Capturing Cancelable Swap Trades

A cancelable swap contains an underlying swap with the option to cancel it in the future.

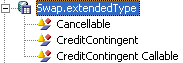

To enable the Cancelable feature, create the domain “Swap.extendedType” and add the Cancellable value to that domain. Note that domain values are case sensitive.

Choose Trade > Interest Rates > Swap to open the Swap worksheet, from the Calypso Navigator or from the Trade Blotter.

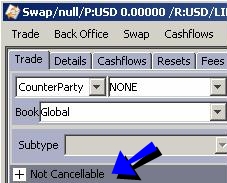

The Cancellable area is added to the swap worksheet. The trade is marked "Not Cancellable" by default.

Click + to view the Cancelable details.

| » | Check the Cancellable checkbox to make the trade cancelable, then specify the cancelable details described below. |

| » | Then enter more trade details as described in Capturing Swap Trades. |

| » | You can cancel the trade using Back Office > Exercise, or from the Calypso Navigator using Trade Lifecycle > Exercise & Expiration > Option Exercise - Help is available from that window. |

Cancelable Details

| Fields | Description |

|---|---|

|

Cancellable |

Check the Cancellable checkbox to indicate that the trade is cancelable, or uncheck otherwise. |

|

BUY/SELL |

Select BUY or SELL, the direction of the trade from the book’s perspective. |

|

Call Type |

Select European, Bermudan, or American. See below for details. |

European

The trade can only be canceled on the expiration date.

| » | Enter the expiration date in the Exp Dt field. If you enter a non-business day, it will automatically move to the previous business day. |

| » | Click Expiry Time to enter the expiration time, and select the corresponding timezone and holiday calendars. |

| » | The delivery date defaults to the spot date for the selected currency. You can modify as needed. You can also enter the number of lag days in the adjacent field and select whether the lag days are business days or calendar days. |

| » | Enter the fee amount in the Fee field, and select the fee currency from the adjacent field. |

Or you can enter a percentage to compute the fee - Check the “as percent” checkbox, and enter a percentage in the adjacent field.

Bermudan

The trade can be canceled according to a user-defined schedule.

| » | The Exp Dt and Del Dt fields in the Trade panel are not editable. |

| » | Click Expiry Time to enter the expiration time, and select the corresponding timezone and holiday calendars. |

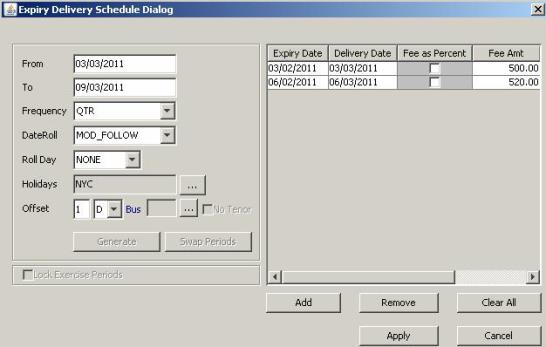

| » | Click Exp/Del Schedule to define the cancellation schedule. |

Enter From and To dates, select a frequency, a date roll and holiday calendars (for the expiration date and for the delivery date).

Enter a number of lag days to compute the delivery date based on the actual call date. And select Bus if the lag days are business days, or Cal for calendar days.

Then click Generate to generate the schedule.

You can also click Add to add specific dates.

You can enter the fees in the delivery schedule in percentage or in amounts. The Fee currency is selected in the "Cancellable" area.

Then click Apply to save the schedule.

| » | Select the Fee currency. |

American

The trade can be canceled within a date range.

| » | Enter the expiration date in the Exp Dt field. Enter the expiration time and select the timezone from the adjacent fields. |

| » | Click Expiry Time to enter the expiration time, and select the corresponding timezone and holiday calendars. |

| » | Enter the first exercise date in the First Ex Dt field. The trade can be canceled between the first exercise date and the expiration date. |

| » | The delivery date defaults to the spot date for the selected currency. You can modify as needed. You can also enter the number of lag days in the adjacent field and select whether the lag days are business days or calendar days. |

Ⓘ [NOTE: Fee schedules are not taken into account for American cancelable swaps]