Generating Corporate Actions for Warrants

Several events can occur in the life of Warrants and Certificates:

| • | Mark-Up: The issuer increases the size of its issuance. It will be captured as a new trade similar to an issuance. |

| • | Mark-Down: The issuer decreases the size of its issuance. It can be captured as a closing trade on the issuance product. Calypso also allows for generation of these trades with a Corporate Action. |

| • | Expiry: At maturity, if the product is “out the money” (i.e., the underlying does not reach the strike), a Corporate Action will close all liquidated positions and inventory positions on the related product. |

| • | Exercise: When the product is “in the money”, the issuer can totally or partially close its issuance and pay performance or/and deliver the underlying product to the owners of the Warrants. A Corporate Action will close all liquidated positions and inventory positions, and will create a transfer for the payment of the performance and/or a new trade for the buy/sell of the underlying product. |

| • | Assignment: Once the underlying product reaches the strike of the Warrant, each owner can assign the issuer in order to receive the performance and/or the underlying product. A Corporate Action on the issuance product will close all positions, and will create a transfer for the performance and/or a trade on the underlying product. |

| • | Barrier Deactivation: Once the strike is reached, the product is deactivated. It is not tradable anymore. At maturity, a Corporate Action will close all positions and will create a transfer for the performance and/or a trade on the underlying product. |

| • | Strike / Parity / Name / ISIN change: The product can be updated in the Static Data. But if accounting events are needed, a new product will be created, and a Corporate Action will transfer all positions from the old product to the new one. |

| • | Maturity Date change: The product is updated in the Static Data and the new maturity date is propagated to the trades using the Process Trade. |

| • | For warrants in which dividends are passed, a Corporate Action will be created on the dividend ex-date. This only applies to warrants with an equity as an underlying. |

| • | Coupons on Certificates: Use the same Corporate Action used for Bonds. |

Exercising European Warrants

If the domain “Allow_Warrant_Exercise_On_Any_Date” does not exist or is empty, European Warrants cannot be exercised before Maturity. If it contains Value = true, Warrants can be exercised on any date.

1. Creating Corporate Actions

Choose Trade Lifecycle > Corporate Action > Corporate Action to open the Corporate Action window as shown below.

For coupons on certificates, the Corporate Actions can be automatically generated.

Refer to Calypso Corporate Actions documentation for details.

Refer to Calypso Corporate Actions documentation for details.

Otherwise, you can define the Corporate Actions manually, as described below.

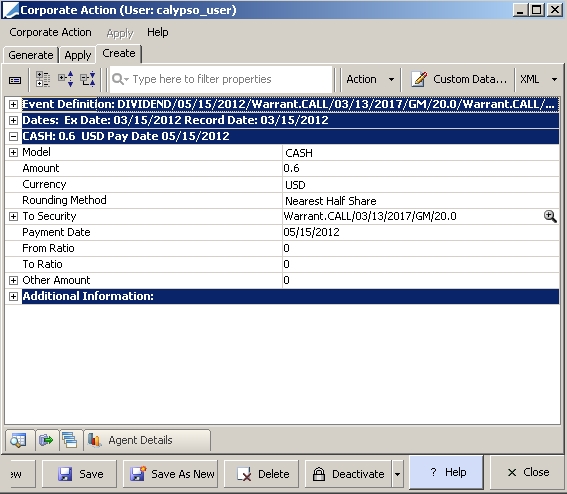

To define a Corporate Action, choose Calypso Navigator > Trade Lifecycle > Corporate Action > Corporate Action and select the Create panel as shown below.

When capturing a Corporate Action on a Warrant or a Certificate, if an issuance position exists on this product, a second Corporate Action is automatically created on the Issuance product. The opposite is not true when capturing a Corporate Action on an Issuance product.

Sample Warrant Corporate Action

| » | To define a Corporate Action on a Warrant or a Certificate, enter the fields described below. |

| » | See Option Corporate Action below for delivery options for Corporate Actions. |

| » | Then click Save. |

Fields Details

|

Fields |

Description |

||||||||||||||||||

|

Product |

Select a Warrant or a Certificate from the product chooser .... |

||||||||||||||||||

|

Model |

Select the model: EXERCISE: The product is "in the money”. Cash performance could be paid and underlying product could be delivered. The Warrant positions are closed. EXPIRY: The product is “out the money”. The Warrant positions are closed. |

