ECMS - European Collateral Management System

The European Central Bank (ECB) has created a single European Collateral Management System (ECMS) to manage the assets used as collateral for Eurosystem credit operations for all of the Eruozone. Calypso supports the following ECMS requirements:

| • | Ability to identify ECMS margin call contracts |

| • | Management of Mobilisation (adding collateral) and Demobilisation (removing collateral) |

| • | Provided an Available Credit Line calculation, including maximum credit line, with specific trade attributes |

You can use ECMS as a central bank or as a central bank member.

1. Central Bank Functions

As a central bank, you can compute, aggregate and notify members of their credit line using the ECMS engine or using the COLLATERAL_CREDIT_LINE_CALCULATOR scheduled task.

1.1 ECMS Engine

The ECMS engine is configured automatically when Execute SQL is run. It subscribes to PSEventCreditLineCalc, PSEventMarginCallEntry and PSEventTransfer.

The engine allows a central bank to compute the aggregated credit line of its members and publish an event per member for message / notification purposes based on mobilisation transfer events.

Engine Parameter

By default, back dated transfers are not processed by the ECMS engine.

You can set engine parameter ALLOW_BACKDATED_PROCESSING = true to process back dated transfers in a test environment.

Ⓘ [NOTE: Setting ALLOW_BACKDATED_PROCESSING = true in a production environment is not supported]

Domain Values

There are two domain values required for the ECMS Engine.

Domain "ECMSEngineEventType"

Configured values should be CONFIRMED_SEC_DELIVERY and CONFIRMED_SEC_RECEIPT

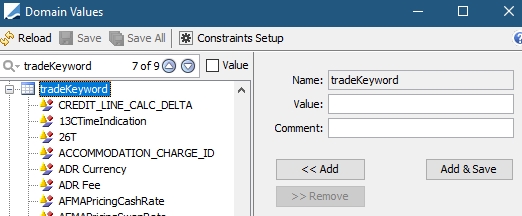

Domain "tradeKeyword"

The value CREDIT_LINE_CALC_DELTA should be added to the tradeKeyword domain.

1.2 Scheduled Task COLLATERAL_CREDIT_LINE_CALCULATOR

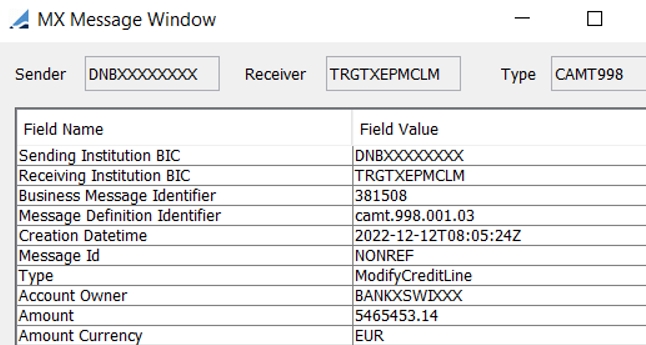

Execute the COLLATERAL_CREDIT_LINE_CALCULATOR scheduled task to generate the camt.998 messages.

This scheduled task allows a central bank to compute the aggregated credit line of its members and to publish CollateralCreditLineCalc events that allow generating camt.998 messages. Events are published only if all of the margin call entries for a given member are Fully Priced and if the FX rate is present in the system.

Setup Requirements

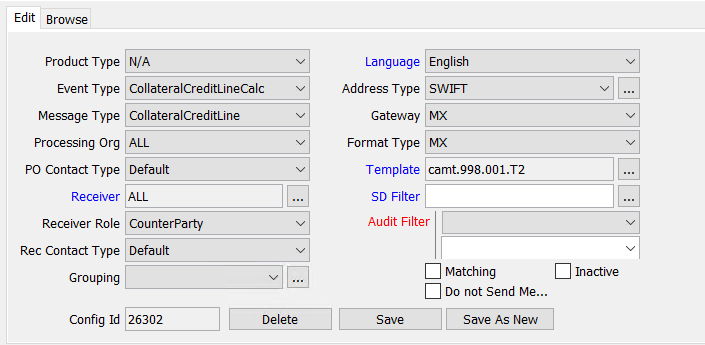

Domain "eventType"

Value = CollateralCreditLineCalc

This type of event is generated by the scheduled task COLLATERAL_CREDIT_LINE_CALCULATOR.

The message engine needs to subscribe to PSEventCreditLineCalc events in order to generate camt.998 messages.

Domain "messageType"

Value = CollateralCreditLine

Domain "MX.Templates"

Value = camt.998.001.T2

Domain "MX.T2"

Value = SAA.ReceiverCLM

Comment = <DN receiver full name>

Value = ReceiverDNCLM

Comment = <DN receiver>

Please refer to Calypo MX Payment Messages for complete details on the domain "MX.T2".

Please refer to Calypo MX Payment Messages for complete details on the domain "MX.T2".

