Borrow Curve

Equity Derivatives pricing requires the incorporation of a funding rate into the calculation of a “Forward” value of an underlying. The funding rate will be based on an institution’s cost of “borrowing” the security.

The borrow curve adds either a spread to the spread curve, or calculates a borrow rate. In the case of a spread, the spread curve can either be the prevailing discount curve, or in some cases other curves. For example, in the U.S. the borrow curve would be based off of FEDFUNDS.

The logic is that the pricer first looks for a borrow curve based on the underlying product, then based on the currency (general borrow curve), and then if the borrow curve is not found, use the discount curve (meaning that the spread is 0).

In the trade worksheet, you can overwrite the borrow spread used in pricing by entering a spread in the BORROW_SPREAD transient pricing parameter.

The borrow curve functionality is available in equity derivatives options pricing.

From the Calypso Navigator, navigate to Market Data > Equity Curves > Borrow Curve (menu action marketdata.CurveBorrowWindow).

|

Borrow Curve Quick Reference Configuration Requirements

Curve Generation 1. Click New to start a new curve. 2. Select the quote instance to use in the curve generation (CLOSE, LAST, or OPEN). 3. The Current checkbox is selected by default, meaning that when you save the curve, the system timestamps the curve with the current date and time. Clear the Current checkbox to enter a back-dated curve. You can modify the date and time fields. 4. Definition Panel — Select the following to define the curve: currency, underlying equity or equity index, Spread or Absolute, interpolator, holiday calendar. 5. Offsets Panel — Select the tenors. 6. Points Panel — Click Generate to generate the curve points. Enter the spreads or borrow rates. 7. Click Save, enter a name for the curve, and click OK. Pricer Configuration A borrow curve is associated with a pricing environment under the Product Specific panel of the pricer configuration with the BORROW usage. |

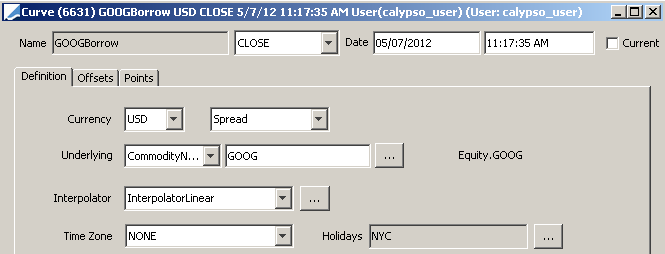

1. Curve Definition Panel

Click New to start a new curve.

Select the following to define the curve: currency, underlying equity (or do not select an underlying to create a general borrow curve), borrow curve type (Spread to enter a spread in basis points over the discount curve, or Absolute to enter the borrow rates in percentage), interpolator, holiday calendar.

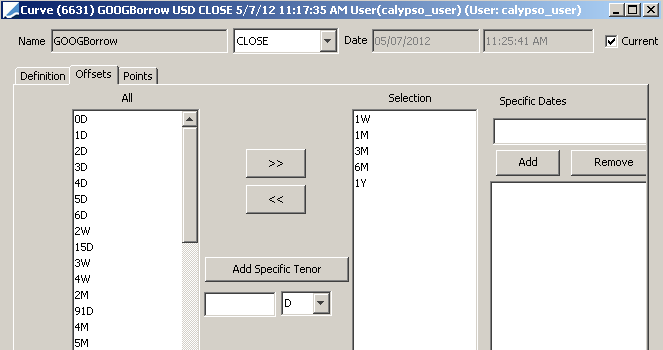

2. Curve Offsets Panel

Click the Offsets tab.

Select the offsets in the left panel, and click >> to add them to the Selection panel.

| » | Specific Tenors — you can add specific tenors to the list. Enter the number, select the type of tenor, and click Add Specific Tenor. |

| » | Specific Dates — alternatively, you can enter specific dates for the offsets and click Add to list them in the panel below. |

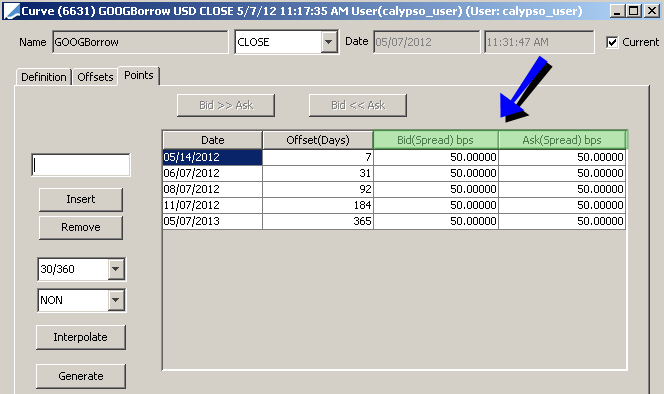

3. Curve Points Panel

Click the Points tab. Click Generate to create the curve points. Enter the spreads or rates.

4. Save Curve

Click Save in the bottom of the curve window. Enter a name for the curve, and click OK.

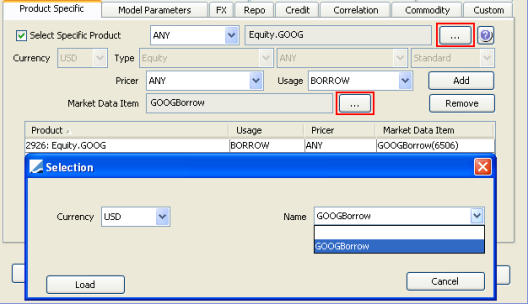

5. Pricer Configuration

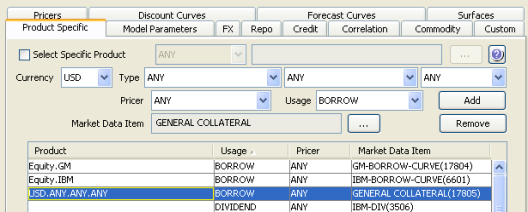

5.1 Assign Specific Product Borrow Curves

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration.

| » | Click Load, select the pricer configuration name, and click OK. |

| » | Click the Product Specific tab. |

| » | Check the “Select Specific Product” checkbox. |

| » | Click ... to select the equity product. |

| » | Set the usage to BORROW. |

| » | Click ... to select the borrow curve. |

| » | Click Add to add the curve to the list. |

| » | Click Save to save the pricer configuration. |

5.2 Assign General Borrow Curves

A general borrow curve that does not have an underlying equity can be assigned to a specific currency.

Click Load, and select the pricer configuration.

Click the Product Specific tab.

| » | Select the currency. |

| » | Set the usage to BORROW. |

| » | Click ... to select the borrow curve. |

| » | Click Add to add the curve to the list. |

| » | Click Save to save the pricer configuration. |