Swaption - Vol Surface Underlying

The Swaption underlying can be used in construction of the RATE volatility surfaces.

Swaption Configuration

| • | Create the Rate Index Definition in Configuration > Interest Rates > Rate Index Definitions from the Calypso Navigator. |

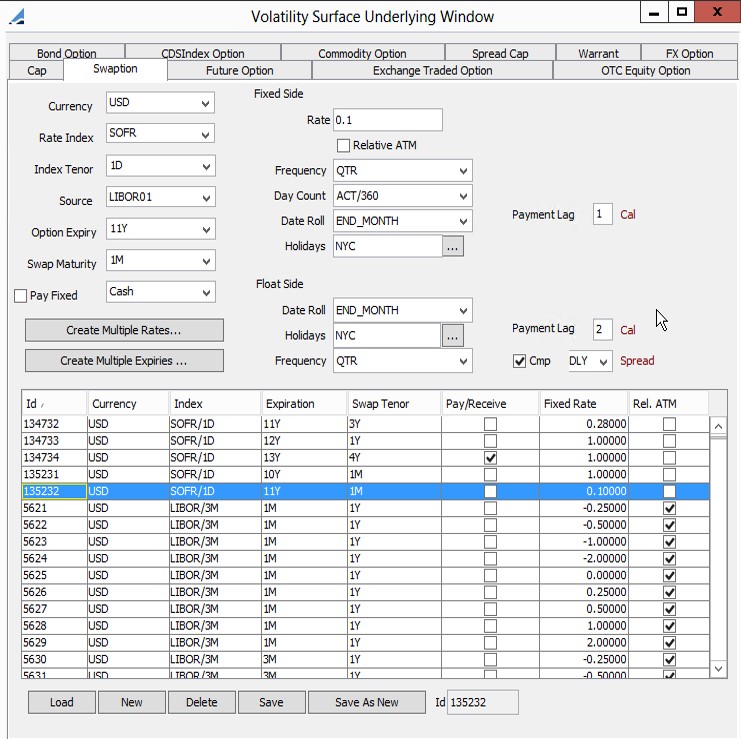

1. Swaption Volatility Surface Underlying

Create the underlying instruments in the Volatility Surface Underlying Window, Swaption panel.

| » | Click New to create new volatility surface underlying. |

Complete the details as described in the table below.

| » | Click Save to create the underlying. They appear in the table below. |

The system creates quotes like in the following example.

Fields Details

| Field | Description | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Currency |

Base currency selected in the Currency drop-down list in the bottom of the window. | ||||||||||||||||||

|

Rate Index |

Select the rate index. | ||||||||||||||||||

|

Index Tenor |

Tenor for the index. | ||||||||||||||||||

|

Source |

Quoting source for the index. | ||||||||||||||||||

|

Option Expiry |

Tenor for the option expiry. | ||||||||||||||||||

|

Swap Maturity |

Maturity for the swap. | ||||||||||||||||||

|

Pay Fixed |

Select the cash settlement method in order to affect the calculation of the value of the underlying when generating the surface. | ||||||||||||||||||

|

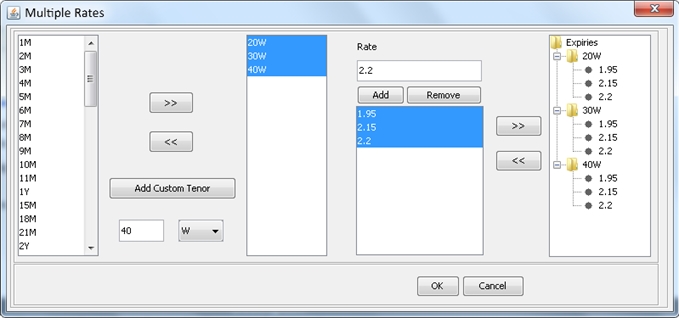

Create Multiple Rates |

You can click Create Multiple Rates to create multiple rates for instruments in the Multiple Rates window.

Ⓘ [NOTE: before creating multiple rates, make sure to specify other relevant information for the fixed and float side - such as currency, rate index, source, date roll, and holidays - on the Swaption panel.] |

||||||||||||||||||

| Create Multiple Expiries | You can click Create Multiple Expiries to create multiple instruments associated with the specified expiries. | ||||||||||||||||||

| Payment Lag | Enter the number of days between the interest date and the payment date, and specify Business or Calendar. | ||||||||||||||||||

| Cmp |

Check the Cmp checkbox to enable interest compounding.

There is no compounding otherwise. |

||||||||||||||||||

|

Fixed Side |

|||||||||||||||||||

|

Rate |

Enter the fixed interest rate in percentage. | ||||||||||||||||||

|

Relative ATM |

Select for relative at-the-money. | ||||||||||||||||||

|

Frequency |

Payment frequency. | ||||||||||||||||||

|

Day Count |

Select the daycount convention used for determining the periods. | ||||||||||||||||||

|

Date Roll |

Select the date roll convention to use when the date falls on a non-business day. | ||||||||||||||||||

|

Holidays |

Holiday calendars used in calculating the pay dates. | ||||||||||||||||||

|

Float Side |

|||||||||||||||||||

|

Date Roll |

Select the date roll convention to use when the date falls on a non-business day. | ||||||||||||||||||

|

Holidays |

Holiday calendars used in calculating the pay dates. | ||||||||||||||||||

|

Frequency |

Payment frequency. | ||||||||||||||||||

|

Other Details |

|||||||||||||||||||

|

Id |

Displays the system assigned unique identifier for the Swaption volatility surface underlying. | ||||||||||||||||||