Collateral

The Collateral analysis displays all the collaterals associated with repo trades.

To run a Collateral analysis, you first need to define the Collateral parameters.

1. Collateral Parameters

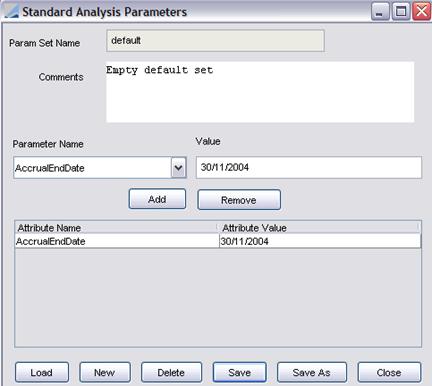

Click Risk in the Calypso Navigator, and select the analysis type Collateral then click ... next to the field "Analysis Param Set".

Sample parameters

| » | Click Load to load an existing Parameters Set, or click New to create a new one. |

| » | Enter the fields described below as applicable. |

| » | Click Save to save your changes. You will be prompted to enter a Parameters Set name. |

|

Fields |

Description |

|

Param Set Name |

Displays the name of the selected / saved Parameters Set. |

|

Comments |

Enter comment if desired. |

|

Parameter Name Value |

Select a parameter name as applicable and enter a value in the Value field. Then click Add to add the parameter. |

2. Collateral Results

The Collateral analysis can be run using the scheduled task RISK_ANALYSIS to save the results to the database or to a file.

The columns of the Collateral analysis are described below.

Total Row

|

Columns |

Description |

|

Nominal |

Face value of the security. |

|

Loan Amount |

Initial amount of the cash leg without accrued interest. |

|

Rating Agency Margin |

Contractual value at trade price (Trade value on trade date including accrued interest) less contractual haircut. |

|

Today Contractual Value |

Value of the security (market value on value date including accrued interest) less contractual haircut. |

|

Today RA Value |

Value of the security (market value on value date including accrued interest) less rating agency haircut. |

|

Contractual Margin Call |

Gross amount of collateral call. |

|

Available Capital |

Difference between today contractual value and today rating agency value. |

|

Actual Call |

Amount of collateral call considering the threshold amount from the margin call agreement. |

|

Clean Collateral Value |

Collateral value not adjusted for the haircut. |

Trade Details

|

Columns |

Description |

|

Nominal |

Face value of the security. |

|

Today Price |

Security price on value date. |

|

Initial Price |

Security price when trade executed. |

|

Contractual HAR |

Contractual haircut rate. |

|

RAAR |

Rating agency haircut. |

|

Threshold |

Threshold amount from margin call agreement. |

|

Loan Amount |

Initial cash amount without accrued interest. |

|

Rating Agency Margin |

Contractual value at trade price (Trade value on trade date including accrued interest) less contractual haircut. |

|

Today Contractual Value |

Value of the security (market value on value date including accrued interest) less contractual haircut. |

|

Today RA Value |

Value of the security (market value on value date including accrued interest) less rating agency haircut. |

|

Contractual Margin Call |

Gross amount of collateral call. |

|

Available Capital |

Difference between today contractual value and today rating agency value. |

|

Facility Limit |

Overall limit for facility repo. |

|

Actual Call |

Amount of collateral call considering the threshold amount from the margin call agreement |

|

Clean Collateral Value |

Collateral value not adjusted for the haircut. |