first period is 04/01 and start date of last period is 09/15) Creates four periods: 03/01 - 04/01, 04/01 - 07/01, 07/01 - 09/15, 09/15 - 10/15 |

|

FULL COUPON |

Creates three periods: 01/15 - 04/15, 04/15 - 07/15, 07/15 - 10/15 |

| » | Select Custom Stub Tolerance to specify the stub period offset in days, and enter the number of days in the adjacent field. If the period in calendar days is less than or equal to the stub tolerance, it will be merged into the period immediately next to it. If it is not set, the default is set in the environment property STUB_TOLERANCE. |

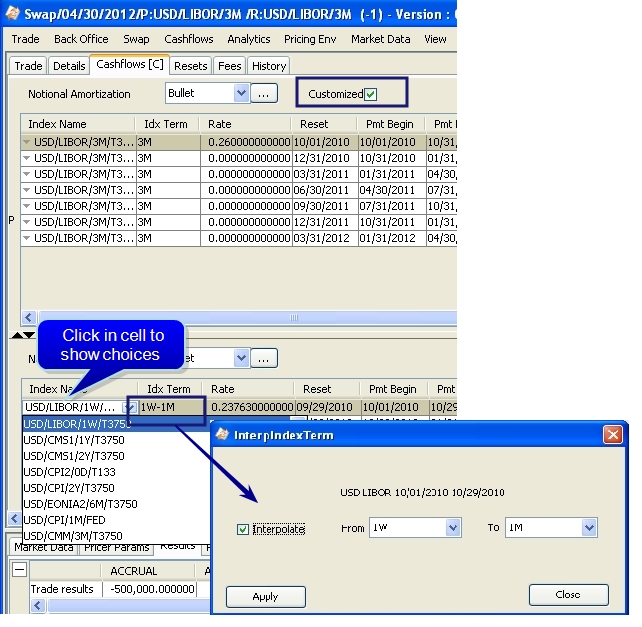

| » | Whenever there is a stub on a floating rate, the system automatically calculates the best index tenor for the stub period (provided No Auto Interp is un-checked on the rate index definition.) If the length of a stub period matches exactly one of the index tenors, there is no interpolation required. If the length of a stub period is between two index tenors, the system defaults the stub index to interpolate between the two index tenors. |

| » | You may customize these tenors using the Interp checkbox and the adjacent tenor fields. If no interpolation is required, select the same tenor in both boxes. When other index tenors are selected, the Custom checkbox will be checked. To return to the default tenors computed by the system, un-check the Custom checkbox. |

4. General Logic of the Period Calculations

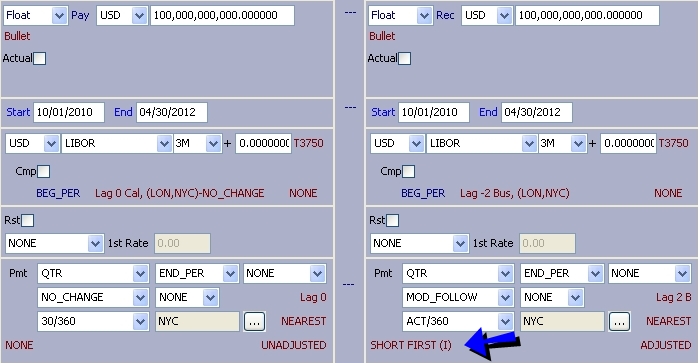

Calypso uses some standard date rules to calculate accrual periods, payment dates and reset dates.

| • | Using the trade end date and the frequency in the Payment section, Calypso calculates unadjusted period begin and end dates. Calypso starts at the trade date and works backward to the start date. This then results in stubs being automatically put at the beginning of the trade. |

| • | Using the day-count (e.g. ACT/360), holiday (e.g. LON), non-business day roll rule (e.g. MOD FOLLOW) and the accrual method selection (e.g. ADJUSTED), the period start and end date of each period is adjusted. |

| • | The payment dates are calculated using the period end dates and the payment lag settings. Note that payment date logic uses the same holidays and date rolls as the calculation periods. |

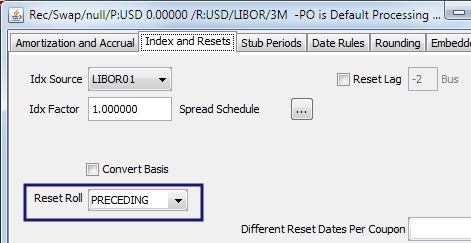

| • | The reset dates are calculated using the period start dates, the reset lags and the reset roll setting (on the Swap Details window) |

| • | The forward dates are calculated from the reset lag and the tenor of the index. |

Example

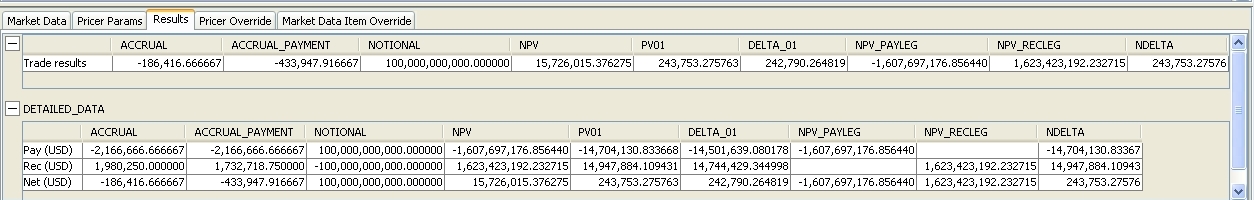

In this trade, the Pay Leg is set so that there are no adjustments for any dates, while the Receive Leg has adjustments applied.

4.1 Curve Usage

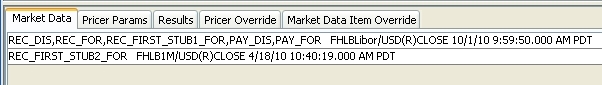

Because of the settings (stub, with interpolation and pricing parameter), the system finds the curves that are declared for use in the pricing environment for the 3M and the 1M curve. In this example, there is no 1W curve. These curves are used for forecasting forward rates.

4.2 Reset Rates Used

Calypso automatically looks for the rates needed for the resets.

Ⓘ [NOTE: Stub periods are independent of the setting for compounding and averaging, and for the Notional amounts on which interest is computed]

4.3 Customizing Cashflows

Rate Index, Day Count, Interpolation, Currency, Rates and Amount can be customized for any flow row. Dates can be also set for Payment Dates and Reset Dates, but not Forward Dates.