Generating a Clearing Statement

You can generate a statement for a clearing account to report all the activity on the account: deals, fees, and margin calls.

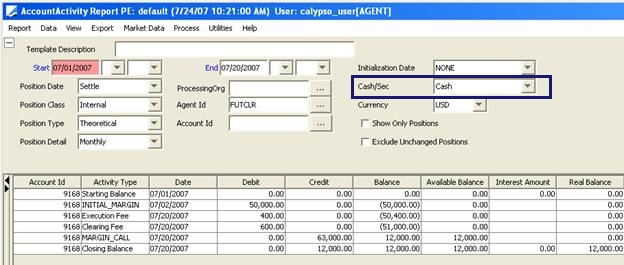

You can also run the Activity Report on the clearing account to view all the activity on the account. From the Calypso Navigator, navigate to Reports > Nostro / Custodian Positions > Account Activity.

In this example, there was an initial margin for $50,000.00 entered as a simple transfer, then a future trade with clearing fees and execution fees, and a margin call computed by the EOD_BROKER_VALUATION scheduled task.

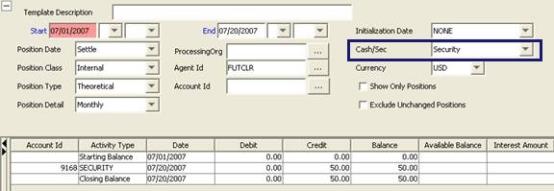

The trade is visible on the Security side of the report.

The activity on the clearing account is computed by the inventory engine based on all the transfers registered on the clearing account (inventory position / back office position).

Refer to the Calypso Cash Management User Guide for information on computing inventory positions.

Clearing Statement Generation Flow

1. Setup Requirements

The clearing account requires additional setup in order to generate a statement: you need to indicate the message configuration to be used to generate the statement.

1.1 Message Configuration

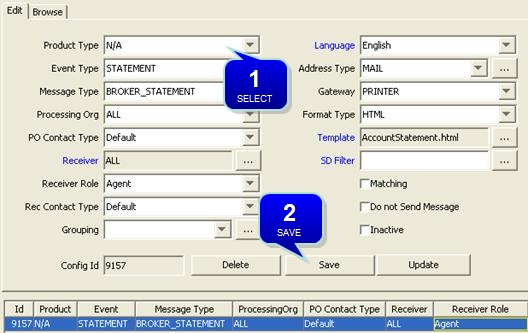

From the Calypso Navigator, navigate to Configuration

> Messages & Matching > Message Set-Up (menu action refdata.AdviceSetupWindow).

Step 1 - Select the product type “N/A”, the event type STATEMENT, the message type BROKER_STATEMENT, and the role Agent.

Fill in the other fields as needed.

Step 2 - Click Save to save the configuration.

Message Keywords

The following message keywords are specific to the message type BROKER_STATEMENT.

| Keyword Names | Description |

|---|---|

| ACCOUNT_OWNER | First Name and Last Name of the Legal Entity Contact. |

| ACCOUNT_NAME | Account Name. |

| PREV_STATEMENT_DATE | Previous Statement Date. |

| STATEMENT_DATE | Statement Date. |

| STATEMENT_CURRENCY | Statement Currency. |

| STATEMENT_DETAILS | TRADE DATE, TRANSFER TYPE, TRANSFER ID, SETTLE_DATE, DEBIT AMOUNT, CREDIT AMOUNT, BALANCE. |

1.2 Account Configuration

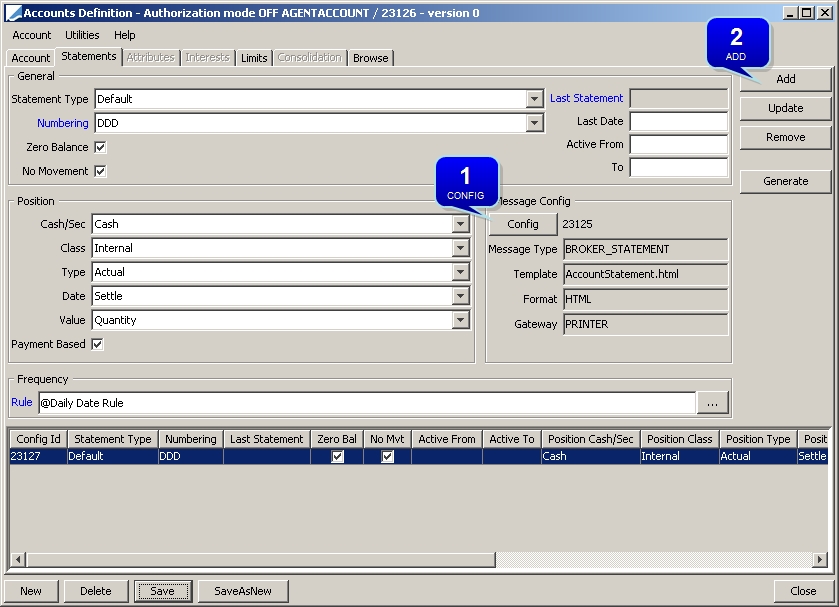

Select the Statements panel to define the statement configuration.

