FX Derived Zero Curves

From the Calypso Navigator, navigate to Market Data > Interest Rate Curves > FX Derived Curve (menu action marketdata.CurveZeroFXDerivedWindow).

An FX Derived Zero Curve generates an interest rate curve in one currency from the interest rate curve of another currency and an FX curve.

Refer to the FX and Money Market Analytics Guide for details about the curve generation algorithm.

1. General Curve Information

| • | The name of the curve is set upon saving. It will identify the curve throughout the system. |

| • | The instance of the curve dictates the quote side of the underlying instruments to be used for generating the curve. |

| – | The CLOSE instance uses CLOSE quotes. |

| – | The LAST instance uses BID, MID, and ASK quotes. |

| – | The OPEN instance uses OPEN quotes. |

| • | By default, the curve is saved as of the current date and time. You can clear the Current checkbox and change the curve date as needed. |

| • | You can change the precision of the discount factors using Utilities > Set Df Precision - Default is 8. |

Curve Update

You can use the scheduled task PROP_RATE_1BUSDAY to roll the quotes which are not liquid.

You can use the scheduled task GENERATE_CURVE to regenerate a curve as of the current valuation date.

Setup Information

The environment property INT_CURVE_INTERP_RATE_B impacts the zero curve.

| • | If INT_CURVE_INTERP_RATE_B = Y (Default value), curves are interpolated on the zero rates. |

| • | If INT_CURVE_INTERP_RATE_B = N, curves are interpolated on the discount factors. |

However, you can override the interpolation space at the curve level using the "Interp As" field in the curve definition window:

| • | Default - Uses the value of environment property INT_CURVE_INTERP_RATE_B. |

| • | Rate - Interpolates the curve on the zero rates, regardless of environment property INT_CURVE_INTERP_RATE_B. |

| • | DiscountFactor - Interpolates the curves on the discount factors, regardless of environment property INT_CURVE_INTERP_RATE_B. |

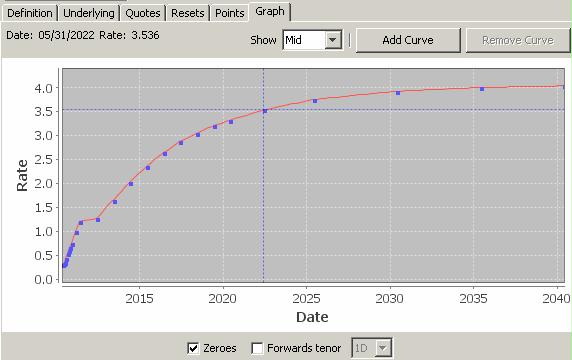

Graph Panel

Once a curve is generated, you can select the Graph panel to view the curve in graphical form.

2. Generating an FX Derived Zero Curve

|

FX Derived Zero Curve Quick Reference Curve Underlying Instruments The curve automatically includes the spot underlying instrument. Optional — You can use Swap underlying instruments in building the curve. From the Calypso Navigator, navigate to Configuration > Market Data > Curve Underlyings, or in the curve application’s Underlying panel, click New/Edit Underlying. Curve Generation 1. Click New to start a new curve. 2. The Current checkbox is selected by default, meaning that when you save the curve, the system timestamps the curve with the current date and time. Clear the Current checkbox to enter a back-dated curve. You can modify the date and time fields. 3. Select the following to define the curve: solving for currency, reference index, and tenor, holiday calendars, interpolator, generation algorithm “FXDerived”, curve type CurveZeroFXDerived should be selected, Pricing Env, FX curve, and zero curve in the other currency. 4. Underlyings Panel — by default, the curve adds the spot underlying instrument for the currency pair defined in the FX curve. Also, you can select swap underlying instruments. 5. Quotes Panel — enter quotes manually, use quotes from the quote set, or use real-time quotes. 6. Points Panel — click Generate to generate the points. 7. Click Save, enter a name for the curve, and click OK. Pricer Configuration An FX Derived Zero Curve can be associated with a pricing environment under the Discount Curves or Forecast Curves panel in the pricer configuration. Ⓘ [NOTE: The selected FX Curve and curve in the other currency must also be registered with the selected pricing environment] |

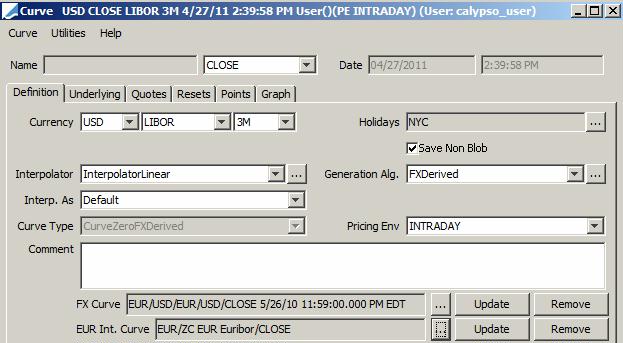

2.1 Definition Panel

Click New to start a new curve.

