Capturing Overnight Index Swap Trades

An overnight index swap is a fixed-for-floating interest rate swap. The floating-rate period is tied to a daily overnight rate and the floating interest is calculated on a compound basis.

|

Overnight Index Swap Quick Reference

|

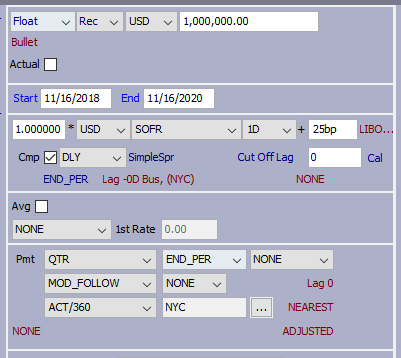

1. Trade Panel

In the Calypso Navigator, point to Trade > Interest Rates > Swap to open the Swap trade window. You can also open the trade window from the Trade Blotter by following the same menu items.

The following is a sample trade that uses an overnight rate index.

| » | When DailyIndexCalculator specifies either the DailyCompound or DailyCompound2 calculator, select the "Cmp" checkbox in the trade window and specify "DLY" for the compounding frequency. |

Ⓘ [NOTE: Selecting daily compounding on the trade while specifying a rate index that is not configured for daily compounding automatically defaults to the DailyCompound calculator.]

| » | The Cut Off Lag feature is enabled after selecting the "Cmp" checkbox and then "DLY" for the frequency. Select a number of days for the cutoff lag. You can then click the Cal/Bus label to specify whether the cutoff lag applies to calendar or business days. |

This feature provides a way to stop observing daily fixings prior to the end of a sample period for a daily compounding coupon and then use the fixing on the specified lag day to set the rate for the remainder of the period. See "Setting the Cut Off Lag for Daily Compounding" immediately below for details.

| » | When using one of the legacy calculators (IndexCalculator = OIS or OISNew), selecting the "Cmp" checkbox is not required. Daily compounding is hard-coded in the calculator. |

Daily Compounding with Spread Interest Treated as Simple Interest

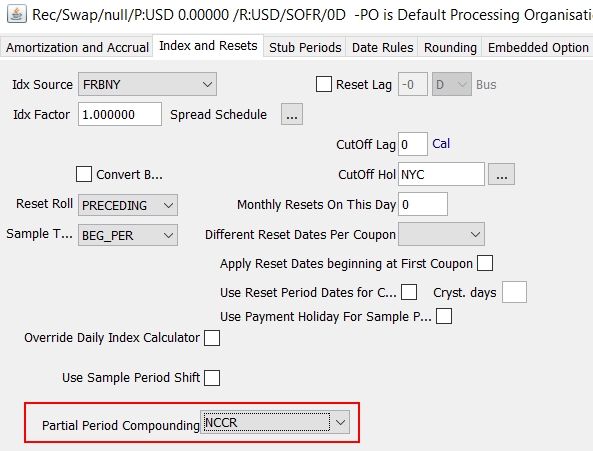

Mid coupon amortization - You can set the field Partial Period Compounding to NCCR in the Index and Resets tab of the Product Detail window.

Select NCCR for Non-Cumulative Compound Rate (only applicable to daily compounding trades), or not set for CCR (Cumulative Compound Rate). The NCCR rate is the daily change in CCR rate.

The value NCCR can be added to the domain "PartialPeriodCompRateEnrichmentMethods" if it is not available for selection.

In the Reset Samples window, the Partial Period Comp Rate column is computed.

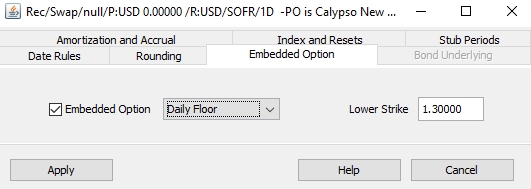

Flooring or Capping Daily Quotes - It is also possible to apply a cap or a floor to each daily interest rate before compounding in the Embedded Option panel of the Product Detail window.

