Commodity Spread Curve

From the Calypso Navigator, navigate to Market Data > Commodity Curves > Spread Curve (menu action marketdata.CurveCommoditySpreadWindow).

|

Commodity Spread Curve Quick Reference Configuration Requirements

Curve Underlying Instruments The curve generator available is CommoditySpread. The curve underlyings available for this generator are CommodityFwdPoint, FutureCommodity and CommoditySpot. Note: The CommoditySpreadAllInPoints and MonthlyAsianSwapSpread generators have been deprecated. Both generators are available in cases where they are already in use. Base Curve The base curve should be a forward curve.

Curve Generation 1. Click New to start a new curve. 2. Select the quote instance to use in the curve generation (CLOSE, LAST, or OPEN). 3. The Current checkbox is selected by default, meaning that when you save the curve, the system timestamps the curve with the current date and time. Clear the Current checkbox to enter a back-dated curve. You can modify the date and time fields. 4. Definition Panel — Select the following to define the curve: currency, delivery tenor, units of measure, commodity product, interpolator is not mandatory, “Generate from instruments” should be checked, generator, holiday calendar, Pricing Env, base curve. 5. Underlyings Panel — Select the underlying instruments. 6. Quotes Panel — Enter quotes manually, use quotes from the quote set, or use real-time quotes. 7. Points Panel — Click Generate to generate the points. 8. Click Save, enter a name for the curve, and click OK. Pricer Configuration A commodity spread curve is associated with a pricing environment under the Commodity panel of the pricer configuration. |

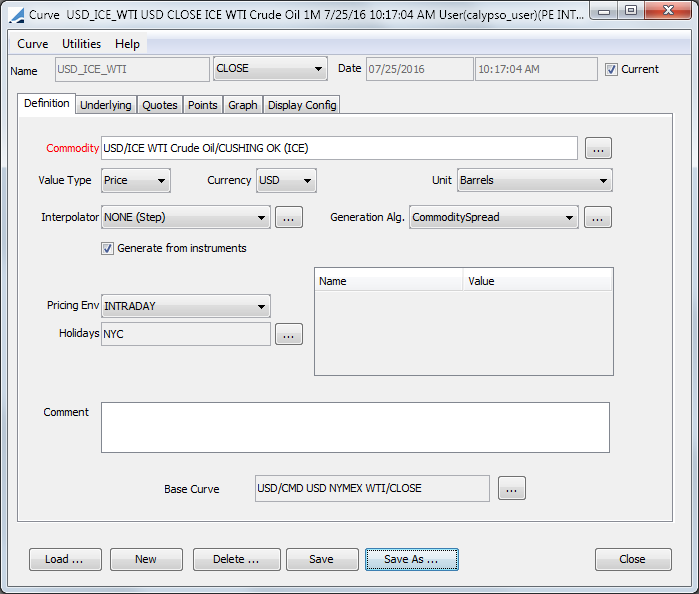

1. Definition Panel

Click New to start a new curve.

Select the following to define the curve: currency, delivery tenor, units of measure, commodity product, interpolator is not required, “Generate from instruments” should be checked, generation algorithm, holiday calendar, Pricing Env, base curve.

Select the Commodity Spread generation algorithm. The generator will get a price from the base curve and display it in the Spread column in the Points panel. The Price column shows the sum.

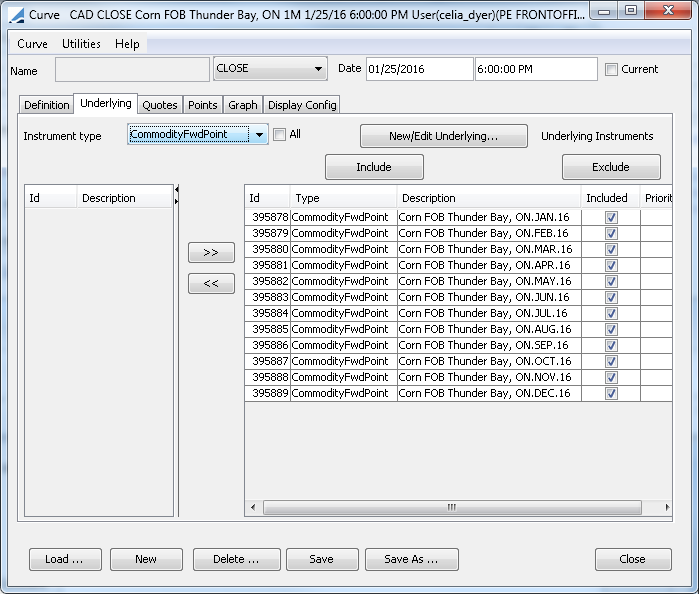

2. Underlying Panel

Click the Underlying tab. Select the underlying instruments to use in the curve.

