Inflation Curve

From the Calypso Navigator, navigate to Market Data > Interest Rate Curves > Inflation Curve (menu action marketdata.CurveInflationWindow).

You can create a derived inflation curve from underlying instruments.

| • | Inflation index example |

| • | Inflation curve from underlying instruments |

| • | Pricer configuration |

1. Inflation Index Example

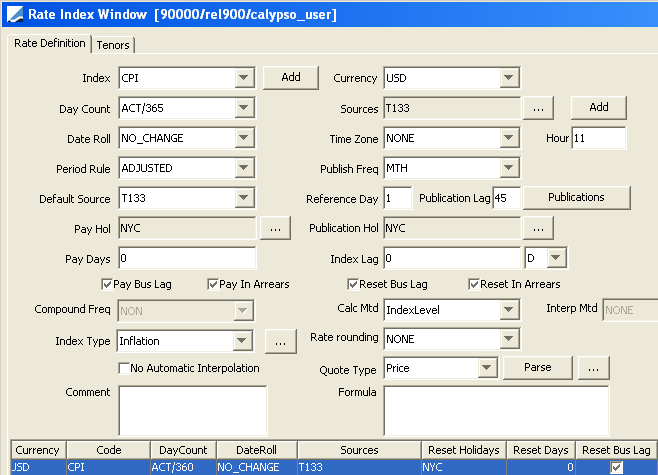

From the Calypso Navigator, navigate to Configuration > Interest Rates > Rate Index Definitions.

The Rate Definition panel is selected by default.

| » | Select the rate index from the Index field, and enter its details. Select Inflation from the Index Type field. Fields specific to inflation indices are described below. |

| » | You can click Add to add a rate index. |

Fields Details

|

Rate Index |

Attributes |

||||||

|---|---|---|---|---|---|---|---|

|

Index Type |

Select Inflation. |

||||||

|

Calc Mtd |

Select the calculation method:

|

||||||

|

Interp Mtd |

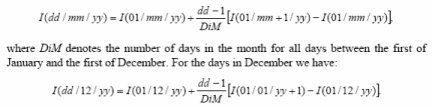

Only appears for the Interpolated calculation method. Select Weighted or NONE. Index levels are interpolated using the following formula:

For example, to calculate an interpolated May 12th CPI index level, which has a 3 month lag:

|

||||||

|

No Automatic Interpolation |

This checkbox is not related to the interpolation method of Inflation rates. When checked, there is no automatic interpolation applied to stub periods, otherwise stub periods are automatically interpolated. |

||||||

|

Publish Freq |

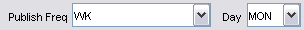

Select the frequency at which the rate is published. For the weekly frequency, you can select the day of the week the rate is published from the Day field.

When Inflation is selected for Index Type, the quarterly frequency also allows you to select the month of the year.

For Inflation indices, select a publication frequency, enter a reference day and a publication lag.

The reference day is the day of the month when the inflation is effective, and the publication lag is the time lag between the effective date of an inflation level and its actual publication. You can click Publications and generate the dates to make any modification if needed. Otherwise the reference day and publication lag are used to determine the publication dates.

|

||||||

|

Index Lag |

Enter the index lag, usually 3M. |

| » | Click Attributes and set the following attribute. You can click ... to add the attribute if it does not exist. |

Note that the attributes and their values are case sensitive.

IndexCalculator = InflationIndexKerkhof

| » | Click Save to save your changes. |

| » | Then select the Tenors panel to define tenors for the rate index, and click Save to save your changes. |

You can set the tenor to “0D”.

2. Inflation Curve from Underlying Instruments

|

Inflation Curve from Underlying Instruments Quick Reference Configuration Requirements

Curve Underlying Instruments You can use zero coupon swaps and cash instruments for building the inflation curve with the InflationIndexKerkhof generator. You can use basis swaps for building the inflation curve with the InflationRealRate generator. Curve Generation 1. Click New to start a new curve. 2. Select the quote instance to use in the curve generation (CLOSE, LAST, or OPEN). If you select the LAST instance, you can use real-time quotes in the curve. Select a real-time source and the RT checkbox in the bottom of the curve application. 3. The Current checkbox is selected by default, meaning that when you save the curve, the system timestamps the curve with the current date and time. Clear the Current checkbox to enter a back-dated curve. You can modify the date and time fields. 4. Definition Panel — Select the following to define the curve: currency, index, holiday calendars, interpolator=InterpolatorFlatForward, generation algorithm, “Generate from Instruments” should be checked, Pricing Env. 5. Underlyings Panel — Select the underlying instruments. 6. Quotes Panel — Enter quotes manually, use quotes from the quote set, or use real-time quotes. 7. Points Panel — Click Generate to generate the points. 8. Click Save, enter a name for the curve, and click OK. Pricer Configuration Assign the inflation swap curve as a forecast curve. From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration. |

2.1 Underlying Instruments

You can set up underlying instruments before creating the curve, or while you are creating the curve.

