Defining Message Templates

![]() Download PDF - Message Templates

Download PDF - Message Templates

A number of HTML message templates are provided out-of-the-box under <calypso home>/client/resources/com/calypso/templates. They can be customized using any text or HTML editor, or you can create your own templates.

Message templates should be registered in the domain “MESSAGE.Templates”.

Templates contain free-form text as well as message keywords to retrieve information from trades, messages and transfers. All

available message keywords are described below. Keywords have the format |keyword name|, they are bracketed using the "|" symbol.

Two types of keywords are available: simple keywords and conditional keywords.

Ⓘ [NOTE: Customized template files need to be copied to <calypso home>/tools/calypso-templates/resources/com/calypso/templates for HTML templates. You will then need to deploy the files to your applications servers]

For information on Swift Messages Templates, please refer to Calypso Swift Messages documentation.

For information on Swift Messages Templates, please refer to Calypso Swift Messages documentation.

1. Simple Keywords

| • | All Products |

| • | Back Office Operations |

| • | Commodities |

| • | Credit Derivatives |

| • | Equity Derivatives |

| • | Exotic Variables |

| • | External Trades |

| • | Fixed Income |

| • | FX |

| • | FX Options |

| • | Interest Rate Derivatives |

| • | Money Market |

| • | Statements |

1.1 All Products

These keywords apply to all product types.

|

Keyword Names |

Description |

||||||||||||

|

<any amount keyword>#<locale> |

If you add #<locale> after any amount keyword, the amount will be formatted in the specified locale provided the environment property USE_MESSAGE_AMOUNT_FORMAT is set to True. Otherwise, the amounts are formatted according to the default format ###,###.##. Example: TRADE_SETTLEMENT_AMOUNT#US. |

||||||||||||

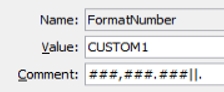

| <any amount keyword>#FormatNumber#<formatter> |

The <formatter> can be:

Examples: TRADE_SETTLEMENT_AMOUNT#FormatNumber#SWIFT, TRADE_SETTLEMENT_AMOUNT#FormatNumber#CUSTOM1 With CUSTOM1, defined as:

|

||||||||||||

| <any date keyword>#<format> |

If you add #<format> after any date keyword, the date will be formatted with the specified format. Date formats follow the Java date format: https://docs.oracle.com/javase/8/docs/api/java/text/SimpleDateFormat.html Example: #yyMMdd or #yyyyMMdd. Otherwise, the dates are formatted according to the language selected on the message configuration. NOTE: FEE_*_DATE message keywords have two parameters. The first parameter is the fee type and the second parameter is the date format. Example: FEE_DATE#COMM##yyMMdd – The Fee date for the COMM fee will be displayed as yyMMdd. |

||||||||||||

|

ALL_KEYWORDS |

Shows all the message keywords supported for a given message formatter. |

||||||||||||

|

ALTERNATE_DATE |

trade.getSettleDate(). |

||||||||||||

|

ACTION_AGREEMENT_DATE |

Agreement Date of the event. |

||||||||||||

|

ACTION_EFFECTIVE_DATE |

Effective Date of the event. |

||||||||||||

|

ADDITIONAL_FIXED_AMOUNT |

HTML table listing fees. |

||||||||||||

|

BASKET_COMP_ASSET BASKET_COMP_CCY BASKET_COMP_WEIGHT_QTY BASKET_COMP_FXRESET_QTO BASKET_COMP_ISSUER_ATTR BASKET_COMP_SECURITY_CODE BASKET_COMP_SECURITY BASKET_COMP_NUMBER |

BASKET keywords can only be used inside the BasketComponent iterator. |

||||||||||||

|

IS_UNDERLYING_BASKET |

True if the underlying product is a basket, or False otherwise. |

||||||||||||

|

BROKER_FEE |

HTML table listing broker fees. |

||||||||||||

|

BROKER_FULL_NAME |

Broker name. |

||||||||||||

|

BROKER_SETTLEMENT_INSTRUCTIONS |

HTML table containing broker settlement. |

||||||||||||

|

BOOK_<attribute_name> |

Book attribute. |

||||||||||||

|

CASHFLOW_START_DATE CASHFLOW_END_DATE CASHFLOW_DATE CASHFLOW_RESET_DATE CASHFLOW_DAY_COUNT CASHFLOW_DAYS CASHFLOW_RATE CASHFLOW_FINAL_RATE CASHFLOW_RATE_INDEX CASHFLOW_SPREAD CASHFLOW_AMOUNT CASHFLOW_CURRENCY CASHFLOW_NOTIONAL CASHFLOW_TYPE CASHFLOW_FIXED_PRICE CASHFLOW_FIXING_DATE CASHFLOW_CAP_RATE CASHFLOW_DAYS CASHFLOW_SPREAD CASHFLOW_DEAL_QUANTITY CASHFLOW_DEAL_UNITS CASHFLOW_PAYMENT_AMT CASHFLOW_PAYMENT_DATE CASHFLOW_NDS_NATIVE_CURRENCY CASHFLOW_NDS_NATIVE_INTEREST_AMT CASHFLOW_NDS_SETTLEMENT_RESET_DATE CASHFLOW_NDS_SETTLEMENT_RESET_RATE CASHFLOW_RESET_DATE CASHFLOW_RESET_PRICE |

CASHFLOW keywords can only be used inside the CashFlow related iterators, as in the example shown below. <!--calypso> iterator ( "CashFlow" ) inline " <tr> <td>|CASHFLOW_START_DATE|</td> <td>|CASHFLOW_END_DATE|</td> <td>|CASHFLOW_RATE|</td> </tr> "; </calypso--> Compounding Cashflows CASHFLOW_PERIOD_BEGINNING NOTIONAL_REDUCTION Sample You can also find a sample usage under Trade Flows in

More iterators are also available.

|

||||||||||||

|

CASHFLOW_IS_FALLBACK_APPLIED CASHFLOW_OBS_DATE CASHFLOW_PUB_DATE CASHFLOW_ORIGINAL_RESET_DATE |

Libor fallback cashflows: CASHFLOW_IS_FALLBACK_APPLIED = true if the cashflow uses the libor fallback method Fallback observation date Fallback publication date Fallback original reset date |

||||||||||||

|

CASHFLOW_UND_FUT_FIRST_DEL_DATE |

Underlying Future First Delivery Date |

||||||||||||

|

CASHFLOW_UND_FUT_LAST_DEL_DATE |

Underlying Future Last Delivery Date |

||||||||||||

|

CASHFLOWS |

Includes details from compound periods. |

||||||||||||

|

CASH_SETTLE_APPLICABLE |

Cash settlement defined - Yes or No. |

||||||||||||

|

CASH_SETTLE_BERMUDA_EXERCISE_DATES |

Cash settlement Bermudan exercise dates. |

||||||||||||

|

CASH_SETTLE_BERMUDA_FREQUENCY |

Cash settlement Bermudan frequency. |

||||||||||||

|

CASH_SETTLE_BERMUDA_FROM |

Cash settlement Bermudan start date. |

||||||||||||

|

CASH_SETTLE_BERMUDA_HOLIDAYS |

Cash settlement Bermudan holidays. |

||||||||||||

|

CASH_SETTLE_BERMUDA_TO |

Cash settlement Bermudan end date. |

||||||||||||

|

CASH_SETTLE_EARLIEST_EXERCISE_TIME |

Cash settlement exercise time. |

||||||||||||

|

CASH_SETTLE_EXERCISE_BUS_DAYS_NUM |

Cash settlement - Exercise days lag. |

||||||||||||

|

CASH_SETTLE_EXERCISE_BUS_DAYS |

Cash settlement - True for business days, and False for calendar days. |

||||||||||||

|

CASH_SETTLE_EXERCISE_DATE_CONVENTION |

Cash settlement exercise date convention. |

||||||||||||

|

CASH_SETTLE_EXERCISE_HOLIDAYS |

Cash settlement exercise holidays. |

||||||||||||

|

CASH_SETTLE_EXPIRATION_TIME |

Cash settlement expiration time. |

||||||||||||

|

CASH_SETTLE_METHOD |

Cash settlement method. |

||||||||||||

|

CASH_SETTLE_OPTIONAL_MANDATORY |

Cash settlement - Optional or Mandatory indicator. |

||||||||||||

|

CASH_SETTLE_OPTION_STYLE |

Cash settlement option style. |

||||||||||||

|

CASH_SETTLE_PAYMENT_BUS_DAYS |

Cash settlement payment days lag. |

||||||||||||

|

CASH_SETTLE_PAYMENT_CURRENCY_1 |

Cash settlement - Payment currency 1. |

||||||||||||

|

CASH_SETTLE_PAYMENT_CURRENCY_2 |

Cash settlement - Payment currency 2. |

||||||||||||

|

CASH_SETTLE_PAYMENT_DATE |

Cash settlement payment date. |

||||||||||||

|

CASH_SETTLE_PAYMENT_HOLIDAYS |

Cash settlement payment holidays. |

||||||||||||

|

CASH_SETTLE_QUOTE_TYPE |

Cash settlement quote type. |

||||||||||||

|

CASH_SETTLE_RATE |

Cash settlement rate description. |

||||||||||||

|

CASH_SETTLE_RATE_INDEX |

Cash settlement rate index. |

||||||||||||

|

CASH_SETTLE_VALUATION_BUSINESS_DAYS |

Cash settlement exercise days lag. |

||||||||||||

|

CASH_SETTLE_VALUATION_DATE |

Cash settlement - Valuation date. |

||||||||||||

|

CASH_SETTLE_VALUATION_TIME |

Cash settlement - Valuation time. |

||||||||||||

|

COUNTERPARTY_INSTRUCTIONS |

HTML table listing the Settlement Instructions of the Counterparty. |

||||||||||||

|

CPTY_BENEFICIARY_COUNTRY |

For a transfer, ISO Code of the receiver's country. Otherwise, ISO code of the trade counterparty's country. |

||||||||||||

|

CPTY_RATING |

HTML table of counterparty ratings. Rating agency, Rating value. |

||||||||||||

|

EXERCISE_FEE_AMOUNT |

Amount of fee "EXERCISE_FEE" for an option-based trade. |

||||||||||||

|

EXERCISE_FEE_AVGYIELDPRICE |

Average yield/price of inflation lock. |

||||||||||||

|

EXERCISE_FEE_DATE |

Date of fee "EXERCISE_FEE" for an option-based trade. |

||||||||||||

|

EXERCISE_FEE_CURRENCY |

Currency of fee "EXERCISE_FEE" for an option-based trade. |

||||||||||||

|

EXERCISE_FEE_FWDYIELD |

Strike of inflation lock. | ||||||||||||

|

FEE_AMOUNT FEE_CURRENCY FEE_DATE FEE_DESCRIPTION FEE_END_DATE FEE_KNOWN_DATE FEE_LEGAL_ENTITY FEE_METHOD FEE_PAYER FEE_PAY_REC FEE_RECEIVER FEE_ROLE FEE_START_DATE FEE_TYPE |

