FX Option - Vol Surface Underlying

The FX Option underlying can be used in construction of the FX OPTION volatility surface.

1. FX Option Volatility Surface Underlying

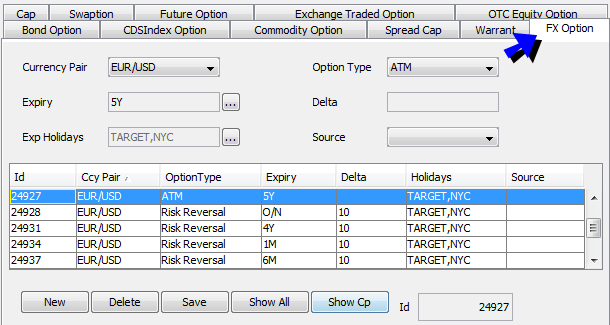

Create the underlying instruments in the Volatility Surface Underlying Window, FX Option panel.

| » | You can click Show All to view all existing instruments. You can also select a currency pair, and click Show Cp to view the existing instruments for that currency pair. |

| » | Click New to create new volatility surface underlyings, and enter the fields described below. |

| » | Click Save to create the instruments. They appear in the table below. |

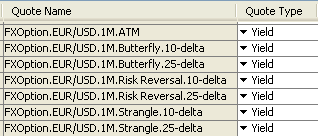

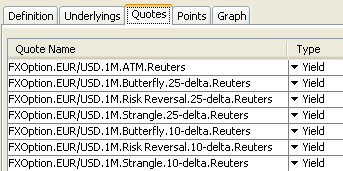

The system creates quotes like in the following example.

Sample quotes with source name.

Fields Details

| Fields | Description | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Currency Pair |

Select the currency pair for the FX Option from the drop-down menu. You can click Show Cp to display existing instruments for this currency pair. |

|||||||||||||||

|

Option Type |

Select one of the following option types:

Vreversal = |Vcall – Vput|

Vbutterfly = 0.5 * (Vcall + Vput) – Vatm

Vstrangle = 0.5 * (Vcall + Vput)

|

|||||||||||||||

|

Expiry |

Use this feature to create multiple instruments with different maturities. The application creates an instrument for each maturity that you select. For example, create ATM options with a maturity of 1D, 1W, 2W, and so on. Click ... to open the selector window. |

|||||||||||||||

|

Delta |

Not applicable for ATM options. Enter the delta for the instruments. You can enter a list of comma-separated deltas. |

|||||||||||||||

|

Exp Holidays |

Currently not used. The default value is to use the calendar(s) specified in the currency defaults when calculating the expiration dates of the underlying instruments. Do not specify any holiday calendar(s) on the underlying instruments. |

|||||||||||||||

| Source |

Optional. Select the source for the volatilities as applicable. If specified, it is added to the quote name. Sources can be added to the domain "FXOptVolSurfUndSource". |