Capturing Credit Contingent Swap Trades

A Credit Contingent Swap contains an underlying swap contingent upon credit events.

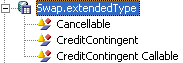

To enable the Credit Contingency feature, create the domain “Swap.extendedType” and add the CreditContingent and “CreditContingent Callable” values to that domain. Note that domain values are case sensitive.

Choose Trade > Interest Rates > Swap to open the Swap worksheet, from the Calypso Navigator or from the Trade Blotter.

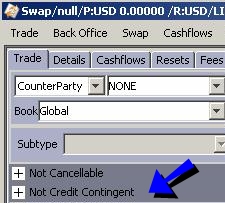

The Credit Contingent area is added to the swap worksheet. The trade is marked "Not Credit Contingent" by default.

Click + to view the Credit Contingent details.

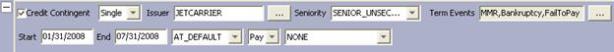

| » | Check the Credit Contingent checkbox to make the swap sensitive to credit events, then enter the credit details. |

The swap is sensitive to credit events between the Start and End dates defined here.

| » | Then enter more trade details as described in Capturing Swap Trades. |

| » | You can define and apply credit events from the Calypso Navigator using Trade Lifecycle > Corporate Action > Credit Events. |

Credit Contingent Details

| Fields | Description | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Credit Contingent |

Check the “Credit Contingent” checkbox to indicate that the trade is sensitive to credit events, or uncheck otherwise. |

||||||||||||||||||

|

Credit Type |

Choose Single or Basket. Single

Basket

|

||||||||||||||||||

|

Term Events |

Click ... to select the credit events to which the trade is sensitive. |

||||||||||||||||||

|

Start Date End Date |

Enter the start and end date of credit contingency. The trade will only be sensitive to credit events between the start and end dates. |

||||||||||||||||||

|

Settlement Details |

Select whether the settlement is done when a default occurs (AT_DEFAULT) or at maturity (AT_MATURITY). Select the direction of the settlement: Pay or Rec. Select the type of settlement:

|