Check Embedded Option, and select either Daily Floor or Daily Cap, and specify the upper or lower strike.

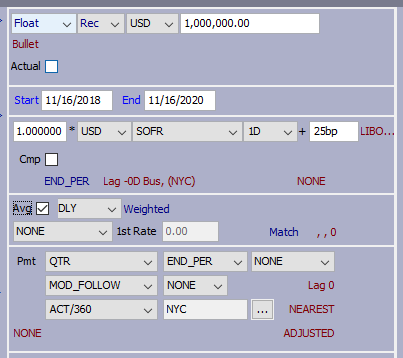

Daily Averaging Coupons

Setting the Cut Off Lag for Daily Compounding

When daily compounding is selected on the trade, the Cut Off Lag number box and Cal/Bus flag are enabled.

The Cut Off Lag allows the daily fixings to be "crystallized" prior to the end of the sample period. When a number is specified for Cut Off Lag, the number of days entered will determine how far back the calculator goes in the sample period to fix the day and its rate before applying it forward to the remaining days in the sample period. The Cal/Bus label allows for using either business days or holiday calendar days for the cut off.

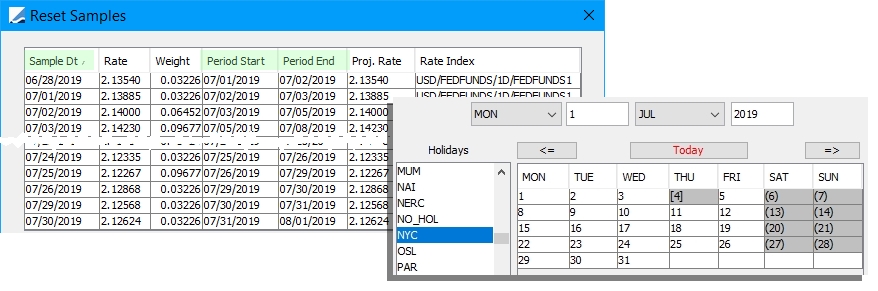

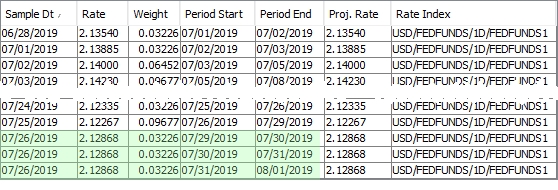

For example, if a trade has monthly coupons for the period July 1, 2019 through August 1, 2019, the sample dates within that period may look like so.

If the user specifies 3 calendar days for the Cut Off Lag (demonstrated above), the fixing three days prior to the end of the sample period will be used forward for the remainder of the period. In this case, the 7/26/2019 fixing is applied to the remaining three daily periods.

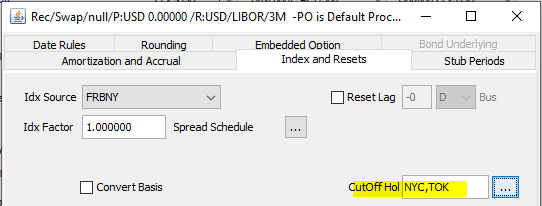

Cut Off Lag with Independent Holiday Calendar

When Cut Off Lag with Bus days is specified, the default Holiday Calendar used for counting business days is the Reset Holiday Calendar. It is possible to override this value to be a different value. This same Cutoff Holiday Calendar is used for cutoff lag on both daily compounding and daily averaging coupons.

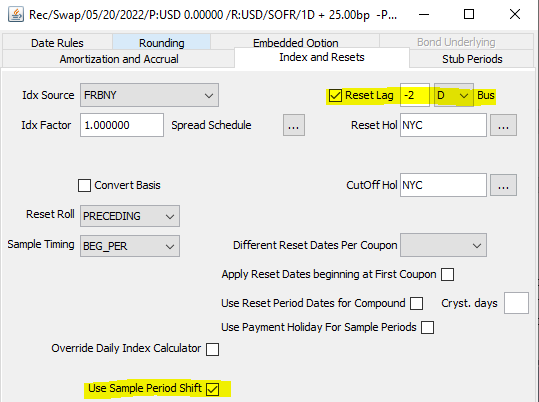

Reset Lag with Observation Shift

When a Reset Lag is specified on an RFR trade, it is possible to specify whether an observation shift should be applied to change the way the weight of any given daily rate is calculated.

