Basket Correlation Surface

From the Calypso Navigator, navigate to Market Data > Correlation & Covariance > Basket Correlation (menu action marketdata.CorrelationSurfaceWindow).

The Basket Correlation Surface window allows creating basket correlation surfaces derived from an index tranche structure, or based on a bespoke structure.

The Basket Correlation Surface also computes the CDS Index Basis Adjustment and the Implied Correlation. The basis adjustment can be overwritten.

Sample Correlation Surface

Contents

- Generating a Derived Correlation Surface

- Generating a Bespoke Correlation Surface

1. Generating a Derived Correlation Surface

|

Derived Correlation Surface Quick Reference Configuration Requirements Issuer – From the Calypso Navigator, navigate to Configuration > Legal Data > Entities. CDS Index Definition – From the Calypso Navigator, navigate to Configuration > Credit Derivatives > CDS Index Definition. Reference Entity Basket – From the Calypso Navigator, navigate to Configuration > Credit Derivatives > Reference Entity Basket. Correlation Surface Underlying Instruments You can use CDS index tranches in building the correlation surface. From the Calypso Navigator, navigate to Configuration > Market Data > Correlation Surface Underlyings, or in the correlation surface application’s Underlying panel, click New/Edit Underlying. Surface Generation 1. Click New to start a new surface. 2. Select the following to define the surface: basket, check the Derived checkbox, generator BaseCorrelation or BaseCorrelationLPM (large pool model), interpolator, and pricing env. 3. Underlyings Panel — Select the tranche indices. 4. Quotes Panel — Enter tranche index quotes, upfront fee and implied correlation. 5. Click Generate to generate the correlations and other indicators. You can modify the basis adjustments. 6. Click Save, enter a name for the surface, and click OK. Pricer Configuration A correlation surface is associated with a pricing environment under the Credit panel of the pricer configuration for the CORR_SKEW usage. |

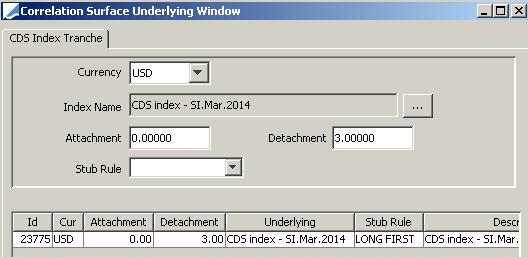

1.1 Creating Underlying Instruments

Create the index tranche underlying instruments for the correlation surface. From the Calypso Navigator, navigate to Configuration > Market Data > Correlation Surface Underlyings, or click New/Edit Underlyings in the Underlyings panel.

| » | Select the currency. |

| » | Click ... to select the index. |

| » | Enter the attachment and detachment points, and select the stub rule as needed. |

| » | Click Save at the bottom of the window. |

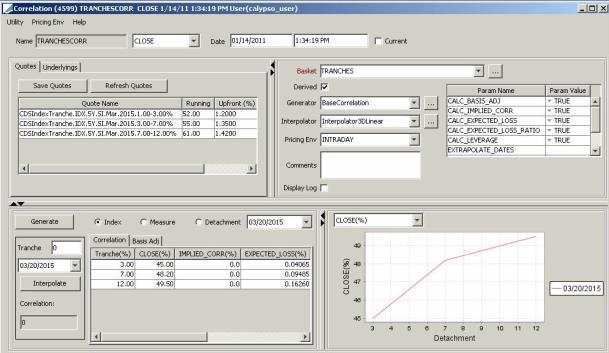

1.2 Generating a Correlation Surface

Click New to create a new Correlation Surface.

Select the following details to define the correlation surface:

| » | Click ... to select the basket. You can also select a basket directly if you have set up favorite baskets. To set up favorite baskets, double-click the label “Basket” and add favorite baskets. |

NOTE: The basis adjustment will not be calculated if the basket weight is not 100%.

| » | Check the “Derived” checkbox. |

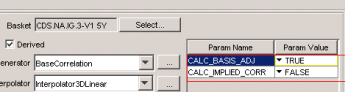

| » | Select the BaseCorrelation generator or the BaseCorrelatiorLPM generator. You can set a number of parameters on the generator. They are described below. |

NOTE: For the BaseCorrelation generator, your pricer configuration must assign the CDSNthLossOFM pricer (or a custom functional equivalent) for pricing CDSNthLoss products. You also need pricing data for the index tranches]

| » | Select the interpolator. |

| » | Select a pricing environment to retrieve / save quotes, and pricing data for tranche indices. |

You can choose Pricing Env > Reload to reload the components of the pricing environment.

