Applying Repo Actions in Bulk

The Bulk Actions window allows performing the following actions in bulk on repo trades:

| • | Amend |

| • | Return |

| • | Call Exercise |

| • | Rerate |

| • | Reprice |

| • | Remove Collateral |

From the Security Finance Trade Browser or the Security Finance Workstation's Trade Drill Down or Trade Browser panels, select the trades to be actioned, then right-click and select Process > <action>. The selected trades will be populated in the Bulk Actions window. An individual trade can be opened in the Bulk Actions window by selecting Repo > <action> in the Repo trade window.

The Bulk Actions window varies slightly for each action type. Details specific to each action are described in each section. Generally, the process is as follows:

| » | You can change the pricing details at the bottom of the window – By default, the pricing environment comes from the User Defaults, and the valuation date is the current date and time. |

| » | Check/uncheck the "Selected" checkbox to include / exclude trades. You can also use |

| » | Select the trade action to be applied, and enter date(s) as needed. |

You can select a cell and click Bulk Fill to copy its value to all other cells in the column.

| » | Enter action-specific values as needed. You can modify the columns from Data > Configure Columns. |

| » | The Action Status column displays whether or not the action is able to be applied. The Error Messages column displays the error message if the action is unable to be applied. |

You can check if all required pricing data are available in the pricing environment from Market Data > Check.

| » | Click Apply & Save to carry out the action. |

Before You Begin

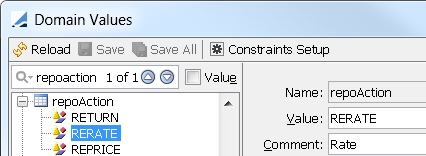

You can truncate the workflow actions that can be applied, using the domain repoAction. If these domain values are not defined, then the list of available actions is determined by the applicable Trade workflow.

You can also use the repoAction domain values to customize the default workflow action, based on the bulk action type.

| » | Enter the workflow action to be defaulted in the Value field. |

| » | Enter the bulk action in the Comment field. |

The workflow actions can be defaulted for the following repo bulk actions:

| – | CBLReturn – Comment to enter: "Return", or "CBLReturn" |

| – | Rerate – Comment to enter: "Rate" |

| – | Reprice – Comment to enter: "Reprice" |

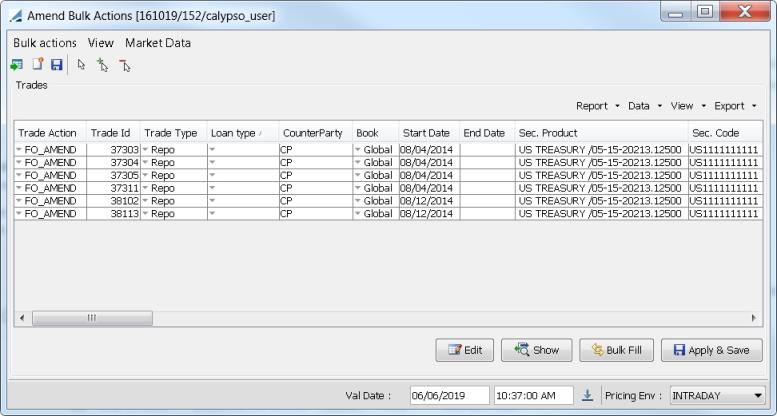

1. Bulk Amend

The bulk amend action allows amending repo trades in bulk.

Bulk Actions Window - Amend

These are the action-specific steps. See General Process for the rest of the generic steps.

| » | Select the trade action to be applied. |

Note: All editable trade keywords for repo and sec lending trades configured into a report for update action must be added to the Repo.keywords domain.

