Generating Draft Cheques

The purpose of this document is to describe the setup required to generate the following messages :

| • | Draft Cheques |

| • | MT110 (Advice of Cheque) |

| • | MT111 (Request for Stop Payment of Cheque) |

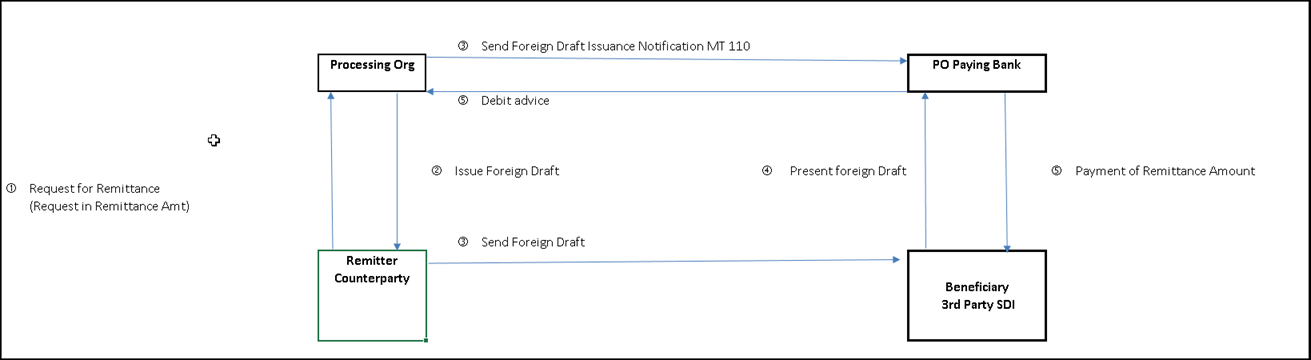

The diagram below illustrates the different parties involved in the request for a draft cheque and the resulting messages. The Processing Org will issue a printed cheque to send to a 3rd party for the payment of foreign funds.

Process flow:

1. A Counterparty contacts the Processing Org who manages a USD DDA Account or Foreign Currency Call Account for the Counterparty.

2. The Counterparty asks the Processing Org to issue a foreign currency draft cheque to a 3rd party using funds obtained from either:

| • | An FX spot trade - Withdrawal of USD from the Counterparty’s USD DDA account, which is converted to foreign currency, using an FX spot trade entered in Calypso. |

| • | A Call Account Customer Transfer - Withdrawal of foreign currency from the same currency Call Account maintained in Calypso. |

3. The draft cheque is sent to the Remitter on 3rd Party SDI. At the same time, the MT110 Swift message is sent by the Processing Org to their paying bank, where the Processing Org holds a Foreign Currency account in the currency of the draft cheque.

4. The Beneficiary receives the draft cheque and deposits the draft cheque in its foreign currency bank account.

5. The paying bank will honor the funds when the MT110 is received.

6. If the draft cheque is lost or duplicated and the Counterparty provides sufficient evidence, the FX Spot or Customer Transfer trade can be canceled and the resulting MT111 will be sent from the Processing Org to their paying bank.

1. Setup Requirements

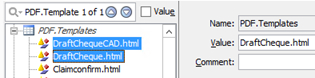

Two different Draft Cheque formats are available, one for all currencies (DraftCheque.html) and one for Canadian dollars only (DraftChequeCAD.html). The choice of the template will be determined by the Message Setup.

1.1 Domain Values

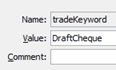

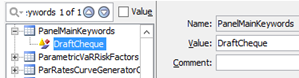

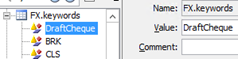

Domain "tradeKeyword"

Value = DraftCheque - This trade keyword should be set to true to distinguish trades for which the foreign currency payment will be made using a draft cheque for FX spot trades (FX) and Customer Transfer Trades (Call Account).

To use this trade keyword, it must also be added to the following domains:

| • | "PanelMainKeywords" |

| • | "PropagateTradeKeyword" |

Propagation of trade keyword to transfer attributes.

| • | "FX.Keywords" |

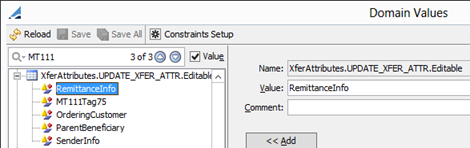

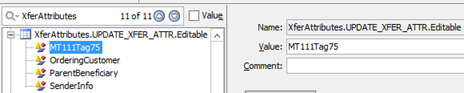

Domain "XferAttributes"

Value = DraftCheque - Used for the propagation of the trade keyword identifying the trade as a trade being settled using a draft cheque.

Value = RemittanceInfo - This transfer attribute can be set using the transfer action UPDATE_XFER_ATTR to update the Reference details which are sourced originally from the 3rd Party SDI Tag 70 field. This field is referenced in the draft cheque.

