Capturing Forward Starting Trades

In a forward starting trade, the two parties agree to a rate that is set at a forward specified date. The rate is set based on a fixing and then adjusted with specified basis points or a percentage of the fixing rate. In Calypso, you are able to configure a forward starting forward, swap or NDF trade.

The forward start trades have product names that begin with FXForwardStart. After the reset date, the product name of the newly created trade (or child trade) is no longer labeled a forward start. For example, FXForwardStartFXForward become an FXForward trade after the fixing.

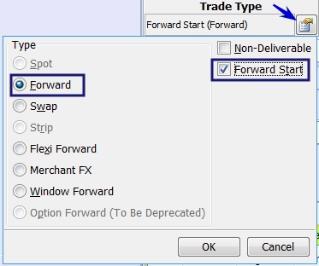

Step 1 - To begin to capture a Forward Starting trade in Deal Station, select Forward Start in the Trade Type selection window.

Step 2 - Select the Forward Start Reset and the reset date

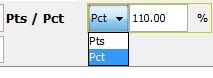

Step 3 - You can also specify basis points or a percentage to be added to the fixing rate.

Points may be entered as either a positive or a negative value. Percentage, however, can be entered as a positive value only. For example, entering a value of 110% means that the value will be the fixing rate plus 10%. If the fixing rate was 1.30 then the FX rate would be 1.43 (1.30 +.13). If the value entered was 90%, the FX rate would be 1.17 (1.30-.13).

Note: For cross fixings, the fix points and percentage rate are only added to the actual cross rate, not the individual fixing rates. For example, if you have a EUR/JPY forward start trade with split fixings and fix points of 50. And on the reset date, the EUR/USD fixing is 1.200 and the USD/JPY fixing is 80.00, this would give a EUR/JPY rate of 96.00. The final forward rate would be 96.00 + 0.50 = 96.50.

Below are some examples of forward starting trades:

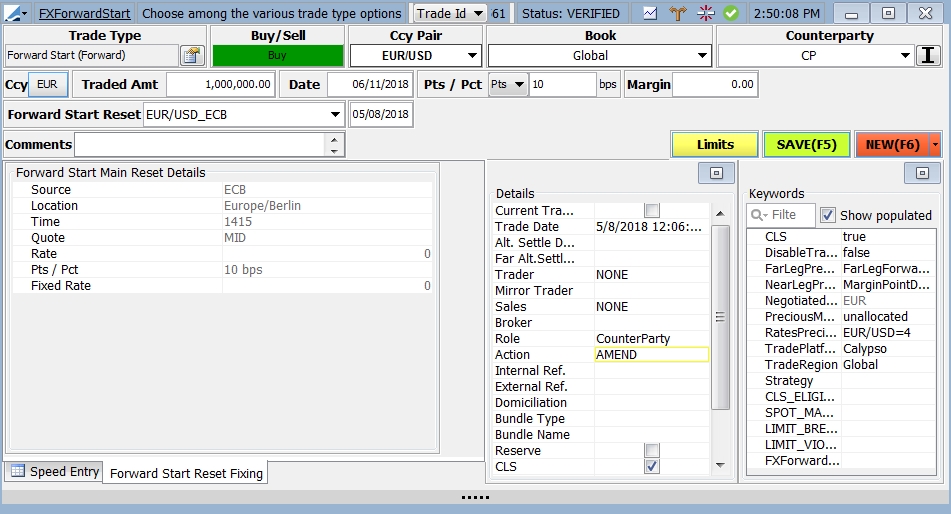

Forward Starting Forward

In this example, this is a 6 month EUR/USD forward with 1 million Euro being the amount traded. The rate will be set using the EUR/USD_BCB reset on May 8, 2018. Ten points will be added to the reset rate.

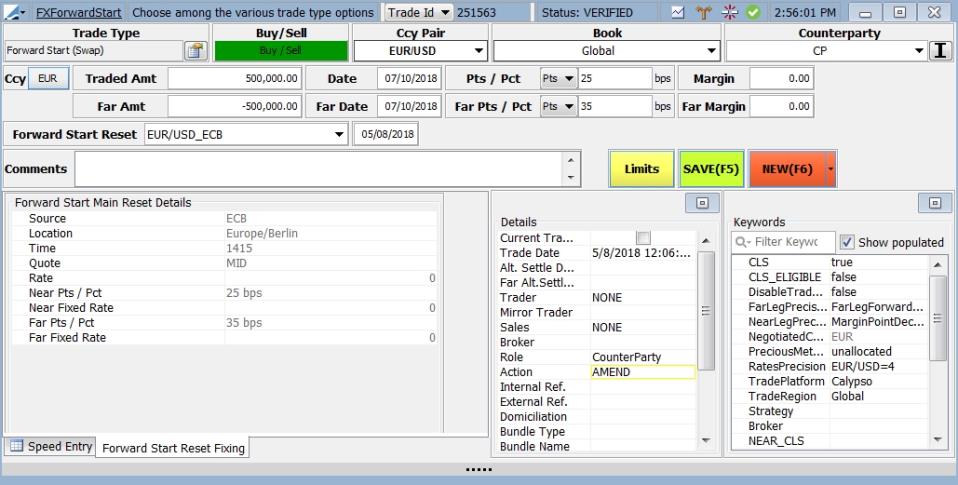

Forward Starting Swap

This is an example of a 1 year EUR/USD swap. The rate is set using the EUR/USD_ECB reset rate on May 8, 2018. 25 basis points are added onto the near rate and 35 are added onto the far rate.