From the Calypso Navigator, navigate to Configuration > Market Data > Curve Underlyings, or in the curve application’s Underlying panel, click New/Edit Underlying. Set up cash instruments, zero coupon swaps, or inflation spreads.

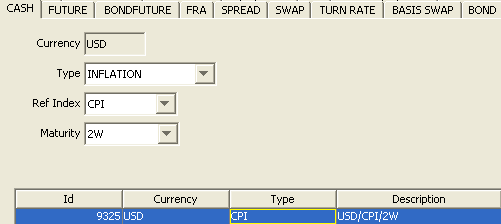

Sample Cash instrument

The quote of a cash instrument is an index level. Using cash instruments in building the curve corresponds to setting up custom index levels.

| » | Make sure to select the INFLATION type. |

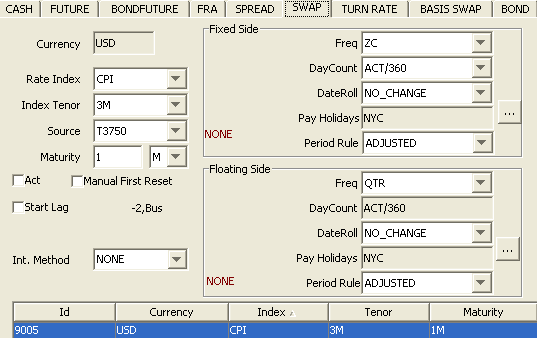

Sample ZC Swap

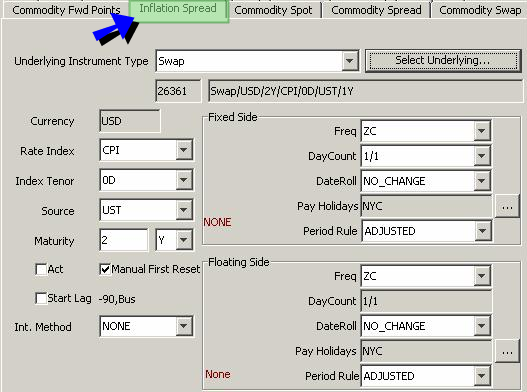

Sample Inflation Spread (Instrument Spread)

This underlying instrument allows selecting a swap, and entering a spread over the swap’s quote.

| » | Click Select Underlying to select a swap (defined as an underlying instrument). |

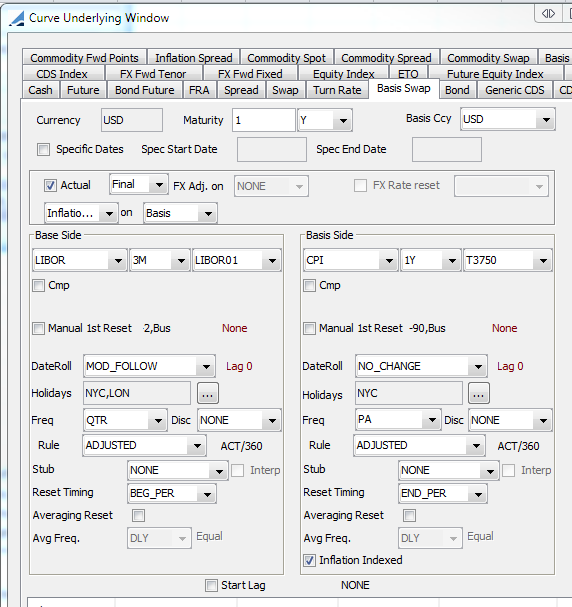

Sample Basis Swap for InflationRealRate Generator

2.2 Definition Panel

| » | The base date is the reference month of the closest publication date before the curve date. |

You need an inflation quote on that date in the quote set.

[NOTE: Inflation quote values are identified as “Inflation.<currency>.<rate index>” for example, “Inflation.USD.CPI”]

| » | Select the generation algorithm: InflationIndexKerkhof for inflation swaps, or InflationRealRate for Real Yield Swaps. |

| » | Select the interpolator: InterpolatorFlatForward. |

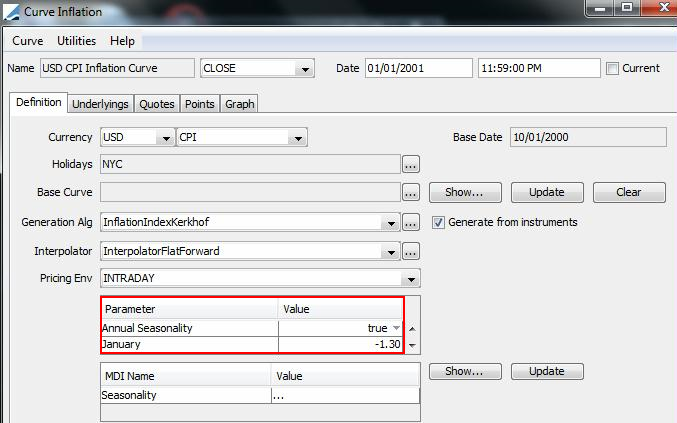

InflationIndexKerkhof

It allows generating inflation curves using the Kerkhof methodology. It applies additive seasonal adjustments to the index levels.

