Commodity Option - Vol Surface Underlying

The commodity option underlying can be used in construction of the COMMODITY volatility surface.

Commodity Option Configuration

| • | Create the commodity product using Configuration > Commodities > Commodities from the Calypso Navigator. |

| • | Create the date rules using Configuration > Definitions > Date Rule Definitions from the Calypso Navigator. |

| • | Run the GENERATE_COMM_VOL_POINTS scheduled task once to create the commodity vol surface underlyings. From that point on, only the GENERATE_COMM_VOL_POINTS_QUOTES should be used to create quote names for rolled commodity vol surface underlyings as of the val date when the scheduled task is executed, creating quote names for the new expiry. |

Refer to Calypso Scheduled Tasks documentation for details.

Refer to Calypso Scheduled Tasks documentation for details.

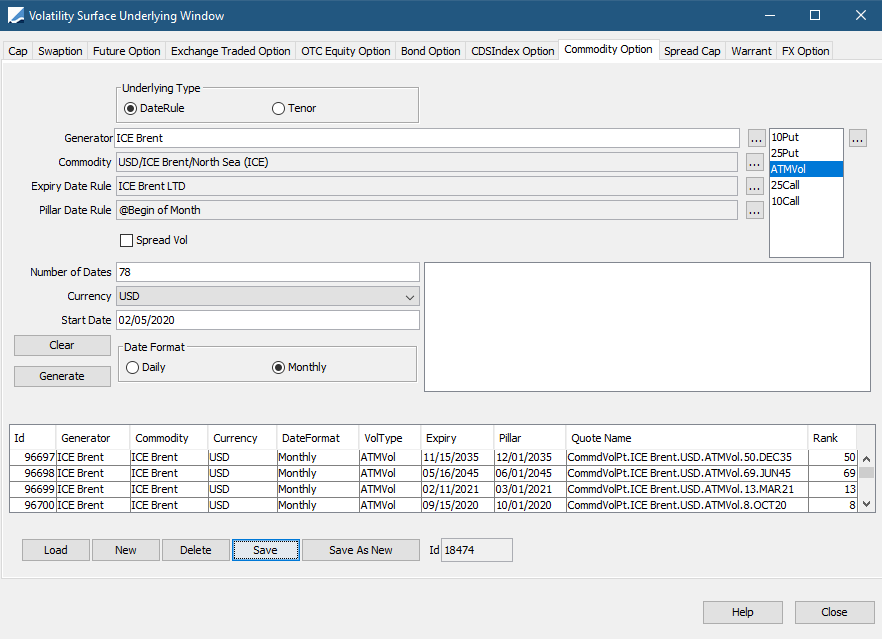

1. Delta based Volatility Surface Underlying

Create Delta based underlying instruments in Volatility Surface Underlying Window using 'Commodity Option' panel. The Delta based Volatility Surface Underlings are supported by Commodity Delta generator while generating Commodity Volatility Surface.

| » | Click New to create new volatility surface underlyings. |

Complete the details as described in the table below.

| » | Click Generate to create a list of underlying instruments. A preview is displayed. |

| » | Click Save to create the underlyings. They appear in the table below. |

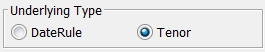

The Underlying Type can be either DateRule or Tenor based.

A DateRule based underlying is configured with a specific expiry date and specific pillar date. With a Tenor based underlying, the user can map the tenors against a live feed to capture quotes. This eliminates the need to recreate new underlyings with new expiry and pillar dates as well as eliminating the need to enter quotes manually.

Quotes using a DateRule underlying use the following naming convention: CommdVoltPt.VolPtGeneratorName.Currency.VolType.Expiry as in the example below.

CommdVolPt.ICE Brent.USD.ATMVol.01JAN18

CommdVolPt.ICE Brent.USD.ATMVol.01FEB18

Quotes using a Tenor underlying use the following naming convention: CommdVolPt.VolPtGeneratorName.Currency.VolType.Tenor as in the example below.