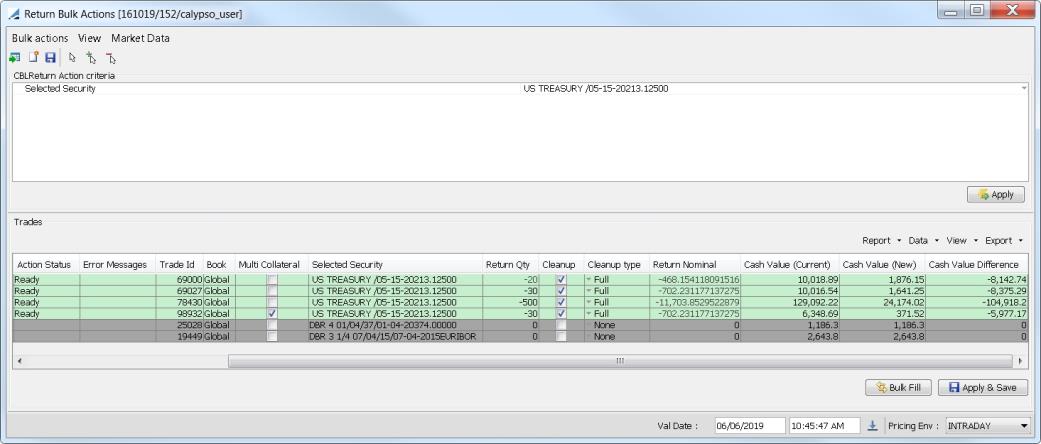

2. Bulk Return

The bulk return action allows returning repo collaterals in bulk.

For multi-collateral trades, the "Multi Collateral" checkbox will appear checked.

Bulk Actions Window - Return

These are the action-specific steps. See General Process for the rest of the generic steps.

The Return Action criteria panel can be used to select all of the trades below with a given security.

| » | Select the security to be returned from the drop down, then click Apply. All trades with that security, including multi-collateral trades, are selected, and all without it are de-selected. |

| » | Enter the quantity to return on each trade. Note that a full return is not permitted so the quantity to return must be less than the current quantity. |

| » | Alternatively, you can opt not to select a security and simply enter the amounts to be returned in the Return Qty column of the Trades panel. |

| » | Check the "Cleanup" checkbox to pay the interest, otherwise leave it un-checked. Specify a cleanup type as needed to pay the interest up to the effective date. Select Full to calculate based on the remaining value, or Partial to calculate based on the returned value. |

Interest cleanup is allowed on non-business days for Repo and Sec Vs Cash trades if the AuthorizeHolidaySecFinanceCleanup access permission function is granted.

Performing multiple intraday partial returns with cleanup is possible, provided that each intraday partial return is done with partial cleanup, and that Interest Dispatch = Default on the trades.

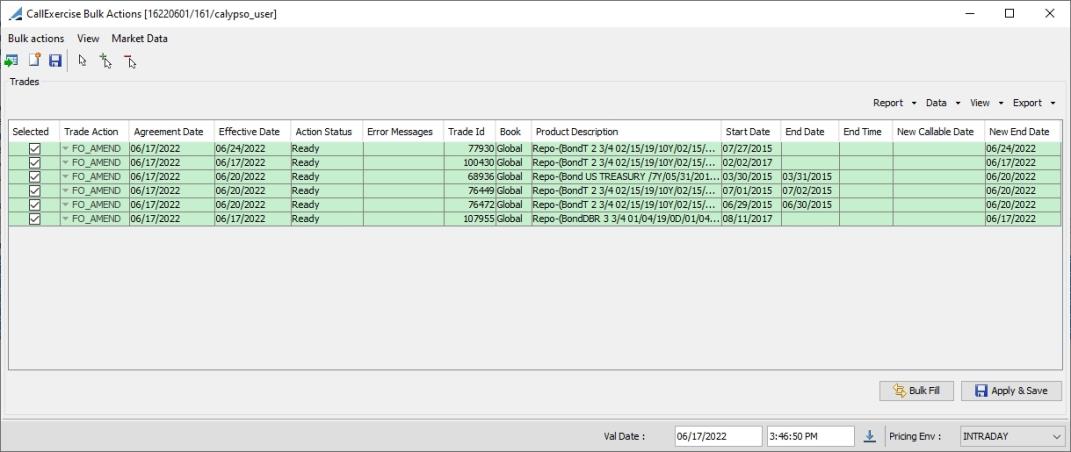

3. Bulk Call Exercise

The bulk call exercise action allows exercising a call on callable OPEN and TERM repos, and repos of maturity types EVERGREEN, EXTENDABLE, ROE (Right of Exit), and INTRADAY.

