Prepayment Curve

A prepayment curve is used to apply assumptions regarding early return of principal because of borrowers paying down the bond collateral (mortgage or home equity loans) ahead of the mandated scheduled amortization. Specifying a prepayment provides an analysis basis for assessing risk.

Prepayment curves can be assigned to a fixed income product (MBS, ABS, etc.) by mapping it to a pricing environment.

Prepayment curves are used for pricing bonds in the context of the Intex integration.

Refer to the Calypso Intex Integration User Guide for complete details.

Refer to the Calypso Intex Integration User Guide for complete details.

1. Prepay Types

| Field | Description |

|---|---|

| PSA |

Public Securities Association model. Assumes a gradual rise in payments that peaks after 30 months. Standard increase is 0.2% per month with an indicator of 100%. |

| CPR |

Conditional Prepayment Rate model. Rate is equal to the proportion of the principal of the pool assumed to be paid off prematurely each period. Expressed as a percentage. Calculated as annualized monthly prepayment rate / pool balance at the beginning of the month. CPR = 1-(1-SMM)12 Example: A pool of mortgages with a CPR of 8% would indicate that for each period, 8% of the pool's outstanding principal will be paid. |

| SMM |

Single Monthly Mortality factor. Calculated as monthly prepayments / pool balance at the beginning of the month. |

| CPP | Constant Percent Prepayment. Estimates cashflows from annualized prepayments based on the average 12 month life of a mortgage. Does not calculate compounding interest. The SMM factor is multiplied by 12 to obtain the CPP. |

| CPB | Constant Prepayment on the Balloon. A pattern of prepayments assuming CPR until a reset date and a balloon payment on loans after. |

| ABS |

Asset Backed Securities prepayment rate. Used primarily in automobile deals. Calculated as monthly income / original balance. |

| HEP |

Home Equity Prepayment Model. Assumes home equity loans become seasoned after 10 months. Assumes even increases in payment per month, beginning at 2% in the first month, and leveling at 20% in the 10th month. |

| MHP | Manufactured Housing Prepayment model. Assumes a schedule of a ramping schedule in the first 24 months. Begins at 3.7% with .01% increments and levels off at 6% in the 24th month. |

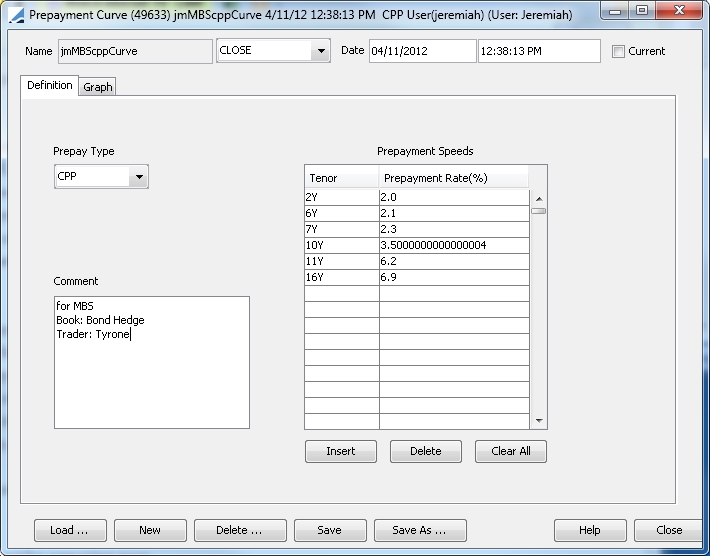

2. Prepayment Curve Window

You can define a curve in the Prepayment Curve window. From the Calypso Navigator, navigate to Market Data > Credit Curves > Prepayment Curve.

Prepayment Curve Window

Prepayment curve speeds are defined by securities organizations. Models can be defined by selecting a type, tenor and prepayment speed. Each defined curve will be assigned an individual system ID which will be displayed at the top of the window.

| » | Specify Prepay type from the drop down. |

| » | Specify tenor and rate in the Prepayment Speeds table.You can use the buttons to insert, delete, or clear the table. |

| » | Enter an optional free form comment. |

| » | Click Save and name your curve. |

You can load existing curves and modify the values. Click Save after making changes.

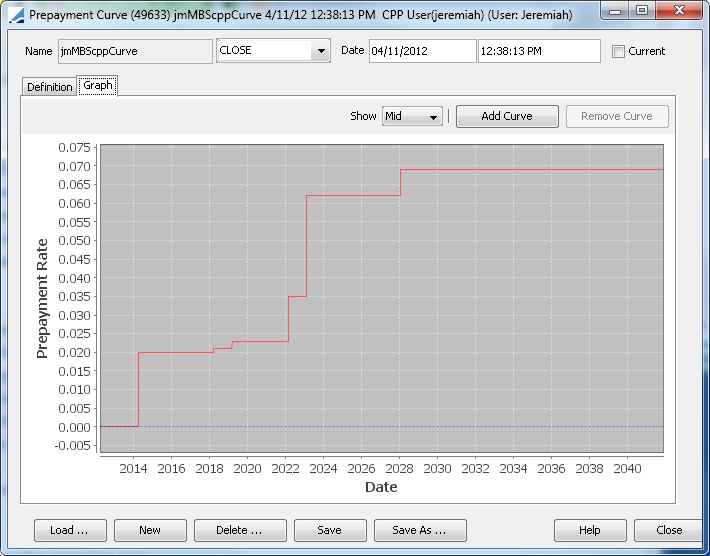

3. Curve Graph

Toggle between the tabs in the curve window to view a graphical display of your defined curve.