Spread Cap - Vol Surface Underlying

The Spread Cap underlying can be used in construction of the RATE volatility surfaces using the SpreadCap generator, and as calibration instruments.

Spread Cap Configuration

| • | Create the Rate Index Definition using Configuration > Interest Rates > Rate Index Definitions from the Calypso Navigator. |

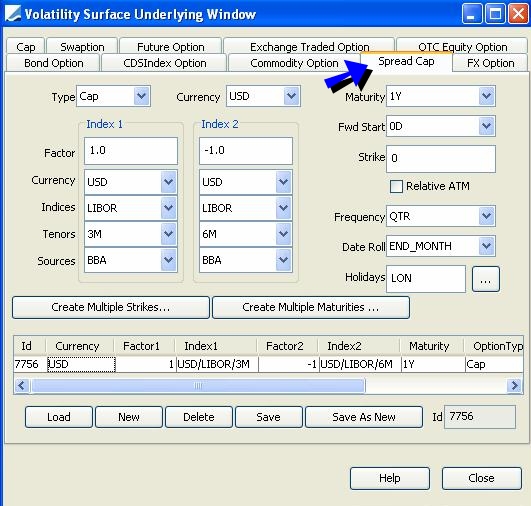

1. Spread Cap Volatility Surface Underlying

Create the underlying instruments in the Volatility Surface Underlying Window, Spread Cap panel.

| » | Click New to create new volatility surface underlying. |

Complete the details as described in the table below.

| » | Click Save to create the underlying. They appear in the table below. |

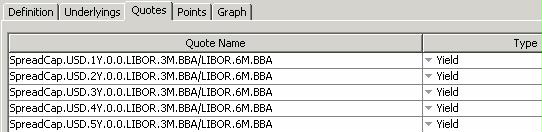

The system creates quotes like in the following example.

Fields Details

| Field | Description |

|---|---|

|

Type |

Cap or Floor. |

|

Currency |

Cap currency. |

|

Index 1 / Index 2 |

|

|

Factor |

Factor for the index. |

|

Currency |

Underlying currency for the index. |

|

Indices |

Select the name of the index. |

|

Tenors |

Tenor for the index. |

|

Sources |

Sources for the index. |

|

Other Details |

|

|

Maturity |

Maturity for the spread cap. |

|

Fwd Start |

Start tenor. |

|

Strike |

Strike in percentage. |

|

Relative ATM |

Select for relative at-the-money. |

|

Frequency |

Frequency code such as QTR, WK, SA. |

|

Date Roll |

Type of date roll such as MOD_FOLLOWING, FOLLOWING. |

|

Holidays |

Calendar used for Holidays. |

|

Create Multiple Rates / Create Multiple Expiries |

You can click Create Multiple Rates and Create Multiple Expiries to create multiple instruments. |

|

Id |

Displays the system assigned unique identifier for the Spread Cap volatility surface underlying. |