Capturing Chilean Camara Swap Trades

Camara swap trades are swap trades on the Chilean ICP rate indices in Chilean Peso and Chilean UF - They require additional setup.

|

Camara Swaps Quick Reference

|

1. Defining the ICP Rate Indices

From the Calypso Navigator, choose Configuration > Interest Rates > Rate Index Definitions.

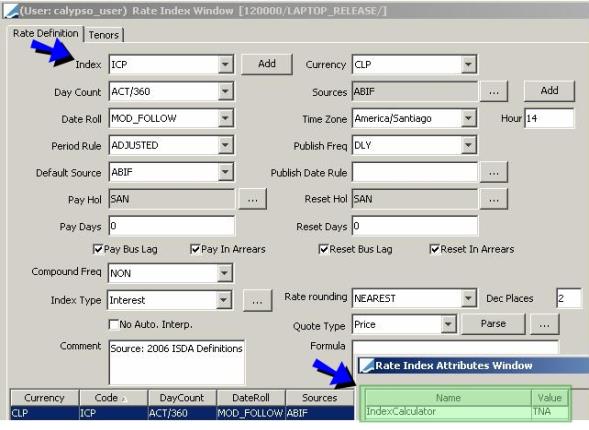

ICP on CLP Setup

The Rate Definition panel is selected by default.

| » | Click Add to add the index name, ICP for example. |

| » | Click Attributes and set the following attribute. It brings up the Rate Index Attributes window. You can click ... in the Rate Index Attributes window to add the attribute if it does not exist. |

Note that the attributes and their values are case sensitive.

| – | IndexCalculator = TNA |

| » | Click Save to save your changes. |

| » | Then select the Tenors panel to define the 1D tenor for the rate index, and click Save to save your changes. |

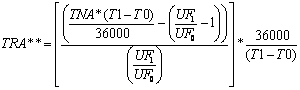

TNA = Round(((ICP1 / ICP0) - 1) * 36000 / (T1-T0);2)

Where ICP1 – value at T1, and ICP0 = value at T0

T1= end calculation period

T0 = start calculation period

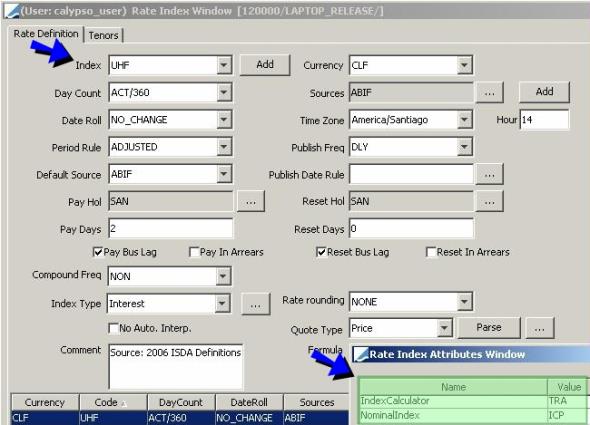

ICP on CLF Setup

The Rate Definition panel is selected by default.

| » | Click Add to add the index name, UHF for example. |

| » | Click Attributes and set the following attributes. It brings up the Rate Index Attributes window. You can click ... in the Rate Index Attributes window to add the attribute if it does not exist. |

Note that the attributes and their values are case sensitive.

| – | IndexCalculator = TRA |

| – | NominalIndex = Rate index name of the ICP rate index in CLP (TRA is derived from TNA and the CLF/CLP rates) = ICP in this example |

| » | Click Save to save your changes. |

| » | Then select the Tenors panel to define the 1D tenor for the rate index, and click Save to save your changes. |

Where UF1=value at T1 and UF0 = value at T0

T1= end calculation period

T0 = start calculation period

2. Sample Curve Underlying Swap

You can define the underlyings from the Zero Curve window.

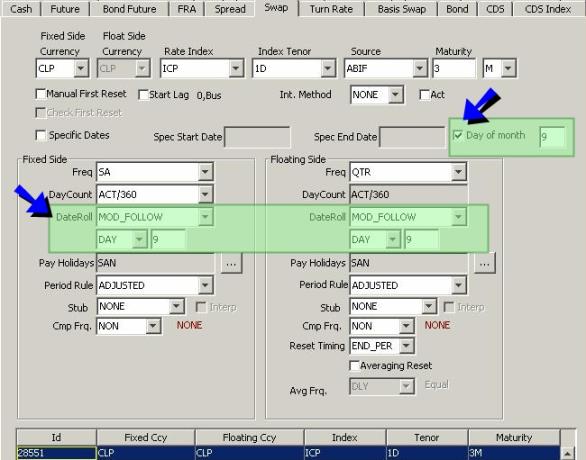

The swapsare defined with payment on the 9th day, and with termination on the 9th of the termination month.

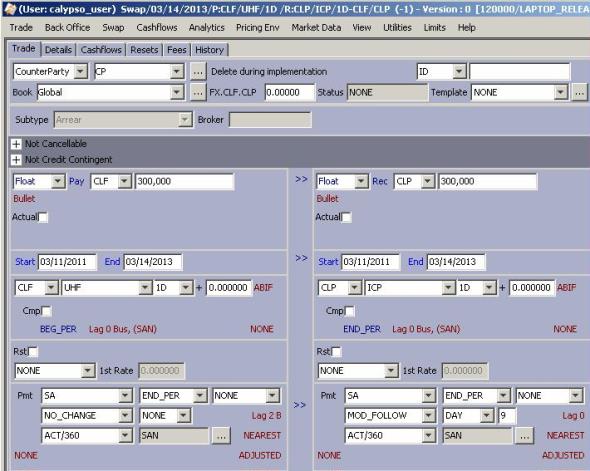

3. Capturing Camara Swap Trades

Choose Trade > Interest Rates > Swap to open the Swap worksheet, from the Calypso Navigator or from the Trade Blotter.

| » | Choose the indices, and set up the swap to match the term sheet. |

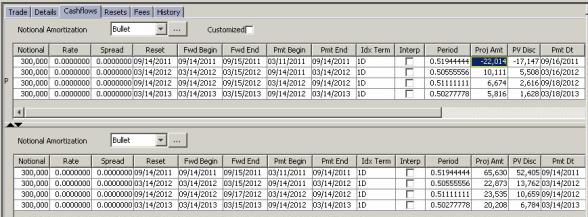

Cashflows

Select the Cashflows panel for displaying the cashflows.

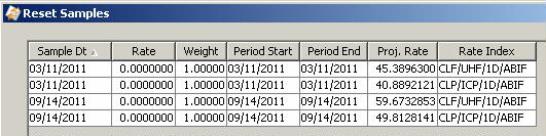

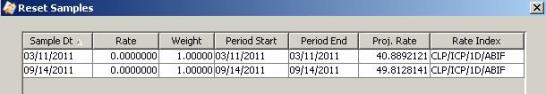

| » | Right-click a cashflow and choose Sample Dts to display the rates used in the calculations.It brings up the Reset Samples window. |

The TRA index will display four values, while the TNA index will display two. Known rates/values are from the quote set. Forecast rates are the one-day forward rates.