FX Position Monitor

The Calypso FX Position Monitor provides the ability to quickly assess risk, determine profitability and react to changes in the market. It also enables the ability to efficiently manage and mitigate market risk and lock in profitability.

The Position Monitor receives updates from the Position Keeping Server, as well as the Market Data Server (which is contained in the Risk Server). During each refresh cycle, the Position Monitor picks up the latest position and market data.

Note: All visible windows (including floating windows) will be automatically refreshed when new market data is received. Windows or tabs which are not visible will not be refreshed until they are viewed.

There are three components of the Position Viewer:

| • | FX Position Failure Monitor |

| • | FX Position Monitor Configuration |

| • | FX Position Monitor |

All of these can be accessed from Calypso Navigator by choosing Position & Risk > FX Position Monitor. The FX Position Failure Monitor can also be access from FX Deal Station.

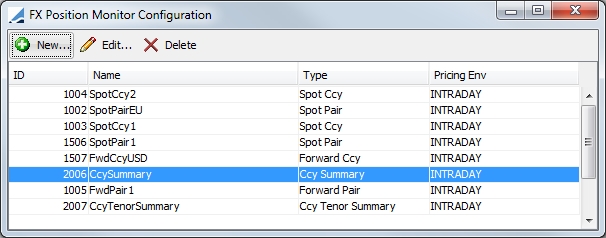

1. FX Position Monitor Configuration

In order to use the FX Position Monitor, you must first establish the configurations. These are set up in the FX Position Monitor Configuration window.

You may view this window by selecting Position & Risk > FX Position Monitor > FX Position Monitor Configuration from Calypso Navigator. Menu action positionkeeping.blotter.configuration.MarksetConfigurationPanel.

The FX Position Monitor Configuration allows you to set up a configuration for each type of position that can be viewed in the Position Monitor:

| • | Spot Pair |

| • | Spot Currency |

| • | Forward Pair |

| • | Forward Currency |

| • | Currency Summary |

| • | Currency Tenor Summary |

You may have more than one configuration for each type of position. All of the selections in each position type will be available for filtering in the Position Monitor. Each configuration can be selected in the Report Catalog for viewing in the Monitor portion of the window. The selection may be filtered further in the Configure Filter area of the window.

Currency positions show the FX positions as well as the cash created from Cash / SimpleMM / Structured Flows trades. For all non-FX trades, the Position Monitor only acts on actual cash positions created in the system via the Position Engine. If there are Simple Transfers (non-PL sell off), Simple MM, Cash or Structured Flows trades configured in the book and you need positions from those trades to show up in the Position Monitor, it is expected that the Position Engine is configured and running to generate the relevant cash positions for those trades. The Position Monitor only shows actual cash positions generated by the system.

Note: To ensure that the Official PL sell off (Simple Transfer) trades' positions are part of the mark reference, the scheduled task CREATE_POS_MON_MARKS must be run after the sell off trades are created. This mark reference (time) can still point to the same EOD as the Official PL task, but the marks scheduled task has to be run after theOfficial PL task has been successfully run.

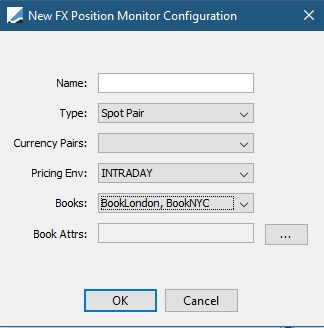

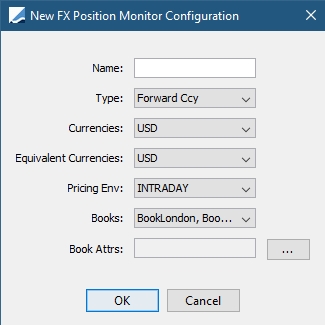

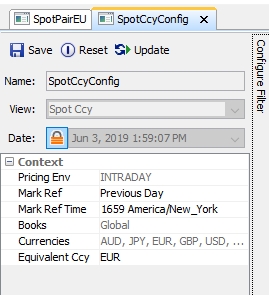

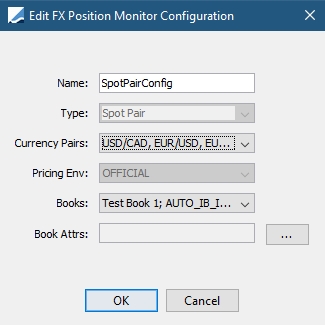

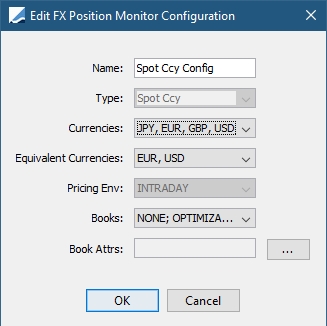

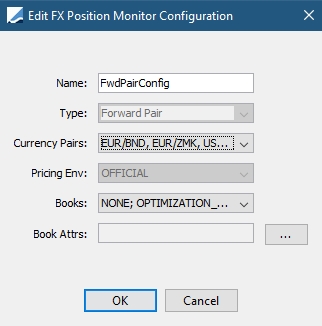

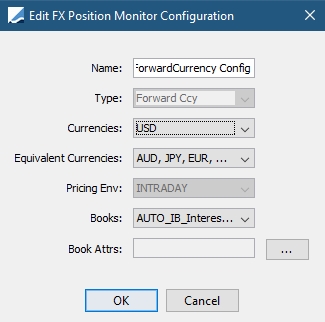

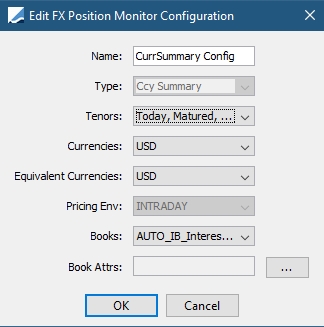

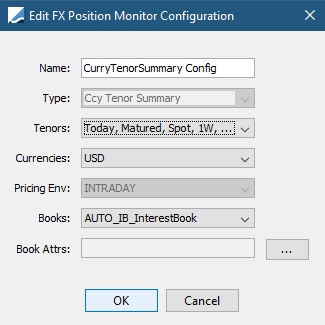

To create a new Position Configuration, select  . There are two versions of the New Configuration window, depending on whether you are configuring a currency or a currency pair.

. There are two versions of the New Configuration window, depending on whether you are configuring a currency or a currency pair.

