Capturing BEN Issuance Trades

An issuance trade allows configuring issues offered by a processing org.

To configure an issuance trade, navigate to Trade > Equity Derivatives > Issuance (menu action trading.TradeIssuanceWindow).

|

Issuance Quick Reference

Entering Trade Details

Or you can enter the trade fields directly. They are described below. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

Trade Lifecycle

|

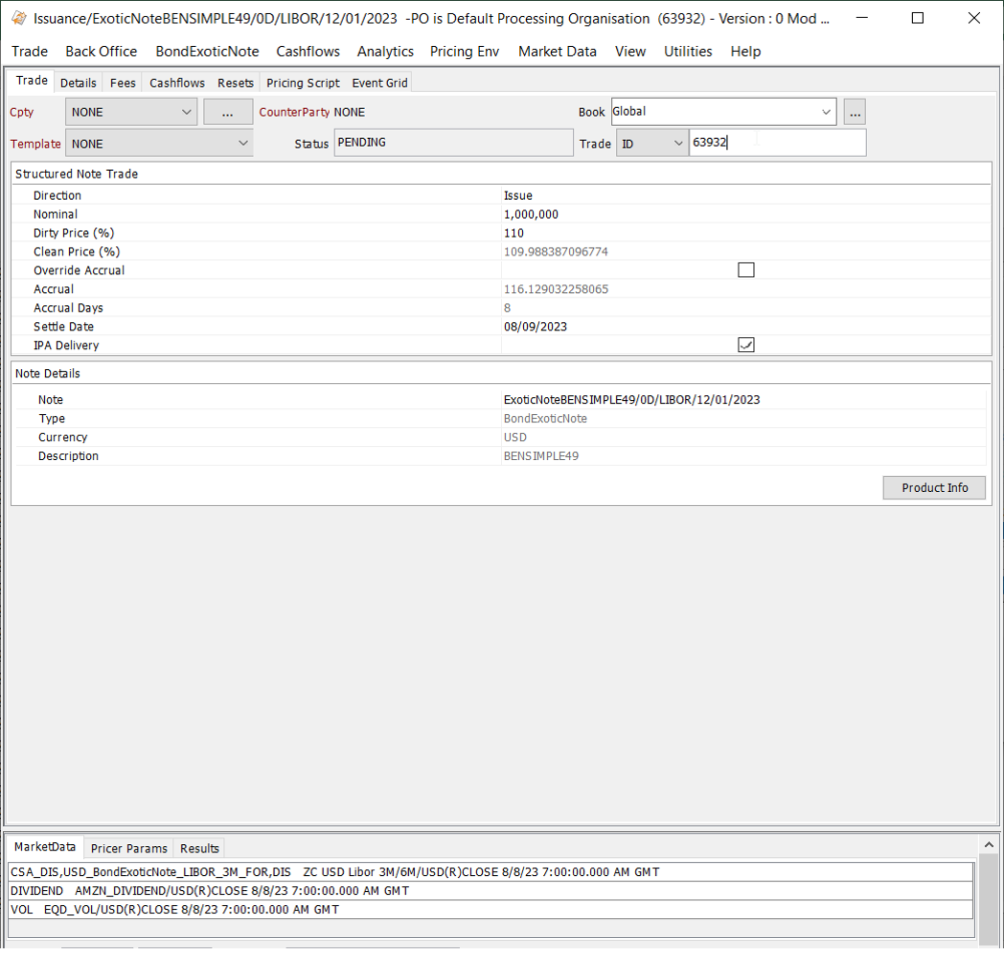

1. Sample Issuance Trade

Ben issuance trades can be booked using Direction 'Issue'.

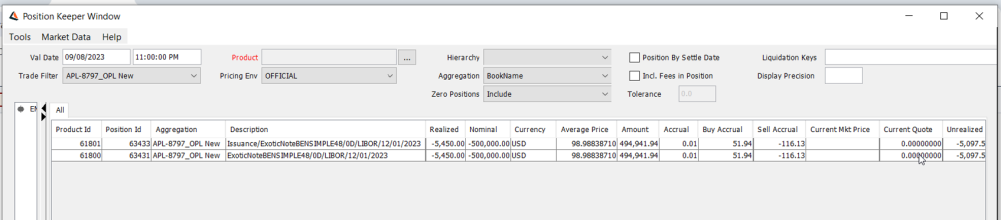

2. Issuance Position

From the Calypso Navigator, navigate to Position & Risk > Positions to view the open position of the issuance, provided the liquidation is running.

Note that the system creates an Issuance product linked to the bond exotic note, when the Issuance Trade is validated.

3. Issuance Corporate Actions

From the Calypso Navigator, navigate to Trade Lifecycle > Corporate Action > Corporate Action to generate corporate actions. The Corporate Action window will appear as shown below.

The characteristic of corporate actions on issuance trades is that they are generated on the Issuance product created by the system and not on the bond exotic note of the issuance trade.

| » | Enter the start and end dates as applicable. |

| » | Click Select Product and choose the Issuance product as shown below. |

| » | Then click Generate to generate the corporate actions. |

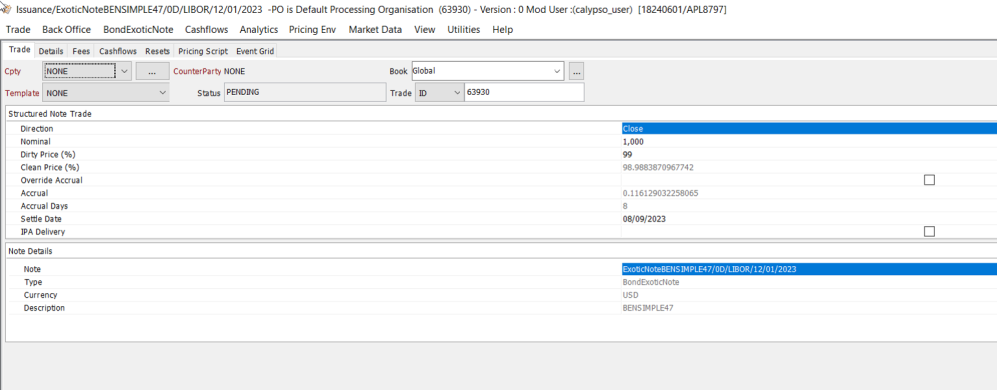

4. Closing an Issuance

You can close an issuance by entering a Closing trade on the bond exotic note, using the Bond exotic window to buy back the bond exotic note.

The Closing trade will liquidate the entire open position of the bond exotic note.

5. Issuance Activity

5.1 Issuing a Bond Exotic Note

The issue corresponds to the sale of a note from the perspective of the processing org.

For an issue, the note should have the following characteristics:

| • | The Issuer should be the processing org of the selected book. |

| • | The Issue Paying Agent (legal entity or role IPA) should be populated on the bond. The IPA handles the coupon payments for the issuer and will be used in the corporate action process. |

5.2 Upsizing a Bond Exotic Note

Once a note has been issued but not yet settled, you can use that action to modify the total issued on the bond. Select the note that has been issued, and enter a nominal amount to increase the total issued.

5.3 Re-Opening a Bond Exotic Note

After the settlement date of the issue, you can still increase the total issued of the note using that action. You can enter a different price, and accrued interest will be computed.

5.4 Closing a Bond Exotic Note

This action allows buying back the note.

See also -

See also -