Value = MT111Tag75 - This transfer attribute can be set using the transfer action UPDATE_XFER_ATTR before the trade/transfer is canceled to set Tag 75 for message MT111.

Domain "PDF.Templates"

Value = DraftCheque.html

Value = DraftChequeCAD.html

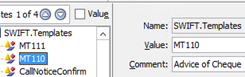

Domain "SWIFT.Templates"

Value = MT110

Value = MT111

Domain "messageTYPE"

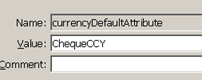

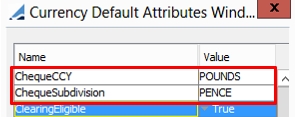

Domain "currencyDefaultAttribute"

Value = ChequeCCY

Value = ChequeSubdivision

If set, the value of these attributes is displayed in the draft cheque field "Amount in Words".

This is not needed for the CAD currency.

Example for the GBP currency:

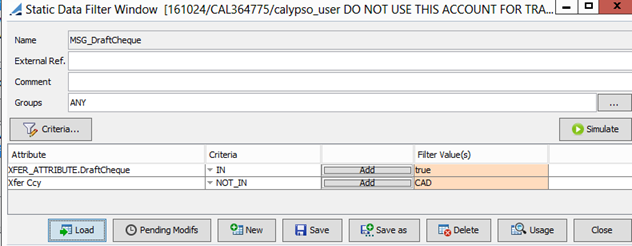

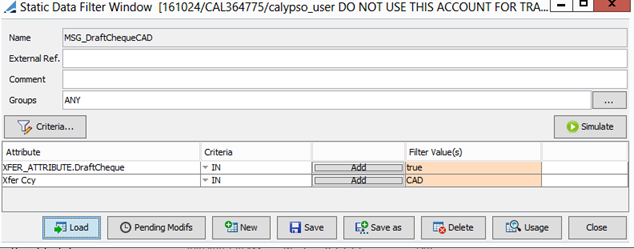

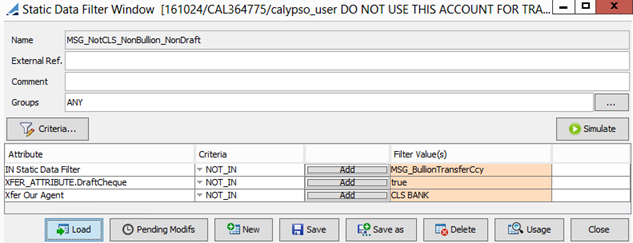

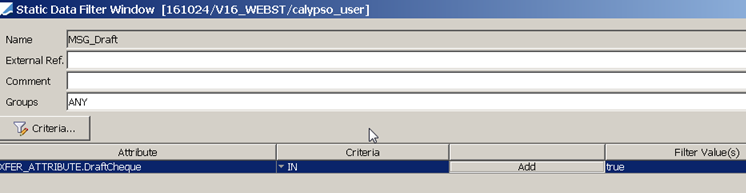

1.2 Static Data Filters

Sample static data filters are provided below, for the Message Setup.

The inclusion of the Xfer Ccy in the filter criteria is only required when using the template DraftChequeCAD.html.

1.3 Sample Message Setup

|

Product |

Event |

Message Type |

Address Type, Gateway, Format Type |

Template Name |

Static Data Filter |

|---|---|---|---|---|---|

| CustomerTransfer | VERIFIED_PAYMENT | DRAFTS |

MAIL, PRINTER, PDF |

DraftChequeCAD.html | MSG_DraftChequeCAD |

| CustomerTransfer | VERIFIED_PAYMENT | DRAFTS | MAIL, PRINTER, PDF | DraftCheque.html | MSG_DraftCheque |

| CustomerTransfer | VERIFIED_PAYMENT | PAYMENTMSG | SWIFT, SWIFT, SWIFT | Payment.selector | MSG_NotCLS_NonBullion_NonDraft |

| CustomerTransfer | VERIFIED_PAYMENT | PAYMENTMSG | SWIFT, SWIFT, SWIFT | MT110 | MSG_Draft |

| CustomerTransfer | CANCELED_PAYMENT | PAYMENTMSG | SWIFT, SWIFT, SWIFT | MT111 | MSG_Draft |

| FX | VERIFIED_PAYMENT | DRAFTS | MAIL, PRINTER, PDF | DraftCheque.html | MSG_DraftCheque |

| FX | VERIFIED_PAYMENT | DRAFTS | MAIL, PRINTER, PDF | DraftChequeCAD.html | MSG_DraftChequeCAD |

| FX | CANCELED_PAYMENT | PAYMENTMSG | SWIFT, SWIFT, SWIFT | MT111 | MSG_Draft |

| FX | VERIFIED_PAYMENT | PAYMENTMSG | SWIFT, SWIFT, SWIFT | Payment.selector | MSG_NotCLS_NonBullion_NonDraft |

| FX | VERIFIED_PAYMENT | PAYMENTMSG | SWIFT, SWIFT, SWIFT | MT110 | MSG_Draft |

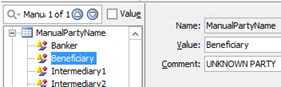

Please note that the Receiver for message type DRAFTS should be set in the Comment field of the domain "ManualPartyName" for Value = Beneficiary.