| » | Select the instrument type, and the panel below displays the list of available instruments. The panel is blank if you have not set up any instruments. Click New/Edit Underlying to create new instruments. |

| » | Select instruments and click >> to add them to the instrument list in the right panel. |

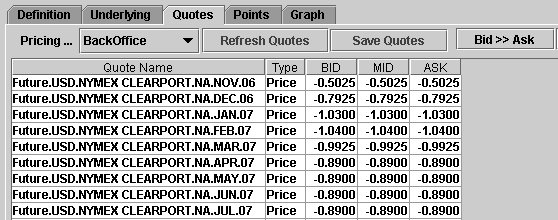

3. Quotes Panel

Click the Quotes tab. You can enter quotes and Save Quotes to the quote set associated with the selected pricing environment.

The quotes may be automatically populated if you are running a real-time feed, or they may be populated from the quote set associated with the selected pricing environment.

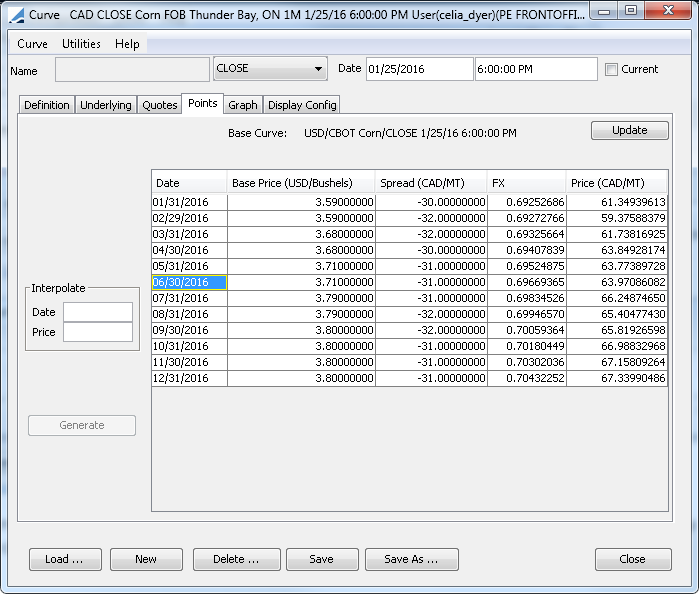

4. Points Panel

Click the Points tab. Click Generate to generate the points.

| » | The curve underlyings will be used to generate forward point dates using similar logic to the commodity forward curve. The quote prices make up the base prices in the Points panel. |

| » | For each point date, the generator gets a price from the base curve and display it in the Spread column. The Price column shows the sum of the Base Price and the Spread. |

| » | The spread curve and the base curve may have different price currencies and different price units. The spread is converted to the spread curve unit using the commodity conversion factor setup for the commodity of the spread curve. |

| » | The spread is converted to the spread curve currency using the spot FX rate adjusted for the forward point date. |

| » | The Points panel shows the point date which comes from the curve underlyings in the same way as for the commodity generator of the commodity forward curve. |

| » | The Base Price is the price on the base curve on the point date. This price is in the currency and unit of the base curve. |

| » | The Spread is the price on of the underlying quote in the currency and unit of the underlying. |

| » | The final Price is the base price plus the spread. With the base price converted to the currency and unit of the spread curve. |

5. Save Curve

Click Save in the bottom of the curve window. Enter a name for the curve, and click OK.

6. Pricer Configuration

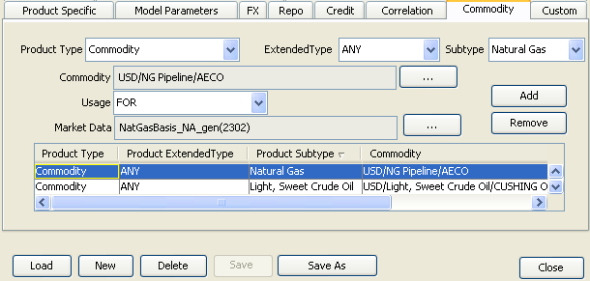

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration.

| » | Click Load, select the pricer configuration name, and click OK. |

| » | Click the Commodity tab to bring it to the front. |

| » | Select the product type or ANY, extended type or ANY, and subtype or ANY. |

| » | Click ... to select the commodity product. |

| » | Select the usage (for example, forecast). |

| » | Click ... to select the commodity spread curve. |

| » | Click Add to add the curve to the list. |

| » | Click Save to save the pricer configuration. |

See

See