FEE keywords can only be used inside the Fee iterators. |

||||||||||||

|

<FEE keyword>#NOVATION_FEE |

Provides the FEE keywords for the NOVATION_FEE. Examples: |FEE_AMOUNT#NOVATION_FEE|, |FEE_CURRENCY#NOVATION_FEE| |

||||||||||||

|

<FEE keyword>#TERMINATION_FEE |

Provides the FEE keywords for the TERMINATION_FEE. Examples: |FEE_AMOUNT#TERMINATION_FEE|, |FEE_DATE#TERMINATION_FEE| |

||||||||||||

|

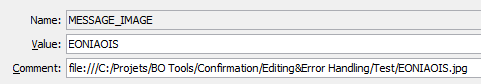

FORMULA#<image name> |

Displays an image which location is defined in the domain "MESSAGE_IMAGE" or in the Image Repository.

|

||||||||||||

|

HAS_SCHEDULE SCHEDULE_DATE SCHEDULE_VALUE |

SCHEDULE keywords can only be used inside the Schedule iterator, as in the examples shown below. HAS_SCHEDULE takes some parameters to specify which schedule the template wants to export (type of leg and type of schedule). The parameters should be separated by #. HAS_SCHEDULE#RECEIVELEG#RATE The same parameters can be used on the “Schedule” iterator. Rate Schedule example: <!--calypso> if ( |HAS_SCHEDULE#PAYLEG#RATE| != "No" ){ inline "<p>Rate Schedule</p>"; inline "<table>"; iterator("Schedule#PAYLEG#RATE") { inline " <tr> <td>Date:</td><td>|SCHEDULE_DATE|</td> <td>Value:</td><td>|SCHEDULE_VALUE|</td> </tr>"; } inline "</table>"; } </calypso--> Spread Schedule example: <!--calypso> if ( |HAS_SCHEDULE#PAYLEG#SPREAD| != "No" ){ inline "<p>Spread Schedule</p>"; inline "<table>"; iterator("Schedule#PAYLEG#SPREAD") { inline " <tr> <td>Date:</td><td>|SCHEDULE_DATE|</td> <td>Value:</td><td>|SCHEDULE_VALUE|</td> </tr>"; } inline "</table>"; } </calypso--> |

||||||||||||

|

INCREASE_NOMINAL |

Nominal to increase. Displayed in absolute value (only for Seclending). |

||||||||||||

|

INCREASE_QUANTITY |

Quantity to increase. Displayed in absolute value (only for Seclending). |

||||||||||||

|

INTEREST_AMOUNT INTEREST_DATE INTEREST_POSITION INTEREST_RATE INTEREST_TOTAL INTEREST_TYPE |

INTEREST keywords can only be used inside the InterestEntries iterator, as in the example shown below. These keywords allow displaying information for interest entries generated on call accounts. <!--calypso> iterator ( "InterestEntries" ) inline " <tr> <td>|INTEREST_AMOUNT|</td> <td>|INTEREST_DATE|</td> </tr> "; </calypso--> You can also find a sample usage in

INTEREST_RATE is the rate index displayed as “<currency>-<index name>-<index source>” by default. If the rate index attribute “RATE_INDEX_CODE.<source>” is set, its value is used instead. |

||||||||||||

|

INTEREST_ENTRIES_DETAILS |

Displays a table of interest bearing entries for Interest Bearing trades: VALUE DATE TYPE INTEREST AMOUNT INTEREST RATE SPREAD FINAL RATE INTEREST TOTAL POSITION CHANGE INTEREST POSITION |

||||||||||||

|

INTEREST_RATE_CHANGE |

Displays a table of interest rate change transfers for interest bearing trades. VALUE DATE DETAILS |

||||||||||||

|

IS_TOP_LEVEL |

Used to determine whether or not to include 'top-level' HTML tags. For example: <!--calypso> if (|IS_TOP_LEVEL| == "true") { inline "<html>"; inline "<head><title>Bugzilla Test</title></head>"; } </calypso--> Can be used in conjunction with STACK_DEPTH. |

||||||||||||

|

ITERATOR_CURRENT_COUNT |

Can be used within any iterator to give the number of items in the iterator. |

||||||||||||

|

KEYWORD_<keyword_name> |

Trade Keyword Value. Note that you should not use termination keywords in order to display the dates with proper formatting. The keyword KEYWORD_TerminationDate should be replaced by LONG_TERMINATION_DATE, and the keyword KEYWORD_TerminationTradeDate should be replaced by LONG_TERMINATION_TRADE_DATE, in order to be displayed with proper formatting. |

||||||||||||

|

LA_<additional_info_name> |

Legal agreement. |

||||||||||||

|

LE_<attribute_name> |

Legal entity attribute. |

||||||||||||

|

LA_LEGAL_AGREEMENT_TYPE |

Legal Agreement type. |

||||||||||||

|

LA_LEGAL_JURISDICTION |

Legal Jurisdiction. |

||||||||||||

|

LA_REFERENCE_NUMBER |

Legal Agreement. |

||||||||||||

|

LA_STATUS |

la.getLegalAgreementStatus() |

||||||||||||

|

LA_AGREEMENT_DATE |

la.getAgreementDate() |

||||||||||||

|

LA_SPECIAL_CLAUSE |

LegalAgreement la =getLegalAgreement(dsCon, trade) la.getReferenceNumber() |

||||||||||||

|

LONG_TERMINATION_DATE |

Termination effective date. |

||||||||||||

|

LONG_TERMINATION_TRADE_DATE |

Termination trade date. |

||||||||||||

|

MASTER_AGREEMENT |

LegalEntity po = BOCache.getProcessingOrg(dsCon,trade.getBook()) LegalAgreement leAgr = dsCon.getRemoteReferenceData().getLegalAgreement(po.getCode(), trade.getCounterParty().getCode(),trade.getProductFamily(), trade.getProductType())leAgr.getLegalAgreementType() |

||||||||||||

|

MASTER_AG_DATE |

leAgr.getAgreementDate() |

||||||||||||

|

MESSAGE_ACTION |

if (message.getAction().equals(Action.CANCEL)) return "cancel" if (message.getAction().equals(Action.AMEND)) return "amend" return "confirm" |

||||||||||||

|

MESSAGE_ADDRESSMETHOD |

message.getAddressMethod() |

||||||||||||

|

MESSAGE_CREATIONDATE MESSAGE_CREATIONDATE#yyMMdd MESSAGE_CREATIONDATE#yyyyMMdd |

message.getCreationDate() |

||||||||||||

|

MESSAGE_EFFECTIVEDATE MESSAGE_EFFECTIVEDATE#yyMMdd MESSAGE_EFFECTIVEDATE#yyyyMMdd |

Message effective date. |

||||||||||||

|

MESSAGE_EVENTTYPE |

message.getEventType() |

||||||||||||

|

MESSAGE_GATEWAY |

message.getGateway() |

||||||||||||

|

MESSAGE_ID |

message.getId() |

||||||||||||

|

MESSAGE_LANGUAGE |

message.getLanguage() |

||||||||||||

|

MESSAGE_LINKEDID |

message.getLinkedId() |

||||||||||||

|

MESSAGE_RECEIVER |

le.getCode() |

||||||||||||

|

MESSAGE_RECEIVERADDRESSCODE |

message.getReceiverAddressCode() |

||||||||||||

|

MESSAGE_RECEIVERCONTACTTYPE |

message.getReceiverContactType() |

||||||||||||

|

MESSAGE_RECEIVERROLE |

message.getReceiverRole() |

||||||||||||

|

MESSAGE_RESETDATE |

message.getTransferId() |

||||||||||||

|

MESSAGE_SENDER |

LegalEntity le = BOCache.getLegalEntity(dsCon,message.getSenderId()) le.getCode() |

||||||||||||

|

MESSAGE_SENDERADDRESSCODE |

message.getSenderAddressCode() |

||||||||||||

|

MESSAGE_SENDERCONTACTTYPE |

message.getSenderContactType() |

||||||||||||

|

MESSAGE_SENDERROLE |

message.getSenderRole() |

||||||||||||

|

MESSAGE_STATUS |

message.getStatus().toString() |

||||||||||||

|

MESSAGE_SUBACTION |

message.getSubAction().toString() |

||||||||||||

|

MESSAGE_SUBSTATUS |

message.getSubStatus().toString() |

||||||||||||

|

MESSAGE_TEMPLATENAME |

message.getTemplateName() |

||||||||||||

|

MESSAGE_TRADEID |

message.getTradeId() |

||||||||||||

|

MESSAGE_TRADEUPDATEDATETIME |

message.getTradeUpdateDatetime() |

||||||||||||

|

MESSAGE_TRANSFERID |

message.getTransferId() |

||||||||||||

|

MESSAGE_TYPE |

message.getMessageType() |

||||||||||||

| MESSAGE_TYPE_COMMENT |

Value of the comment specified for the message type in the domain “messageType”. |

||||||||||||

|

NETTED_TRANSFER_TABLE |

Displays a table of all the products involved in the netting in the following form: Product type - Trade id - Transfer Type - Currency - Amount Paid - Amount Received - Total Amount to be paid or received by PO. |

||||||||||||

|

OPTION_STRIKE |

Strike of an option-based trade. |

||||||||||||

|

OPTION_EXERCISEDDATE |

Exercise date of an option-based trade. |

||||||||||||

|

OPTION_EXERCISEDTYPE |

"Partial exercise" or "Full exercise" for an option-based trade. |

||||||||||||

| PO_HAS_PARENT |

PO_HAS_PARENT - Returns Yes if PO of the trade has a Parent PO, or No otherwise. The following message keywords display the information of the parent PO: TRADE_SELLER_NAME#PARENT TRADE_BUYER_NAME#PARENT TRADE_PROCESSING_ORGANIZATION#PARENT FIX_PAYER_CODE#PARENT FLT_PAYER_CODE#PARENT PAYLEG_PAYER_CODE#PARENT RECEIVELEG_PAYER_CODE#PARENT SENDER_FULL_NAME#PARENT RECEIVER_FULL_NAME#PARENT |

