Beta Value

The Beta coefficient, in terms of finance and investing, is a measure of an asset's volatility in relation to the rest of the market. Beta is calculated for individual assets using regression analysis.

The formula for the Beta of an asset within a portfolio is:

Where a is the asset and p is the portfolio.

The Beta coefficient can be positive or negative and greater than 1 and -1. The direction and magnitude of the number is important. A Beta of 2 implies that on average if the market moves by some amount X, the asset will move 2 times this amount. A Beta is a best approximation. There are other measures that represent the stability of Beta.

The motivation behind Beta is that different assets have different volatilities and have two types of risk, market and idiosyncratic. The goal is to represent the market associated risk with the Beta.

|

Beta Value Quick Reference Beta values may be imported from a text file in the Beta window and stored in this window. Date types outside of the US format are supported based on the Locale. The Beta value is currently supported in the Equity Derivatives trade worksheets: ADR-Equity, Asset Performance Swap, Futures (Equity and Equity Index), Equity Linked Swap, Equity Structured Option, ETO Equity Option (Equity and Equity Index), and Variance Swap/Variance Option. You can add the following pricer measures in the trade worksheet by choosing the Product Name > Configure Results (for example, Equity > Configure Results): BETA and BETA_ADJUSTED_DELTA. |

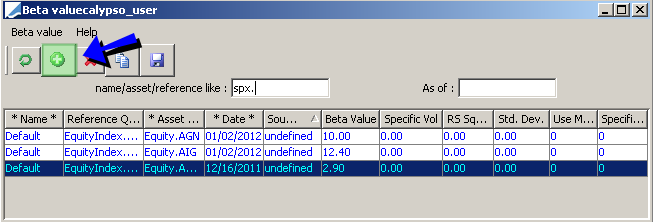

1. Adding Beta Values

From the Calypso Navigator, navigate to Market Data > Correlation & Covariance > Beta Value to open the Beta Value Window.

Sample beta values

| » | Click  to add a line and complete the details described below. To modify a field, double click the field. to add a line and complete the details described below. To modify a field, double click the field. |

| » | Then click  when you are done. when you are done. |

| » | You can click  to copy / paste a selected line and then modify as necessary. to copy / paste a selected line and then modify as necessary. |

| Attributes | Description |

|---|---|

| *Name* | Enter a Beta Set name. The Beta Set identifies a set of beta values. |

| Reference Quote Name | Select the reference asset name. Example: "Equity Index". |

| *Asset Quote Name* | Select the asset name. Example: "Equity GOOG". You can use an Index for this field. |

| *Date* |

Enter the date for the Beta value. |

| Source | Enter a user-defined list of sources. Examples: Bloomberg, Yahoo, Internal, and Barra. |

| Beta Value |

Enter the beta value. |

| Specific Volatility |

Enter the volatility of the Asset in the Reference/Asset pair as needed. This is currently for information purposes only. |

| RS Squared |

Enter the stability of the beta value as needed. This is currently for information purposes only. |

| Standard Deviation | Enter the standard deviation used in VaR calculations as needed. This is currently for information purposes only. |

| Use Method | Set to "0" or "1" as needed to indicate that the beta value should only be used in certain calculations. This is currently for information purposes only. |

| Specific Risk | Set to "1" to use this beta value in VaR calculations, or "0" otherwise. This is currently for information purposes only. |

Ⓘ [NOTE: An attribute with the "**" characters cannot be modified once saved]

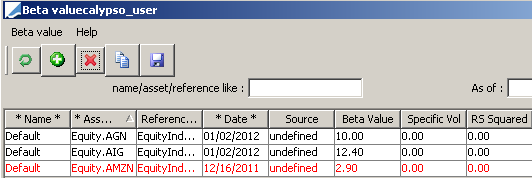

2. Deleting Beta Values

Select one or more lines and click  . The selected rows will appear in red, and will be deleted upon saving.

. The selected rows will appear in red, and will be deleted upon saving.

Sample delete of beta values

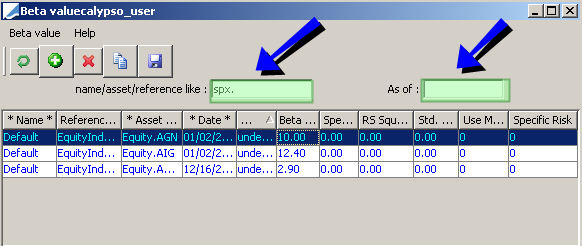

3. Searching and Filtering Results

Sample search results

Name/asset/reference like: Searches a specified character string. The search will include all fields and will not be case sensitive.