||||||||||||||||||

|

Sub Type |

Select the model’s subtype. For model EXERCISE

For model EXPIRY

When the IPA is defined on the WarrantIssuance product or CertificateIssuance product, the CA Option trades are generated with the counterparty role IPA instead of Agent. This only applies to CA Option trades EXERCISE and EXPIRY for the EXERCISE_FEE. |

||||||||||||||||||

|

Other fields |

The other data are managed in the same way as the other Corporate Actions. |

1.1 Option Corporate Action

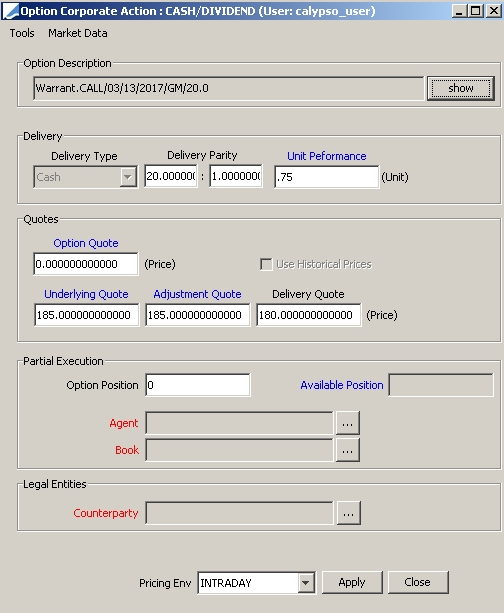

Choose Action > CA Option to bring up the Option Corporate Action window.

Option Corporate Action window

| » | Enter the fields described below, then click Apply. |

Delivery Details

|

Fields |

Description |

||||||||||||||||||||||||

|

Delivery Type |

Initialized by default from the product. It should be changed only for products which have the delivery type “Not known”. |

||||||||||||||||||||||||

|

Delivery Parity |

Initialized by default from the product. It could be changed for products with “Mix” or “Physical” delivery. |

||||||||||||||||||||||||

|

Unit Performance |

Enter the unit performance amount to pay, or click the heading to calculate it.

This field is not editable for products with “Physical” delivery. |

Quotes Details

|

Fields |

Description |

|

Option Quote |

Enter a quote when you want to close your Warrant positions at a fixed price, instead of zero. Click the heading to feed the field from the product quotes (at Ex Date). Default value is zero. |

| Use Historical Prices | Tick this checkbox when you want to close your Warrant positions at historical price. It should be used only in case of Barrier Deactivation. |

|

Underlying Quote |

Enter a quote which will be used to calculate the Unit Performance. Click the heading to feed the field from the product quotes (at Ex Date). This field is not editable for products with “Physical” delivery. Default value is zero. |

|

Adjustment Quote |

This quote will be used to valuate the Adjustment position. Click the heading to feed the field from the product quotes (at Ex Date). Default value is zero. |

|

Delivery Quote |

Enter the delivery price of the underlying product. This field is not editable for products with “Cash” delivery. Default value is the Strike of the product. You can disable the automatic population by setting the environment property AUTO_FEED_DELIVERY_QUOTE to false. |

Partial Execution Details

|

Fields |

Description |

|

Option Position |

Enter a number of Warrants if you want to apply the Corporate Action to a specified quantity. Default value is zero and means that the Corporate Action is related to the whole position. |

|

Agent |

When the previous field is fed, you must capture a Corporate Action by position managed in Calypso. Enter the Agent of your Inventory Position. A click on the red heading resets the field. |

|

Book |

When the previous field is fed, you must capture a Corporate Action by position managed in Calypso. Enter the Book of your Inventory Position. A click on the red heading resets the field. |

Legal Entities Details

|

Fields |

Description |

|

Counterparty |

This field should be filled only in case of Assignment. If you need to identify it, enter the Counterparty which wants to Assign the Issuer. A click on the red heading resets the field. |

Tools Menu

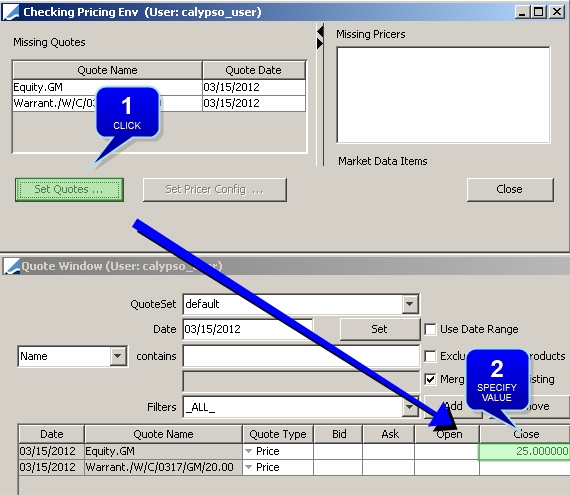

You can choose Tools > Check Quotes to check if quotes are missing (at Ex Date) on Warrants and Underlyings, and you can capture them directly by clicking Set Quotes.

