Dividend Curve

Dividends are defined as any payment a security will make to its owner. A security’s dividend payment will be modeled assuming a discrete or continuous payment model. Stocks typically pay their discrete dividends on a quarterly basis, while the dividends on indices tend to be paid more uniformly.

Dividend Curves show the Forward Value of the Underlying Asset to the Ex-Dividend date. Ownership is determined by Ex-Dividend date, not by the payment date.

Regardless of dividend payout method, the projected dividend stream can be represented as series of time and continuously compounded dividend yield pairs. You can model a security using either discrete dividends or continuous dividend yields.

| • | For the Yield dividend type, you can generate the yields from a zero curve and the equity spot price, or from underlying instruments. |

| • | For the Discrete dividend type, you can generate projected dividends using existing dividends and the projected rate of growth. |

The Dividend Curve represents forward prices for equities. Forward prices are what can be traded now for delivery at a future date.

From the Calypso Navigator, navigate to Market Data > Equity Curves > Dividend Curve (menu action marketdata.CurveDividendWindow) to create a dividend curve.

1. Yield Dividend Curve from Offsets

|

Yield Dividend Curve from Offsets Quick Reference Configuration Requirements

Curve Generation 1. Click New to start a new curve. 2. Select the quote instance to use in the curve generation (CLOSE, LAST, or OPEN). 3. The Current checkbox is selected by default, meaning that when you save the curve, the system timestamps the curve with the current date and time. You can clear the Current checkbox to enter a back-dated curve, and modify the date and time fields. 4. Definition Panel — Select the following to define the curve: equity product, “Yield” dividend type, checkbox Derived” unchecked, interpolator, currency, holiday calendar, Pricing Env. 5. Offset Panel — Select tenors. 6. Points Panel — Enter the spot price of the equity, select the zero curve, borrow curve, and click Generate to generate the curve points. 7. Click Save, enter a name for the curve, and click OK. Pricer Configuration Assign the dividend curve in the Product Specific panel for the Dividend usage. Choose Market Data > Pricing Environment > Pricer Configuration. |

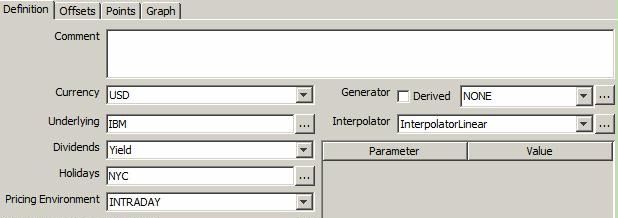

1.1 Definition Panel

Click New to start a new curve.

Select the following to define the curve: underlying, “Yield” dividend type, interpolator, currency, holiday calendar, Pricing Environment.

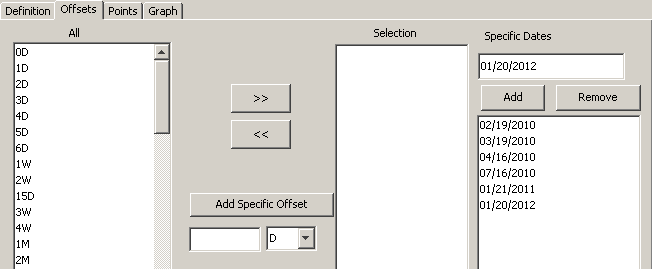

1.2 Offsets Panel

On the Offsets tab, select tenors or specific dates.

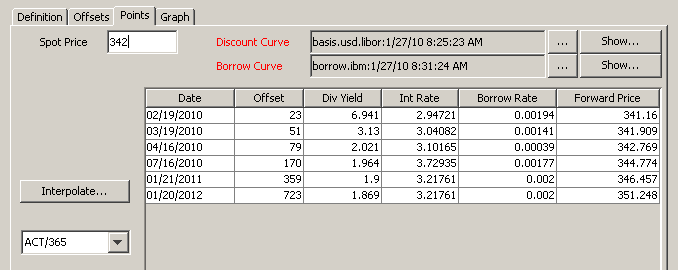

1.3 Points Panel

Select the Points panel.

| » | Enter the spot price, click ... next to the Discount Curve field to select a discount curve, and click ... next to the Borrow Curve field to select a borrow curve. Then click Generate. |

| – | Spot Price of the underlying equity - If you select the CLOSE curve instance, then the curve uses the CLOSE quote from the quote set associated with the pricing environment. You can modify the price. |

| – | The system uses the Borrow Rate from the borrow curve to calculate the Forward Price. |

1.4 Save Curve

Click Save in the bottom of the curve window, enter the name for the curve and click OK.