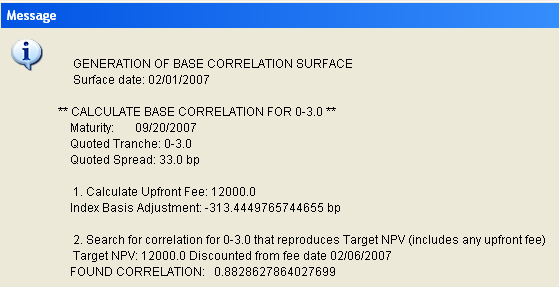

| » | You can check the “Display Log” checkbox to display a log report at the end of the surface generation that shows computation details. You can also choose Help > Display Generate Log to display the log report at any time after you have generated the surface. |

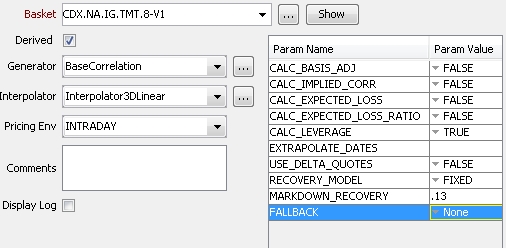

1.3 Base Correlation and Base Correlation LPM Parameters

| Parameter | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

CALC_BASIS_ADJ |

Default is TRUE. The index basis is calculated as follows: The adjustment is performed on the Curve Points that are stored in a probability curve. Each Curve Point holds a survival probability as of the Curve Point’s date t. Call this P (t). Then an adjusted curve is created by copying the original curve, using the same dates t, and for each date changing P (t) to Padj (t), where Padj (t) = exp(-ht)*P(t). The factor h is the basis adjustment which adjusts the probability curves so that the BE_Rate is equal to the Quoted value of the Index. It is the same for all curves in the index. This can be set up as follows:

The Basis adjustment should tally the number obtained in Step 1. If the CALC_BASIS_ADJ flag is set to True in the correlation surface and this regenerated correlation surface is applied back to the CDS Index trade, then the NPV from credit curves will match the NPV from the market spread quote and the B/E rate of the trade will match the market spread. Ⓘ [NOTE: If USE_CDS_BASIS_ADJ=true and CALC_BASIS_ADJ=false, there is no basis adjustment] Ⓘ [NOTE: If basket weight is not 100%, CALC_BASIS_ADJ will be set to false] |

||||||||||||

| BASIS_ADJ_METHOD |

Select the basis adjustment method.

The method that appears to be most used in the marketplace is Dur Wtd Mult. Calibration has been seen to be most reliable using this method. |

||||||||||||

| BASIS_ADJ_BOOTSTRAP |

Default is FALSE. If set to FALSE, the basis adjustment method is a constant adjustment across all curve points. In that case, the index quotes for each maturity are each solved separately for a basis adjustment. When pricing a CDS at any maturity point, the basis adjustment for that point is interpolated from those calculated for each index maturity. If set to TRUE, the basis adjustments are calculated using a bootstrap approach. An adjustment is applied to the probability curves up to the first index maturity, then a new adjustment is applied up to the second maturity, and so on. The adjustments are solved successively so that at each maturity the PV or Dur Wtd condition is met (depending on the basis adjustment method). |

||||||||||||

|

CALC_IMPLIED_CORR |

Default is FALSE. If set to True, the generator should display Implied as a point’s adjustment. |

||||||||||||

|

CALC_EXPECTED_LOSS |

Default is FALSE. If set to True, the surface displays the calculated expected loss. |

||||||||||||

|

CALC_EXPECTED_LOSS_RATIO |

Default is FALSE. If set to True, the surface displays the calculated expected loss ratio. |

||||||||||||

|

CALC_LEVERAGE |

Default is FALSE. If set to True, the surface displays the calculated leverage. |