This flag ensures that even with a Reset Lag, the Friday rate consistently has a weight of 3 days when calculating the compounded rate.

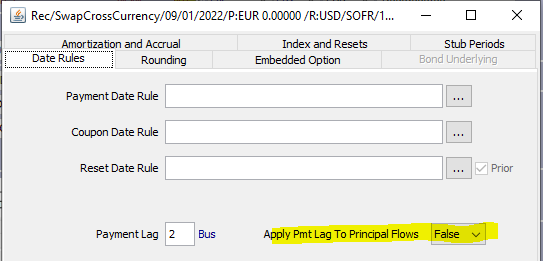

Payment Lag with Different Pmt Dates for INTEREST vs. PRINCIPAL Cashflows

For cross currency or other swaps with PRINCIPAL cashflows, any Pmt Lag specified on a swap leg applied to all cashflows. RFR swaps require to only apply the payment delay to INTEREST cashflows and settle PRINCIPAL cashflows on the accrual end date.

The flag "Apply Pmt Lag To Principal Flows" allows specifying whether the Pmt Lag should apply to Principal cashflows or not.

When the flag is set to false, only INTEREST cashflows are impacted by the Pmt Lag.

Pricing Optimization

By default, pricing optimization is turned off in the Trade window.

You can choose Swap > Allow Daily Compounding Optimization to enable pricing optimization based on the value of pricing parameter DLY_CMP_OPTIMIZATION:

| • | Default - Pricing optimization for flat compounding swaps with no spread. |

| • | ForceOn - Pricing optimization or all daily compounding swaps. |

| • | Off - No pricing optimization. |

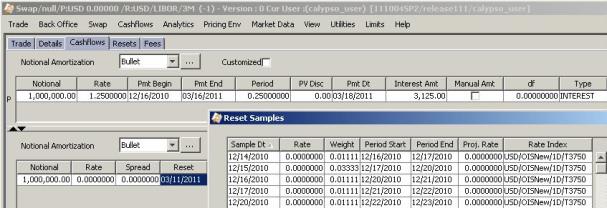

2. Displaying the Cashflows

Select the Cashflows panel for displaying the cashflows.

| » | Right-click a cashflow and choose "Sample Dts" to display the compounding periods. It brings up the Reset Samples window. |

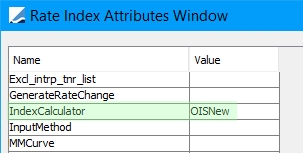

3. Notes on Legacy Calculators

The OIS and OISNew index calculators are considered legacy calculators by Calypso and have been superseded by the DailyCompound and DailyCompound2 calculators. Still functional, information on them is provided here to describe their use.

The OIS and OISNew index calculators are specified using the IndexCalculator attribute in the Rate Index Window attributes.

For details on the specific features of the legacy calculators, please refer to Calypso Getting Started documentation. Additional details are included in the points below.

| • | With DailyCompound/DailyCompound2, you set the compound frequency on the trade. With OIS/OISNew, the compound frequency is hard-coded to DLY (Daily). You cannot select the DLY compounding frequency on the trade - The index calculator manages the daily compounding. When using one of the legacy calculators, the "Compounding Freq" drop-down setting on the rate index must be NON. |

| • | With OISNew, USE_ARREAR_ADJ is set to true to calculate convexity adjustments. For OIS, it is hard-coded to false. |

| • | Note that when IndexCalculator = OISNew and OISMethod=OIS, compounding behaves the same as though IndexCalculator = OIS. |

Please refer to Calypso Getting Started documentation for details on defining overnight rate indices.

Please refer to Calypso Getting Started documentation for details on defining overnight rate indices.