Step 1 - Select the position for which you want to generate the statement and click Config in the Message Config area. In the Message Configuration Setup Window that is then displayed, double-click the message configuration of the BROKER_STATEMENT message previously configured. This loads the related data in the Message Config area.

Step 2 - Click Add and Save. You may want to configure a statement for the Cash position and another statement for the Security position.

2. Running the ACCOUNT_STATEMENT Scheduled Task

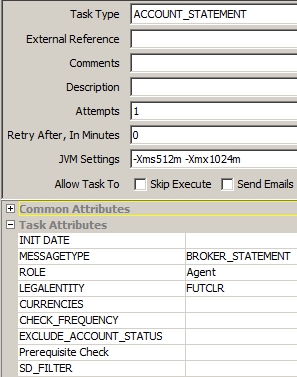

From the Calypso Navigator, navigate to Configuration > Scheduled Tasks (menu action scheduling.ScheduledTaskListWindow), and create a scheduled task of type ACCOUNT_STATEMENT.

| » | Select a Trade Filter, Pricing Env and a Processing Org. |

| » | Set the attributes as needed: |

| – | MESSAGETYPE - BROKER_STATEMENT |

| – | ROLE - Agent |

| – | LEGALENTITY - Clearer (FUTCLR in this example) |

| » | Save the scheduled task and execute it as applicable. |

The scheduled task generates a STATEMENT event that will be picked up by the message engine in order to generate the BROKER_STATEMENT message. Therefore, the message engine should be running.

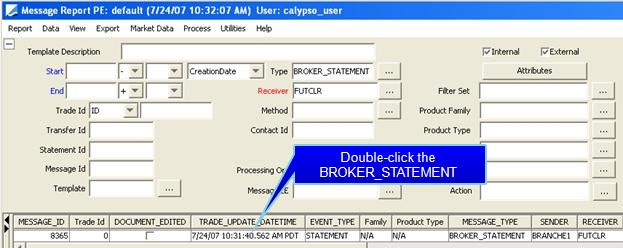

3. Viewing the Results

Run the Message report.

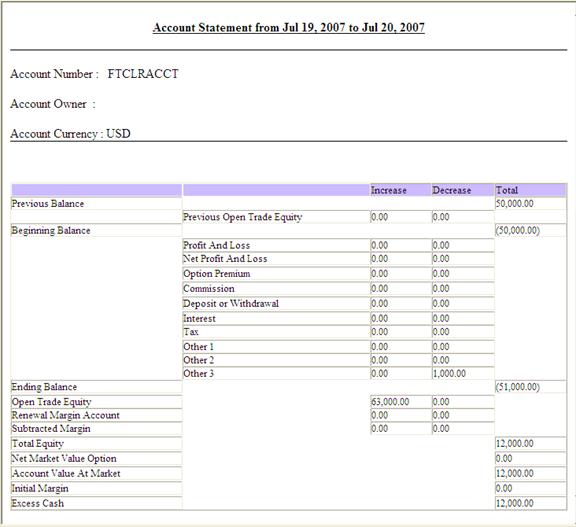

The rows of the statement are populated based on the types of transfers.

| Rows | Transfer Type |

|---|---|

|

Previous Open Trade Equity |

Sum of MARGIN_CALL transfers prior to statement end date. |

|

Profit And Loss |

REALIZED transfers. |

|

Option Premium |

PRINCIPAL transfers. |

|

Commission |

COMMISSION and EXECUTION transfers. |

|

Deposit or Withdrawal |

DEPOSIT and WITHDRAWAL transfers. |

|

Interest |

INTEREST transfers. |

|

Tax |

TAX transfers. |

|

Other 1 |

OTHER1 transfers. |

|

Other 2 |

OTHER2 transfers. |

|

Other 3 |

OTHER3 transfers, and all other types of transfers not categorized here. |

|

Open Trade Equity |

MARGIN_CALL transfers on statement end date. |

|

Renewal Margin Account |

RENEWAL_MARGIN transfers. |

|

Subtracted Margin |

SUBST_MARGIN transfers. |

|

Total Equity |

= Ending Balance + Open Trade Equity + Renewal Margin Account + Subtracted Margin |

|

Net Market Value Option |

NPV transfers. |

|

Account Value At Market |

= Total Equity + Net Market Value Option |

|

Initial Margin |

INITIAL_MARGIN transfers. |

|

Excess Cash |

= Account Value At Market + Initial Margin |