Configuration for currency pair

Configuration for currency

| » | Currency Summary and Currency Tenor Summary also have Tenors selection fields. |

| » | Equivalent Currencies are used to filter the selection to view a position in terms of a local currency. Calypso uses the market rate to convert a trade currency to the Equivalent Currency. |

| » | The Books and Book Attrs fields can be configured concurrently. The logic for how these fields work is as follows: |

| – | If the Books field and the Book Attrs field is empty, no positions are displayed as at least one criterion needs to be set. |

| – | If the Books field is empty and Book Attributes are defined, positions are shown for books that satisfy the Book Attributes criteria. |

| – | If Books are defined and the Book Attributes field is empty, positions are shown for books that are in the defined list before the introduction of attributes. |

| – | If Books are defined and Book Attributes are defined, positions are shown for the subset of books that are in the defined Books list that also match the Book Attributes criteria. |

| » | For Spot Currency and Spot Pair, the Currencies and / or Currency Pair fields can be left blank. This allows ALL currencies to be applicable in the position. When this setup is used, the Position Monitor will subscribe to market data related to all currencies or currency pairs, irrespective of whether there is an established position for that currency /currency pair or not. Therefore, this setting should only be used when needed. |

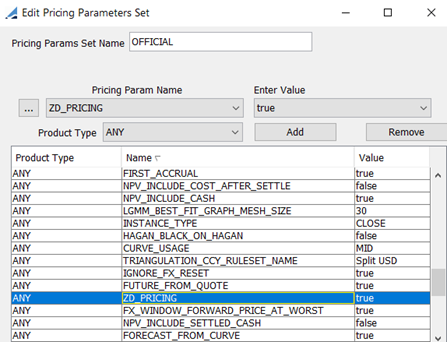

Pricing Environment

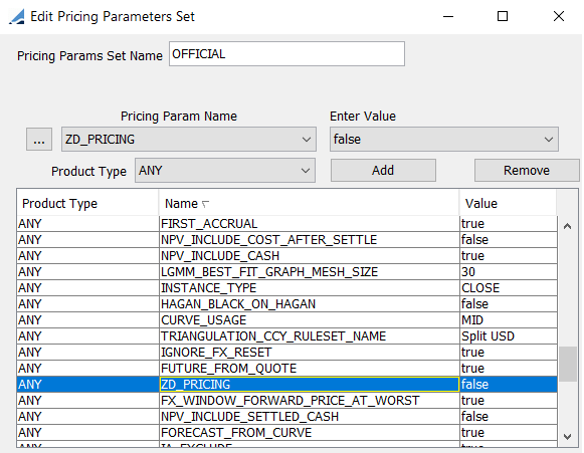

| » | FX Position Monitor Spot views, Spot Currency Pair view and Spot Currency view are not affected by the pricing parameter ZD_PRICING. |

| » | In the Spot views, FX positions up to spot date will not be discounted, and FX positions beyond the spot date will be discounted to spot. |

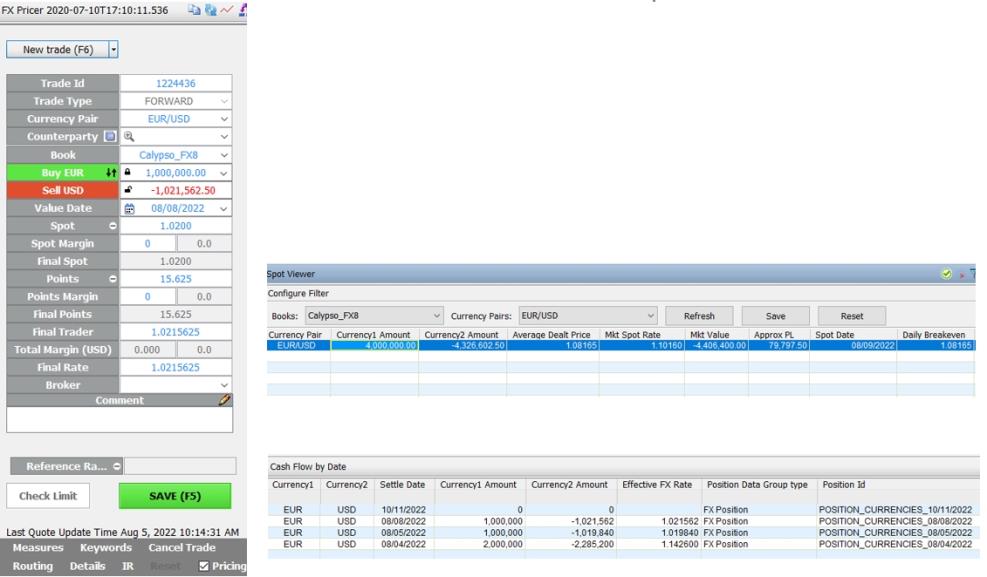

Example - ZD_PRICING set to false

Examples:

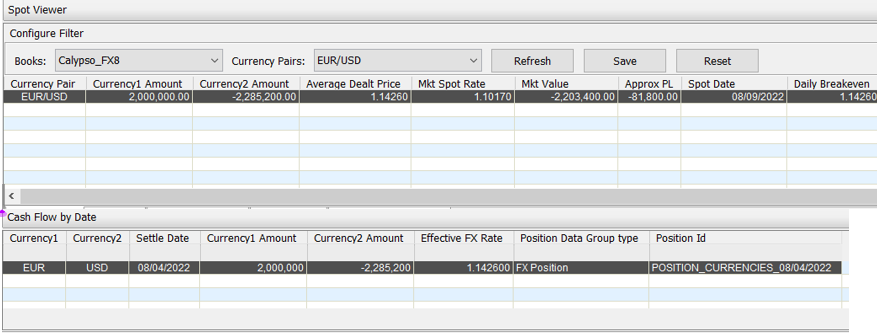

Before new trades are booked, there are some matured positions in the book. They are not discounted in the Spot Currency Pair view:

EUR/USD

EUR/JPY

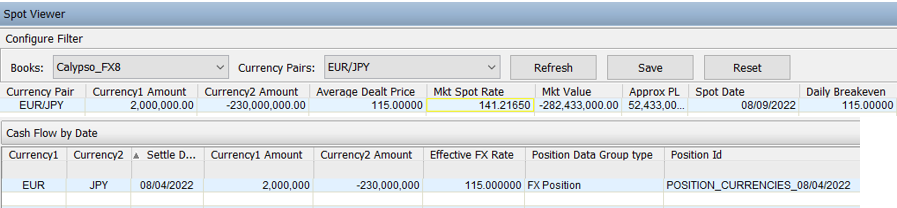

Book an ON trade and the positions from the trade are not being discounted. It can be viewed in the Cash Flow by Date drilldown:

Book a T/N trade and see that the positions from the trade are not being discounted:

