Jump To Default

The Jump To Default analysis analyzes the default exposure for each name in a basket structure by calculating the change in NPV due to a name defaulting, termination payment (Notional * (1 - Recovery rate)) associated with that default, and the accrued interest (applicable for CDS).

To run a Jump To Default analysis, you first need to define the Jump To Default parameters.

Supported Products

The Jump To Default analysis is applicable to:

Basket Structures (Nth Loss / Nth Default)

| • | CDS Index |

| • | Credit Default Swaps |

| • | Credit Default Swaption |

| • | CDS Options |

| • | Bonds |

| • | Performance Swaps |

| • | Total Return Swaps |

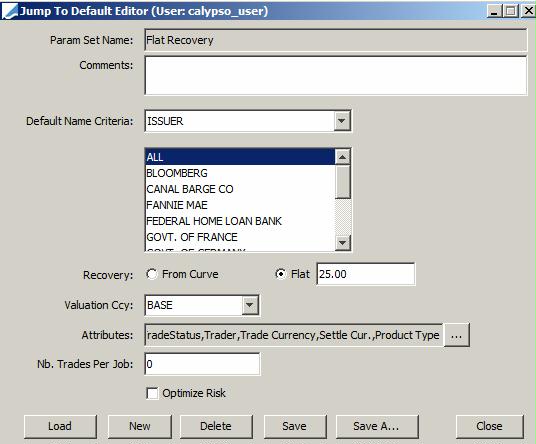

1. Jump To Default Parameters

You can define a set of parameters from one of the following windows:

| • | Click Risk in the Calypso Navigator, and select the analysis type JumpToDefault then click ... next to the field "Analysis Param Set". |

| • | From the Calypso Navigator, navigate to Configuration > Reporting & Risk > Calculation Server. Select the type JumpToDefault then click ... next to the field "Params". |

| » | Click Load to load an existing Parameters Set, or click New to create a new one. |

| » | Enter the fields described below as applicable. |

| » | Click Save to save your changes. You will be prompted to enter a Parameters Set name. |

|

Fields |

Description |

||||||

|

Param Set Name |

Displays the name of the selected / saved Parameters Set. |

||||||

|

Comments |

Enter comment if desired. |

||||||

|

Default Name Criteria |

Select INDUSTRY or ISSUER. This will display the list of industries or issuers. You can select ALL or a list of industries / issuers that are defaulting. Please note that the analysis defaults one issuer at a time. So if a Basket has 100 names, it will default each name one by one and calculate the New NPV and the Settlement amount for each. |

||||||

|

Recovery |

Select one of the following options:

|

||||||

|

Valuation Ccy |

Select the valuation currency used to aggregate the trades: BASE currency, TRADE currency, or a specific CURRENCY. |

||||||

|

Attributes |

Select the attributes that you want to display in the report. In particular, you should add the issuer / industry as needed. |

||||||

|

Number Trades per Job |

In the case where the calculation server runs in distributed processing mode, you can specify the number of trades per calculation server. Refer to Calypso Distributed Processing documentation for setup details. |

||||||

|

Optimize Risk |

Check to optimize the risk computation. When checked, the analysis calculates the risk on one trade, and applies it to other trades based on the notional. For example, if the delta for a CDS index trade with Notional 10M is 1000, then the delta for a CDS index trade with notional 25M, is 1000 * 25 / 10 = 2500. |

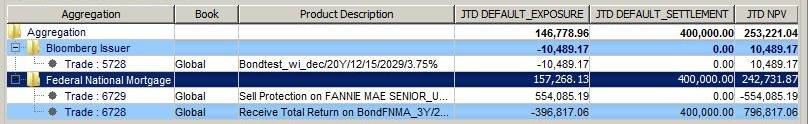

2. Jump To Default Results

Risk analyses can be run using the following methods:

| • | Using the scheduled task RISK_ANALYSIS to save results to the database and/or to a file - Saved results can be viewed in the Calypso Workstation using the risk servers. |

| • | In real-time using the risk servers - The results are displayed in the Calypso Workstation. |

See Calypso Workstation for details.

See Calypso Workstation for details.

Ensure that you have selected a Trade Filter before running the report.

Note on Performance Swaps

For Performance Swaps on Bonds and CLN Bonds, you should use the pricer "PricerPerfomanceSwapAccrual".

The JTD analysis sets the pricing parameter NPV_INCLUDE_COST = False.