||||||||||||

|

PARENT_RECEIVER_ADDRESS |

parentRec.getMailingAddress() |

||||||||||||

|

PARENT_RECEIVER_SWIFT |

parentRec.getSwift() |

||||||||||||

|

PARENT_RECEIVER_TITLE |

parentRec.getTitle() |

||||||||||||

|

PARENT_RECEIVER_CONTACT_NAME |

LEContact parentRec = findParentReceiverContact(message,trade,sender,rec,transferRules,transfer, dsCon)parentRec.getContactName() |

||||||||||||

|

PARENT_RECEIVER_FAX |

parentRec.getFax() |

||||||||||||

|

PARENT_RECEIVER_ZIPCODE |

parentRec.getZipCode() |

||||||||||||

|

PARENT_RECEIVER_TELEX |

parentRec.getTelex() |

||||||||||||

|

PARENT_RECEIVER_EMAIL |

parentRec.getEmailAddress() |

||||||||||||

|

PARENT_RECEIVER_STATE |

parentRec.getState() |

||||||||||||

|

PARENT_RECEIVER_FAX |

parentRec.getFax() |

||||||||||||

|

PARENT_RECEIVER_COUNTRY |

parentRec.getCountry() |

||||||||||||

|

PARENT_SENDER_CONTACT_NAME |

LEContact parentSender =findParentSenderContact( message, trade,sender,rec,transferRules,transfer,dsCon) parentSender.getContactName() |

||||||||||||

|

PARENT_SENDER_TITLE |

parentSender.getTitle() |

||||||||||||

|

PARENT_SENDER_ADDRESS |

parentSender.getMailingAddress() |

||||||||||||

|

PARENT_SENDER_EMAIL |

parentSender.getEmailAddress() |

||||||||||||

|

PARENT_SENDER_FAX |

parentSender.getFax() |

||||||||||||

|

PARENT_SENDER_TELEX |

parentSender.getTelex() |

||||||||||||

|

PARENT_SENDER_PHONE |

parentSender.getPhone() |

||||||||||||

|

PARENT_SENDER_STATE |

parentSender.getState() |

||||||||||||

|

PARENT_SENDER_SWIFT |

parentSender.getSwift() |

||||||||||||

|

PARENT_SENDER_COUNTRY |

parentSender.getCountry() |

||||||||||||

|

PARENT_SENDER_COMMENT |

parentSender.getComment() |

||||||||||||

|

PARENT_SENDER_CITY |

parentSender.getCityName() |

||||||||||||

|

PARENT_SENDER_ZIPCODE |

parentSender.getZipCode() |

||||||||||||

|

PRODUCT_ID |

trade.getProductID() |

||||||||||||

|

PRODUCT_TYPE |

trade.getProductType() |

||||||||||||

|

PRODUCT_FAMILY |

trade.getProductFamily() |

||||||||||||

|

PRODUCT_ENTEREDDATE |

trade.getProduct().getEnteredDatetime() |

||||||||||||

|

PRODUCT_ENTEREDUSER |

trade.getProduct().getEnteredUser() |

||||||||||||

|

PRODUCT_COMMENT |

trade.getProduct().getComment() |

||||||||||||

|

PRODUCT_CLASS |

trade.getProduct().getProductClass() |

||||||||||||

|

PRODUCT_CURRENCY |

trade.getProduct().getCurrency() |

||||||||||||

|

PRODUCT_DESCRIPTION |

trade.getProduct().getDescription() |

||||||||||||

|

PRODUCT_SECONDARYMARKET |

trade.getProduct().hasSecondaryMarket() |

||||||||||||

|

PRODUCT_QUOTENAME |

trade.getProduct().getQuoteName() |

||||||||||||

|

PRODUCT_SETTLEMENTAMOUNT |

Math.abs(trade.getProduct().calcSettlementAmount(trade)) |

||||||||||||

|

PRODUCT_ISINCODE |

trade.getProduct().getSecCode("ISIN") For CDS trades, it retrieves the ISIN code of the reference obligation. |

||||||||||||

|

PRODUCT_CUSIPCODE |

trade.getProduct().getSecCode("CUSIP") For CDS trades, it retrieves the CUSIP code of the reference obligation. |

||||||||||||

|

PRODUCT_SECCODES |

Not implemented - Use SECCODE_<code name> instead. |

||||||||||||

|

PRODUCT_FLOWS |

Not implemented. |

||||||||||||

|

PRODUCT_PRINCIPAL |

Math.abs(trade.getProduct().getPrincipal()) |

||||||||||||

|

PRODUCT_CUSTOMFLOWSB |

trade.getProduct().getCustomFlowsB() |

||||||||||||

|

PRODUCT_MATURITYDATE |

trade.getProduct().getMaturityDate() |

||||||||||||

|

PO_INSTRUCTIONS |

HTML table listing the Settlement Instructions of the Processing Org. |

||||||||||||

|

PREMIUM_DATE |

for trade.getFees // if PREMIUM fee.getDate() |

||||||||||||

|

PREMIUM_CURRENCY |

for trade.getFees // if PREMIUM fee.getCurrency() |

||||||||||||

|

PREMIUM_AMOUNT |

for trade.getFees // if PREMIUM Math.abs(fee.getAmount()) |

||||||||||||

|

RATE_RESET_DETAILS |

HTML table listing rate resets. Shows Ccy, Name, Tenor, Source, Date, Rate, Rebase Effective Date, Rebase Factor, Rebase Entered Date |

||||||||||||

|

RATE_RESET_FLOWS_DETAILS |

HTML table listing all reset flows. Shows Type, Start Date, End Date, Days, Daycount, Rate, Spread, Rate Index, Payment Date, Notional, Ccy and Amount. |

||||||||||||

|

RATE_RESET_PAYMENT_DETAILS |

HTML table listing payment flows. |

||||||||||||

|

RATE_RESET_SETTLEMENT_INSTRUCTIONS |

HTML table listing interest flows from rate resets and the settlement instructions for each. |

||||||||||||

|

RECEIVE_CASH |

Money to receive. Displayed in absolute value (only for Sec Vs Cash). |

||||||||||||

|

RECEIVER_ID |

rec.getId() |

||||||||||||

|

RECEIVER_LEID |

rec.getLegalEntityId() |

||||||||||||

|

RECEIVER_ROLE |

rec.getLegalEntityRole() |

||||||||||||

|

RECEIVER_CONTACT_TYPE |

rec.getContactType() |

||||||||||||

|

RECEIVER_CONTACT_NAME |

rec.getContactName() |

||||||||||||

|

RECEIVER_TITLE |

rec.getTitle() If null return PARENT_RECEIVER_TITLE |

||||||||||||

|

RECEIVER_ADDRESS |

rec.getMailingAddress() |

||||||||||||

|

RECEIVER_EMAIL |

rec.getEmailAddress() If null return PARENT_RECEIVER_EMAIL |

||||||||||||

|

RECEIVER_FAX |

rec.getFax() If null return PARENT_RECEIVER_FAX |

||||||||||||

|

RECEIVER_TELEX |

rec.getTelex() If null return PARENT_RECEIVER_TELEX |

||||||||||||

|

RECEIVER_PHONE |

rec.getPhone() If null return PARENT_RECEIVER_PHONE |

||||||||||||

|

RECEIVER_SWIFT |

rec.getSwift() If null return PARENT_RECEIVER_SWIFT |

||||||||||||

|

RECEIVER_COMMENT |

rec.getComment() |

||||||||||||

|

RECEIVER_CODE |

le.getName() |

||||||||||||

|

RECEIVER_FULL_NAME |

LegalEntity le = BOCache.getLegalEntity(dsCon,rec.getLegalEntityId()) le.getName() |

||||||||||||

|

RECEIVER_CITY |

rec.getCityName() If null return PARENT_RECEIVER_CITY |

||||||||||||

|

RECEIVER_SIGNATURE SENDER_SIGNATURE |

Displays the SIGNATURE of the receiver or sender respectively. The signature can be set for each contact on the contact attribute SIGNATURE (provided it is available in the domain "addressMethod"). You can define the possible values in the domain “addressMethod.SIGNATURE”. The value of the SIGNATURE should be a link to an image file using:

In the latter case, the content of the image will be embedded in the advice document using a base64 data URL. This allows having the image attached inside the document instead of externally linked. It may not be supported by all web browsers as well as by certain HTML to PDF conversion libraries. You can then use the message keywords SENDER_SIGNATURE and RECEIVER_SIGNATURE to display the SIGNATURE in a message: <img src="|SENDER_SIGNATURE|"/> |

||||||||||||

|

RECEIVER_ZIPCODE |

rec.getZipCode() If null return PARENT_RECEIVER_ZIPCODE |

||||||||||||

|

REGISTR_<attribute_name> |

rec.getZipCode() Registration Details Attribute |

||||||||||||

|

ROLE_<role_name> |

rec.getZipCode() Trade Legal entity role |

||||||||||||

|

RECEIVER_STATE |

rec.getState() If null return PARENT_RECEIVER_STATE |

||||||||||||

|

RECEIVER_COUNTRY |

rec.getCountry() If null return PARENT_RECEIVER_COUNTRY |

||||||||||||

|

REMAINING_NOTIONAL |

Original trade on which full termination was applied, remaining amount = 0.00. Original trade on which partial termination or novation was applied, remaining amount = new trade amount (n/a if new trade from novation was not created). Newly created trade from partial termination or novation, remaining amount = this amount. |

||||||||||||

|

REMAINING_PARTY REMAINING_PARTY_ADDRESS REMAINING_PARTY_CITY REMAINING_PARTY_CONTACT_NAME REMAINING_PARTY_COUNTRY REMAINING_PARTY_EMAIL REMAINING_PARTY_FAX REMAINING_PARTY_FULL_NAME REMAINING_PARTY_PHONE REMAINING_PARTY_REFERENCE REMAINING_PARTY_STATE REMAINING_PARTY_SWIFT REMAINING_PARTY_TELEX REMAINING_PARTY_TITLE REMAINING_PARTY_ZIPCODE REMAINING_QUANTITY |