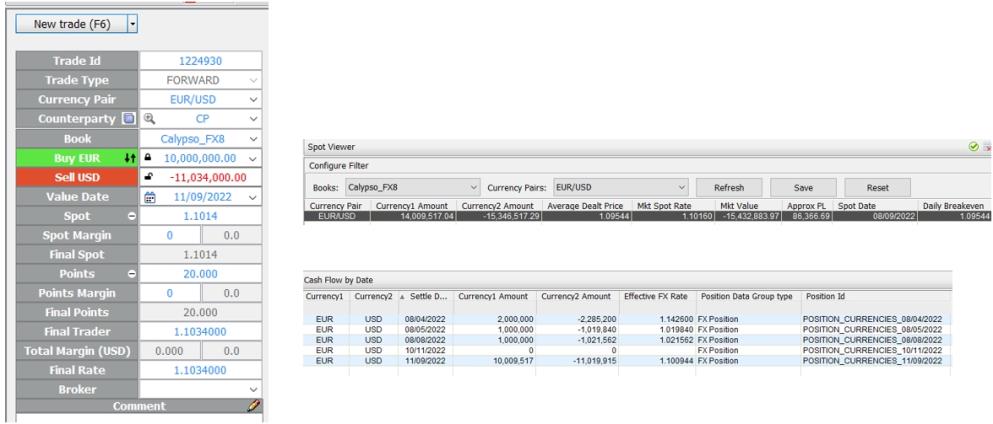

Book a 3M Forward trade and see the 3M positions are discounted to Spot:

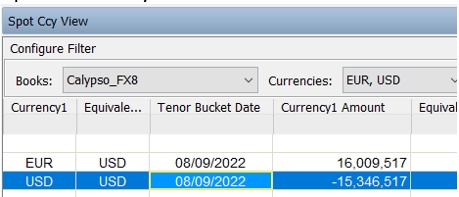

Spot currency views show the same total values:

Example - ZD_PRICING set to true

Set Pricing Parameter ZD_Pricing = true. The Position Monitor Spot views remain unchanged because ZD_Pricing has no effect on Spot Position views:

Settle_Position_Snapshot table in loading Matured Positions

To improve the speed of Initial position loading if the system contains very high numbers of settled FX positions, use Settle_Position_Snapshot for FX Position monitors to calculate current live positions. To configure the environment property,

1) USE_SNAPSHOT_TO_FX_POSITIONS = TRUE

2) Run the CREATE_SNAPSHOT_POSITION scheduled task to generate the snapshot regularly.

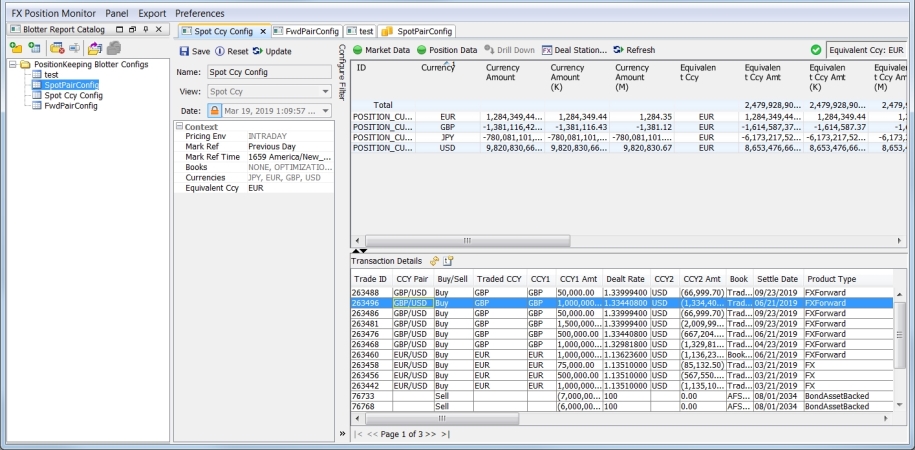

2. FX Position Monitor

The FX Position Monitor allows you to view position data for any of the Position Configurations that have been created. To view the FX Position Monitor, from Calypso Navigator, select Position & Risk > FX Position Monitor > FX Position Monitor. Menu action positionkeeping.blotter.LaunchPositionKeepingBlotter.

A red warning indicator in the upper right side of the window next to the Equivalent Ccy designation, alerts the user if there is an error in risk routing, trade saves, position updates, position saves, etc... Click on the indicator (whether red or green) to display the Position Failure Monitor to investigate the issue. Once the issue is resolved, the indicator returns to green status.

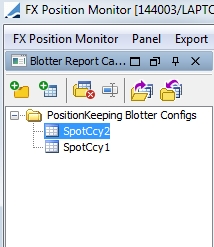

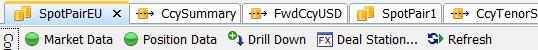

2.1 Configuration Selection - Report Catalog

The Report Catalog is the area used to select and organize the FX Position Monitor Configuration reports. This area is displayed by default when the FX Position Monitor is opened. It may also be displayed by selecting Panel > Report Catalog.

- Add a folder to the Report Catalog

- Add a folder to the Report Catalog

- Add a FX Position Monitor Configuration

- Add a FX Position Monitor Configuration

- Delete the current selection (either a folder or report configuration)

- Delete the current selection (either a folder or report configuration)

- Rename selected report

- Rename selected report

- Open the selected report or reports (To select multiple reports, hold the control key and select the desired reports.)

- Open the selected report or reports (To select multiple reports, hold the control key and select the desired reports.)

- Close the selected report or reports (To select multiple reports, hold the control key and select the desired reports.)

- Close the selected report or reports (To select multiple reports, hold the control key and select the desired reports.)

2.2 Position Monitor Filtering

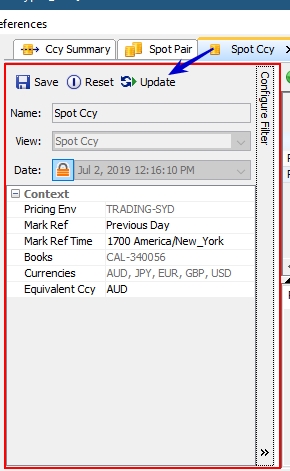

The Configuration Filter is an area that allows for the selection of criteria for the Position Monitor display. In many of the fields, the data available for selection comes from the Position Monitor Configurations for the selected position type.

| » | Books, Currencies and Currency Pairs are designated in the Position Monitor Configuration. They appear in the Filter section for display only. |

| » | An Equivalent Currency can be selected to filter the selection to view a position in terms of a local currency. Calypso uses the market rate to convert a trade currency to the Equivalent Currency. |

| » | When you make any changes to the filter, click the Update button  to update the Position Monitor's display. When this button is clicked it will also re-load the positions and save any changes made to the filter. to update the Position Monitor's display. When this button is clicked it will also re-load the positions and save any changes made to the filter. |