As of: For each key {name, asset} only the line corresponding to the lasted date before or equal to the "As of" criteria will be shown. This feature is similar to the market data item loading feature in the Trade Window, which retrieves the last item with a date before or equal to the valuation date.

4. Exporting and Importing Beta Values

4.1 Exporting

Choose Beta Value > Export to file.

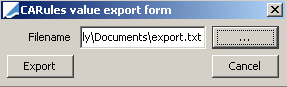

Export dialog

| » | Click ... to select the folder, and enter a file name. |

| » | Click Export to export the beta values. |

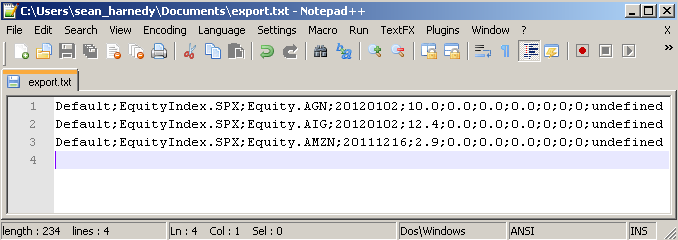

Sample export file:

4.2 Importing

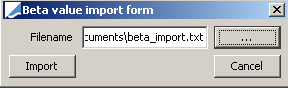

Choose Beta Value > Import from file.

Import dialog

| » | Click ... to select the file to import. |

| » | Click Import to import the beta values. The expected format for the input file is the same as the format used for exporting. |

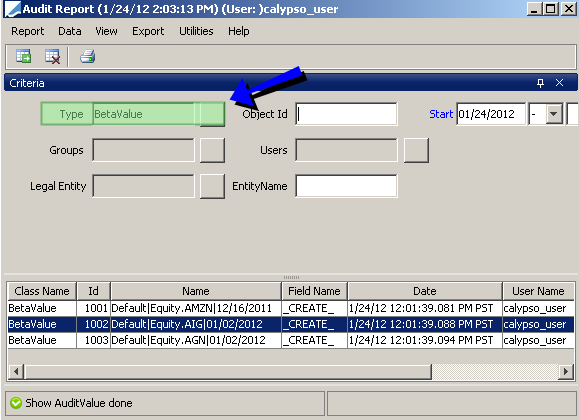

5. Audit Report

If not already specified, add BetaValue to the domain "classAuditMode" to enable audit.

From the Calypso Navigator, navigate to Reports > Audit > Audit Report to bring up the Audit Report Window.

Sample audit report

| » | You can select the BetaValue type. |

| » | Click  to load the report. to load the report. |

6. Using Beta Value

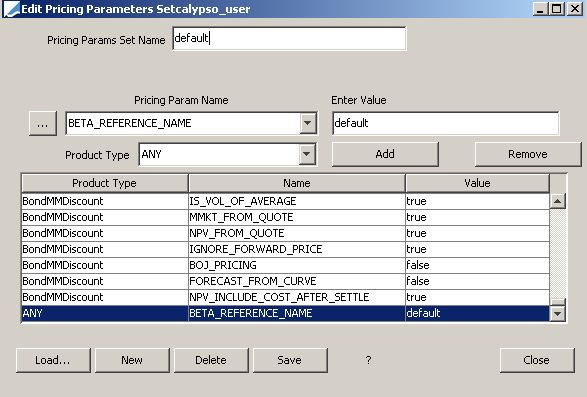

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricing Parameter Set.

BETA_REFERENCE_NAME pricing parameter

| » | Set the Beta Set name you want to use in the pricing parameter BETA_REFERENCE_NAME. |

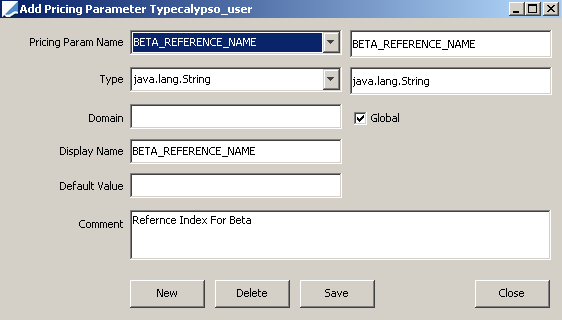

For reference, here is the definition of BETA_REFERENCE_NAME.

