Accrual Period

The Accrual Period analysis provides comprehensive details about accrued interest over a user-defined period. The analysis can be based off positions or trades.

To run a Accrual Period analysis, you first need to define the Accrual Period parameters.

1. Accrual Period Parameters

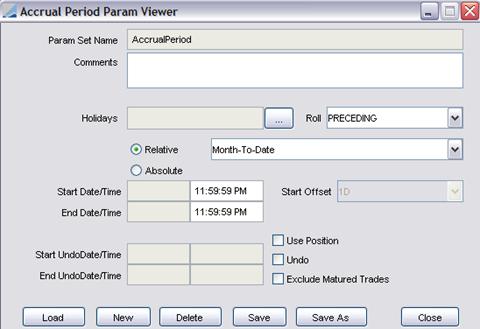

Click Risk in the Calypso Navigator, and select the analysis type AccrualPeriod then click ... next to the field "Analysis Param Set".

Sample parameters

| » | Click Load to load an existing Parameters Set, or click New to create a new one. |

| » | Enter the fields described below as applicable. |

| » | Click Save to save your changes. You will be prompted to enter a Parameters Set name. |

|

Fields |

Description |

||||||

|

Param Set Name |

Displays the name of the selected / saved Parameters Set. |

||||||

|

Comments |

Enter a free format comment as applicable. |

||||||

|

Holidays |

Select a holiday calendar to apply to the start and end dates. |

||||||

|

Roll |

Select a date roll convention to be applied when the start and end dates fall on non-business days. |

||||||

|

Relative Absolute |

Click the Relative radio button to select a relative period, or click the Absolute radio button to enter start and end dates. Relative

If the relative period “Month-To-Date” is chosen, the Start Date of the report will be the first day of the month during which the valuation date falls and the End Date will be the Valuation Date. Similarly if “Year-To-Date” is chosen then the Start Date of the report will be the first day of the year in which the Valuation Date falls and the End Date will be the Valuation Date. For example, if the Valuation Date is 5/10/2004 and if the relative period is “Month-To-Date” then the Start Date of the report will be 5/1/2004 and the End Date will be 5/10/2004. If the relative period is “Year-To-Date” then the Start Date of the report will be 1/1/2004 and End Date will be 5/10/2004. Absolute

Note that the end date is inclusive. |

||||||

|

Undo |

Check the “Undo” checkbox to specify undo start and end dates. The report will rebuild the image of the trades or position at that date, undoing all modifications that have been audited. [NOTE: The audit mode should be enabled. Refer to the Calypso Security User Guidefor information on enabling the audit mode.] |

||||||

|

Exclude Mature Trades |

Check the “Exclude Mature Trades” checkbox to ignore mature trades over the period. Excluding matured products from the position (when “Use Position” is checked) works in the following way: products must be MATURED and the position must be flat (i.e. expiry process, redemption process, or exercise process must have occurred), otherwise the position will be shown. |

2. Accrual Period Results

The Accrual Period analysis can be run using the scheduled task RISK_ANALYSIS to save the results to the database or to a file.

The columns of the report are described below.

|

Columns |

Description |

|

Total Accrual |

Total amount of interest and cash accrued during the report period (i.e. End Accrual minus Start Accrual plus Cash). |

|

Start Accrual |

Accrued interest from the previous coupon date to the Start Date of the report. |

|

End Accrual |

Accrued interest from the previous coupon date to the End Date of the report. If the report was run from 4/30/04 to 11/15/04 for a bond that has coupon payments on 5/15 and 11/15, the End Accrual amount would be zero. If the report was run from 4/30/04 to 11/30/04 for the same bond the End Accrual amount would display the amount accrued from the previous (last) coupon date which was 11/15/04. |

|

Accrual BS |

Amount of accrued interest bought or sold on the Trade Settle Date. The amount displayed in the report is equal to the amount shown in the “Accrual” field of the bond trade worksheet. |

|

Coupon Outstanding |

Accrued interest (not yet paid or received) for the current interest period. If the report was run from 4/30/04 to 11/15/04 for a bond that has coupon payments on 5/15 and 11/15, this column would display zero. However, if the same report was run from 4/30/04 to 11/5/04, this column would display the coupon accrued from 5/15 to the end of the report. |

|

Cash |

Coupon payments paid/received during the report period. If the report was run from 6/1/04 to 11/30/04 for a bond that has coupon payments on 5/15 and 11/15 this column would display the equivalent of 1 coupon payment. If the report was run from 4/30/04 to 11/15/04, this column would display the equivalent of 2 coupon payments. |

|

Total Cash |

An information field that shows total coupon payments starting from the Settle Date of the trade up until the End Date of the report (regardless of the start date). |

|

Start Notional |

Notional on the Start Date of the report (this column takes factoring into account). |

|

End Notional |

Notional on the End Date of the report (this column takes factoring into account). |

|

Notional Change |

Notional difference between the report Start Date and End Date. |

|

Accrual (Base) |

Base equivalent of the Total Accrual column using the FX rate shown in the FX (Ccy/Base) column. |

|

Cash (Base) |

Base equivalent of the Total Cash column using the FX (Ccy/Base) rate shown in the FX (Ccy/Base) column. |

|

FX (Ccy/Base) |

The exchange rate used to convert trade currency figures into base currency figures. The FX rate used is determined by the “INSTANCE_TYPE” pricing parameter. |

|

Internal Ref |

The internal reference (if any) added to the trade via the “Details” tab of the Trade window. |

|

External Ref |

The external reference (if any) added to the trade via the “Details” tab of the Trade window. |

|

Full Accrual (Base) |

The FX Effect on the Accrual received/paid, i.e. (End Accrual * End FX Rate) minus (Start Accrual * Start FX Rate). NOTE: Tthe Start FX and End FX rates are not displayed in the report. The instance type used for these FX rates (e.g. open, last, close) is dependent on that set in the pricing parameter. |

|

Full Cash (Base) |

The FX Effect on the Cash received/paid during the period. This FX rate (which is not displayed in the report) used for this calculation is the FX rate in place as of the report’s End Date (as with the previous column, the instance type used for this rate is dependent on that set in the pricing parameter). |