Bulk Actions Window - Call Exercise

These are the action-specific steps. See General Process for the rest of the generic steps.

| » | The effective date must be before the callable date for EXTENDABLE and ROE trades. |

| » | You can enter a new callable date in the New Callable Date field as needed. |

| » | The New End Date field shows what the new maturity date of the trade will be. |

| – | Callable TERM: The new end date is the effective date of the call exercise. |

| – | Callable OPEN: The maturity type becomes TERM and the end date is the effective date of the call exercise. |

The trade attribute OriginalMaturityType is automatically populated with OPEN to track the trade history.

| – | EXTENDABLE: The trade is extended according to the original trade tenor. |

| – | EVERGREEN: The new end date is equal to the effective date of the call exercise plus the Notice Days as defined on the trade. |

| – | ROE: The new end date is the effective date of the call exercise. |

| – | INTRADAY: The maturity type becomes TERM and the end date is the effective date of the call exercise. The time of the call exercise is recorded in the "End Time" field. The trade attribute OriginalMaturityType is automatically populated with INTRADAY to track the trade history. |

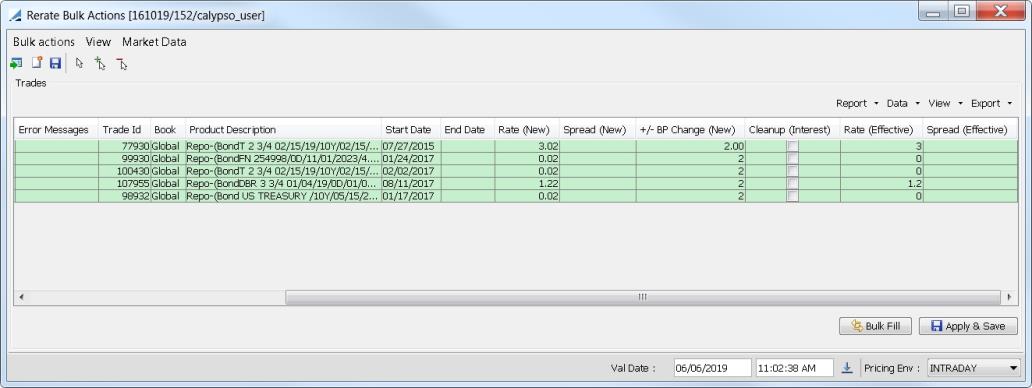

4. Bulk Rerate

The bulk rerate action allows rerating repo collaterals in bulk.

Bulk Actions Window - Rerate

These are the action-specific steps. See General Process for the rest of the generic steps.

| » | You can modify the rerate date to a back-valued date. Note that the rerate date however cannot be before a repricing or an interest cleanup. |

You can insert a rerate between existing rerates as long as there is no un-canceled interest cleanup, with a value date after the value date of the rerate being inserted.

| » | Enter a relative basis point adjustment in the "+/- BP Change (New)" column. The "Rate (New)" column if fixed rate, or "Spread (New)" column if floating rate, is updated to reflect the new rate. |

| » | Alternatively, you can enter an absolute value in %. Enter the new fixed rate in the "Rate (New)" column, or enter the new spread in the "Spread (New)" column if floating rate. |

| » | Check the "Cleanup (Interest)" checkbox to pay the interest on the rerate date, in addition to the rerate. Otherwise leave it un-checked. |

Interest cleanup is allowed on non-business days for Repo and Sec Vs Cash trades if the AuthorizeHolidaySecFinanceCleanup access permission function is granted.

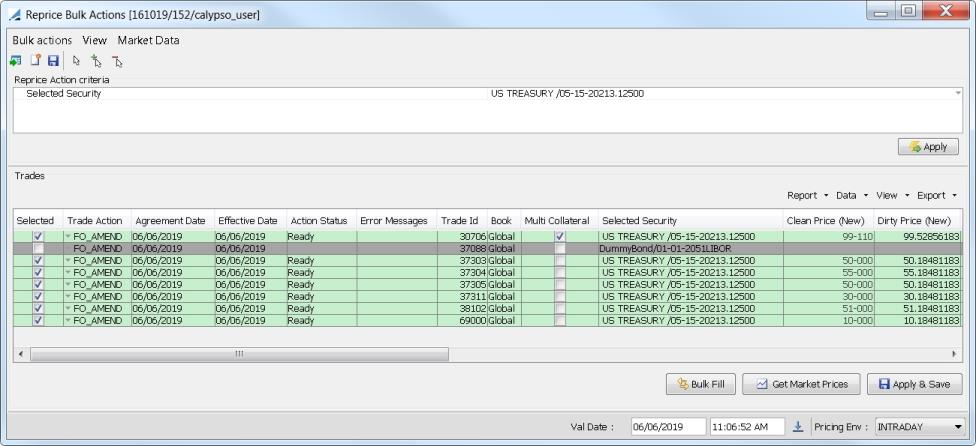

5. Bulk Reprice

The bulk reprice action allows repricing repo collaterals in bulk.

