Repo Curve

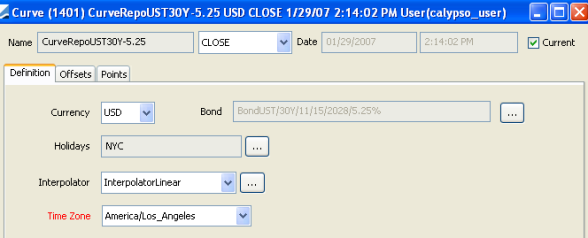

From the Calypso Navigator, navigate to Market Data > Interest Rate Curves > Repo Curve (menu action marketdata.CurveRepoWindow).

Repo curves are used for computing the price of bond trades that settle after the valuation date. Repo curves are also used to compute the forward price of the cheapest-to-deliver bonds, when trading bond futures.

A repo curve can be a zero curve (see Market Data > Interest Rate Curves > Zero Curve) or a repo curve designed as basis points spread over the discount curve.

This topic describes creating the repo curve using the Repo Curve window.

Ⓘ [NOTE: If you want to compute the price of bond trades using today’s quotes, regardless of their settlement date, set the pricing parameter IGNORE_FORWARD_PRICE to true]

|

Repo Curve Quick Reference Configuration Requirements

Curve Generation 1. Click New to start a new curve. 2. The Current checkbox is selected by default, meaning that when you save the curve, the system timestamps the curve with the current date and time. Clear the Current checkbox to enter a back-dated curve. You can modify the date and time fields. 3. Definition Panel — Select the following to define the curve: currency, bond, holiday calendar, interpolator, Pricing Env. 4. Offsets Panel — Select the tenors or dates. 5. Points Panel — Click Generate to generate the points. Enter the spreads. 6. Click Save, enter a name for the curve, and click OK. Pricer Configuration You can associate a repo curve with a pricing environment under the Repo panel of the pricer configuration for the curve type CurveRepo. From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration. |

1. Creating a Repo Curve

Click New to start a new curve.

1.1 Definition Panel

Select the following to define the curve: currency, bond, holiday calendar, interpolator, Pricing Env.

| » | Click ... to select the underlying bond. |

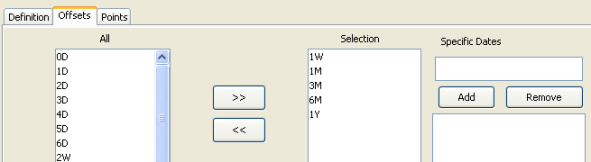

1.2 Offsets Panel

Click the Offsets tab. Select the tenors or dates.

| » | Select the offsets in the left panel, and click >> to add them to the Selection panel. |

| » | Specific Tenors — You can add specific tenors to the list. Enter the number, select the type of tenor, and click Add Specific Tenor. |

| » | Specific Dates — Alternatively, you can enter specific dates for the offsets and click Add to list them in the panel below. |

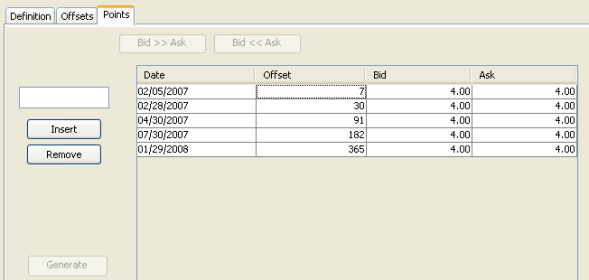

1.3 Points Panel

Click the Points tab.

Click Generate to generate the curve points, and enter the spreads in basis points.

1.4 Save Curve

Click Save in the bottom of the curve window. Enter a name for the curve, and click OK.

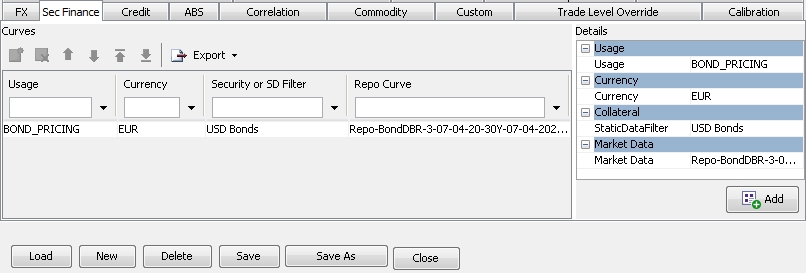

2. Pricer Configuration

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration.

Click Load, select the pricer configuration name, and click OK.

Click the Sec Finance tab.

| » | Click |

| » | Select values in the Details area. |

| – | Select the BOND_PRICING usage for pricing bonds with repo curves. |

CLOSING_TRADE is not used.

COLLATERAL_GC, COLLATERAL_SP, SL_COLLATERAL_GC and SL_COLLATERAL_SP are only used for the repo / sec lending curve allocation process.

Please refer to Calypso Repo Trading / Calypso Security Lending Trading documentation for details on the repo / sec lending curve allocation process.

Please refer to Calypso Repo Trading / Calypso Security Lending Trading documentation for details on the repo / sec lending curve allocation process.

SWEEP is only used for the security finance sweeping process.

Please refer to Calypso Repo Trading / Calypso Security Lending Trading documentation for details on the security finance sweeping process.

Please refer to Calypso Repo Trading / Calypso Security Lending Trading documentation for details on the security finance sweeping process.

| – | Select a currency. |

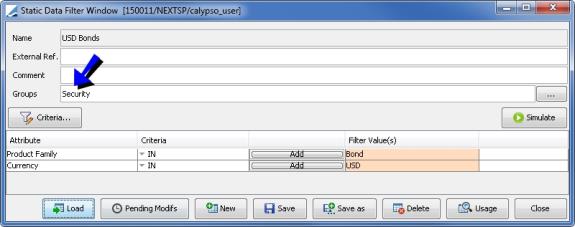

| – | Select a static data filter. Only static data filters with the "Security" group are available for selection. |

| – | Select a repo curve. |

| » | Click Add to add the curve to the list. |

| » | Use |

| » | Click Save to save the pricer configuration. |