||||||||||||

|

EXTRAPOLATE_DATES |

Default is [empty]. A list of comma-separated dates for which the volatility is extrapolated. |

||||||||||||

|

USE_DELTA_QUOTES |

Default is FALSE. If set to true, users must enter additional quotes in the correlation surface window for tranche Deltas, and current index quote. |

||||||||||||

|

RECOVERY_MODEL |

Default is Fixed. The choices are "Fixed" and "Random." "Fixed" is the original Gaussian model, i.e. there is a fixed recovery rate assigned to each asset. "Random" triggers the random recovery model. |

||||||||||||

|

MARKDOWN_RECOVERY |

Default is 0. Can be used to calibrate the base correlations for the Random recovery model, for example "0.2". |

||||||||||||

| FALLBACK |

"None" or "Top Down Calibration". If "Top Down Calibration" is selected, generation will be done by finding the flat correlation of the super-senior tranche and then down the tranche detachment points. Equity tranche correlation is calculated as a flat correlation (not dependent on higher correlations) and is stored at the new point labeled as the '0' attachment point. Using this setting will check if there are one or more tranche maturities with a non-monotonically increasing correlation curve. If none are found, it will use the standard correlation generation method. If one or more are found, all maturities are prior to the last non-monotonic curve. Later maturities will not be re-generated. These non-re-generated maturities will have a zero detachment point added to them. NOTE: If "Top Down Calibration" has been enabled, specific dates entered by a user (not equal to quoted tranche maturities) may be ignored by a top down regeneration. |

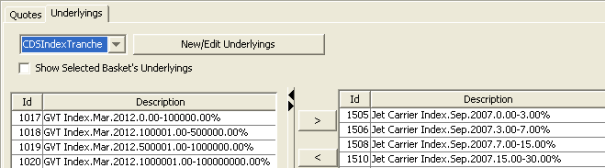

1.4 Selecting Underlying Instruments

The underlying instruments in the Correlation surface are the index tranches. Different indices can be specified (for example, 3, 5, 7, and 10 years) to create a correlation surface.

Select the Underlyings panel.

| » | Select CDSIndexTranche from the first field to display available underlying instruments. You can click New/Edit Underlying to create new underlying instruments. |

| » | Select instruments and click > to add them to the instrument list on the right-hand panel. |

You can select an underlying and press [Ctrl] + double-click to open a corresponding trade for the underlying.

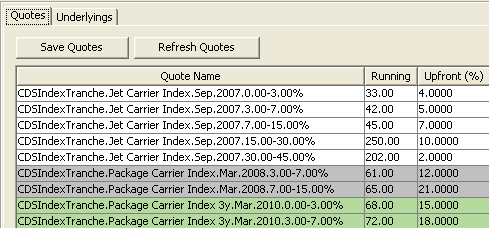

1.5 Setting Quotes

| » | The quotes are displayed from the quote set associated with the pricing environment, or the feed. You can enter quotes, upfront fees, and implied correlations. |

| » | Click Refresh Quotes to refresh the quotes. |

| » | Click Save Quotes to save refreshed/entered quotes. |

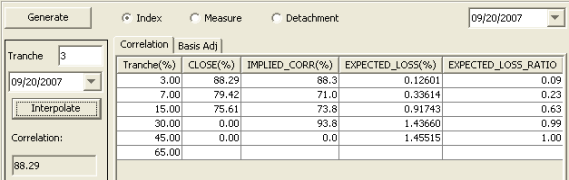

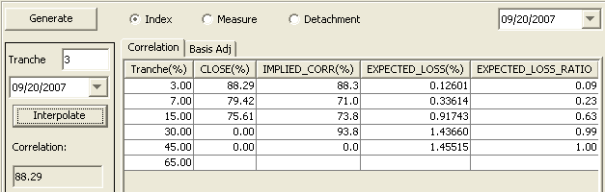

1.6 Generating the Correlation Surface

The bottom left hand corner has two panels, the Basis Adj panel and the Correlation panel.