Information about novation remaining party. |

||||||||||||

|

REPORT#<column name> |

Report columns from the Message report can be used as message keywords with syntax Examples: |REPORT#Exercise Settlement Date| |REPORT#Exercise Settlement Offset| Where "Exercise Settlement Date" / "Exercise Settlement Offset" is the report column name. Available column names are listed under Message Report > Data > Configure Columns. |

||||||||||||

|

RERATE_LIST |

HTML table of specific resets. Rerate date, Rerate rate. |

||||||||||||

|

RERATE_FLOWS_DETAILS |

HTML table of rerate flows. Type, Start Date, End Date, Days, DayCount, Fixed Avg.Rate, Payment Date, Notional, Ccy, Amount. |

||||||||||||

|

RETURN_CASH |

Money to return. Displayed in absolute value (only for Sec Vs Cash) |

||||||||||||

|

RETURN_CLEANUP |

Clean Up type (partial or full) |

||||||||||||

|

RETURN_NOMINAL |

Nominal to return. Displayed in absolute value. |

||||||||||||

|

RETURN_QUANTITY |

Quantity to return. Displayed in absolute value. |

||||||||||||

|

SDI_<attribute_name> |

rec.getZipCode() Settlement delivery instructions attribute. |

||||||||||||

| SECCODE_<security code name> |

Security code <security code name>. |

||||||||||||

|

SETTLE_DATE |

trade.getSettleDate() |

||||||||||||

|

SENDER_FULL_NAME |

LegalEntity le = BOCache.getLegalEntity(dsCon,sender.getLegalEntityId()) le.getName() |

||||||||||||

|

SENDER_CODE |

le.getName() |

||||||||||||

|

SENDER_ID |

sender.getId() |

||||||||||||

|

SENDER_LEID |

sender.getLegalEntityId() |

||||||||||||

|

SENDER_ROLE |

sender.getLegalEntityRole() |

||||||||||||

|

SENDER_CONTACTTYPE |

sender.getContactType() |

||||||||||||

|

SENDER_CONTACT_NAME |

sender.getContactName() |

||||||||||||

|

SENDER_TITLE |

sender.getTitle() If null return PARENT_SENDER_TITLE |

||||||||||||

|

SENDER_ADDRESS |

sender.getMailingAddress() If null return PARENT_SENDER_ADDRESS |

||||||||||||

|

SENDER_EMAIL |

sender.getEmailAddress() If null return PARENT_SENDER_EMAIL |

||||||||||||

|

SENDER_FAX |

sender.getFax() If null return PARENT_SENDER_FAX |

||||||||||||

|

SENDER_TELEX |

sender.getTelex() If null return PARENT_SENDER_TELEX |

||||||||||||

|

SENDER_PHONE |

sender.getPhone() If null return PARENT_SENDER_PHONE |

||||||||||||

|

SENDER_SWIFT |

sender.getSwift() If null return PARENT_SENDER_SWIFT |

||||||||||||

|

SENDER_COMMENT |

sender.getComment() |

||||||||||||

|

SENDER_CITY |

sender.getCityName() If null return PARENT_SENDER_CITY |

||||||||||||

|

SENDER_ZIPCODE |

sender.getZipCode() If null return PARENT_SENDER_ZIPCODE |

||||||||||||

|

SENDER_STATE |

sender.getState() If null return PARENT_SENDER_STATE |

||||||||||||

|

SENDER_COUNTRY |

sender.getCountry() If null return PARENT_SENDER_COUNTRY |

||||||||||||

|

SETTLEMENT_INSTRUCTIONS |

HTML table of settlement instructions. |

||||||||||||

|

SETTLEMENT_TO_SDI_TYPE SETTLEMENT_TO_PAYREC SETTLEMENT_TO_CURRENCY SETTLEMENT_TO_AGENT SETTLEMENT_METHOD SETTLEMENT_FAVOR_OF SETTLEMENT_ACCOUNT_NUMBER SETTLEMENT_TO_INTERMEDIARY SETTLEMENT_TO_METHOD_INTERMEDIARY SETTLEMENT_TO_INTERMEDIARY SETTLEMENT_TO_METHOD_INTERMEDIARY2 SETTLEMENT_TO_DDA_ACCOUNT SETTLEMENT_PO_SDI_<attribute name> SETTLEMENT_CNTP_SDI_<attribute name> SETTLEMENT_ROUTING |

SETTLEMENT keywords can only be used inside the AdviceTransferRules iterator or TransferRules iterator. For the following message keywords, you can use the suffix #INTERNAL for PO SDIs and #EXTERNAL for CP SDIs: SETTLEMENT_TO_SDI_TYPE SETTLEMENT_TO_AGENT SETTLEMENT_METHOD SETTLEMENT_FAVOR_OF SETTLEMENT_ACCOUNT_NUMBER SETTLEMENT_TO_INTERMEDIARY SETTLEMENT_TO_METHOD_INTERMEDIARY SETTLEMENT_TO_INTERMEDIARY2 SETTLEMENT_TO_METHOD_INTERMEDIARY2 SETTLEMENT_ROUTING Example: SETTLEMENT_METHOD#INTERNAL gives the settlement method of the PO SDI and SETTLEMENT_METHOD#EXTERNAL gives the settlement method of the CP SDI. |

||||||||||||

|

SETTLEMENT_CTPY_BENE_<address method> SETTLEMENT_CTPY_BENE_IDENTIFIER SETTLEMENT_CTPY_AGENT_NAME SETTLEMENT_CTPY_AGENT_<address method> SETTLEMENT_CTPY_AGENT_IDENTIFIER SETTLEMENT_CTPY_AGENT_ACCOUNT SETTLEMENT_CTPY_INT_NAME SETTLEMENT_CTPY_INT_<address method> SETTLEMENT_CTPY_INT_IDENTIFIER SETTLEMENT_CTPY_INT_ACCOUNT SETTLEMENT_CTPY_INT2_NAME SETTLEMENT_CTPY_INT2_<address method> SETTLEMENT_CTPY_INT2_IDENTIFIER SETTLEMENT_CTPY_INT2_ACCOUNT SETTLEMENT_CTPY_OI_NAME SETTLEMENT_CTPY_OI_SWIFT SETTLEMENT_CTPY_OI_IDENTIFIER SETTLEMENT_CTPY_OI_ACCOUNT |

These message keywords can only be used inside the TransferRules iterator. They allow retrieving transfer rules information for both standard SDIs and manual SDIs. Standard SDIs SETTLEMENT_CTPY_BENE_* - Counterparty SDI beneficiary long name, <address method> value, identifier SETTLEMENT_CTPY_AGENT_* - Counterparty SDI agent long name, <address method> value, identifier, account SETTLEMENT_CTPY_INT_* - Counterparty SDI intermediary long name, <address method> value, identifier, account SETTLEMENT_CTPY_INT2_* - Counterparty SDI intermediary2 long name, <address method> value, identifier, account SETTLEMENT_CTPY_OI_* - Not applicable Manual SDIs For manual SDIs, the *_ACCOUNT message keyword is empty and only the SWIFT address method applies. SETTLEMENT_CTPY_BENE_* - Counterparty manual SDI beneficiary long name, SWIFT value, identifier SETTLEMENT_CTPY_AGENT_* - Counterparty manual SDI agent long name, SWIFT value, identifier, identifier SETTLEMENT_CTPY_INT_* - Counterparty manual SDI intermediary long name, SWIFT value, identifier SETTLEMENT_CTPY_INT2_* - Counterparty manual SDI intermediary2 long name, SWIFT value, identifier SETTLEMENT_CTPY_OI_* - Counterparty manual SDI ordering customer, name, SWIFT value, identifier |

||||||||||||

|

SENDER_LOGO |

Displays the LOGO of the sender. The logo can be set for each contact on the contact attribute LOGO (provided it is available in the domain “addressMethod”). You can define the possible values in the domain “addressMethod.LOGO”. The value of the LOGO should be a link to an image file using:

In the latter case, the content of the image will be embedded in the advice document using a base64 data URL. This allows having the image attached inside the document instead of externally linked. It may not be supported by all web browsers as well as by certain HTML to PDF conversion libraries. You can then use the message keywords SENDER_LOGO to display the LOGO in a message: <img src="|SENDER_LOGO|"/> |

||||||||||||

|

STACK_DEPTH |

Returns directly the parse depth. For a top level document, the value will be "0". If document1.html includes document2.html, while parsing document2.html, the stack depth is "1". Can be used in conjunction with IS_TOP_LEVEL. |

||||||||||||

|

TERMINATED_AMOUNT |

Amount when trade terminated. Original trade on which full termination or novation was applied, terminated amount = original amount. Original trade on which partial termination was applied, terminated amount = original amount - new trade amount. On the newly created trade from novation, terminated amount = this amount. On the newly created trade from partial termination, termination amount = old trade amount - this amount. |

||||||||||||

|

TERMINATED_QUANTITY |

Terminated quantity. |

||||||||||||

|

TERMINATION_INITIAL_ AMOUNT |

Initial Notional or Quantity before termination. |

||||||||||||

|

TERMINATION_REMAINING_ AMOUNT |

Remaining Notional or Quantity after termination. |

||||||||||||

|

TERMINATION_TERMINATED_AMOUNT |

Termination Notional or Quantity after termination. |

||||||||||||

|

TRADE_ACTION |

Trade Action |

||||||||||||

|

TRADE_AUDIT |

HTML table of audit information. Date (TRADE_AUDIT_DATE), Field (TRADE_AUDIT_FIELD), Old Value (TRADE_AUDIT_OLD_VALUE), New Value (TRADE_AUDIT_NEW_VALUE), User (TRADE_AUDIT_USER). |

||||||||||||

|

TRADE_DATE |

trade.getTradeDate() |

||||||||||||

|

TRADE_FLOWS |

HTML table of trade cashflows. Start Date, End Date, Date, Reset Date, Day Count, Days, Rate, Spread, Amount, Currency, Notional, Type. You can also create your own cashflows table using the "CASHFLOW_" keywords. |

||||||||||||

|

TRADE_ID |

trade.getId() |

||||||||||||

|

TRADE_TIME |

trade.getTradeDate() Trade date time in book timezone. |

||||||||||||

|

TRADE_ACCRUAL |

trade.getAccrual() |

||||||||||||

|

TRADE_COUNTERPARTY_FULL_NAME |

Long name of the counterparty of the trade. |

||||||||||||

|

TRADE_PROCESSING_ORGANIZATION |

BOCache.getProcessingOrg(dsCon,trade.getBook()) |

||||||||||||

|

TRADE_QUANTITY |

Math.abs(trade.getQuantity()) |

||||||||||||

|

TRADE_PRICE |

Math.abs(trade.getTradePrice()) |

||||||||||||

|

TRADE_NEGOCIATEDPRICE |

Math.abs(trade.getNegociatedPrice()) |

||||||||||||

|

TRADE_NEGOCIATEDPRICETYPE |

trade.getNegociatedPriceType() |

||||||||||||

|

TRADE_CURRENCY |

trade.getTradeCurrency() |

||||||||||||

|

TRADE_SETTLECCY |

trade.getSettleCurrency() |

||||||||||||

|

TRADE_ENTEREDDATE |

trade.getEnteredDate() |

||||||||||||

|

TRADE_ENTEREDUSER |

trade.getEnteredUser() |

||||||||||||

|

TRADE_COMMENT |

trade.getComment() |

||||||||||||

|

TRADE_BOOK |

trade.getBook().getName() |

||||||||||||

|

TRADE_TRADER |

trade.getTraderName() |

||||||||||||

|

TRADE_COUNTERPARTY |

trade.getCounterParty().getCode() |

||||||||||||

|

TRADE_STATUS |

trade.getStatus.toString() TRADE_STATUS shows the status of the previous version of the trade when subaction = CANCEL. |