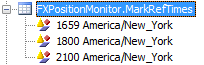

| » | The choices for the Mark Ref Time field are configured via the FXPositionMonitor.MarkRefTimes domain value. The format for this value is hhmm Timezone_name. For example, 1659 America/New_York. |

| » | Click Save to save the filter configuration. The saved configuration will be displayed for the selected position type when the Position Monitor is opened. |

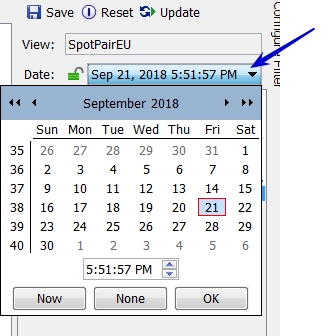

| » | By default, the display will contain live data. You may edit the Date Time by clicking the  and then clicking in Date area and then enter the date and time for which you would like to view position data. and then clicking in Date area and then enter the date and time for which you would like to view position data. |

| » | Tenor choices are given for actual days from spot next to 1 week. For forward views, there may be tenors that have the same bucket date. In those cases, if there are positions for that date, those positions will be displayed in the farthest/highest tenor with that date. Additional tenors can be configured in the FxPositionMonitor.ForwardTenors domain value. |

| » | When any field in the Filter section is changed, a red border appears around the area to indicate that the position needs to be updated. The border is removed after the user clicks the Update button. |

2.3 Position Monitor Display

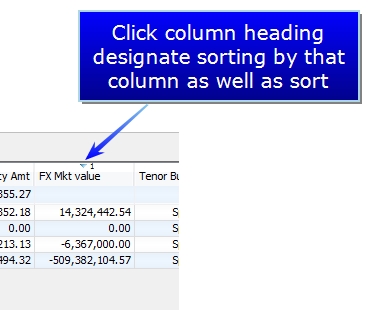

The area of the Position Monitor that contains the actual position information contains data columns that can be used in various views. These columns can be configured in specific ordering and sorting, much like other blotters in Calypso. The column headings can be selected to order the sorting as well.

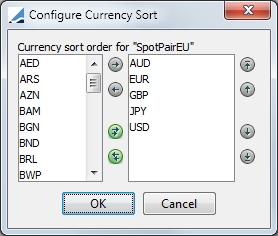

Currencies can be sorted as well via the Currency Sort window which is accessed from Preferences > Currency Sort.

The window contains tabs for each Configuration that has been loaded.

The data available for viewing depends on the Type of configuration selected.

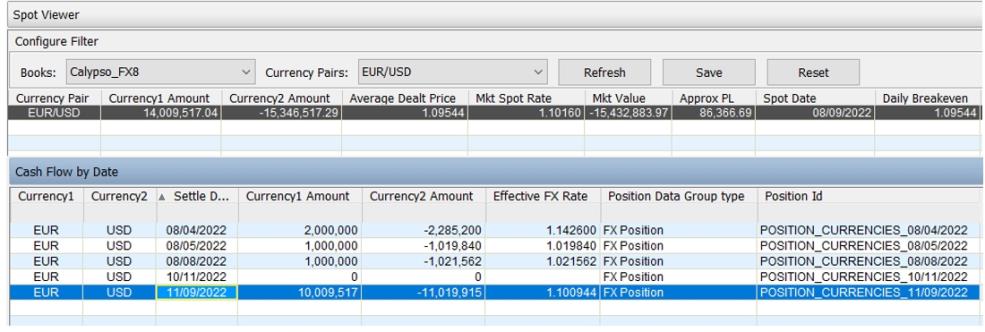

Spot Pair

Manage multiple currency pairs, track average price for the currency pair as well as track daily P&L. All the positions that settle after the spot date are also included but the amounts from those positions are Present Valued to spot.

The columns available in the Spot Pair view are:

| Column | Description |

|---|---|

|

ID |

Internal Id for the bucketed row |

|

Tenor Bucket |

Identifies the tenor |

|

Bucket Date |

Last date of the tenor bucket |

| CurrencyPair |

Identifies the currency pair |

|

Ccy1 |

Primary currency of the pair pos ref currency pair |

|

Ccy2 |

Quoting currency of the pair pos ref currency pair |

|

Ccy1 Amt |

Primary currency amount |

|

Ccy1 Amt (K) |

Primary currency amount displayed as multiple of thousands |

|

Ccy1 Amt (M) |

Primary currency amount displayed as multiple of millions |

|

Ccy2 Amt |

Quoting currency amount |

|

Ccy2 Amt (K) |

Quoting currency amount displayed as multiple of thousands |

|

Ccy2 Amt (M) |

Quoting currency amount displayed as multiple of millions |

|

Avg Dealt Price |

Ccy2 Amt / Ccy1 Amount |

|

Mkt Spot Rate |

Spot rate from market data, MID rate |

|

Mkt Spot Rate Change |

Change in the current rate updated from the previous rate |

|

FX Mkt Value |

Ccy1 amount * Mkt Spot Rate |

|

Delta Ccy |

Delta display currency from the currency pair definition |

|

Delta Ccy Amount |

(Ccy1 or Ccy2 amount, whichever is the risky currency, converted to delta display currency) * -1 |

|

Avg Dealt Price (Ccy1 to PE Base) |

(Ccy2 Amt converted to PE Base currency)/Ccy1 Amt |

|

FX EOD Rate |

FX forward rate for the tenor/bucket date from the mark. Despite the name, it is actually the MID rate. |

|

Move Since EOD |

Movement in the rate since the mark. (FX EOD Rate - Mkt Spot Rate) |

|

Trades Since EOD (Ccy1) |

Ccy1 Amount - Marked Ccy1 Amount |

|

Trades Since EOD (Ccy2) |

Ccy2 Amount - Marked Ccy2 Amount |

|

FX EOD Value |

Reval Ccy2 Amount from mark, i.e. marked Ccy1 Amount * FX EOD Rate |

|

Approx PL |

Ccy1 Amount * (Market Spot Rate - Breakeven Rate) |

|

Approx PL (PE Base) |

Approx PL converted to PE Base currency |

|

Ccy1 Amt EOD |

Primary currency amount at EOD (marked) |

|

Ccy2 Amt EOD |

Quoting currency amount at EOD (marked) |

|

Selloff Amount EOD |

Selloff amounts created from sell off trades generated by the EOD_OFFICIALPL scheduled task. This is zeroed out when FX EOD Marks is run. |

|

Daily Breakeven |

Ccy2 From Breakeven / Ccy2 Amt |

|

Daily Breakeven (Ccy1 to PE Base) |

Daily weighted average rate to PE base currency |

|

Ccy2 From Daily Breakeven |

Trades Since EOD (Ccy2) + FX EOD Value - Selloff Amount EOD |

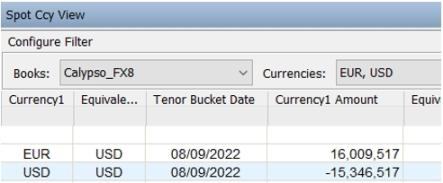

Spot Currency

Currency views are displayed by the traded currency position for spot trades. For example, the Ccy view for EUR displays the EUR portion of a EUR/USD booked trade. In addition to the tenor buckets, there are rows that display any FX Future positions that may be in the book(s). For example, if you have a June 2020 FX Futures position, you can see a row with tenor: June 2020

The equivalent currency can be thought of as the "base" or "reporting" currency. All the positions that settle after the spot date are also included but the amounts from those positions are Present Valued to spot.