The Basis adjustment is calculated by the generator, but you can modify it.

| » | Select the maturity that corresponds to the underlying index. |

| » | Click Generate to generate the Correlation Surface. |

| » | You can enter a tranche value, then click Interpolate to calculate and display the corresponding correlation value. |

| » | Click Save at the bottom of the window. You will be prompted to enter a name for the correlation surface. |

Different effective detachments are displayed per maturity depending on the selection made.

| • | Index - displays only the detachments relevant to the selected maturity. |

| • | Measure - shows all detachments for the surface. |

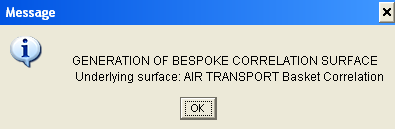

2. Generating a Bespoke Correlation surface

|

Bespoke Correlation Surface Quick Reference Configuration Requirements Issuer – From the Calypso Navigator, navigate to Configuration > Legal Data > Entities. Reference Entity Basket – From the Calypso Navigator, navigate to Configuration > Credit Derivatives > Reference Entity Basket. You need an existing basket correlation surface, or an existing correlation formula. Surface Generation 1. Click New to start a new surface. 2. Select the following to define the surface: basket, uncheck the Derived checkbox, generator BespokeCorrelation or BespokeCorrelationMoneyness, interpolator, and pricing env. 3. Add tranche attachment and detachment points, and select tenors (Index checkbox unchecked), or select CDS Indices (Index checkbox checked). 4. Click Generate to generate the correlations and other indicators. You can modify the basis adjustments. 5. Click Save, enter a name for the surface, and click OK. Pricer Configuration A correlation surface is associated with a pricing environment under the Credit panel of the pricer configuration for the CORR_SKEW usage. |

You can also associate a correlation formula on-the-fly if you do not want to create a bespoke surface. Surface generator will use currency and restructuring definition as defined in the bespoke basket. If no definition is found, the generator will default to values set in the 'dummy' index definition.

| » | See Help > Trade Details in the CDS Nth Default trade worksheet. |

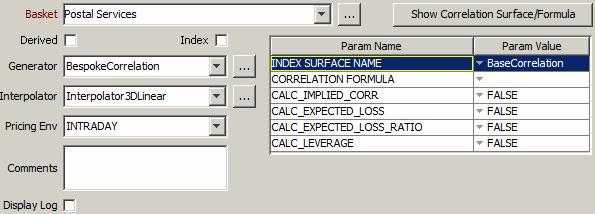

2.1 Generating a Correlation Surface

Click New to create a new Correlation Surface.

Select the following details to define the correlation surface:

| » | Click ... to select the basket. You can also select a basket directly if you have set up favorite baskets. To set up favorite baskets, double-click the label “Basket” and add favorite baskets. |

NOTE: The basis adjustment will not be calculated if the basket weight is not 100%.

| » | Uncheck the “Derived” checkbox. |

If you leave the Index checkbox unchecked, you can add tranche attachment and detachment points, and select an existing basket correlation surface, or a correlation formula. Credit events are not taken into account in the generation of the surface.

If you check the Index checkbox, you can select CDS index definitions to take their credit events into account in the generation of the surface.

| » | Select the BespokeCorrelation or BespokeCorrelationMoneyness generator. You can set a number of parameters on the generator. They are described below. |

| » | Select the interpolator. |

| » | Select a pricing environment to retrieve an existing basket correlation surface, or a correlation formula. |

You can choose Pricing Env > Reload to reload the components of the pricing environment.

| » | You can check the “Display Log” checkbox to display a log report at the end of the surface generation that shows computation details. You can also choose Help > Display Generate Log to display the log report at any time after you have generated the surface. |

Set Dynamic Mixing on a Bespoke surface

The static factor on a bespoke surface can be mixed dynamically. The underlying index with an attached correlation surface can be customized by setting values for Spread and Expected Loss.

Spread and Loss are val date sensitive and are computed during generation.

When pricing parameter MIX_BEFORE_MAPPING = false (default value), the system maps the bespoke basket to each underlying index surface first, then combines the results by applying the defined correlation formula in tranche detachment points space.

When pricing parameter MIX_BEFORE_MAPPING = true, the system constructs a blended index surface at the ELR level based on a correlation formula and underlying index surfaces. Through iteration process, the system maps the bespoke basket to this blended index surface using the ELR method.

