Back-to-Back Trades

1. Overview

You can use a Back-to-Back (B2B) trade to hedge an open position in a Sales book.

You enter a corporate trade which is an external trade with a client. The system automatically creates a mirror trade.

There is an internal trade(s) in the Sales book that is the reverse of the original trade. It flattens the position in the Sales book. This is the B2B trade.

There is another trade in the Trading book that transfers the position of the original trade.

| » | In the trade window, you can change the B2B configuration from the default one, turn the B2B feature off, or turn the B2B feature on if there is no default B2B configuration defined. |

| » | Set up default configuration for B2B trades using Configuration > Automated Operations > Back-to-Back from the Calypso Navigator. |

See detail below.

2. Workflow Configuration

The trade rule MMLinked must be set on all transitions where a trade is saved or modified.

If the trade is being modified this rule will check if there is any trade linked to that trade and if so update those linked trades as well if necessary. Back to back trades are linked trades handled by this rule. So for example, Trade 1 is saved and Trade 2 is created as a Back to Back trade. If the trade amount in Trade 1 is modified, the rule MMLinked will modify the trade amount in Trade 2 as well.

When using the MMLinked rule, trade attributes present in domain "MMLinked" are propagated to the back to back trades.

However, if you want each trade to have its own workflow, you need to set the environment property CASH_MIRROR_WOKFLOW = True. Tt cancels the effects of the MMLinked workflow rule. The workflow emulates the behavior of environment property MIRROR_WORKFLOW = True for Cash trades. Two trades are saved, and two tasks are created, one for each trade. So after the trades are saved, the mirror trade will be independent from the original trade, and will follow its own workflow

3. Defining Back-to-Back Configurations

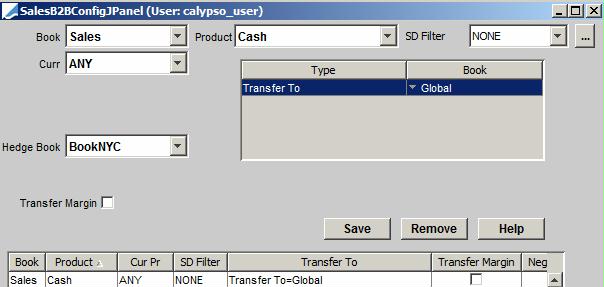

From the Calypso Navigator, navigate to Configuration > Automated Operations > Back-to-Back to define default back-to-back configurations.

Following are the minimum requirements for defining the configuration:

| » | Select the trading book. |

| » | Select the product type. |

| » | Optional. Select a static data filter. |

| » | Select the currency pair or currency. |

| » | For FX trades, select the negotiated currency. |

| » | Select the transfer to book(s) for the B2B trades. |

| » | Click Save to save the configuration. |

The following table describes the input fields in detail.

|

Fields |

Description |

|||||||||

|

Book |

Select the book for the original trade, that is, the trade captured with the customer as the counterparty, or select the transfer from book. |

|||||||||

|

Product |

Select the product type to which this configuration applies, or select “ANY” so that the configuration applies to any of the product types listed. |

|||||||||

|

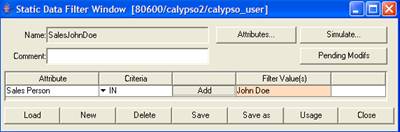

SD Filter |

Optional. You can select a static data filter in the B2B configuration to filter by an amount, counterparty, legal entity attribute, sales person, or some other parameter. Click … to create a new static data filter.

|

|||||||||

|

Cur Pr |

Not used for Cash products. |

|||||||||

|

Neg Ccy |

Not used for Cash products. |

|||||||||

|

Curr |

Select the currency. |

|||||||||

|

Book |

Select the destination book for the system-generated trades. |

|||||||||

|

Hedge Book |

You can select the book for the sales margin hedge trade. |

|||||||||

|

Base Ccy |

You can select the sales margin hedge currency. |

|||||||||

|

Transfer Margin |

Select this checkbox to transfer the margin to the destination book. Clear this checkbox so that the margin remains in the original trade book. |

|||||||||

|

PV Fwd Amount |

Not used for Cash products. |

|||||||||

|

Threshold Ccy |

Not used for Cash products. |

|||||||||

|

Trade Threshold |

Not used for Cash products. |

|||||||||

|

Position Threshold |

Not used for Cash products. |