The columns available in the Spot Currency view are:

| Column | Description |

|---|---|

|

ID |

Internal Id for the bucketed row |

|

Tenor Bucket |

Identifies the tenor |

|

Bucket Date |

Last date of the tenor bucket |

| Currency |

Identifies the currency |

|

Equivalent Ccy |

Equivalent base/reporting currency |

|

Currency Amount |

Position amount |

|

Currency Amount (K) |

Position amount displayed as multiple of thousands |

|

Currency Amount (M) |

Position amount displayed as multiple of millions |

|

Equivalent Ccy Amt |

Amount in Equivalent Ccy, based on the currency market rates |

|

Equivalent Ccy Amt (K) |

Equivalent Ccy Amt displayed as multiple of thousands |

|

Equivalent Ccy Amt (M) |

Equivalent Ccy Amt displayed as multiple of millions |

|

Avg Dealt Price |

Equivalent Ccy Amount / Currency Amount |

|

Mkt Spot Rate |

Spot rate from market data, MID rate - rate of the position currency against the equivalent currency |

|

Mkt Spot Rate Change |

Change in the current rate updated from the previous rate |

|

Delta Ccy |

Delta display currency from the currency/equivalent currency pair definition |

|

Delta Ccy Amount |

(Currency or equivalent currency amount, whichever is the risky currency, converted to delta display currency) *-1 |

|

FX EOD Rate |

FX forward rate for the tenor/bucket date from the mark. Despite the name, it is actually the MID rate. |

|

Move Since EOD |

Movement in the rate since the mark. (FX EOD Rate - Mkt Spot Rate) |

|

Trades Since EOD (Ccy1) |

Currency Amount - Marked Currency Amount |

|

Trades Since EOD (Ccy2) |

Equivalent Currency Amount - Marked Equivalent Amount |

|

FX EOD Value |

Reval Equivalent Amount from mark, i.e. marked Currency Amount * FX EOD Rate |

|

Reval Diff Since EOD |

Current Equivalent Currency Reval Amount - Marked Equivalent Currency Reval Amount Current Equivalent Currency Reval Amount = Currency Amount * (Avg Price - Mkt Spot Rate) Marked Equivalent Currency Reval Amount = Currency Amt (marked) * (Avg Price marked - FX Rate (Close)). This is essentially the FX Close value. |

|

Currency Amt EOD |

Position amount at EOD (marked) |

|

Selloff Amount EOD |

Selloff amounts created from sell off trades generated by the EOD_OFFICIALPL scheduled task. This is zeroed out when FX EOD Marks is run. |

|

Equivalent Ccy Amt EOD |

Equivalent currency amount at EOD (marked) |

|

Daily Breakeven |

Ccy2 From Breakeven / Ccy2 Amt |

|

Ccy2 From Breakeven |

Trades Since EOD (Ccy2) + FX EOD Value - Selloff Amount EOD |

|

Ccy Daily Avg |

[Trades Since EOD (Ccy1) * Mkt Spot Rate + FX EOD Value] / Currency Amount |

|

Ccy Approx Position PL |

Equivalent Ccy Amt – [Trades Since EOD (Ccy1) * Mkt Spot Rate + FX EOD Value] |

Note: When the domain PositionKeepingBlotterHideColumns is set to true,the Ccy Daily Avg and Ccy Approx Position PL columns will be hidden from view. The default value is true. After switching from false to true, the column selector needs to be applied for the columns to disappear.

Forward Pair

Manage a selected currency pair, select forward tenor buckets, track P&L and risk by bucket. Each row represents a tenor bucket. Depending on the actual position settle date, the position will be placed in the closed tenor bucket.

There is a hard coded list of Tenor Buckets for the Forward Pair view:

|

Matured |

5M |

|

Today |

6M |

|

Tom |

7M |

|

Spot |

8M |

|

1W |

9M |

|

2W |

10M |

|

3W |

11M |

|

1M |

1Y |

|

2M |

18M |

|

3M |

2Y |

|

4M |

Future |

All the positions that settle beyond 2Y are included in the Future bucket.

In addition to the tenor buckets, there are also rows that display any "FX Futures" positions that may be in the book(s). For example if you have a June 2020 FX Futures position, you will see a row with tenor: June 2020

The columns available in the Forward Pair view are:

|

ID |

Internal Id for the bucketed row |

|

Tenor Bucket |

Identifies the tenor |

|

Bucket Date |

Last date of the tenor bucket |

| CurrencyPair |

Identifies the currency pair |

|

Ccy1 |

Primary currency of the pair pos ref currency pair |

|

Ccy2 |

Quoting currency of the pair pos ref currency pair |

|

Ccy1 Amt |

Primary currency amount |

|

Ccy1 Amt (K) |

Primary currency amount displayed as multiple of thousands |

|

Ccy1 Amt (M) |

Primary currency amount displayed as multiple of millions |

|

Ccy2 Amt |

Quoting currency amount |

|

Ccy2 Amt (K) |

Quoting currency amount displayed as multiple of thousands |

|

Ccy2 Amt (M) |

Quoting currency amount displayed as multiple of millions |

|

Avg Dealt Price |

Ccy2 Amt / Ccy1 Amount |

|

Mkt Spot Rate |

Spot rate from market data, MID rate |

|

Mkt Spot Rate Change |

Change in the current rate updated from the previous rate |

|

Points |

Market forward points, MID rate (always picked from the FX curve) |

|

Mkt Forward Rate |

Market forward rate (spot + points), MID rate |

|

FX Mkt Value |

Ccy 1 Amt * Mkt Spot Rate |

|

PV |

Ccy 1 amount discounted from bucket date to spot date |

|

PV (K) |

PV amount expressed as multiple of thousands |

|

PV (M) |

PV amount expressed as multiple of millions |

|

PV01 (Current) |

Ccy1 Amt * (Mkt Spot Rate - Avg Dealt Price) * (Ccy 2 DF from today to bucket date, shifted by 1 basis point) |

