Recovery Curve

From the Calypso Navigator, navigate to Market Data > Credit Curves > Recovery Curve (menu action marketdata.CurveRecoveryWindow).

A recovery curve is used to project recovery rates at given dates for Credit Derivatives and ABS Bonds.

If the pricing environment does not contain a recovery curve, the system will use the recovery rate specified on the probability curve to price CRD trades.

|

Recovery Curve Quick Reference Configuration Requirements Issuer Definition – From the Calypso Navigator, navigate to Configuration > Legal Data > Entities. Curve Generation 1. Click New to start a new curve. 2. Select the quote instance to use in the curve generation (CLOSE, LAST, or OPEN). 3. The Current checkbox is selected by default, meaning that when you save the curve, the system timestamps the curve with the current date and time. Clear the Current checkbox to enter a back-dated curve. You can modify the date and time fields. 4. Definition Panel — Select the following to define the curve: currency, issuer/ticker or basket, interpolator, holiday calendar, Pricing Env. 5. Offsets Panel — Select tenors. 6. Points Panel — Click Generate to generate the points, and enter the recovery rates. 7. Click Save, enter a name for the curve, and click OK. Pricer Configuration Recovery curves are associated with a pricing environment under the Credit panel of the pricer configuration for the REC usage to price Credit Derivatives, and under the ABS panel of the pricer configuration to price ABS Bonds. From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration. |

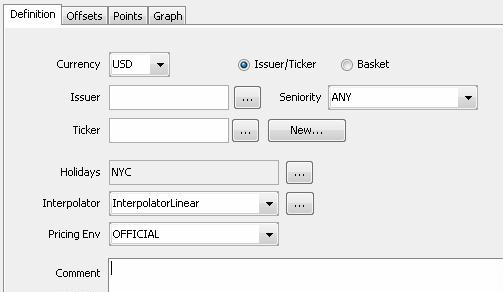

1. Definition Panel

Click New to start a new curve.

Select the following to define the curve: currency, issuer/ticker or basket, interpolator, and holiday calendar.

| » | If you click Issuer/Ticker, select an issuer and a seniority, or select a ticker. You can click New to create a new ticker. A ticker is a combination of currency, issuer, seniority and reference obligation. |

| » | If you click Basket, select a reference entity basket. |

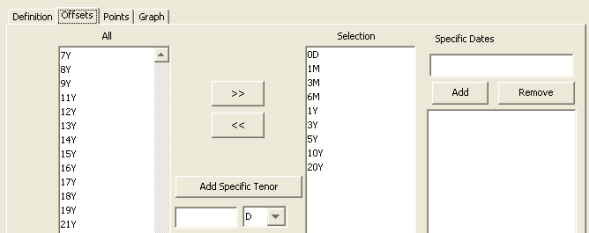

2. Offset Panel

Select the Offsets panel to select tenors.

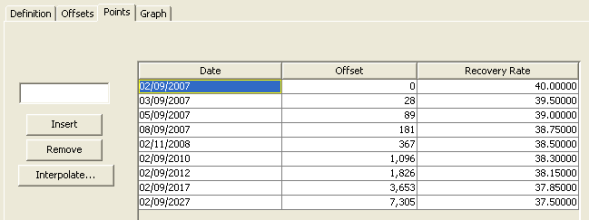

3. Points Panel

Select the Points panel and click Generate to generate the curve points.

| » | Enter recovery rates for each point. |

4. Save Curve

Click Save in the bottom of the curve window. Enter a name for the curve, and click OK.

5. Pricer Configuration

A recovery curve can be used to price credit derivatives as well as ABS bonds.

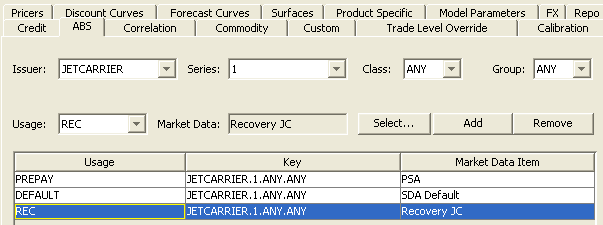

5.1 ABS Bonds

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration.

Load a pricer configuration and select the ABS panel.

Note that the ABS panel will only appear in the Pricer Configuration if you have installed the Intex module.

Refer to the Calypso Intex Integration User Guide for details.

Refer to the Calypso Intex Integration User Guide for details.

| » | Select an issuer and a series, then select a class or ANY, and a group of collaterals or ANY. You can only select an issuer and a series if an ABS bond exists in the system for which the issuer and series are populated. |

| » | Select the REC usage, and click Select to select an actual curve. |

| » | Click Add to add the selected curve for the selected usage. |

| » | Then click Save to save the pricer configuration. |

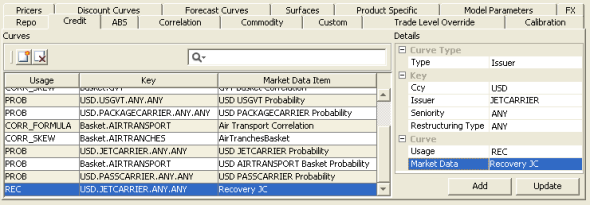

5.2 Credit Derivatives

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration.

Load a pricer configuration and select the Credit panel.

| » | Click  to add market data. to add market data. |

| » | In the Details area, select the type of association you want to perform: Basket, Issuer, or Ticker. Then select the corresponding key for the selected type. |

For Basket, select a basket or ANY.

For Issuer, select a currency, an issuer, a seniority or ANY, and a restructuring type or ANY.

For Ticker, select a ticker – A ticker is a combination of currency, issuer, seniority and reference obligation – You can create tickers from the Credit Market Data window.

For CreditRating, you need to set the default rating agency in the domain creditRatingSource.

| » | Set the credit rating attributes order in the domain PCCreditRatingLEAttributesOrder – For example: RED_REGION, RED_SECTOR. |

| » | Select a currency or ANY, a product type, a product or ANY, a product subtype or any, and a rating. |

| » | Select the REC usage, and select a recovery curve from the Market Data field. |

| » | Then click Add. |

| » | Click Save to save the changes. |