2. Corporate Action Process

2.1 Checking for Missing Information

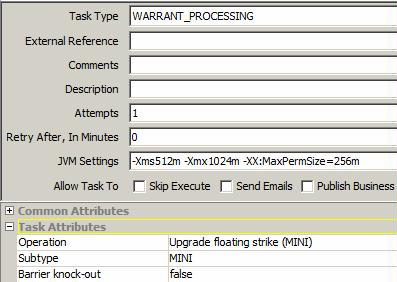

Prior to applying the Corporate Actions, you can run the scheduled task WARRANT_PROCESSING. It allows checking that all information is available prior to applying the Corporate Actions.

It generates exceptions for any missing information.

This only applies to expiring or knocking out CBBC and MINI warrants.

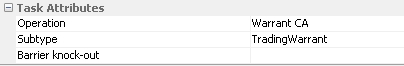

| » | Set the attributes as needed. |

"Operation = Upgrade floating strike (MINI)"

Only applies to the MINI subtype.

You can run the scheduled task with "Operation = Upgrade floating strike (MINI)" and "Barrier knock-out = false". If either strike or stoploss (barrier) quotes are missing, an exception is created: “strike <quote name> for warrant <description> <product id> is missing on value date <value date>”.

"Operation = Warrant CA"

Only applies to the MINI and CBBC subtypes.

You can run the scheduled task with "Operation = Warrant CA" and "Barrier knock-out = true".

| • | For the MINI subtype – If either strike or stoploss (barrier) quotes are missing then an exception is created: “barrier <quote name> for warrant <description> <product id> is missing on value date <valuation date>”. |

| • | For the CBBC subtype – If session1 or session2 quotes are missing, an exception is created: “Missing <quote name1> & <quote name2> for warrant <description> <product id> are missing on value date <value date>”. |

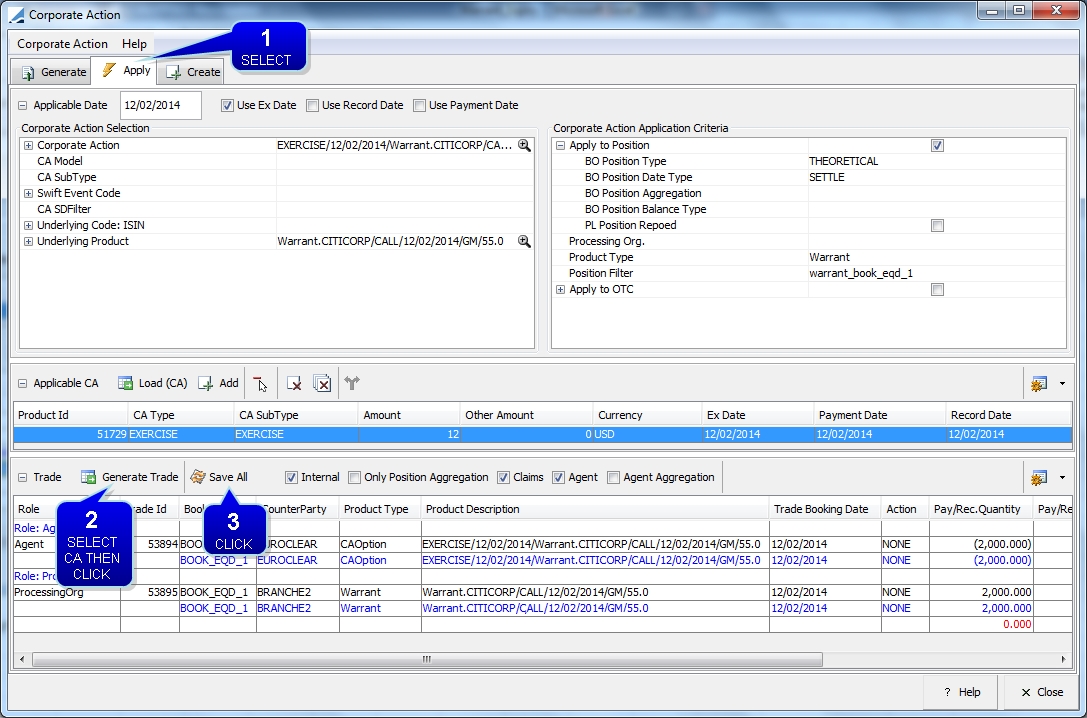

2.2 Applying the Corporate Actions

To apply a Corporate Action, from Calypso Navigator choose Trade Lifecycle > Corporate Action > Corporate Action and select the Apply panel as shown below.