||||||||||||

|

TRADE_STATUS2 |

TRADE_STATUS2 shows the status of the current version of the trade when subaction = CANCEL. |

||||||||||||

|

TRADE_EXCHANGE |

BOCache.getLegalEntityCode(dsCon,trade.getExchangeId()) |

||||||||||||

|

TRADE_MARKET_TYPE |

Trade Market Type. |

||||||||||||

|

TRADE_UPDATEDTIME |

trade.getUpdatedTime() |

||||||||||||

|

TRADE_BUNDLEID |

if (trade.getBundle() != null) return String.valueOf(trade.getBundle().getId()) else return "0" You can also use the TradeBundleTrades iterator to iterate over all the trades in a bundle. |

||||||||||||

|

TRADE_SETTLEMENT_AMOUNT |

Math.abs(trade.getProduct().calcSettlementAmount(trade)) |

||||||||||||

|

TRADE_NOMINAL |

Math.abs(trade.computeNominal()) |

||||||||||||

|

TRADE_BUYER_NAME |

LegalEntity po = BOCache.getProcessingOrg(dsCon,trade.getBook()) if (trade.getQuantity() > 0) return po.getName(); else return trade.getCounterParty().getName() |

||||||||||||

|

TRADE_SELLER_NAME |

LegalEntity po = BOCache.getProcessingOrg(dsCon,trade.getBook()) if (trade.getQuantity() < 0) return po.getName() else return trade.getCounterParty().getName() |

||||||||||||

|

TRADE_TRANSFER_RULES |

HTML table of trade's transfer rules. Pay/receive, Transfer Type, Currency, Product Type, Payer, Payer Role, Payer SDI Name, Payer SDI Status, Payer Agent, Receive, Receiver Role, Receiver SDI Name, ReceiverSDI Status, Receiver Agent, Percent, Settle Ccy, Delivery Type, Netting Type. |

||||||||||||

|

TRADE_INTERNALREFERENCE |

trade.getInternalReference() |

||||||||||||

|

TRADE_EXTERNALREFERENCE |

trade.getExternalReference() |

||||||||||||

|

<TRADE keyword>#NOVATED_TRADE |

Provides the TRADE keyword for the NOVATED_TRADE (trade resulting from a novation, termination, etc.). Example |TRADE_CURRENCY#NOVATED_TRADE| |

||||||||||||

|

<TRADE keyword>#PARENT_TRADE |

Provides the TRADE keyword for the PARENT_TRADE (original trade of a novation, termination, etc.). Example |TRADE_CURRENCY#PARENT_TRADE| |

||||||||||||

|

TRADEBUNDLE_<attribute name> |

Trade bundle attributes. You can also use the TradeBundleTrades iterator to iterate over all the trades in a bundle. |

||||||||||||

|

TRANSFER_CONTAINS_DIVIDEND DIVIDEND_COMP_EX_DIV_DATE DIVIDEND_COMP_DIVIDEND_EQUITY_NAME DIVIDEND_COMP_EQUITY_QTY DIVIDEND_COMP_DIVIDEND_PER_SHARE DIVIDEND_COMP_TOTAL_DIVIDEND |

DIVIDEND keywords can only be used inside the DividendDetail iterator, as in the examples shown below. TRANSFER_CONTAINS_DIVIDEND determines whether the transfer is associated with dividends. <!--calypso> If (|TRANSFER_CONTAINS_DIVIDEND| == "Yes") { inline "<p class=header2>Dividend Details</p>"; inline " <table> iterator ( "DividendDetail" ) { inline " <tr> <td>|DIVIDEND_COMP_EX_DIV_DATE|</td> <td>|DIVIDEND_COMP_EQUITY_NAME|</td> <td>|DIVIDEND_COMP_EQUITY_QTY|</td> <td>|DIVIDEND_COMP_DIVIDEND_PER_SHARE|</td> <td>|DIVIDEND_COMP_TOTAL_DIVIDEND|</td>"; } inline "</table>"; } </calypso--> |

||||||||||||

|

TRANSFER_ID |

transfer.getId() |

||||||||||||

|

TRANSFER_EVENTCODE |

transfer.getEventType() |

||||||||||||

|

TRANSFER_TRADEID |

transfer.getTradeId() |

||||||||||||

|

TRANSFER_PRODUCTID |

transfer.getProductId() |

||||||||||||

|

TRANSFER_PRODUCTFAMILY |

transfer.getProductFamily() |

||||||||||||

|

TRANSFER_PRODUCTTYPE |

transfer.getProductType() |

||||||||||||

|

TRANSFER_STATUS |

transfer.getStatus().toString() |

||||||||||||

|

TRANSFER_TYPE |

transfer.getTransferType() |

||||||||||||

|

TRANSFER_SETTLEMENTAMOUNT |

Math.abs(transfer.getSettlementAmount()) |

||||||||||||

|

TRANSFER_SETTLEMENTCCY |

transfer.getSettlementCurrency() |

||||||||||||

|

TRANSFER_TRADECURRENCY |

transfer.getTradeCurrency() |

||||||||||||

|

TRANSFER_PAYRECEIVE |

if (transfer.getPayReceive().equals(BOProductHandler.PAY)) return "pay" if(transfer.getPayReceive().equals(BOProductHandler.RECEIVE)) return "receive" if (transfer.getSettlementAmount() > 0) return "receive" else return "pay" |

||||||||||||

|

TRANSFER_VALUEDATE |

transfer.getValueDate() |

||||||||||||

|

TRANSFER_SETTLEDATE |

transfer.getSettleDate() |

||||||||||||

|

TRANSFER_EXTERNALLEGALENTITY |

LegalEntity le = BOCache.getLegalEntity(dsCon,transfer.getExternalLegalEntityId()) le.getCode() |

||||||||||||

|

TRANSFER_EXTERNALROLE |

transfer.getExternalRole() |

||||||||||||

|

TRANSFER_EXTERNALSDID |

transfer.getExternalSettleDeliveryId() |

||||||||||||

|

TRANSFER_MANUALSDID |

Transfer Manual Settlement Delivery Instruction Id |

||||||||||||

|

TRANSFER_EXTERNALAGENT |

LegalEntity le = BOCache.getLegalEntity(dsCon,transfer.getExternalAgentId()) le.getCode() |

||||||||||||

|

TRANSFER_INTERNALSDID |

transfer.getInternalSettleDeliveryId() |

||||||||||||

|

TRANSFER_INTERNALAGENT |

LegalEntity le = BOCache.getLegalEntity(dsCon,transfer.getInternalAgentId()) le.getCode() |

||||||||||||

|

TRANSFER_GLACCOUNTNUMBER |

Accountacc = dsCon.getRemoteAccounting().getAccount(transfer.getGLAccountNumber()) if (acc != null) return acc.getName() else return "SUSPENSE" |

||||||||||||

|

TRANSFER_NETTINGTYPE |

transfer.getNettingType() |

||||||||||||

|

TRANSFER_DELIVERYTYPE |

transfer.getDeliveryType() |

||||||||||||

|

TRANSFER_OTHERAMOUNT |

transfer.getOtherAmount() |

||||||||||||

|

TRANSFER_BOOK |

Book book = BOCache.getBook(dsCon,transfer.getBookId()) return book.getName() |

||||||||||||

|

TRANSFER_AVAILABLE |

transfer.getAvailableB() |

||||||||||||

|

TRANSFER_TRADEDATE |

transfer.getTradeDate() |

||||||||||||

|

TRANSFER_NETTED |

transfer.getNettedTransfer() |

||||||||||||

|

TRANSFER_NETTEDTRANSFERID |

transfer.getNettedTransferId() |

||||||||||||

|

TRANSFER_BUNDLEID |

transfer.getBundleId() |

||||||||||||

|

TRANSFER_SETTLEMENTINSTRUCTIONS |

HTML table containing the transfer's settlement instructions. |

||||||||||||

|

TRANSFER_DETAILS |

HTML table listing all the payments and security transfers. Shows TradeId, Description, Type, Ccy and Amount.

|

||||||||||||

|

TransferDetails#FIXED |

Displays the fixed payment / receipt inside the TransferDetails iterator. |

||||||||||||

|

TransferDetails#FLOATING |

Displays the floating payment / receipt inside the TransferDetails iterator. |

||||||||||||

|

TRANSFEREE TRANSFEREE_ADDRESS TRANSFEREE_CITY TRANSFEREE_CONTACT_NAME TRANSFEREE_COUNTRY TRANSFEREE_EMAIL TRANSFEREE_FAX TRANSFEREE_FULL_NAME TRANSFEREE_PHONE TRANSFEREE_REFERENCE TRANSFEREE_STATE TRANSFEREE_SWIFT TRANSFEREE_TELEX TRANSFEREE_TITLE TRANSFEREE_ZIPCODE |

Information about novation transferee. |

||||||||||||

|

TRANSFEROR TRANSFEROR_ADDRESS TRANSFEROR_CITY TRANSFEROR_CONTACT_NAME TRANSFEROR_COUNTRY TRANSFEROR_EMAIL TRANSFEROR_FAX TRANSFEROR_FULL_NAME TRANSFEROR_PHONE TRANSFEROR_REFERENCE TRANSFEROR_STATE TRANSFEROR_SWIFT TRANSFEROR_TELEX TRANSFEROR_TITLE TRANSFEROR_ZIPCODE |

Information about novation transferor. |

||||||||||||

|

UTI_ISSUER USI_ISSUER ISSUER_CODE REPORTING_JURISDICTION TRANSACTION_IDENTIFIER |

UTI_ISSUER and USI_ISSUER allow retrieving the content of the trade keywords UTIIssuer and USIIssuer respectively, located after the “|” character. Example: If trade keyword UTIIssuer = TES|1234567, message keyword UTI_ISSUER = 1234567. ISSUER_CODE allows retrieving the value of trade keywords UTI/Issuer and USI/USIIssuer. The reporting jurisdiction is ESMA if UTIIssuer is set, or CFTC if USIIssuer is set. The transaction identifier allows retrieving the value of trade keywords UTI/TradeId and USI/USITradeId. |