|

Avg Dealt Price (Ccy 1 to PE Base) |

(Ccy2 Amt converted to PE Base Ccy) / Ccy1 Amt |

|

FX EOD Rate |

FX forward rate for the tenor/bucket date, from the mark. Despite the name, it is actually the MID rate |

|

Move Since EOD |

Movement in the rate since the mark. (FX EOD Rate - Mkt Spot Rate) |

|

Trades Since EOD (Ccy1) |

Ccy1 Amount - Marked Ccy1 Amount |

|

Trades Since EOD (Ccy2) |

Ccy2 Amount - Marked Ccy2 Amount |

|

FX EOD Value |

Reval Ccy2 Amount from mark, i.e. marked Ccy1 Amount * FX EOD Rate |

|

Approx PL |

Current PL - Marked PL Current PL = Ccy1 Amt * (Avg Price - Mkt Forward Rate) Marked PL = Ccy1 Amt (marked) * (Avg Price marked - FX EOD Rate) |

|

Approx PL (PE Base) |

Approx PL converted to PE Base currency |

|

Ccy1 Amt EOD |

Primary currency amount at EOD (marked) |

|

Ccy2 Amt EOD |

Quoting currency amount at EOD (marked) |

|

Selloff Amount EOD |

Selloff amounts created from sell off trades generated by the EOD_OFFICIALPL scheduled task. This is zeroed out when FX EOD Marks is run. |

|

Daily Breakeven |

Ccy2 From Breakeven / Ccy2 Amt |

|

Daily Breakeven (Ccy1 to PE Base) |

Daily weighted average rate to PE base currency |

|

Ccy2 From Breakeven |

Trades Since EOD (Ccy2) + FX EOD Value - Selloff Amount EOD |

Forward Currency

Currency views are displayed by the traded currency position for forward trades. For example, the Ccy view for EUR displays the EUR portion of a EUR/USD booked trade. The Forward Currency view shows currency positions across various tenors, for one currency at a time, against one equivalent currency. Even if the configuration is defined for multiple currency pairs, the view will only show the position for one selected pair at a time. The equivalent currency can be thought of as "base" or "reporting" currency. Ideally, you would only see one equivalent (base or reporting) currency set up.

Each row represents a tenor bucket. Depending on the actual position settle date, the position will be placed in the closes bucket.

There is a hard coded list of Tenor Buckets for the Forward Pair view:

|

Matured |

5M |

|

Today |

6M |

|

Tom |

7M |

|

Spot |

8M |

|

1W |

9M |

|

2W |

10M |

|

3W |

11M |

|

1M |

1Y |

|

2M |

18M |

|

3M |

2Y |

|

4M |

Future |

All the positions that settle beyond 2Y are included in the Future bucket.

In addition to the tenor buckets, there are also rows that display any "FX Futures" positions that may be in the book(s). For example if you have a June 2020 FX Futures position, you will see a row with tenor: June 2020

The columns available in the Forward Currency view are:

| Column | Description |

|---|---|

|

ID |

Internal Id for the bucketed row |

|

Tenor Bucket |

Identifies the tenor |

|

Bucket Date |

Last date of the tenor bucket |

| Currency |

Identifies the currency |

|

Equivalent Ccy |

Equivalent base/reporting currency |

|

Currency Amount |

Position amount |

|

Currency Amount (K) |

Position amount displayed as multiple of thousands |

|

Currency Amount (M) |

Position amount displayed as multiple of millions |

|

Equivalent Ccy Amt |

Amount in Equivalent Ccy, based on the currency market rates |

|

Equivalent Ccy Amt (K) |

Equivalent Ccy Amt displayed as multiple of thousands |

|

Equivalent Ccy Amt (M) |

Equivalent Ccy Amt displayed as multiple of millions |

|

Avg Dealt Price |

Equivalent Ccy Amount / Currency Amount |

|

Mkt Spot Rate |

Spot rate from market data, MID rate - rate of the position currency against the equivalent currency |

|

Mkt Spot Rate Change |

Change in the current rate updated from the previous rate |

|

Points |

Market forward points, MID rate (always picked off the curve) |

|

Mkt Forward Rate |

Market forward rate (spot + points), MID rate |

|

PV |

Currency amount discounted from bucket date to spot date |

|

PV (K) |

PV amount expressed as multiple of thousands |

|

PV (M) |

PV amount expressed as multiple of millions |

|

PV01 (Current) |

Currency Amt * (Mkt Spot Rate - Avg Dealt Price) * (Equivalent currency DF from today to bucket date, shifted by 1 basis point) |

|

Avg Dealt Price (Ccy 1 to PE Base) |

(Equivalent Currency Amt converted to PE Base Ccy) / Currency Amt |

|

FX EOD Rate |

FX forward rate for the tenor/bucket date, from the mark. Despite the name, it is actually the MID rate |

|

Selloff Amount EOD |

Selloff amounts created from sell off trades generated by the EOD_OFFICIALPL scheduled task. This is zeroed out when FX EOD Marks is run. |

|

Move Since EOD |

Movement in the rate since the mark. (FX EOD Rate - Mkt Spot Rate) |

|

Trades Since EOD (Ccy1) |

Currency Amount - Marked Currency Amount |

|

Trades Since EOD (Ccy2) |

Equivalent Currency Amount - Marked Equivalent Currency Amount |

|

FX EOD Value |

Reval Equivalent Currency Amount from mark, i.e. marked Currency Amount * FX EOD Rate |

|

PV01 (EOD) |

PV01 from the mark |

|

PV01 (Chg Since EOD) |

PV01 Current - PV01 EOD |

|

Currency Amt EOD |

Position amount at EOD (marked) |

|

Equivalent Ccy Amt EOD |

Equivalent currency amount at EOD (marked) |

|

Daily Breakeven |

Ccy2 From Breakeven / Ccy2 Amt |

|

Daily Breakeven (Ccy1 to PE Base0 |

Daily weighted average rate to PE base currency |

|

Ccy2 From Daily Breakeven |

Trades Since EOD (Ccy2) + FX EOD Value - Selloff Amount EOD |

|

Ccy Daily Avg |

[Trades Since EOD (Ccy1) * Mkt Forward Rate + FX EOD Value] / Currency Amount |

|

Ccy Approx Position PL |

Equivalent Ccy Amt – [Trades Since EOD (Ccy1) * Mkt Forward Rate + FX EOD Value] |

Note: When the domain PositionKeepingBlotterHideColumns is set to true,the Ccy Daily Avg and Ccy Approx Position PL columns will be hidden from view. The default value is true. After switching from false to true, the column selector needs to be applied for the columns to disappear.