If you set the parameter "Annual Seasonality" to true, you can manually enter the seasonal adjustments for each month.

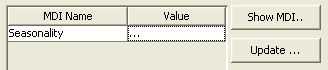

If you set the parameter "Annual Seasonality" to false, you can select a seasonality curve.

Ⓘ [NOTE: Seasonality adjustments are not currently supported for quarterly inflation indices.]

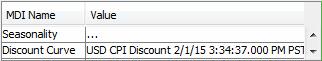

It allows generating inflation curves from nominal rates and real rates using basis swaps as underlying instruments.

You need to select a discount curve and a forecast curve to price the base leg of the basis swaps.

You can apply additive seasonal adjustments as for the InflationIndexKerkhof generator.

2.3 Underlyings Panel

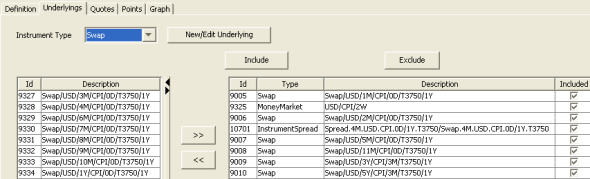

Click the Underlying tab. You can select Swap to add ZC swaps, MoneyMarket to add Cash underlying instruments, and InstrumentSpread to add spreads over swaps.

| » | Select the instrument type, and the left-hand side panel displays the list of available instruments. The panel is blank if you have not set up any instruments. Click New/Edit Underlying to create new instruments. |

| » | Select instruments and click >> to add them to the instrument list in the right-hand side panel. |

2.4 Quotes Panel

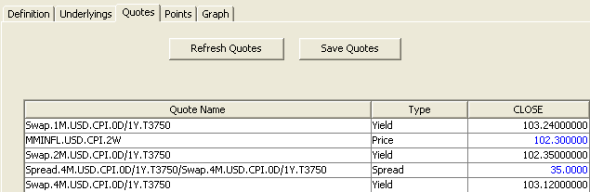

Click the Quotes tab. You can enter quotes and save quotes to the quote set associated with the selected pricing environment.

The quotes may be automatically populated if you are running a real-time feed, or they may be populated from the quote set associated with the selected pricing environment (click Refresh Quotes to get the latest quotes).

| » | Cash quotes are index levels, swap quotes are interest rates, and instrument spread quotes are spreads over swap quotes. |

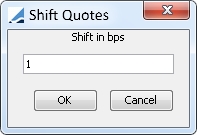

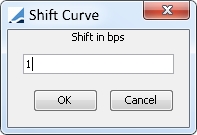

| » | To shift quotes by a specified number of basis points, point to Utilities > Shift Quotes in the Curve Inflation window menu. The Shift Quotes window opens. |

Enter the number of basis points and click OK. Quotes on the Quotes tab are shifted by the specified number of basis points.

Shifting by 1 bp will match the value displayed for any given inflation trade as DELTA_01_INFLATION.

2.5 Points Panel

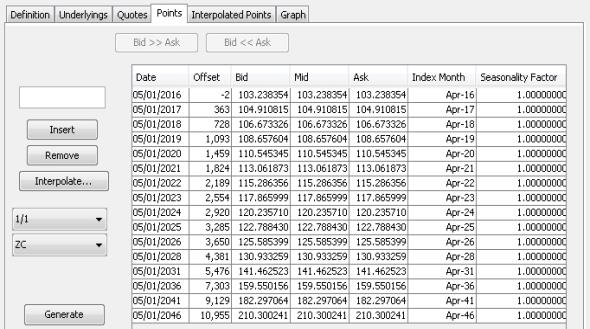

Click the Points tab. Select a daycount convention, a term, and click Generate to create the points grid.

| » | You can manually add dates to the points graph by entering the date in the text field and clicking Insert. Highlight a date and click Remove to remove it from the points graph. |

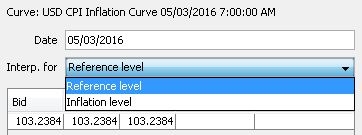

| » | You can interpolate points for a specific date based on Reference Level or Inflation level. Click Interpolate to open the Interpolate window. |

Enter the date you want to interpolate and select either Reference Level or Inflation Level from the "Interp. for" list. Results are displayed below.

| – | Reference Level:Uses the month of inflation (reference date) plus the Index Lag (from the Rate Index Window) to interpolate. Results correspond to those of the same date on the Interpolated Points tab. |

| – | Inflation Level: Uses the actual month of inflation to interpolate. |

| » | To shift points by a specified number of basis points, point to Utilities > Shift Curve in the Curve Inflation window menu. The Shift Curve window opens. |

Enter the number of basis points and click OK. All output forward CPI values on the Points tab and Interpolated Points tab are shifted by the specified number of basis points.