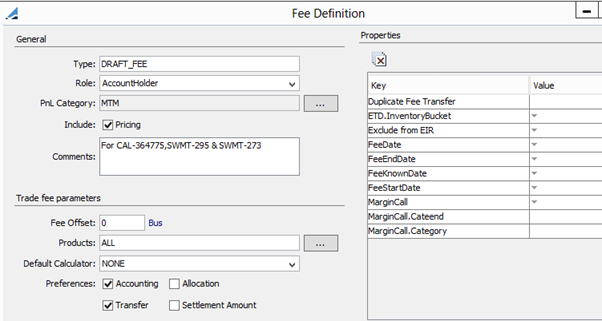

1.4 Fee Setup

Create a Fee Definition for the DRAFT_FEE. Draft fees are currently only supported for FX spot trades.

The fee will be charged in the currency of the DDA account being USD. The role represents the Role in the "AccountHolderRole" domain. If not set, the default role is “Client”.

1.5 Workflow Setup

Make sure that the following are set in the Transfer workflow:

| • | Rule PropagateTradeKeyword on the transition between PENDING and VERIFIED |

| • | Transition VERIFIED - UPDATE_XFER_ATTRIBUTE - VERIFIED - To update the transfer attributes MT111Tag75 and RemittanceInfo as needed |

2. Message Generation

The messages are generated as follows.

2.1 Draft Cheque

| Template Fields | Description |

|---|---|

|

Debit Account Name |

Call Account Name |

|

Credit Account Name |

Processing Org Bank Payer Full Name |

|

Reference |

RemittanceInfo transfer attribute, or Tag 70 first line of 3rd Party SDI |

|

No ID |

Calypso Trade Id |

|

Date |

Transfer Trade Date (yyyyMMdd) |

|

Amount in Figures |

Foreign currency amount (non USD) associated with the FX Spot trade or the foreign currency amount of the Customer Transfer trade |

|

Remitter |

3rd Party SDI Remitter |

|

Pay to the Order Of |

3rd Party SDI Beneficiary, City and Country on the 3rd Party SDI |

|

Amount in Words |

The amount in figures is converted to words using the ChequeCCY and ChequeSubdivision currency attributes of the draft cheque currency (except for CAD) |

|

To |

Processing Org Paying Agent Full Name, Address and Account Number |

|

Details of Payment |

Tag 70 details on the 3rd Party SDI |

|

Mail to |

Remitter Name and Address from the 3rd Party SDI |

|

International Draft ID |

Calypso Trade Id |

|

Draft Amount |

Amount in figures and Currency (ISO Code) |

|

Rate |

FX Spot Trade only - FX rate |

|

USD Equivalent |

FX Spot trade only - USD amount |

|

Fee |

FX Spot trade only - DRAFT_FEE amount |

2.2 MT 110 - Advice of Cheque

The MT110 message is generated when the draft cheque is generated but only moves to SENT status once the draft cheque has been printed and is ready to be mailed to the Remitter.

The details on the MT110 represents the funds being paid externally by the Processing Org from a counterparty’s DDA or Call Account.

| Tags | Description |

|---|---|

| M20 | Sender's Reference - Message Id |

| M21 | Cheque Number - Trade Id |

| M30 | Date of Issue - Transfer value date |

| M32a | Amount - Currency and amount |

| O50a | Payer - 3rd Party Manual SDI ordering customer BIC code, or trade counterparty BIC code |

| M59a | Payee - 3rd Party Manual SDI Beneficiary |

2.3 MT111 - Request for Stop Payment of Cheque

The MT111 message is generated if message MT110 is in SENT status and the trade and transfers are canceled.

The data used to populate the original MT110 is used to populate the MT111. The user manually adds Tag 75 using the transfer action UPDATE_XFER_ATTR prior to canceling the trade.

| Tags | Description |

|---|---|

| M20 | Sender's Reference - Message Id |

| M21 | Cheque Number - Trade Id |

| M30 | Date of Issue - Transfer value date |

| M32a | Amount - currency and amount |

| M59a | Payee - 3rd Party Manual SDI Beneficiary |

| O75 | Queries - Transfer attribute MT111Tag75 |