For multi-collateral trades, the "Multi Collateral" checkbox will appear checked.

Bulk Actions Window - Reprice

These are the action-specific steps. See General Process for the rest of the generic steps.

| » | From the Reprice Action criteria panel you can select all of the trades with a given security. |

Select a security from the drop down. Each underlying security from all of the populated trades, including multi-collateral trades, is available for selection.

Then click Apply. All trades with that security are selected, and all without it are de-selected.

| » | You can modify the repricing date to a back-valued date. Note that the repricing date however cannot be before another repricing, a rerate, or an interest cleanup. |

| » | Click Get Market Prices to get the market data for the selected trades. The new prices are displayed, along with the money to return. You can adjust the prices as needed. |

| » | Check the "Cleanup (Interest)" checkbox to pay the interest on the reprice date, in addition to the reprice. Otherwise leave it un-checked. |

It is also possible to enter a separate interest cleanup. If the "Cleanup" checkbox is checked and no rerate is entered, it is processed as a separate interest cleanup.

Interest cleanup is allowed on non-business days for Repo and Sec Vs Cash trades if the AuthorizeHolidaySecFinanceCleanup access permission function is granted.

| » | The price rounding methodology, if any, specified in the legal agreement, if any, will be applied to the reprice action, and to the interest cleanup if selected. This rounding is specified in the PRICE_ROUNDING_METHOD and PRICE_ROUNDING_VALUE pricing parameters on the Pricing panel of the Legal Agreement. |

See Defining Legal Agreements for details on using the Legal Agreement window.

See Defining Legal Agreements for details on using the Legal Agreement window.

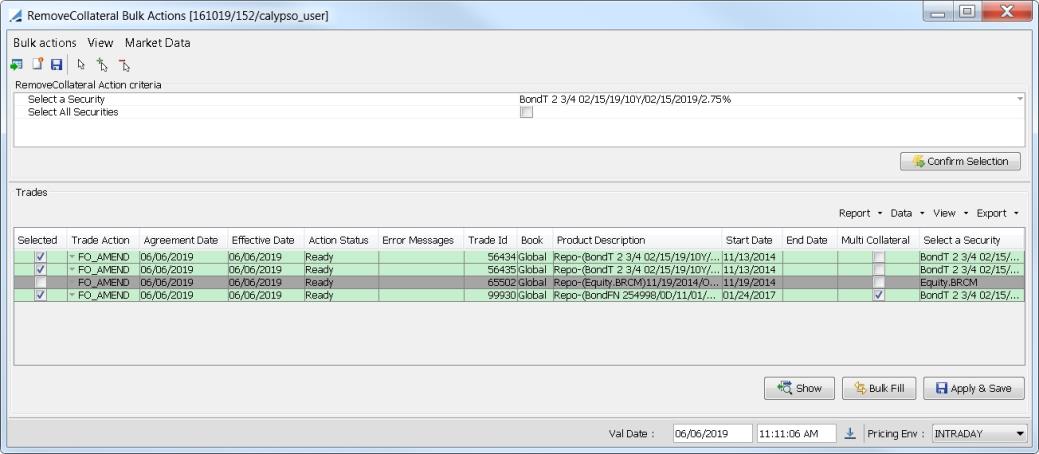

6. Bulk Remove Collateral

The bulk remove collateral action allows removing collaterals from MONEY FILL repos in bulk.

For multi-collateral trades, the "Multi Collateral" checkbox will appear checked.

Bulk Actions Window - Remove Collateral

These are the action-specific steps. See General Process for the rest of the generic steps.

The RemoveCollateral Action criteria panel can be used to select all of the trades below with a given security.

| » | Select the security to be returned from the drop down, then click Confirm Selection. All trades with that security, including multi-collateral trades, are selected, and all without it are de-selected. |

| » | Alternatively, you can simply check the "Select All Securities" checkbox and then click Confirm Selection to select all. |