BETA_REFERENCE_NAME definition

6.1 Viewing Pricer Measures

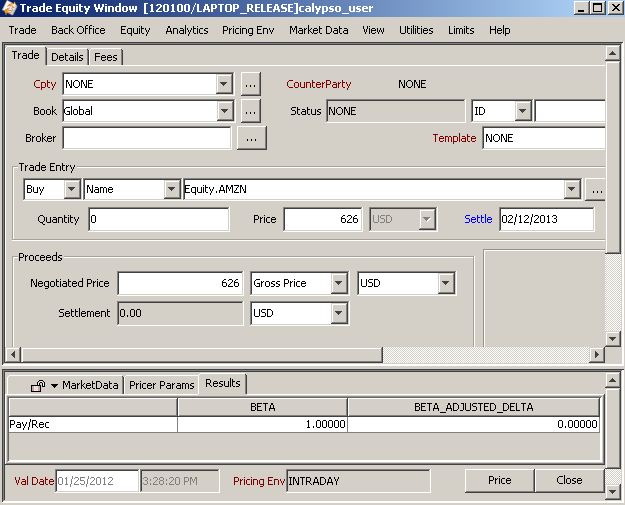

To open the Equity Trade Worksheet, choose Trade > Equity > Equity/ADR.

Sample beta pricer measures

| » | To add the pricer measures to the Results panel, choose Equity > Configure Results. |

You may view the "BETA" and "BETA_ADJUSTMENT_DELTA" pricer measures in the Trade Worksheet.

| Pricer Measure | Description |

|---|---|

| BETA | The Beta between the Stock and Reference Index for the Valuation Date. |

| BETA_ADJUSTED_DELTA | The Delta Pricer measure for Beta. (pm.DELTA *pm.BETA). |

6.2 Risk

Below are several examples showing how Beta can be used in Risk Analyses.

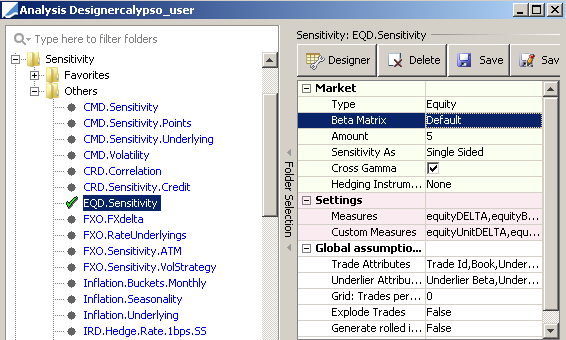

Sensitivity

To configure the Sensitivity analysis, navigate to Configuration > Reporting & Risk > Analysis Designer from the Calypso Navigator. On the right-side of the screen, you can choose to include a Beta Matrix in the Sensitivity configuration.

Sensitivity (Equity Derivatives)

Simulation

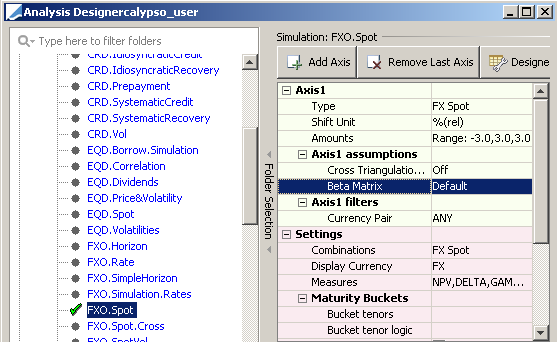

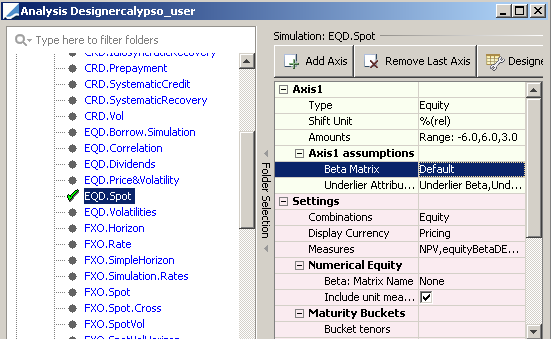

To configure the Simulation analysis, navigate to Configuration > Reporting & Risk > Analysis Designer from the Calypso Navigator. On the right-side of the screen, you can choose to include a Beta Matrix in the Simulation configuration.

Simulation (FX Spot)

Simulation (Equity Derivatives)

Scenario Analysis

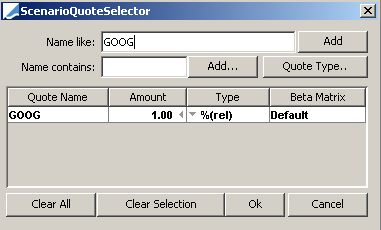

From the Calypso Navigator, navigate to Configuration > Reporting & Risk > Scenario Editor to bring up the Scenario Editor window.

| » | In the Market Data Sets panel, select the market data to be perturbed using Quotes. |

| » | In the Rules Panel, create a Quotes rule and click Quote Selector. |

| » | Select the quotes you want to perturb. |

| » | Right-click the selected line and choose "Add Beta" and select a Beta Set Name. |

Scenario Rule (Quotes)