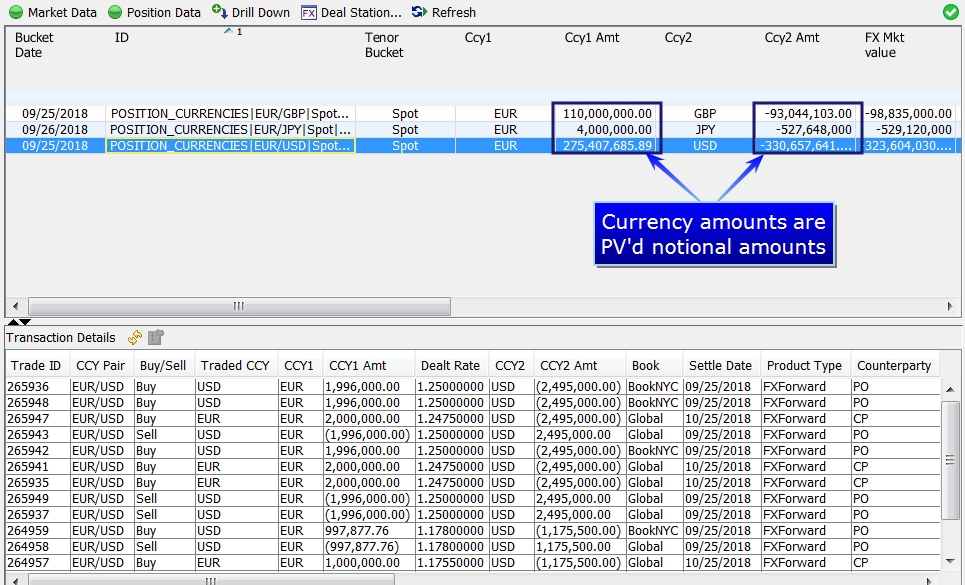

Currency Summary Views

There are two summary views for position by currency.

Currency Summary

Summary of currency across tenors. Displays one row for each configured currency, columns are the tenors configured in the view. There is also a net/total row for the equivalent (base or reporting) currency.

Net Position - Total Position across all tenors

PV Position - The sum of the positions PV-ed from their bucket date to today

Spot Rate - The spot rate to convert the currency positions into the equivalent currency

Currency Tenor Summary

Summary of tenors across currencies. Displays one row for each of the configured tenors in the view and one column each for all of the currencies in the view. A Totals line is displayed at the top to show the total of all the tenors for each currency.

There is also a net/total row for the sum of the positions in each currency across all tenors.

| » | When new position data is added, the row containing the new data flashes a change in color to indicate that there is an update. |

| » | Market data indicators show when rates have gone up or down. |

| » | The column data is configurable through Preferences > Position Monitor Columns. |

| » | There is a Drill Down feature which allows you to view data for the trades contained in the position. Drill Down data is configurable through Preferences > Drill Down Columns. |

| » | It is possible for the user to choose multiple buckets (or all of the buckets) for Cash/Daily Drill down on position reports. This is done by holding down the CTRL key and choosing the desired buckets. The user can also click one row and use the SHIFT key to choose a consecutive group of buckets. |

Note: This feature is not available on Cash/Daily Drill Down for trades.

| » | You are able to export data to a spread sheet or CSV file. |

| » | You are able to freeze live position and/or market data so that the informtion displayed on the blotter is not being continually updated. To do this, click the Market Data or Position Data button: |

Market Data is live -

Market Data is frozen -

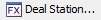

| » | You are able to open Deal Station directly from the Position Monitor by clicking  . . |

| » | Click  to re-load positions for the active view. to re-load positions for the active view. |

| » | The background color changes briefly when there is a change in position. Red indicates a decrease, Green indicates an increase and Turquoise indicates a new position. |

| » | When there is an entry in the Position Keeping Failure Monitor, a red warning sign will flash in the upper right side of the window. Once the issue is resolved, the indicator will return to green. |

| » | Trade statuses in the tradeCancelStatus domain are considered as Cancel statuses. This prevents a PROCESS action on a status in this domain from leading to a second cancellation. |

Note: There is no PV amount for matured buckets.

Drill Down

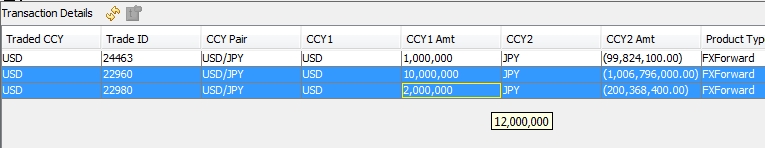

| » | You may drill down to see trade information for any position. To view this information, either select the position row and click  , or double-click on the position row. The columns of the Drill Down tab of the window are configurable through the Preferences menu option Drill Down Columns. When column configurations are edited, click , or double-click on the position row. The columns of the Drill Down tab of the window are configurable through the Preferences menu option Drill Down Columns. When column configurations are edited, click  to refresh the display. to refresh the display. |

| » | The Position Flow Drill Down tab is used to drill down into individual positions within a tenor bucket. |

| » | From the Drill Down area of the window, you may open the actual trade by either double-clicking on the row containing the trade, or by clicking  with the trade row selected. with the trade row selected. |

| » | Select multiple rows, and hover over primary currency to display total primary amount of those rows. |

2.4 Menu Options

FX Position Monitor

The two options in this menu are Distribute and Exit. The Distribute option allows users to distribute Position Monitor data to other users. This includes: the Position Monitor Report Catalog, Position Monitor columns, drill down columns, Position flow drill down preferences and currency sort preferences. Select the items to distribute and choose user groups and / or individual users and click Distribute. The selected items will be made available to the corresponding users.

The Exit menu option is used to close the window.

Panel

This menu option is used to display the Report Catalog.

Export

You may either select to export the position data to a CSV or an XLS file from this menu.

Preferences

From this menu option, you may select to configure the Position Monitor columns or the Drill Down columns. There is also the option to clear all configured column preferences and revert to the default view.

2.5 Logging

Position Monitor view data rows are logged using log category DefaultPositionKeepingBlotterDataProcessor. Context information is logged in an additional category, DefaultPositionKeepingBlotterDataProcessor-Context.