Shifting by 1 bp will match the value displayed for any given inflation trade as PV01_INFLATION.

About Points

| • | The first point corresponds to the index level on the Base Date. |

| • | For cash points, the index level is the cash quote – Cash quotes are not adjusted with seasonality, they represent custom index levels. |

| • | For swap points, the index level is the base index level adjusted by the swap rate over the period, and adjusted by seasonality if any. |

| • | You can set the index level precision using Utilities > Set precision. You will be prompted to enter a number of decimal places. Default is 6. (This also drives decimal precision in the Interpolate window - opened with the Interpolate button - and on the Interpolated Points tab.) |

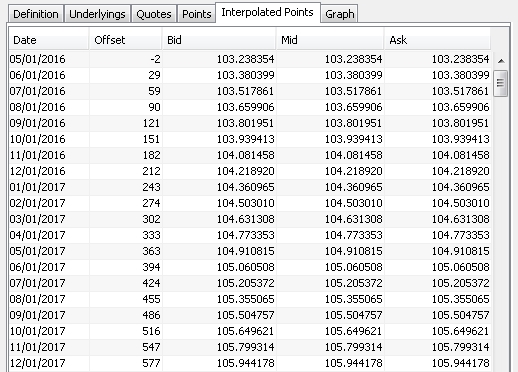

2.6 Interpolated Points Panel

In contrast to the Points tab - which shows points generated from the actual curve underlyings - the Interpolated Points tab provides a quick view of interpolated points that fall between those generated by the underlyings. Interpolated points are based on the Publication Frequency of the Inflation Rate Index. Interpolated points are available once the points grid has been generated from the Points tab.

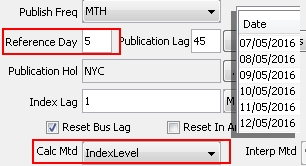

Fixing the Day in Anchor Dates

Setting the day for the "anchor" dates in the Date column is done in either of two ways in the Rate Index Window. See Inflation Index Example above for details on settings mentioned here.

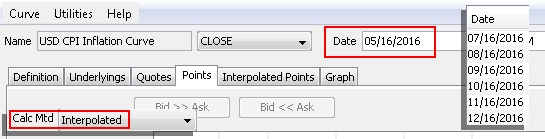

1. When the "Calc Mtd" setting is set to IndexLevel, the Points tab uses the "Reference Day" setting to fix the day.

2. When the "Calc Mtd" setting is set to Interpolated, the Points tab uses the day of the Curve Window Date to fix the day.

Ⓘ NOTE: When "Calc Mtd" is set to Interpolated, it also fixes the day for dates on the Points tab. When "Calc Mtd" is set to IndexLevel, on the other hand, the day is fixed only in dates on the Interpolated Points tab.

Fixing the Interval for Anchor Dates

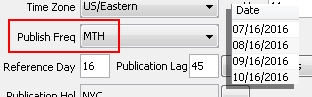

To set the interval between interpolated points, make settings for "Publish Freq" in the Rate Index Window. The recommended setting is "MTH." However, "QTR" is also acceptable.

Sample of interpolated points at monthly intervals

2.7 Save Curve

Click Save in the bottom of the curve window. Enter a name for the curve, and click OK.

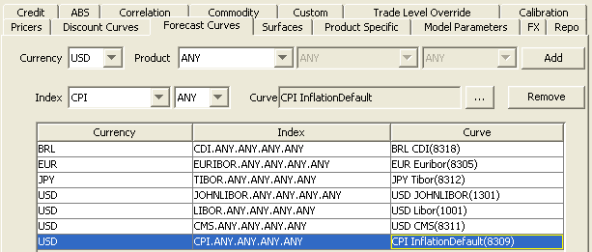

3. Pricer Configuration

Inflation curves can be used for swaps and bonds.

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration.

Load a pricer configuration and select the Forecast panel.

| » | Select the currency, product or ANY, extended type or ANY, subtype or ANY. |

| » | Select the index, tenor or ANY. |

| » | Click ... to select an inflation curve. |

| » | Then click Add. |

| » | Click Save to save the changes. |