1.2 Back Office Operations

Billing

|

Keyword Names |

Description |

|

LINKED_TRADEID |

ID of billing trade. |

| LINKED_TRADE_DATE |

Trade date of billing trade. |

| LINKED_VALUE_DATE |

Value date of billing trade. |

| LINKED_SETTLE_DATE |

Settle date of billing trade. |

| LINKED_TRADE_SETTLEMENT_AMOUNT |

Settlement amount of billing trade. |

| LINKED_TRADE_NOMINAL |

Nominal amount of billing trade. |

| LINKED_PRODUCT_DESCRIPTION |

Product description of billing trade. |

| LINKED_PRODUCT_ISINCODE |

ISIN code of product in billing trade. |

| LINKED_SETTLE_METHOD |

Settlement method of billing trade. |

| LINKED_SETTLE_CCY |

Settlement currency of failed transfer. |

| LINKED_SETTLEMENT_AMOUNT |

Settlement amount of failed transfer. |

| LINKED_PO_SDI_DESCRIPTION |

PO settlement instructions of billing trade. |

| COLSDAYS |

Failed days. |

| COLSRATE |

Rate. |

| DAYCOUNT |

Daycount. |

| REASON_NAME |

Matching reason. |

Call Account

|

Keyword Names |

Description |

|

ACCOUNT_ID |

Call account ID. |

| ACCOUNT_NAME |

Call account name. |

| ACCOUNT_DESCRIPTION |

Call account description. |

| ACCOUNT_LEGAL_ENTITY |

Call account legal entity short name. |

| ACCOUNT_LEGAL_ENTITY_FULLNAME |

Call account legal entity full name. |

| IS_CALL_ACCOUNT |

True for a call account, or false otherwise. |

| CALL_ACCOUNT_TYPE |

Call account type. |

| CALL_ACCOUNT_SUBTYPE |

Call account subtype. |

| ACCOUNT_CCY |

Call account currency. |

| ACCOUNT_CREATION_DATE |

Call account creation date. |

| ACCOUNT_STATUS |

Call account status. |

| ACCOUNT_ACTIVE_FROM |

Call account active start date. |

| ACCOUNT_ACTIVE_TO |

Call account active end date. |

| ACCOUNT_INTEREST_CALCULATION_RULE |

Calculation date rule of account interest associated with call account. |

| ACCOUNT_INTEREST_PAYMENT_RULE |

Payment date rule of account interest associated with call account. |

| ACCOUNT_INTEREST_DAYCOUNT |

Daycount of account interest associated with call account. |

| ACCOUNT_INTEREST_ROUNDING |

Rounding method of account interest associated with call account. |

| ACCOUNT_DEBIT_RATE_TYPE |

Debit rate type of account interest associated with call account: fixed or float. |

| ACCOUNT_CREDIT_RATE_TYPE |

Credit rate type of account interest associated with call account: fixed or float. |

| ACCOUNT_DEBIT_RATE |

Debit rate of account interest associated with call account: fixed or float. |

| ACCOUNT_CREDIT_RATE |

Credit rate of account interest associated with call account: fixed or float. |

Customer Transfer

|

Keyword Names |

Description |

|

REMITTANCE_METHOD |

Remittance method (e.g. Demand Draft, Mail Transfer, Telegraphic Transfer). |

|

BENEFICIARY |

Name of beneficiary. |

|

BENEFICIARY_SDI |

Beneficiary's settlement instructions. |

|

PROCESSING_ORG_SDI |

PO's settlement instructions. |

|

SETTLEMENT_METHOD |

Type of settlement. |

|

PAYMENT_METHOD |

Payment method. |

|

FX_TRADE_ID |

ID of related FX trade. |

|

FX_RESET |

FX reset type. |

|

FX_RATE |

FX rate. |

|

SETTLEMENT_CURRENCY |

Settlement currency. |

|

CUSTOMER_ACCOUNT |

Customer account number. |

|

COMMISSION_ACCOUNT |

Commission account number. |

|

CHARGE_BURDEN |

Charge burden (Payer or Sender). |

|

FEES_EXEMPTION |

Type of fee exemption. |

| PRINCIPAL |

Principal amount. |

Hedge Relationship

|

Keyword Names |

Description |

|

HEDGE_RELATIONSHIP_NAME |

Hedge Relationship name. |

| HEDGE_RELATIONSHIP_ID |

Hedge Relationship ID. |

| HEDGE_RELATIONSHIP_COMMENT |

Hedge Relationship comment. |

|

HEDGE_STRATEGY_NAME HEDGE_NAME |

Hedge Definition name. |

|

HEDGE_STRATEGY_TYPE HEDGE_TYPE |

Hedge Definition type. |

| HEDGED_RISK |

Type of risk being hedged. |

|

HEDGE_STRATEGY_COMMENT HEDGE_DEFINITION_COMMENT |

Description from Hedge Definition. |

|

HEDGE_STRATEGY_EFFMETHOD_PRO HEDGE_EFFMETHOD_PRO |

Prospective method for hedge effectiveness testing from Hedge Definition. |

|

HEDGE_EFFMETHOD_PRO_DESC |

Description from Hedge Effectiveness Testing Parameters for prospective method. |

|

HEDGE_STRATEGY_EFFMETHOD_RETRO HEDGE_EFFMETHOD_RETRO |

Retrospective method for hedge effectiveness testing from Hedge Definition. |

|

HEDGE_EFFMETHOD_RETRO_DESC |

Description from Hedge Effectiveness Testing Parameters for retrospective method. |

| HAS_HEDGED_ITEM |

Yes or No. |

| HEDGED_TRADES_LIST |

List of hedged trades in the relationship. |

| HEDGING_TRADES_LIST |

List of hedging trades in the relationship. |

|

PO_NAME HDG_PO_NAME |

Processing org. |

|

RELATIONSHIP_TYPE |

Relationship Type from Hedge Definition |

|

HDG_TRADE_ID HDG_PRODUCT_TYPE HDG_HEDGE_RATIO HDG_RATIO_TYPE HDG_PRICER_MEASURE HDG_START_DATE RTI_START_DATE HDG_END_DATE RTI_END_DATE HDG_STATUS HDG_TRADE_STATUS HDG_COUNTERPARTY HDG_TRADE_COUNTERPARTY HDG_NOTIONAL HDG_TRADE_NOTIONAL HDG_OPEN_NOMINAL HDG_ORIGINAL_NOMINAL HDG_CREDIT_SPREAD HDG_TRADE_TYPE |

Through the HedgeRelationshipTradeItems iterator. Trade ID Product type Hedge Ratio Ratio type Pricer measure Start date End date Status Counterparty Notional Open Nominal Original Nominal Credit Spread Trade Type - Hedged or Hedging |

Interest Bearing

All Call Account keywords also apply to Interest Bearing.

|

Keyword Names |

Description |

|

TRANSFER_RateChangeValue |

Value of interest bearing attribute RATE_CHANGE_VALUE. |

| TRANSFER_RateChangeName |

Value of interest bearing attribute RATE_CHANGE_NAME. |

| ACCOUNT_ACTUALBALANCE |

ACTUAL back office position on SETTLE_DATE. |

Simple Transfer

|

Keyword Names |

Description |

|

PRINCIPAL |

Principal amount. |

|

CURRENCY |

Currency of the transaction. |

1.3 Commodities

All Commodities

|

Keyword Names |

Description |

| IS_EMISSION_TYPE |

True or False. |

| COMMODITY_ALLOWANCE_TYPE |

Allowance type. |

| COMMODITY_CCY |

Product currency. |

| COMMODITY_UNIT |

Quoting unit. |

| OPTION_STYLE |

Option style for commodity options. |

| COMMODITY_NAME |

Product name. |

|

COMMODITY_START_DATE |

Start date. |

|

COMMODITY_END_DATE |

End date. |

|

COMMODITY_TYPE |

Commodity name. |

|

COMMODITY_QTY_PER_PERIOD |

Notional Quantity per Calculation Period. |

|

COMMODITY_CALC_PERIOD |

Returns a text based on the payment frequency and frequency.

|

|

COMMODITY_PRICING_DATE_ROLL |

Date roll convention. |

|

COMMODITY_PYMT_CALENDAR |

Payment holiday calendar. |

|

FIX_PAYER_CODE |

Fixed price payer - Legal entity short name. |

|

FLT_PAYER_CODE |

Float price payer - Legal entity short name. |

|

PAYLEG_PAYER_CODE |

Floating Price Payer(Float/Float Swap) - Legal entity short name. |

|

RECEIVELEG_PAYER_CODE |

Floating Price Payer(Float/Float Swap) - Legal entity short name. |

|

COMMODITY_FIX_STRIKE |

Strike. |

| COMMODITY_STRIKE_PRICE_PER_UNIT |

Strike price for commodity options. |

|

COMMODITY_REFERENCE_PRICE |

Commodity reset attribute "COMMODITY_REFERENCE_PRICE". |

| COMMODITY_PRICE_SOURCE |

Price source. |

|

PAYLEG_COMMODITY_REFERENCE_PRICE |

Commodity reset attribute on the pay leg "PAYLEG_COMMODITY_REFERENCE_PRICE". |

|

RECEIVELEG_COMMODITY_REFERENCE_PRICE |

Commodity reset attribute on the receive leg "RECEIVELEG_COMMODITY_REFERENCE_PRICE". |

|

COMMODITY_DELIVERY_DATE |

Commodity reset attribute "COMMODITY_DELIVERY_DATE". |

|

COMMODITY_PRICING_DATES |

Returns a text based on the payment frequency and fixing policy.

|

|

PAYLEG_COMMODITY_PRICING_DATES |

Returns a text based on the payment frequency and fixing policy for the pay leg.

|

|

RECEIVELEG_COMMODITY_PRICING_DATES |

Returns a text based on the payment frequency and fixing policy for the receive leg.

|

|

FALLBACK_REFERENCE_PRICE |

Trade keyword "FALLBACK_REFERENCE_PRICE". |

|

COMMODITY_MODIFY_MARKET_DISRUPTION_EVENTS |

Comma-separated list of keywords that are marked applicable in Commodity Swap Trade under "Menu Commodity Swap 2 > Commodity Confirm Keywords" - "Market Disruption Events". |

|

COMMODITY_ADDITIONAL_MARKET_DISRUPTION_EVENTS |

Trade keywords "COMMODITY_ADDITIONAL_MARKET_DISRUPTION_EVENTS". |

|

COMMODITY_DISRUPTION_FALLBACKS |

Comma-separated list of keywords that are marked applicable in Commodity Swap Trade under "Menu Commodity Swap 2 > Commodity Confirm Keywords" - "Disruption Fallbacks". |

| CURRENCY_CONVERSION_PROVISION |

Conversion provision. |

| EXPIRY_TIME |

Expiry time for commodity option. |

| EXPIRY_TIMEZONE |

Expiry timezone for commodity option. |

| HAS_MARKET_DISRUPTION_EVENTS |

True or False. |

| HAS_REFERENCE_PRICE |

True or False. |

| IS_WRITTEN_CONFIRMATION |

True or False. |

| TOTAL_QUANTITY |

Total quantity. |

| FINAL_PAYMENT_DATE |

Final payment date. |

| COMMODITY_RESET_NAME | Commodity reset name. |

Commodity Forward

All Commodities keywords also apply to Commodity Forward.