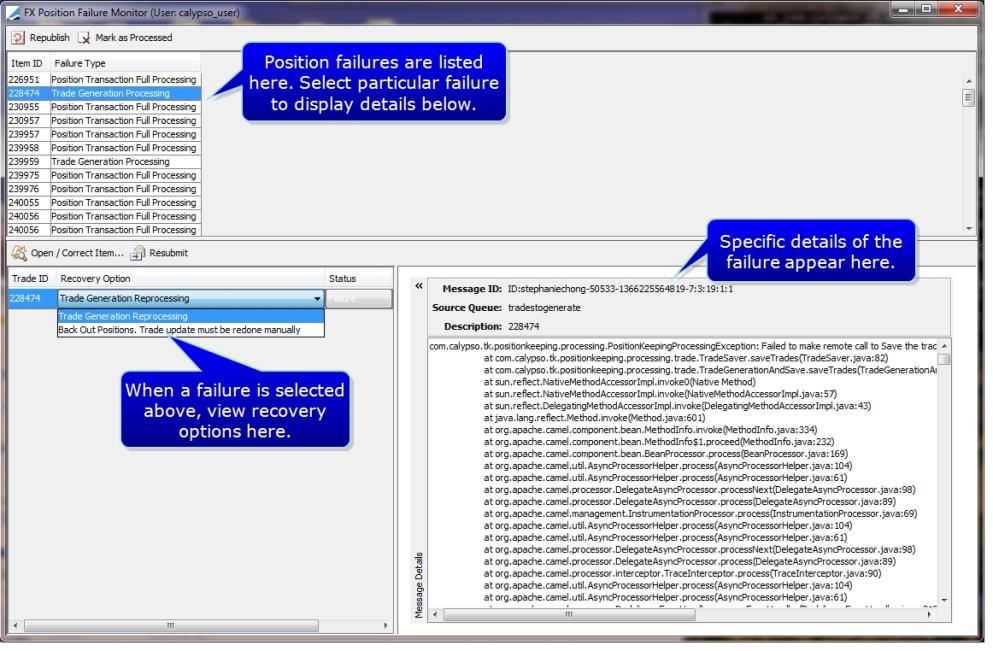

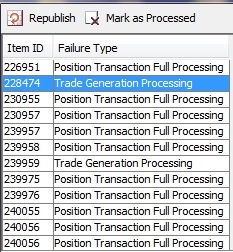

3. FX Position Failure Monitor

The FX Position Failure Monitor details any failures in either trade generation processing or position transaction processing that will affect the accuracy of the data contained in the Position Monitor. You can view the Position Failure Monitor in one of two ways. Either select Position & Risk > FX Position Monitor > FX Position Failure Monitor from Calypso Navigator. Or, in Deal Station, click the Failure Monitor icon in the top right side of the window. This icon ![]() in Deal Station, also appears with a red slash through it when there is a position failure. The details of this window are described below. Menu Action

in Deal Station, also appears with a red slash through it when there is a position failure. The details of this window are described below. Menu Action positionkeeping.processing.admin.failures.PositionKeepingFailureMonitor.

Note: The domain PKSFailureStatusPollingInterval is used to set how often a failure status is looked for. Default is 5000ms.

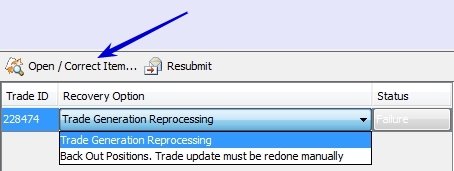

Step 1 - Select the failure item to resolve.

Step 2 - Once the failure item is selected, it appears in the lower portion of the window. In this area, select the recovery option for this failure and click Open/Correct Item.

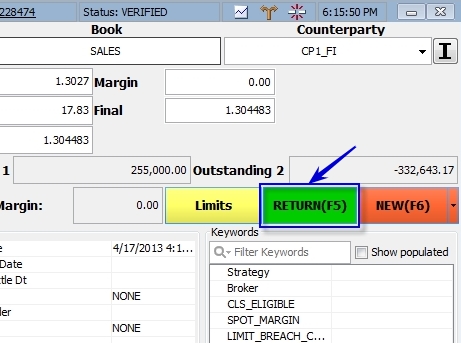

Step 3 - The trade that caused the failure will open in Deal Station, with Return instead of Save displayed.

Fix the error and click Return.

Step 4 - You will then be returned to the Failure Position Monitor. Click

Step 5 - After the trade has been resubmitted, click  to republish the list. Once the list is republished, you should not see the trade listed in the list if the procedure was successful.

to republish the list. Once the list is republished, you should not see the trade listed in the list if the procedure was successful.

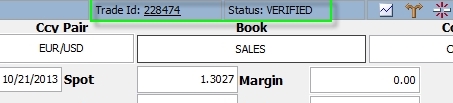

Step 6 - You can then look up the trade to verify that it was saved successfully.

4. FX Position Scheduled Tasks

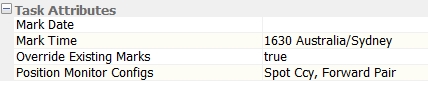

4.1 CREATE_FX_POS_MON_MARKS

This scheduled task takes a snapshot of the FX Position Monitor report’s positions and stores them in the database as marks. The FX Position Monitor marks can later be accessed by the mark date time. A specific mark date can be input in the parameter. If it is not set up, the scheduled task run date is the mark date. The mark time is a drop down that lists all the mark reference times that were set up for the system.

It is possible to select specific Pricing Monitor Configurations for the scheduled task. Not selecting a specific set of configurations results in marks being created according to all position configurations defined. Selecting specific configurations helps in the following cases:

| • | If there are configurations defined only for live views and not for any columns that require marks, those configurations can be filtered out during the scheduled task execution. |

| • | If the optimization results in a long execution time or memory footprint for the scheduled task execution, this option can be used to break down the marks generation into multiple scheduled task runs. |

The mark reference time and timezones can be defined in the PositionKeepingMonitor.MarkRefTimes domain value.

Ⓘ Official PL should be used to track PL, including FX trades. Cross asset OPL should be used to do any PL sweeping.

Note: It is recommended for the CREATE_FX_POS_MON_MARKS scheduled task definition that the following JVM Setting be used: -Dcalypso.appname=PositionKeepingClient.

To ensure that the Official PL sell off (Simple Transfer) trades' positions are part of the mark reference, the scheduled task CREATE_POS_MON_MARKS must be run after the sell off trades are created. This mark reference (time) can still point to the same EOD as the Official PL task, but the marks scheduled task has to be run after the Official PL task has been successfully run.

4.2 FX_MARGIN_SWEEP_POSITIONAL_TRADES

This scheduled task is used to sweep foreign currency left in a Sales book as Margin and exchange it for base currency, leaving the foreign currency risk in the desired trading book.

This includes only FX positional trades, FX Spot, FX Forward and FX Swap. It covers simple transfers such as PL selloffs which have currency pair attributes and generate positions in the FX Position Monitor.

Non-positional FX products will be addressed at a later time.

The FXMarginConfig attribute is used to designate a sweeping configuration and is optional.