Capturing Real Yield Swap Trades

Real yield swaps are based on a fixed leg against the yield to maturity of an inflation bond.

|

Real Yield Swaps Quick Reference

|

Before you Begin

Make sure that RealYield is added to the domain "Swap.subtype".

1. Market Data Requirements

Real yield swap trades use the pricer PricerRealYieldSwap.

It requires the following market data:

| • | a zero yield discount curve for the trade currency |

| • | an inflation forecast curve generated by the generator InflationRealRate from basis swaps underlyings for the inflation index of the bond |

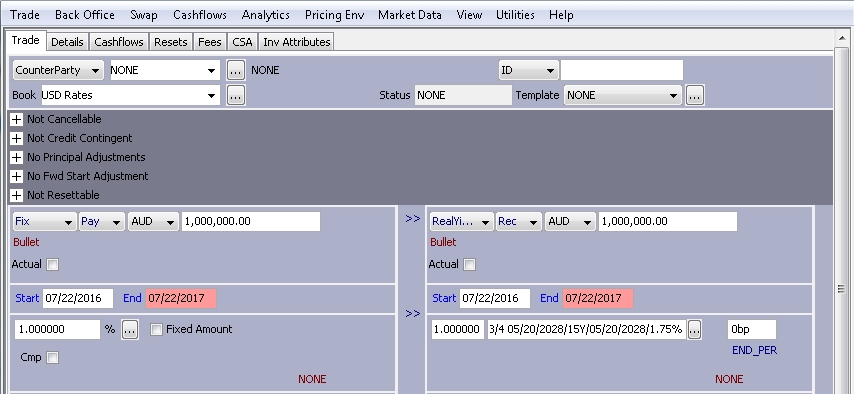

2. Sample Real Yield Swap Trade

Choose Trade > Interest Rates > Swap to open the Swap worksheet, from the Calypso Navigator or from the Trade Blotter.

| » | For the fixed leg, enter swap details as described in Capturing Swap Trades. |

| » | For the floating leg, select the RealYield type of leg. |

Enter an inflation factor as needed, and select the underlying inflation bond.

Enter a spread over the inflation bond as needed.

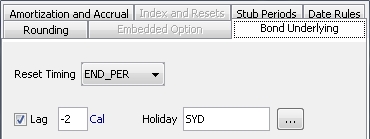

You can double-click the END_PER label to open the Swap Details window. The Bond Underlying tab is displayed by default.

| – | Select either BEG_PER or END_PER for the Reset Timing. |

| – | Select the Lag checkbox to enter the number of lag days, whether business or calendar days are used, and holiday schedule to be used. |

| – | Click Apply to save the settings. |

Upon saving, the subtype is set to RealYield.