CommdVol.Pt.LME Tin.USD.25Put.3D

CommdVol.Pt.LME Tin.USD.25Put.5D

Fields Details

| Field | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Generator |

Enter a generator name for the volatility surface. |

|||||||||

|

Commodity |

Displays the associated commodity product if any. You can click ... to select the underlying commodity product. |

|||||||||

|

Expiry Date Rule / Expiry Tenor |

Displays the expiry date rule or tenors of the commodity product by default. Click ... to select the date rule or tenors to generate the expiry for each underlying. |

|||||||||

|

Pillar Date Rule / Expiry Tenor |

Displays the pillar date rule or tenors of the commodity product by default. Click ... to select the date rule to generate the pillar dates. Note: When using the Tenor Underlying Type, this field is automatically populated with the same tenors selected for the Expiry Tenor. |

|||||||||

|

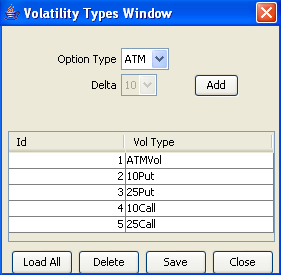

Volatility Types |

Select the volatilities for which you want to generate underlyings. You can click ... to add new volatility types.

|

|||||||||

| Spread Vol |

Check to indicate that the underlying is a volatility spread, to be used for the volatility surfaces generated with the CommodityVolatilitySpread generator. |

|||||||||

|

Number of Dates |

Enter the number of dates that you want to generate. |

|||||||||

|

Currency |

Select the reference currency for the underlyings. |

|||||||||

|

Start Date |

Enter the start date from which the underlyings will be generated. |

|||||||||

|

Date Format |

Select a date format for the underlying according to the market convention:

|

|||||||||

|

Id |

Displays the system assigned unique identifier. |

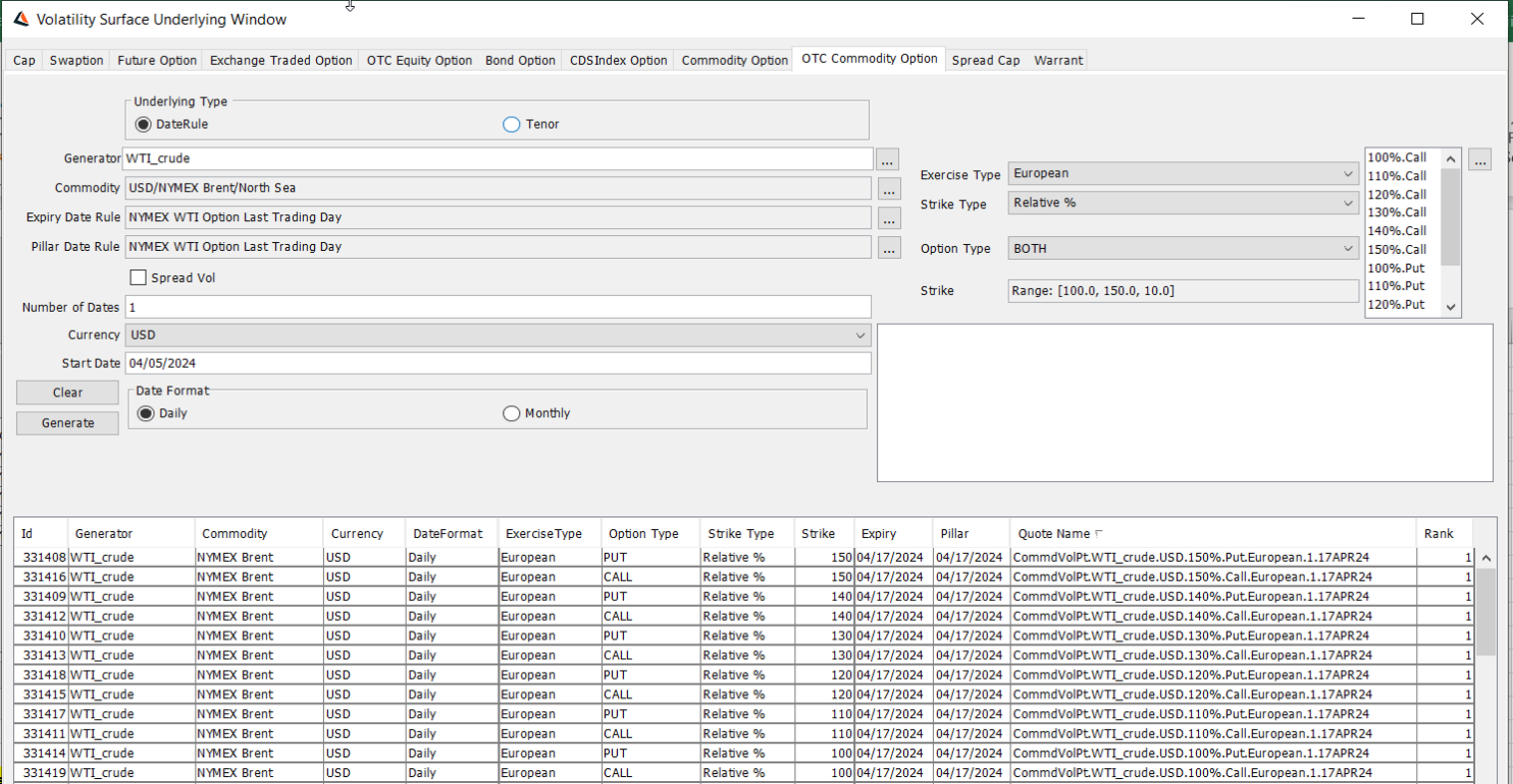

2. Commodity Volatility Surface Underlying

Create Strike, Relative% and Delta based underlying instruments in Volatility Surface Underlying Window using 'OTC Commodity Option' panel. Currently the Moneyness based i.e., Relative% Volatility Surface Underlings are supported by Commodity generator while generating Commodity Volatility Surface.

| » | Click New to create new volatility surface underlyings. |

Complete the details as described in the table below.

| » | Click Generate to create a list of underlying instruments. A preview is displayed. |

| » | Click Save to create the underlyings. They appear in the table below. |

The Underlying Type can be either DateRule or Tenor based.

A DateRule based underlying is configured with a specific expiry date and specific pillar date. With a Tenor based underlying, the user can map the tenors against a live feed to capture quotes. This eliminates the need to recreate new underlyings with new expiry and pillar dates as well as eliminating the need to enter quotes manually.

| • | Quotes using a DateRule underlying use the following naming convention: |

CommdVoltPt.VolPtGeneratorName.Currency.StrikeType.OptionType.ExerciseType.Rank.Expiry as in the example below:

Strike type - Strike

CommdVolPt.WTI_crude.USD.64.Call.European.1.Nov22

CommdVolPt.WTI_crude.USD.72.Call.European.1.Nov22

Strike type - Relative%

CommdVolPt.WTI_crude.USD.80%.Call.European.1.Nov22

CommdVolPt.WTI_crude.USD.90%.Call.European.1.Nov22

Strike type - Delta

CommdVolPt.WTI_crude.USD.40Delta.Call.European.1.Nov22

CommdVolPt.WTI_crude.USD.ATMDelta.European.1.Nov22

| • | Quotes using a Tenor underlying use the following naming convention: |

CommdVoltPt.VolPtGeneratorName.Currency.StrikeType.OptionType.ExerciseType.Tenor as in the example below:

Strike type - Strike

CommdVolPt.WTI_crude.USD.64.Call.European.1M

CommdVolPt.WTI_crude.USD.72.Call.European.1M

Strike type - Relative%

CommdVolPt.WTI_crude.USD.80%.Call.European.1M

CommdVolPt.WTI_crude.USD.90%.Call.European.1M

Strike type - Delta

CommdVolPt.WTI_crude.USD.40Delta.Call.European.2M

CommdVolPt.WTI_crude.USD.ATMDelta.European.2M

Fields Details

| Field | Description | ||||||

|---|---|---|---|---|---|---|---|

|

Generator |

Enter a generator name for the volatility surface. |

||||||

|

Commodity |

Displays the associated commodity product if any. You can click ... to select the underlying commodity product. |

||||||

|

Expiry Date Rule / Expiry Tenor |

Displays the expiry date rule or tenors of the commodity product by default. Click ... to select the date rule or tenors to generate the expiry for each underlying. |

||||||

|

Pillar Date Rule / Expiry Tenor |

Displays the pillar date rule or tenors of the commodity product by default. Click ... to select the date rule to generate the pillar dates. Note: When using the Tenor Underlying Type, this field is automatically populated with the same tenors selected for the Expiry Tenor. |

||||||

| Spread Vol |

Check to indicate that the underlying is a volatility spread, to be used for the volatility surfaces generated with the CommodityVolatilitySpread generator. |

||||||

|

Number of Dates |

Enter the number of dates that you want to generate. |

||||||

|

Currency |

Select the reference currency for the underlyings. |

||||||

|

Start Date |

Enter the start date from which the underlyings will be generated. |

||||||

|

Date Format |

Select a date format for the underlying according to the market convention:

|

||||||

|

Id |

Displays the system assigned unique identifier. | ||||||

|

Exercise Type |

Select Exercise Type from American and European. |

||||||

|

Strike Type |

Select from Strike, Relative %, and Delta. |

||||||

|

Option Type |

Select Options from CALL, PUT, BOTH. |

||||||

|

Strike |

Click ... to select the Strike to Input from Shift Amount List or Shift Amount Range.

|