2. Derived Yield Dividend Curve

|

Derived Yield Dividend Curve Quick Reference Configuration Requirements

Ⓘ [NOTE: Only European ETO contracts are supported] Curve Generation 1. Click New to start a new curve. 2. Select the quote instance to use in the curve generation (CLOSE, LAST, or OPEN). 3. The Current checkbox is selected by default, meaning that when you save the curve, the system timestamps the curve with the current date and time. You can clear the Current checkbox to enter a back-dated curve, and modify the date and time fields. 4. Definition Panel — Select the following to define the curve: equity product, “Yield” dividend type, checkbox “Derived” checked, interpolator, currency, holiday calendar, Pricing Env. 5. Underlyings Panel — Select underlying ETO instruments. 6. Quotes Panel — Enter quotes for the underlying instruments. 6. Points Panel — Select the daycount convention, and click Generate to generate the curve points. 7. Click Save, enter a name for the curve, and click OK. Pricer Configuration Assign the dividend curve in the Product Specific panel for the Dividend usage. Choose Market Data > Pricing Environment > Pricer Configuration. |

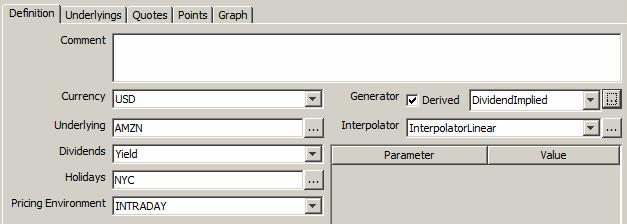

2.1 Definition Panel

Click New to start a new curve.

Select the following to define the curve: underlying, “Yield” dividend type, "Derived" checked, generator "DividendImplied", interpolator, currency, holiday calendar, Pricing Environment.

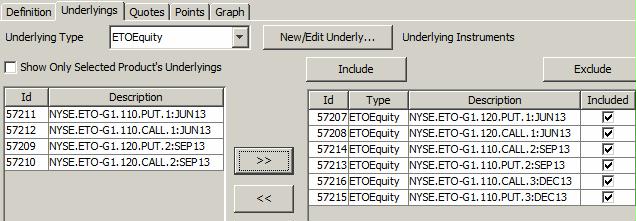

2.2 Underlyings Panel

Click the Underlying tab, and select the underlying instruments.

You can select ETO Equity and ETO Equity Index instruments.

Ⓘ [NOTE: Only European ETO contracts are supported]

| » | Select an instrument type to display the list of available instruments. If none appear, you can click New/Edit Underlying to create new instruments. |

| » | Select instruments from the list of available instruments on the left-hand side, and click >> to add them to the list of selected instruments on the right-hand side. |

You can exclude instruments from the curve generation if they are no longer needed.

You can set a priority when multiple instruments have the same maturity date. The highest priority is 0.

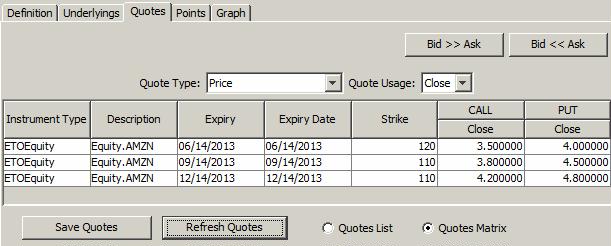

2.3 Quotes Panel

Click the Quotes tab.

| » | You can click Refresh Quotes to load the quotes from the pricing environment selected in the Definition panel. If your market data server is running, quotes will be updated in real-time. |

| » | You can also enter the quotes manually, and save them to the pricing environment. |

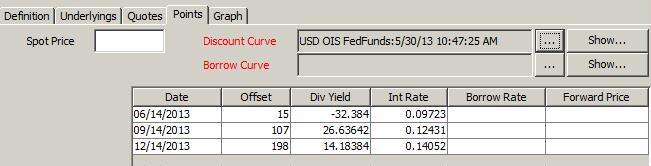

2.4 Points Panel

Click the Points tab.

| » | Enter the spot price, click ... next to the Discount Curve field to select a discount curve, and click ... next to the Borrow Curve field to select a borrow curve. Then click Generate. |

| – | Spot Price of the underlying equity - If you select the CLOSE curve instance, then the curve uses the CLOSE quote from the quote set associated with the pricing environment. You can modify the price. |

| – | The system uses the Borrow Rate from the borrow curve to calculate the Forward Price. |

Implied dividends are calibrated from option prices (prices of exchange traded puts & calls using the put-call-parity). The output from this curve has fixed future dates on the horizontal axis and implied dividends derived from Put/Call Prices.

2.5 Save Curve

Click Save in the bottom of the curve window, enter the name for the curve and click OK.