Select the following to define the curve: solving for currency, reference index, and tenor, holiday calendars, interpolator, generation algorithm “FXDerived”, curve type CurveZeroFXDerived should be selected, Pricing Env, FX curve, and zero curve in the other currency.

| » | Select the solving for currency, reference index, and tenor. |

| » | Click ... to select the FX curve. |

| » | Click ... to select the zero curve in the other currency. |

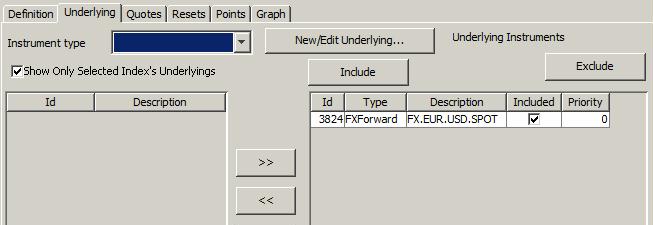

3. Underlying Panel

Click the Underlying tab.

| » | By default, the curve adds the spot underlying instrument for the currency pair defined in the FX curve. |

| » | Select other instruments as needed. |

The panel below displays existing underlying instruments in the solving for currency. You can select these instruments to extend the curve beyond the points in the FX curve. This is optional.

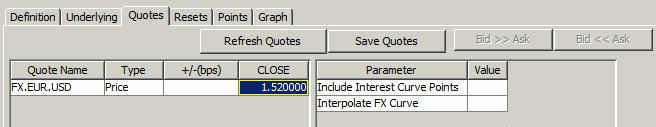

3.1 Quotes Panel

Click the Quotes tab. You can enter quotes and Save Quotes to the quote set associated with the selected pricing environment.

The quotes may be automatically populated if you are running a real-time feed, or they may be populated from the quote set associated with the selected pricing environment.

You can set “Include Interest Curve Points” to true to include the interest rate points; otherwise, the points come only from the FX curve underlyings.

You can set "Interpolate FX Curve" to true to calculate the discount factor from the FX curve and other currency yield curve, instead of being interpolated between tenors.

Resets Panel

You can choose Curve > Show Reset Tab to display / hide the Resets panel.

The Resets panel shows manual resets requirements for underlying instruments (cash quotes associated with a given underlying instrument). This applies when "Manual First Reset" is checked in the definition of the underlying instrument.

Ⓘ [NOTE: If you hide the Resets panel, the required cash quotes are displayed in the Underlying panel, along with the quotes of the underlying instruments]

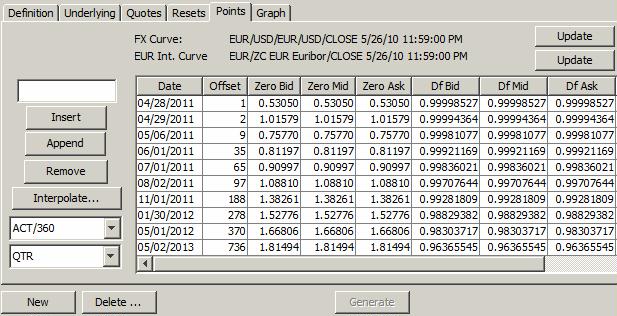

3.2 Points Panel

Click the Points tab.

| » | Select a daycount convention. From the Calypso Navigator, navigate to Help > Day-Count Conventions for descriptions. |

| » | Click Generate to generate the points. |

3.3 Save Curve

Click Save in the bottom of the curve window. Enter a name for the curve, and click OK.

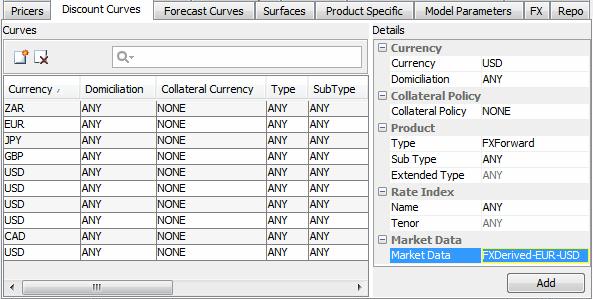

4. Pricer Configuration

You can assign the FX Derived Zero Curve as a discount curve in the pricer configuration.

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration, and click Load to select a pricer configuration.

Click the Discount Curves tab.

| » | Select a currency, a product or ANY, a subtype or ANY, an index or ANY, a tenor or ANY. |

| » | Click ... to select a curve. |

If the curve you have created is not available for selection, make sure that CurveZeroFXDerived is set in domain "curveZeroType".

| » | Click Add to add the curve to the pricer configuration. |

| » | Click Save to save the pricer configuration. |