Covariance Matrix

From the Calypso Navigator, navigate to Market Data > Correlation & Covariance > Covariance Matrix (menu action marketdata.CovarianceMatrixWindow).

Use the Covariance Matrix for Multi-Factor Model pricing for Vanilla Swap with floating rates like LIBOR, CMS, and CMT, Swaptions with the same floating rates, and CapFloors with the same floating rates.

In contrast to the One Factor Models which assume all the interest rate movements are a function of the (unobservable) short rate, the Multi-Factor Model assumes the future of the interest rate movements depend on several observable forward rates that are allowed to move with different random behavior. This lends the model to be calibrated more accurately to the market and is why this model is also known by the name Libor Market Model.

Calypso’s implementation of the model uses Monte Carlo simulation to repeatedly walk down possible paths and then average out the total collection of values to determine an expected value of a given trade.

The model is calibrated to specific tenors on the interest rate curve chosen by the user. These points are allowed to have different volatilities which are specified by a volatility surface. Besides identifying the tenors on the curve which will correspond to the forward rates used in the model, we must also determine the correlations between these. This is achieved by taking a daily history of a given interest rate curve as a sample and computing the correlation from this set.

|

Covariance Matrix Quick Reference Covariance Matrix Generation 1. In the Definition panel, select the Derived checkbox, the generator, pricing environment, variable for each axis, click ... next to each axis to select specific tenors of the same currency as the underlyings, complete the attribute details. 2. Select the Points panel and click Generate. 3. Click Save, enter a name for the covariance matrix, and click OK. Pricer Configuration The covariance matrix must be assigned in the Product Specific panel in the pricer configuration with the usage FACTOR_COVARIANCE_MATRIX. From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration. |

Covariance Matrix for Parametric VaR

The covariance matrix which is generated using the Historical generation algorithm, or created manually using the Manual algorithm, is only used for the Parametric VaR buy side report.

Please refer to Calypso Portfolio Workstation documentation for details on creating a covariance matrix for Parametric VaR.

Please refer to Calypso Portfolio Workstation documentation for details on creating a covariance matrix for Parametric VaR.

1. Creating a Covariance Matrix

| » | Click New to start a new matrix. |

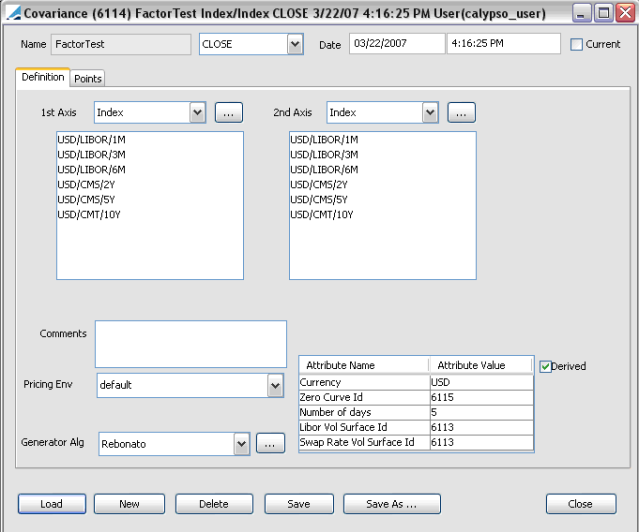

1.1 Definition Panel

The Definition panel is selected by default.

| » | Select the Derived checkbox. |

| » | Select the pricing environment. |

| » | Select the generator Rebonato (suggested generator) or MFMDefault. |

| » | Select the first axis variable, and the second axis variable. Then click ... next to each axis to select specific tenors of the same currency as the underlyings. |

| » | Complete the attribute details as described below. |

|

Attribute Name |

Description |

|---|---|

|

Currency |

To match the currency code of the underlying instruments. |

|

Zero Curve Id |

A zero curve of the same currency to drive the implied correlations. |

|

Number of Days |

Specifies the number of days history of the interest rate curve to be used for the correlations. |

|

Libor Vol Surface Id |

A volatility surface used to define the volatilities of the LIBOR rate indexes – for short dated curve points. |

|

Swap Rate Vol Surface Id |

A volatility surface used to define the volatilities of the Swap Rate indexes – for longer dated curve points. |

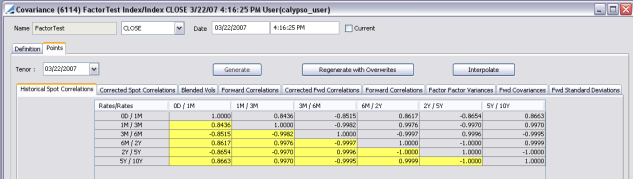

1.2 Points Panel

Select the Points panel and click Generate.

The Points panel contains several tabs that display the results of generating the matrix.

Historical Spot Correlation

The generated Spot correlations from the historical sequence of curve instances. The cells highlighted in yellow may be overridden by the user if there are certain correlations that are more desirable.