3. Discrete Dividend Curve

|

Discrete Dividend Curve Quick Reference Configuration Requirements

Curve Generation 1. Click New to start a new curve. 2. Select the quote instance to use in the curve generation (CLOSE, LAST, or OPEN). 3. The Current checkbox is selected by default, meaning that when you save the curve, the system timestamps the curve with the current date and time. You can clear the Current checkbox to enter a back-dated curve, and modify the date and time fields. 4. Definition Panel — Select the following to define the curve: underlying equity, “Discrete” dividend type, interpolator, currency, holiday calendar, Pricing Env. 5. Dividends Panel — Select a frequency, maturity, and enter a growth rate. Click Generate. 6. Points Panel — Select the daycount convention. Click Generate to generate the curve points. 7. Click Save, enter a name for the curve, and click OK. Pricer Configuration Assign the dividend curve in the Product Specific panel for the Dividend usage. From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration. |

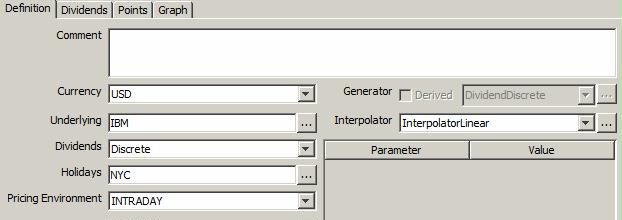

3.1 Definition Panel

Click New to start a new curve.

Select the following to define the curve: equity product, “Discrete” dividend type, interpolator, currency, holiday calendar.

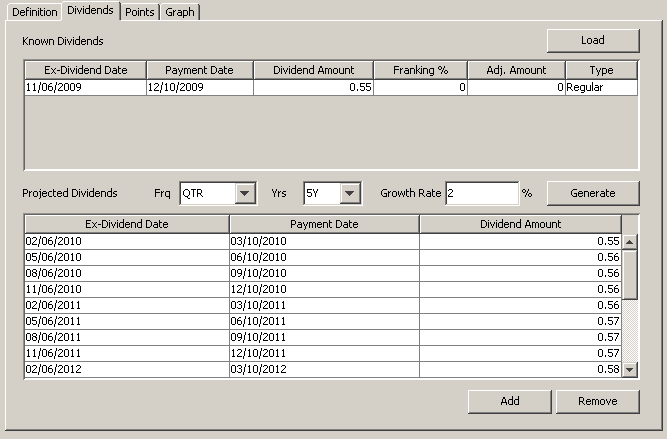

3.2 Dividends Panel

Select the Dividends panel.

The known dividends are retrieved from the selected equity product.

The frequency used to generate the projected dividends is initialized with the "Dividend Frequency" on the equity product, if any.

To generate the projected dividends:

| » | Select a frequency, maturity, and enter a growth rate. |

| » | Click Generate. |

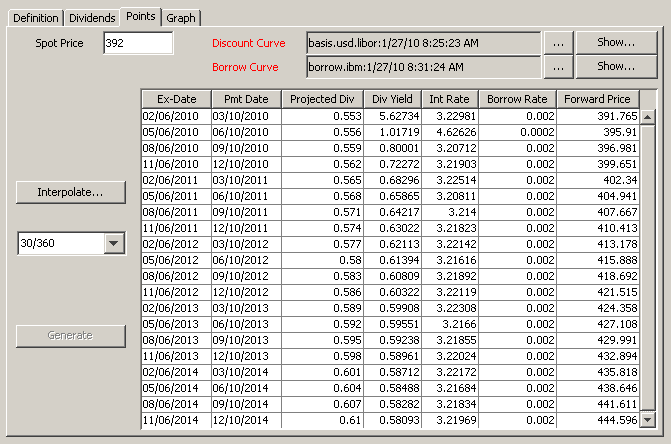

3.3 Points Panel

Select the Points panel. This panel displays:

| • | Spot Price of the underlying equity. |

For example, if you select the CLOSE curve instance, then the curve uses the CLOSE quote from the quote set associated with the pricing environment.

You can modify the price.

| • | Discount Curve from the pricing environment. |

- Click Show to view or edit the discount curve.

- Click ... to select a different discount curve.

| • | The Borrow Curve from the pricing environment. Calypso will use the Borrow Rate from the borrow curve in calculating the Forward Price. |

- Click Show to view or edit the borrow curve.

- Click ... to select a different borrow curve.

| » | Select the day-count convention. |

| » | Click Generate to generate the curve points. |

3.4 Save Curve

Click Save in the bottom of the curve window, enter the name for the curve and click OK.

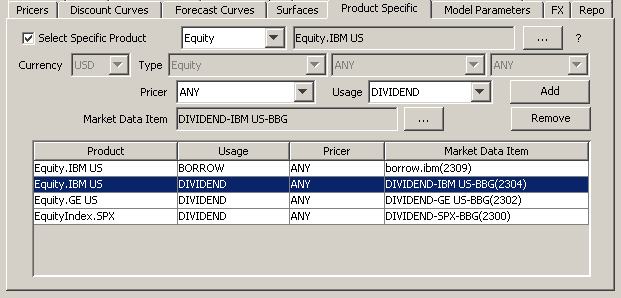

4. Pricer Configuration

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration.

Click Load, and select a pricer configuration.

Click the Product Specific tab.

| » | Select the product and click ... to select the equity. |

| » | Select the pricer or ANY, and usage (DIVIDEND). |

| » | Click ... to select the dividend curve. |

| » | Select the curve in the Selection window and click Load to display the curve name in the pricer configuration. |

| » | Click Add to add the curve to the list. |

| » | Click Save to save the pricer configuration. |