|

Keyword Names |

Description |

|

PRODUCT_TYPE |

Commodity forward. |

| COMMODITY_UNADJ_PRICE |

Unadjusted price. |

| COMMODITY_QUANTITY |

Quantity. |

| COMMODITY_DELIVERY_DATE |

Delivery date. |

| COMMODITY_COMPLIANCE_PERIOD |

Compliance period. |

| IS_FIXED_RATE |

True or False. |

Commodity Index Swap

|

Keyword Names |

Description |

|

SWAP_NOTIONAL_QTY |

Total notional quantity. |

| INDEX_PAYER_CODE |

Index payer. |

| INTEREST_PAYER_CODE |

Interest payer. |

| INDEX_BEGIN |

Start index level. |

| FEE_RATE |

Premium fee rate. |

| FLT_RATE_INDEX |

Rate index displayed as “<currency>-<index name>-<index source>” by default. If the rate index attribute “RATE_INDEX_CODE.<source>” is set, its value is used instead. |

| FLT_RATE_TENOR |

Rate index tenor. |

Commodity Spot

All Commodities keywords also apply to Commodity Spot.

|

Keyword Names |

Description |

|

PRODUCT_TYPE |

Commodity spot. |

| COMMODITY_TYPE |

Product name. |

| COMMODITY_QUANTITY |

Quantity. |

| COMMODITY_PRICE |

Price. |

| COMMODITY_SETTLEMENT_AMT |

Settlement amount. |

| COMMODITY_PAYMENT_DATE |

Payment date. |

| COMMODITY_DELIVERY_DATE |

Delivery date. |

| COMMODITY_VINTAGE_YEAR |

Vintage year. |

Commodity OTC Option

All Commodities keywords also apply to Commodity OTC Option.

|

Keyword Names |

Description |

|

COMMODITY_STRIKE_PRICE_PER_UNIT |

“Strike price for CALL. |

|

COMMODITY_STRIKE_PRICE_PER_UNIT_TWO |

Strike price for PUT. |

| IS_PHYSICAL |

True or false. |

|

KEYWORD_OPTION_TYPE_ONE |

“CALL” option type. |

|

KEYWORD_OPTION_TYPE_TWO |

“PUT” option type. |

|

PRODUCT_TYPE |

Commodity option. |

| FX_ROUNDING |

FX conversion - FX rate rounding number of decimals. |

| PRICE_ROUNDING |

FX conversion - Price rounding number of decimals. |

Commodity Swap

All Commodities keywords also apply to Commodity Swap.

|

Keyword Names |

Description |

|

PRODUCT_TYPE |

Commodity swap. |

| COMMODITY_TYPE |

Product name. |

| ISAVERAGING_B |

True or False. |

| SWAP_NOTIONAL_QUANTITY |

Total notional quantity. |

| PAYLEG_SWAP_NOTIONAL_QUANTITY |

Payleg notional quantity. |

| RECEIVELEG_SWAP_NOTIONAL_QUANTITY |

Receive leg notional quantity. |

| FIX_CPN_FREQ |

Fixed leg coupon frequency. |

| FIX_ROLL_DAY |

Fixed leg roll day. |

| FIX_FIRST_PAYMENT_DATE |

Fixed leg first payment date. |

| FIX_CPN_DATE_ROLL |

Fixed leg coupon date roll. |

| FLT_CPN_OFFSET |

Floating leg payment lag. |

| FIX_FIXED_RATE |

Fixed leg rate. |

| PAYLEG_PAYER_CODE |

Payer code on pay leg. |

| RECEIVELEG_PAYER_CODE |

Receiver code on pay leg. |

| COMMODITY_FLT_LEG_TYPE |

Floating leg type. |

| COMMODITY_FLT_FUTURE_CONTRACT |

Future contract on floating leg. |

| COMMODITY_FLT_FWD_PRICE_METHOD |

Forward price method on floating leg. |

| COMMODITY_FLT_FIXING_CALENDAR |

Fixing calendar on floating leg. |

| COMMODITY_FLT_SPREAD |

Spread on floating leg. |

| COMMODITY_FIX_LEG_TYPE |

Fixed leg type. |

| PAYLEG_COMMODITY_FLT_SPREAD |

Spread on pay floating leg. |

| RECEIVELEG_COMMODITY_FLT_SPREAD |

Spread on receive floating leg. |

| COMMODITY_FIX_UNIT |

Quoting unit on fixed leg. |

| COMMODITY_PYMT_FRQ |

Payment frequency. |

| COMMODITY_FXNG_POLICY |

Fixing policy. |

| COMMODITY_FIRST_CONTRACT |

First delivery date. |

| COMMODITY_LAST_CONTRACT |

Last delivery date. |

| PAYLEG_COMMODITY_QTY_PER_PERIOD |

Notional Quantity per Calculation Period on pay leg. |

| RECEIVELEG_COMMODITY_QTY_PER_PERIOD |

Notional Quantity per Calculation Period on receive leg. |

| COMMODITY_PYMT_CALENDAR |

Payment calendar. |

| COMMODITY_PYMT_PERIOD |

Payment period. |

| COMMODITY_ROLL_DAY |

Roll day. |

| COMMODITY_PYMT_LAG |

Payment lag. |

| PAYLEG_COMMODITY_CALC_PERIOD |

Calculation period on pay leg. |

| RECEIVELEG_COMMODITY_CALC_PERIOD |

Calculation period on receive leg. |

| IS_FLOAT_FLOAT |

True or False. |

| IS_PAYLEG_RECEIVELEG_TOTAL_QTY_DIFF |

True or False. |

| IS_PAYLEG_RECEIVELEG_QTY_PER_PERIOD_DIFF |

True or False. |

| IS_PAYLEG_RECEIVELEG_CALC_PERIOD_DIFF |

True or False. |

| IS_PAYLEG_RECEIVELEG_PRICING_DATES_DIFF |

True or False. |

| IS_SETTLEMENT_DATES_DIFF |

True or False. |

| SETTLEMENT_DATES |

Settlement dates. |

| PAYLEG_SETTLEMENT_DATES |

Settlement dates on pay leg. |

| RECEIVELEG_SETTLEMENT_DATES |

Settlement dates on receive leg. |

| FX_ROUNDING |

FX conversion - FX rate rounding number of decimals. |

| PRICE_ROUNDING |

FX conversion - Price rounding number of decimals. |

|

Payment Frequency |

Frequency |

Value of COMMODITY_CALC_PERIOD |

|---|---|---|

|

Bullet |

N/A |

"The Effective Date." |

|

FutureContractFND |

N/A |

"Each Calendar Month from and including the effective date to and including the Termination Date, including the first and last calendar days of each month." |

|

FutureContractLTD |

N/A |

"Each Calendar Month from and including the effective date to and including the Termination Date, including the first and last calendar days of each month." |

|

Periodic |

WK |

"Each Calendar Week from and including the effective date to and including the Termination Date, including the first and last calendar days of each week." |

|

MTH |

"Each Calendar Month from and including the effective date to and including the Termination Date, including the first and last calendar days of each month." |

|

|

QTR |

"Each Calendar Quarter from and including the effective date to and including the Termination Date, including the first and last calendar days of each quarter." |

|

|

Periodic IR Convention |

WK |

"Each Weekly Period from and including the effective date to and including the Termination Date, including the first and last calendar days of each week." |

|

MTH |

"Each Monthly Period from and including the effective date to and including the Termination Date, including the first and last calendar days of each month." |

|

|

QTR |

"Each Quarterly Period from and including the effective date to and including the Termination Date, including the first and last calendar days of each quarter." | |

|

Third Wednesday |

MTH |

"Each Calendar Month from and including the effective date to and including the Termination Date, including the first and last calendar days of each month." |

|

Whole |

N/A |

"From and including the Effective Date to and including the Termination Date." |

|

Payment Frequency |

Fixing Policy |

Value of COMMODITY_PRICING_DATES, PAYLEG_COMMODITY_PRICING_DATES, RECEIVELEG_COMMODITY_PRICING_DATES |

|---|---|---|

|

Bullet |

Bullet |

"The Commodity Business Day equal to the Effective Date of the relevant calculatoin period." |

|

FutureContractFND |

Contract Last Day |

"In respect of each Calculation Period, the Commodity Business Day which corresponds to the Notification Date of the relevant Futures Contract." |

|

Penultimate |

"In respect of each Calculation Period, the Commodity Business Day immediately preceding the Commodity Business Day which corresponds to the Notification Date of the relevant Futures Contract." |

|

|

Last Three Days |

"In respect of each Calculation Period, the last three Commodity Business Days immediately preceding and including the Notification Date of the relevant Futures Contract." |

|

|

FutureContractLTD |

Contract Last Day |

"The last Commodity Business Day on which the relevant Futures Contract is scheduled to trade on the Exchange." |

|

Penultimate |

"In respect of each Calculation Period, the Commodity Business Day immediately preceding the last Commodity Business Day on which the relevant Futures Contract is scheduled to trade on the Exchange." |

|

|

Last Three Days |

"In respect of each Calculation Period, the last three Commodity Business Days on which the relevant Futures Contract is scheduled to trade on the Exchange." |

|

|

Periodic |

First Day |

"The first Commodity Business Day on which the Commodity Reference Price is published for the relevant calculation period." |

|

Last Day |

"The last Commodity Business Day on which the Commodity Reference Price is published for the relevant calculation period." |

|

|

Whole |

"Every Commodity Business Day on which the Commodity Reference Price is published for the relevant calculation period." |

|

|

Periodic IR Convention |

First Day |

"The first Commodity Business Day on which the Commodity Reference Price is published for the relevant calculation period." |

|

Last Day |

"The last Commodity Business Day on which the Commodity Reference Price is published for the relevant calculation period." |

|

|

Whole |

"Every Commodity Business Day on which the Commodity Reference Price is published for the relevant calculation period." |

|

|

Third Wednesday |

Third Wednesday |

"The Commodity Business Day on which the Commodity Reference Price is published which precedes the Third Wednesday of the relevant calculation period." |

|

Whole |

First Day |

"The first Commodity Business Day on which the Commodity Reference Price is published for the relevant calculation period." |

|

Last Day |

"The last Commodity Business Day on which the Commodity Reference Price is published for the relevant calculation period." |

|

|

Whole |

"Every Commodity Business Day on which the Commodity Reference Price is published for the relevant calculation period." |