This does not apply to Expected Loss or Moneyness, only to Expected Loss Ratio.

Bespoke Correlation Parameters

|

Parameter |

Description |

||||||

|

INDEX SURFACE NAME |

Select the name of basket correlation surface from the drop-down (only needed if you do not enter a correlation formula). You can click Show Correlation Surface/Formula to display the selected basket correlation surface. |

||||||

|

CORRELATION FORMULA |

Select the name of a correlation formula from the drop-down (only needed if you do not enter a basket correlation surface). Correlation formulas are created using Market Data > Correlation & Covariance > Correlation Formula from the Calypso Navigator, and require an existing correlation surface. You can click Show Correlation Surface/Formula to display the selected correlation formula. |

||||||

|

CALC_IMPLIED_CORR |

Default is FALSE. If set to True, the generator should display Implied as a point’s adjustment. |

||||||

|

CALC_EXPECTED_LOSS |

Default is FALSE. If set to True, the surface displays the calculated expected loss. |

||||||

|

CALC_EXPECTED_LOSS_RATIO |

Default is FALSE. If set to True, the surface displays the calculated expected loss ratio. |

||||||

|

CALC_LEVERAGE |

Default is FALSE. If set to True, the surface displays the calculated leverage. |

||||||

| FORMULA_MIXING |

Defaults to STATIC_MIXING. Value can be set when CORRELATION_FORMULA exists. |

||||||

| FORMULA_MIXING_METHOD |

Defaults to STATIC_MIXING. PricerCDSNthLossBespoke uses the same correlation surface. |

||||||

|

TIME_INTERPOLATION |

Select the time interpolation method:

|

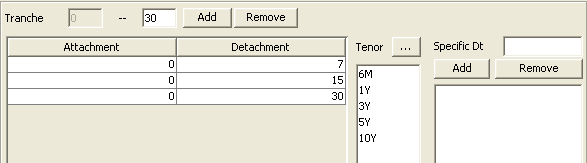

2.2 Adding Tranche Points and Selecting Tenors

When Index is not checked, you can add tranche points and select tenors.

| » | Enter a detachment point and click Add. Repeat as needed. |

| » | Click ... next to the Tenor field and select tenors. You can also add specific dates. |

2.3 Select CDS Indices

When Index is checked, you can select CDS indices so that their credit events will be taken into account in the surface generation.

| » | Click Select to select CDS indices. You need to select at least one. |

| » | You can highlight a selected CDS Index and click Show to view its definition. |

If pricing parameter USE_CDS_BASIS_ADJ=true, the bespoke generation will look in the pricer configuration for a CDS Basis Adjustment Curve for off-the-run indices. If no curve exists, then the generation continues without making any basis adjustment.

2.4 Generating the Correlation Surface

| » | Click Generate to generate the Correlation Surface. |

| » | You can enter a tranche value, then click Interpolate to calculate and display the corresponding correlation value. |

| » | Click Save at the bottom of the window. You will be prompted to enter a name for the correlation surface. |

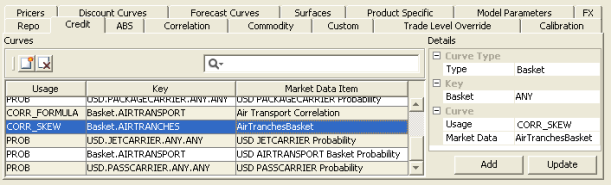

3. Pricer Configuration

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration.

Load a pricer configuration and select the Credit panel.

| » | Click  to add market data. to add market data. |

| » | In the Details area, select the type of association you want to perform: Basket, Issuer, or Ticker. Then select the corresponding key for the selected type. |

| – | For Basket, select a basket or ANY. |

| – | For Issuer, select a currency, an issuer, a seniority or ANY, and a restructuring type or ANY. |

| – | For Ticker, select a ticker – A ticker is a combination of currency, issuer, seniority and reference obligation – You can create tickers from the Credit Market Data window. |

| » | Select the CORR_SKEW usage, and select a correlation surface from the Market Data field. |

| » | Then click Add. |

| » | Click Save to save the changes. |