Corporate Action window - Apply panel

| » | Click  to display Corporate Actions corresponding to criteria specified in the upper section of the Apply panel. You can click to display Corporate Actions corresponding to criteria specified in the upper section of the Apply panel. You can click  to add Corporate Actions using the Product Chooser Window. to add Corporate Actions using the Product Chooser Window. |

| » | Click  to retrieve the positions and compute the Corporate Action trades to be created. Positions are calculated based on transfers by the Inventory Engine. to retrieve the positions and compute the Corporate Action trades to be created. Positions are calculated based on transfers by the Inventory Engine. |

Refer to the Calypso Cash Management User Guide for information on generating back office positions.

Refer to the Calypso Cash Management User Guide for information on generating back office positions.

| » | Click  to create the Corporate Action trades. to create the Corporate Action trades. |

Number of Securities

Firstly, the Corporate Action process calculates the number of securities which can be processed, depending on the Expiry Size set up in the product.

Number of expiry size lot exercised = INT [Warrant Position / expiry size]

When the product is “in the money” and if the position is not a multiple of the Expiry Size, the exceeding part of the position (lost quantity) cannot participate to the Corporate Action calculations (performance and/or underlying delivered). But the whole position is closed.

Lost Quantity = Warrant Position - Exercised Quantity

Physical and mix warrant or certificate, the number of underlying securities to deliver is calculated by warrant, based on the expiry quantity.

Delivered Quantity = INT [Parity2 / Parity1 * expiry size] * number of expiry size lot exercised

If the Warrant position is not a multiple of the parity, a part of this position cannot be converted into the underlying product. But it often happens that the Issuer converts this part into cash.

Adjustment Quantity = [(Parity2 / Parity1 * expiry size * number of expiry size lot exercised) - Delivered Quantity]

When the product is “in the money”, the Issuer will pay the owner(s) as follows.

Performance

Calculated in case of “Cash” or “Mix” delivery. The Unit Performance is related to one Warrant held.

Vanilla products:

Unit Performance = Abs(Underlying quote - Strike) / Parity

Capped Call:

Unit Performance = [Min(Underlying quote, Strike2) - Strike] / Parity

Capped Put:

Unit Performance = [Strike - Max(Underlying quote, Strike2)] / Parity

Quanto:

Unit Performance = Abs(Underlying quote - Strike) / Parity * 1 / FX rate

Exotic Warrant and Certificate:

No unit performance.

Compo products:

The Unit Performance is calculated in the product currency, taking into account the FX rate set up in the product.

Performance = Exercised Quantity * Unit Performance

Barrier:

Unit Performance = Abs(final reference price - Strike) / Parity

MINI:

Unit Performance = Abs(final reference price - Strike) / Parity

CBBC:

CBBC = Abs(final reference price - Strike) / Parity

For bull CBBC, the final reference level is the lowest of the two special quotes.

For bear CBBC, the final reference level is the highest of the two special quotes.

Adjustment Valuation

In case of “Physical” or “Mix” delivery, if the Warrant position is not a multiple of the parity, the part of the position that cannot be converted into the underlying product is valuated with the underlying quote or a specific quote captured in the CA for Option panel.

Adjustment Valuation = Adjustment Quantity * Underlying Adjustment Quote

Both amounts will generate a fee linked to the closing trades.

Ⓘ [NOTE: Physical delivery of International Warrants is a manual process. The delivery price and currency must be provided in Corporate Action options in order for the settlement to be completed]

3. Expiration Process

Warrant expiration can be done manually or by using scheduled tasks.

3.1 Manual Expiration

Generating the Corporate Action

First you need to generate the Corporate Action.