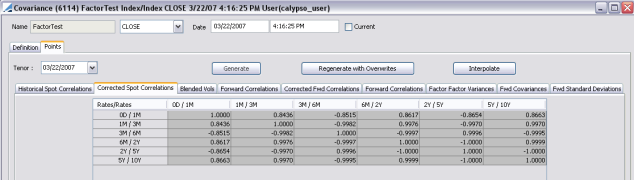

Corrected Spot Correlation

If changes have been made in the previous tab, then some corrections may have to be made to ensure the matrix remains positive definite. These cells may not be modified. Also, note that if no changes were made in the previous tab then this matrix will be the same as the original.

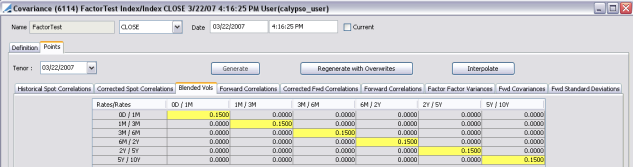

Blended Vols

The volatilities are drawn from the identified volatility surfaces defined as generator parameters on the Definition tab. The yellow values may be overridden by the user once again.

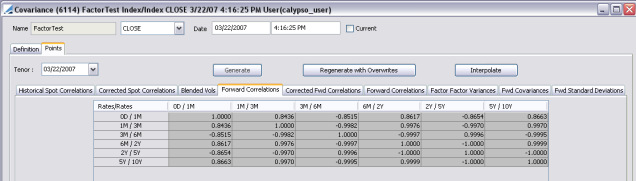

Forward Correlations

From the spot correlations, forward correlations are determined.

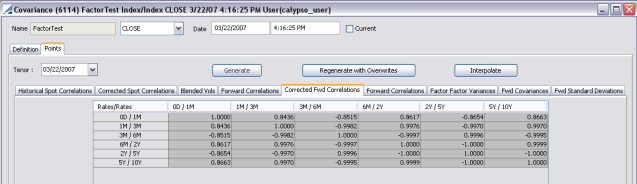

Corrected Fwd Correlations

The previous forward matrix is corrected to ensure positive-definiteness.

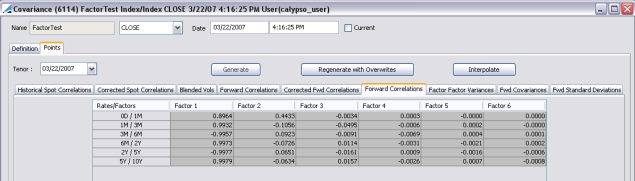

Forward Correlations

Notice that the column titles are no Factors instead of the Forward rates. These factors make up the factors in the Multi Factor Model.

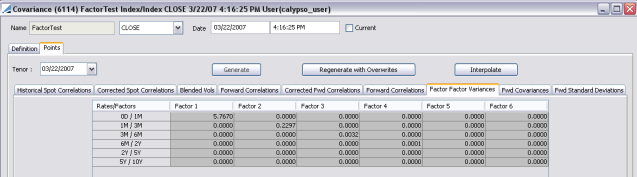

Rates Factor Variances

From the volatility matrix, the Rates/Factors variances are determined.

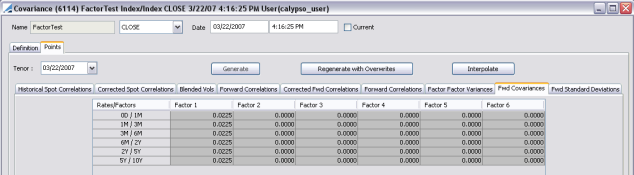

Fwd Covariances

Using the variances and the correlations from previous matrices, the covariances of the forward/factors are determined.

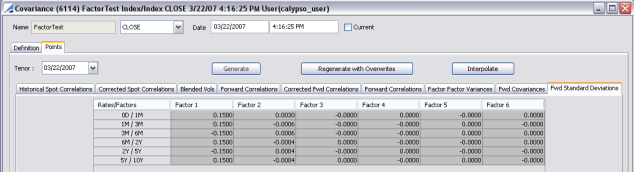

Fwd Standard Deviations

Finally, using matrix algebra and Newton’s method, the square root of the previous matrix is found and the result is displayed. In this final matrix the influence of each factor is clearly visible.

1.3 Save Correlation Matrix

Click Save in the bottom of the Covariance window. Enter a name for the covariance matrix, and click OK.

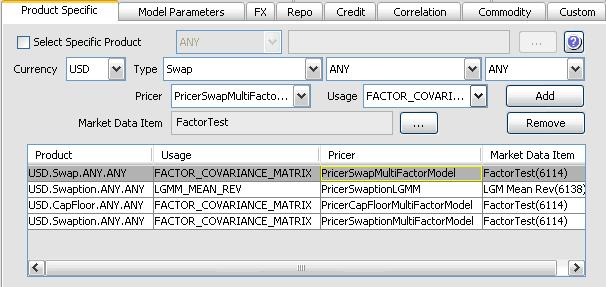

2. Pricer Configuration

| » | From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration. |

| » | Click Load, select a pricer configuration, and click OK. |

Select the Product Specific panel.

| » | Select the currency, product type, pricer, and usage FACTOR_COVARIANCE_MATRIX. |

| » | Click ... to select the covariance matrix. |

| » | Click Add to add it to the list. |

| » | Click Save to save the changes. |