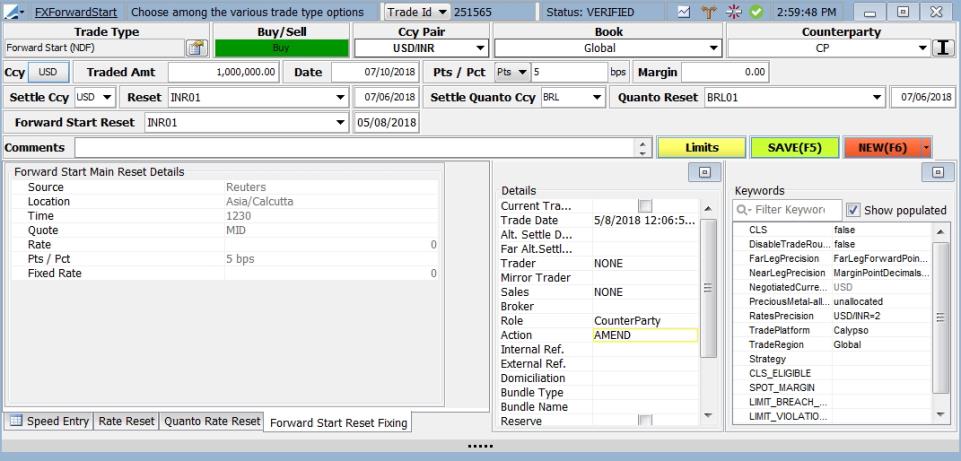

Forward Starting NDF

The example below is a forward start USD/INR NDF trade with 1 million USD being the trade amount. The forward start rate is set on May 8, 2018 using the INR01 reset rate. This trade will settle in BRL using the BRL01 reset rate.

1. Forward Start Keywords

| » | The linking keyword on the parent Forward Start trade is FXForwardStartChildTradeId and is only populated when the underlying child trade is created. |

| » | The child trade is created when the forward start reset is fixed. |

| » | The keyword on the child trade that links back to the parent Forward Start trade is FXForwardStartParentTradeID. |

| » | The keywords listed under the domain FXForwardStartKeywordsToCopy will be copied over from the parent Forward Start trade to the new child underlying trade when the forward start reset is fixed. |

2. Forward Starting Pricer

The pricer used for Forward Starting FX trades is FXForwardStart.

3. Importing Forward Start Trades

There is trade import support for the FX Forward Start product. The columns in the .csv files are:

|

Column |

Description |

|---|---|

|

Fwd Start Und Type |

The type of forward start. Supported types are FXForward, FXNDF, FXSwap and FXNDFSwap |

|

Fwd Start Fixing Date |

Fixing date of the forward start |

|

Fwd Start FX Reset |

FX reset name for the forward start fixing. This is populated for straight currency pairs or for cross pairs that are not fixed using splitting. |

|

Fwd Start Split Reset |

This represents the FX reset pair name for the cross currency pair if the forward start is for a cross currency pair that is fixed using split fixings. |

|

Split Ccy |

This is populated with the split currency if the forward start is for a cross currency pair that is fixed using split fixings. |

| Near Leg POF Type |

Points over fixing type for the forward start with underlying FXForward or FXNDF. If the underlying is FXSwap or FXNDFSwap, this represents the points over fixing type for the near leg of the underlying swap. The valid types supported are 'FixedPoints' and 'Percent'. |

|

Near Leg POF |

Points over fixing value for the forward start with underlying FXForward or FXNDF. If the underlying is FXSwap or FXNDFSwap, this represents the points over fixing value for the near leg of the underlying swap. |

|

Far Leg POF Type |

Points over fixing type for the forward start with underlying FXSwap or FXNDFSwap. This represents the points over fixing type for the far leg of the underlying swap. The valid types supported are 'FixedPoints' and 'Percent'. |

|

Far Leg POF |

Points over fixing value for the forward start with underlying FXSwap or FXNDFSwap. This represents the points over fixing value for the far leg of the underlying swap. |

| » | In addition, the forward start trade import includes the currency pair and other relevant trade attributes, including negotiated currency, negotiated amount in the negotiated currency, and margin (near and far), if needed. |

| » | The trade import details for the forward start can skip the rates - spot, points, negotiated rate, etc - as they aren't used in forward start trade lifecycle. |

| » | When the forward start trade is "fixed", the new underlying product trade will be created. Therefore, the forward start trade import should ensure that all the product details for the underlying trade are input with the import for the forward start. |

For example, if the forward start is being imported with underlying product type of FXNDF, then the forward start import should also contain all the non-deliverable product details, including the NDF reset information like FX reset, reset date, settle currency, etc...

4. Undo Rate Reset

When a trade or series of trades are reset using the scheduled task process or are reset manually using the FX Rate Reset window, the reset trades are stamped with the relevant reset rate. In the event that a mistake has been made, such as an incorrect reset rate being entered on the forward start trade, you have the ability to either run the scheduled task action UNDO_RATERESET or applying a manual UNDO_RATERESET.

When this action takes place the following will happen:

| • | The trade status of the child trade will be CANCELLED |

| • | The forward start trade status will revert back to what it previously was (e.g. VERIFIED) |

| • | The Details window Action will be set to FO_Amend or BO_Amend (depending on user) to indicate that the trade was previously reset |

| • | In the forward start trade the reset details will be empty |

You cannot apply the UNDO_RATERESET action on trades that don't have a status of RATE_RESET.

You cannot apply UNDO_RATERESET to trades where the fixing date is less than Today.