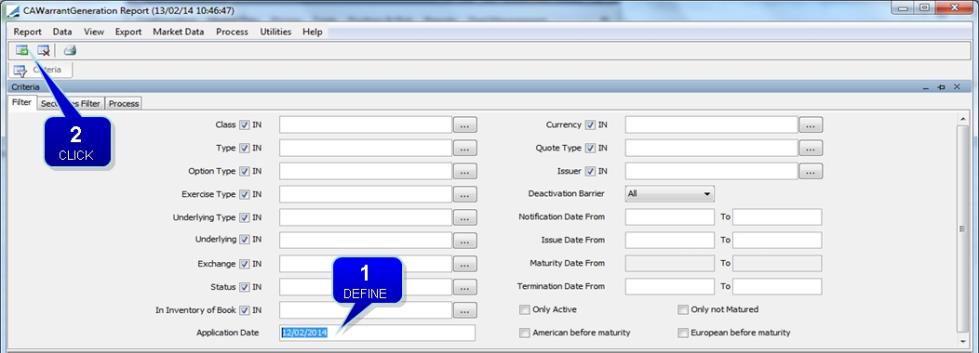

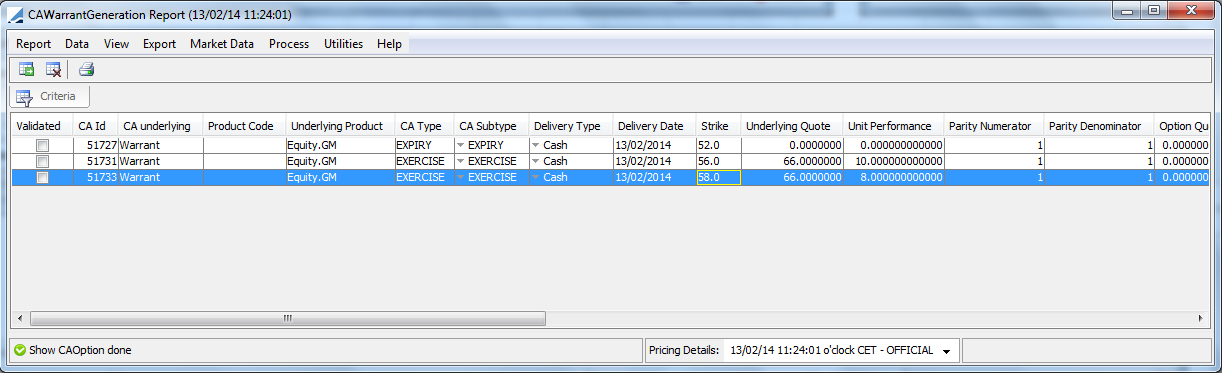

Choose Calypso Navigator > Trade Lifecycle > Corporate Action > CA Warrant Generation to open the CAWarrantGeneration Report window.

CAWarrantGeneration Report window - Filter panel

| » | Enter the expiry date in the Application Date field. |

| » | Click  . . |

CAWarrantGeneration Report window - Process panel

| » | Select the Process panel. |

| » | Tick the Underlying checkbox. |

| » | Click Update Quotes. |

| » | Click Validate All. |

| » | Click Apply. |

Applying the Corporate Action

After you have generated the Corporate Action, you need to apply it.

Double-click the Corporate Action to open it.

Corporate Action window - Apply panel

| » | Select the Apply panel. |

| » | Select the Corporate Action and click  . . |

| » | Click  . . |

3.2 Scheduled Task Expiration

Warrant expiration can be done with a sequence of two scheduled tasks which first generate and then apply a Corporate Action.

Generated Corporate Action

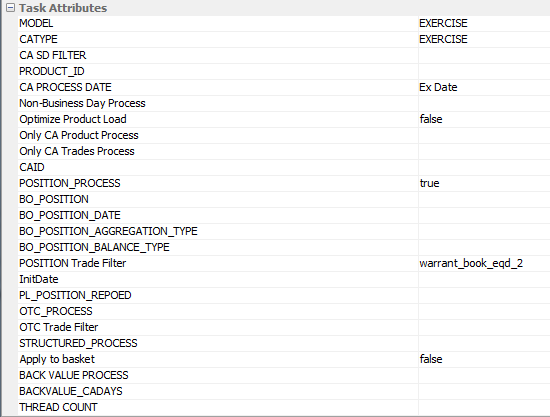

| » | Open the Scheduled Task Definition window and define a WARRANT_PROCESSING scheduled task with Task Attributes as shown below. |

| » | Run the scheduled task to generate the Corporate Action. |

| » | Then define a CORPORATE_ACTION scheduled task. |

| – | The MODEL and CATYPE Task Attributes both need to be set to EXERCISE. |

| – | Set the other Task Attributes as needed. An example is shown below. |

| » | Run the scheduled task to apply the Corporate Action. |