1.4 Credit Derivatives

Credit Default Swap

|

Keyword Names |

Description |

|

CD_BUY_OR_SELL_PROTECTION |

Direction of the cds deal: buy or sell credit protection. |

|

CD_START_DATE |

Start date of the cds deal. |

|

CD_SETTLEMENT_TYPE |

Settlement type, such as cash, physical, etc. |

|

CD_REFERENCE_ENTITY |

Reference issuer and seniority. |

|

CD_REFERENCE_ENTITY_RATING |

HTML table of all available credit ratings for reference entity. |

|

CD_TERMINATION_EVENTS |

Termination events specified for this cds deal. |

|

CD_PREMIUM_FREQ |

Frequency of premium payments. |

|

CD_PREMIUM_FIXED_RATE |

Fixed rate of premium payments. |

|

CD_NOTIONAL |

Notional amount. |

|

CD_CALC_AGENT |

The party responsible for determining actions as detailed in Section 1.14 of the ISDA Credit Derivatives Definitions. |

|

CD_CALC_AGENT_CITY |

The city in which the office of the Calculation Agent is located. |

|

RED_CODE |

RED_PAIR attribute on the issuer LE. |

|

PROTECTION_SELLER_CODE |

The name of the Seller. |

|

PROTECTION_BUYER_CODE |

The name of the Buyer. |

|

FIX_CPN_HOL |

Fixed leg payment holidays. |

|

FLT_CPN_HOL |

Floating leg payment holidays. |

|

FIX_CPN_FREQ |

Fixed leg payment frequency. |

|

FIX_CPN_DATE_ROLL |

Fixed leg payment date roll. |

|

FIX_FIXED_RATE |

Fixed rate. |

|

FIX_DAY_COUNT |

Fixed leg day count fraction. |

|

FIX_ROLL_DAY |

Fixed leg roll day. |

|

FIX_FIRST_PAYMENT_DATE |

Fixed leg first payment date. |

|

NOTIFYING_PARTY |

Party responsible for delivering a Credit Event Notice. |

|

CONDITIONS_OF_PAYMENT |

Cash, Physical, or Customer Option Settlement. |

|

NOTICE_OF_PAI |

Notice of Publicly Available Information. |

| NOTICE_OF_PHYSICAL_SETTLEMENT |

Applicable or not. |

|

PUBLIC_SOURCES |

Source of Publicly Available Information. |

|

SPECIFIED_NUMBER |

The number of Pubic Sources providing Publicly Available Information. |

|

REFERENCE_SENIORITY |

Seniority of Reference Entity. |

|

ISSUER |

Issuer of the Underlying. |

| PRODUCT_ISINCODE |

ISIN security code value. |

| PRODUCT_CUSIPCODE |

CUSIP security code value. |

|

DESCRIPTION |

Description of the Issuer. |

|

INDUSTRY |

Industry associated with the Issuer. |

|

RATING |

Rating of the Issuer. |

|

REFERENCE_OBLIGATION |

Obligation specified in the confirmation. |

| REFERENCE_OBLIGATIONS |

Each obligation specified in the confirmation. |

|

TICKER |

Ticker symbol for Issuer. |

|

CREDIT_EVENTS |

One or more of events such as Bankruptcy, Failure to Pay, Obligation Acceleration, Obligation Default, Repudiation/Moratorium or Restructuring. |

| BANKRUPTCY |

Bankruptcy type. |

| FAILURE_TO_PAY |

Failure to pay type. |

| GRACE_PERIOD_APPLICABLE |

Applicable or not. |

| GRACE_PERIOD |

Grace period. |

| PAYMENT_REQUIREMENT |

Payment amount. |

| OBLIGATION_ACCELERATION |

Text. |

| REPUDIATION_OR_MORATORIUM |

Repudiation or Moratorium. |

| RESTRUCTURING |

Restructuring type. |

|

RESTRUCTURING_MR RESTRUCTURING_MMR |

Applicable or not. |

| MULTIPLE_HOLDER_APPLICATION |

Applicable or not. |

| DEFAULT_REQUIREMENT |

Default amount. |

|

OBLIGATION_TYPE |

Obligation category. |

|

OBLIGATION_CHARACTERISTICS |

One or more of characteristics such as Listed, Not Contingent, Not Domestic Currency, Not Domestic Issuance, Not Domestic law, Not Sovereign Lender, Not Subordinated, Pari Passu, or Specified Currency. |

|

CONV_OBLG_SUPPLEMENT |

An obligation that is convertible into Equity Securities. |

|

RESTRUCTURING_SUPPLEMENT |

Supplement will be produced when there is the occurrence of one or more of: a reduction in the rate or amount of interest, a reduction in he amount of principal or premium, a postponement of dates, a change in ranking priority of a payment, any change in currency. |

|

SUCCESSOR_EVENT_SUPPLEMENT |

A supplement will be issued when an event such as a merger, consolidation, amalgamation, transfer of assets or liabilities, spin-off occurs. |

|

DISPUTE_RESOLUTION |

Only used with the 1998 ISDA Credit Derivative Definitions. |

|

ISDA_TYPE |

1998, 1999, or 2003 ISDA Credit Derivative Definitions. |

|

SETTLEMENT_METHOD |

Auction, Cash, Physical, or Customer Option Settlement. |

|

SETTLEMENT_HOLIDAYS |

Holidays applicable to Settlement. |

|

TERMINATION_PAYMENT |

Either Par Minus Recovery or Initial Minus Recovery. |

|

SETTLE_LAG |

Settlement Lag. |

|

DEL_OBLIGATION_CATEGORY |

One of Bond, Bond_or_Loan, Borrowed Money, Loan, Payment, or Reference Obligation. |

|

DEL_OBLIGATION_CHARACTERISTICS |

One or more of the list of Obligation deliverable characteristics. |

|

INCLUDE_ACCRUED_INTEREST |

Accrued Interest to be determined by the Calculation Agent. |

| INCLUDE_EXLUDE_ACCRUED_INTEREST |

Applicable or not. |

|

CASH_SETTLE_LOANS |

Cash settlement of loans to be determined by the Calculation Agent. |

|

CASH_SETTLE_ASSIGN_LOANS |

Cash settlement of assignable loans to be determined by the Calculation Agent. |

|

CASH_SETTLE_PARTICIPATIONS |

Cash settlement of participations to be determined by the Calculation Agent. |

|

ESCROW_APPLICABLE |

Physical settlement to take place through the use of an Escrow Agent. |

|

VAL_DATE_LAG |

The number of business days required after satisfaction of all Conditions to Settlement. |

|

MULT_VAL_DATE_LAG |

The number of business days specified in the VAL_DATE_LAG and each successive date after the date on which the Calculation Agent obtains a Market Value. |

|

MULT_VAL_DATES |

The total number of Valuation Dates. |

|

VAL_DATETIME |

11:00am in the principal trading market for the reference obligation. |

|

TIME_ZONE |

Time zone for the valuation date. |

|

VAL_METHOD |

Either Highest or Market. |

|

QUOTATION_METHOD |

Bid. |

|

QUOTATION_CCY |

Currency of the quotation amount. |

|

QUOTATION_AMT |

An amount calculated by the Calculation Agent. |

|

MIN_QUOTATION_CCY |

Currency of the quotation amount. |

|

MIN_QUOTATION_AMT |

The lower of USD 1,000,000 and the quotation amount. |

|

INCLUDE_ACCR_INTEREST |

Accrued Interest to be determined by the Calculation Agent. |

| INCLUDE_EXCLUDE_ACCR_INTEREST |

Applicable or not. |

|

REFERENCE_DEALERS |

Institutions responsible for providing quotes. |

|

SETTLEMENT_CCY |

Settlement currency. |

| DEFAULT_SETTLE_DATE_DESC |

Description text. |

| DEFAULT_SETTLE_AMT |

Text. |

| RED_CODE |

Issuer's RED_PAIR attribute. |

| ALL_GUARANTEES |

Applicable or not. |

| EXCLUDED_OBLIGATIONS |

Excluded obligations. |

| DEL_EXCLUDED_OBLIGATIONS |

Delivery excluded obligations. |

Asset Swap

|

Keyword Names |

Description |

| AMORTIZING_SCHEDULE |

Amortizing schedules of floating leg. Calculation Period(s) Beginning, Notional Amount, Notional Reduction from Previous Calculation Period(s). |

|

ASSET_TYPE |

Underlying asset. |

|

GUARANTOR |

Guarantor of asset swap. |

|

ASSET_PRICE |

Price. |

| ASSET_YIELD |

Yield. |

|

ASSET_DIRTY_PRICE |

Dirty Price. |

|

ASSET_NOTIONAL |

Notional Amount. |

|

ASSET_CURRENCY |

Currency. |

|

ASSET_SETTLE_DATE |

Settlement Date. |

|

ASSET_ACCRUAL |

Accrual percentage. |

|

ASSET_ACCRUAL_AMOUNT |

Accrual amount. |

|

ASSET_COUPON_DATE |

Coupon date. |

|

ASSET_COUPON_AMOUNT |

Coupon amount. |

| FIX_PAYER_CODE |

Payer of fixed leg. |

| FLT_PAYER_CODE |

Payer of floating leg. |

| FLT_CPN_FREQ |

Coupon frequency of floating leg. |

| FLT_CPN_DATE_ROLL |

Date roll of floating leg. |

| FLT_ROLL_DAY |

Roll day of floating leg. |

| FLT_FIRST_RESET_RATE |

First reset date of floating leg. |

| FLT_FIRST_PAYMENT_DATE |

First payment date of floating leg. |

| FLT_RATE_INDEX |

Index rate of floating leg. |

| FLT_INDEX_TENOR |

Index tenor of floating leg. |

| FLT_SPREAD |

Spread of floating leg. |

| FLT_DAY_COUNT |

Daycount of floating leg. |

| FLT_RATE_DETERMINED |

Determined rate of floating leg. |

| FLT_COMPOUND_FREQ |

Compound frequency of floating leg. |

| SWAP_NOTIONAL |

Notional of underlying swap. |

CDS ABS

|

Keyword Names |

Description |

|

EFFECTIVE_DATE |

Start date. |

| REFERENCE_ENTITY |

Issuer. |

| INSURER |

Guarantor. |

| SEC_CODE |