Domain "MappingOutgoingWithContact"

Value = CollateralCreditLine

Comment = <contact type to be used for populating SWIFT BIC of counterparty account owner (tag AcctOwnr)>

Message Setup

Margin Call Contract

Additional Info - CREDIT_LINE_CALC = True

The scheduled task only processes margin call contracts where CREDIT_LINE_CALC = True.

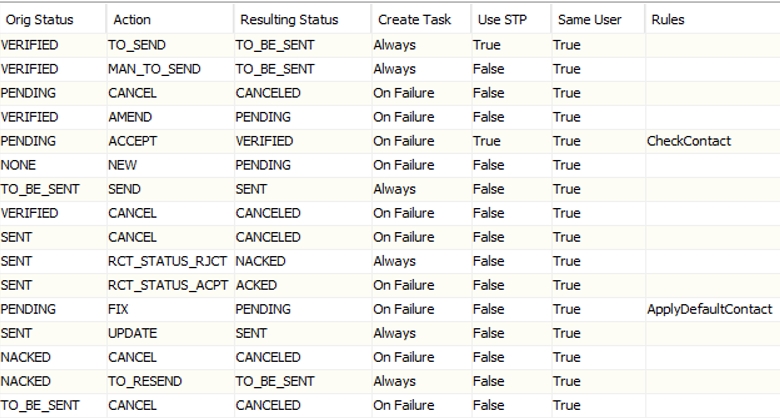

CollateralCreditLine Message Workflow

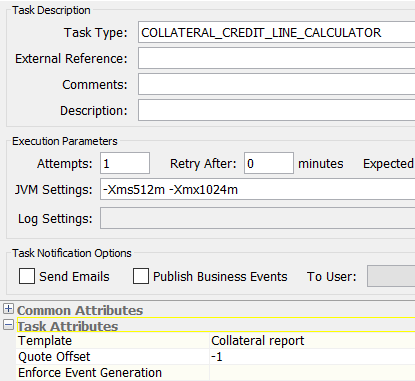

Scheduled Task

The attributes for the scheduled task are:

| • | Template - (optional) - Collateral Manager report template used to define the scope of the margin call contracts, and per extension, the members that will be processed by the scheduled task. |

| • | Quote Offset - (optional) - Set to 0, the system uses the closing FX quote as of the scheduled task value date. Set to -1, the system uses the closing FX quote as of the previous business day (scheduled task value date -1). |

| • | Enforce Event Generation - true or false - If set to false, an event is generated for the current member only if there is no entry in the database table collateral_credit_line for the member for that day and there is a Credit Limit value change since the previous run of the scheduled task. If set to true (default), an event is generated for all members without any check. |

Upon execution, CollateralCreditLineCalc events are generated. They are processed by the Message engine to generate camt.998 messages.

2. Central Bank Member Functions

As a central bank member, you can manage your ECMS contracts.

2.1 Contract Setup

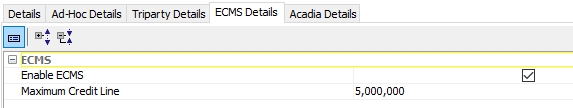

In the Details > ECMS Details panel, the Enable ECMS field must be selected and a Maximum Credit Line should be designated.

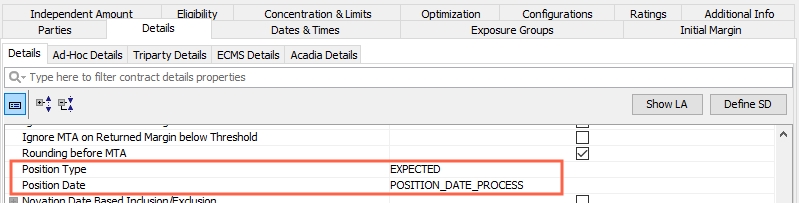

In the Details > Details panel, the Position Type should be set to EXPECTED and Position Date should be set to POSITION_DATE_PROCESS.

2.2 Mobilisation & Demobilisation

Mobilisation in the ECMS context is the process of adding a new collateral asset in the collateral counterparty account or increasing the collateral position of an existing asset.

Demobilisation is the process of removing a collateral asset from the collateral counterparty account or reducing the collateral position of an existing asset.

Demobilisation needs to be initiated by the counterparty and can be completed only if there is sufficient remaining collateral asset in value to cover the current outstanding credit line.

In case of mobilisation, the collateral position is updated in the counterparty collateral account only when asset has settled. In case of demobilisation, the collateral position is updated in the counterparty collateral account on the settlement date even if is not effectively settled.

Counterparties are responsible for ensuring that the mobilised assets are compliant with the ECB eligible asset list. However, if a mobilised asset is ineligible or become ineligible then the collateral value of this asset will be 0.

Cash mobilisation is allowed only at last resort in case of a margin call and no other eligible collateral is available. Once additional assets are provided and the sufficiency is resolved, ECMS will automatically demobilise the cash collateral.

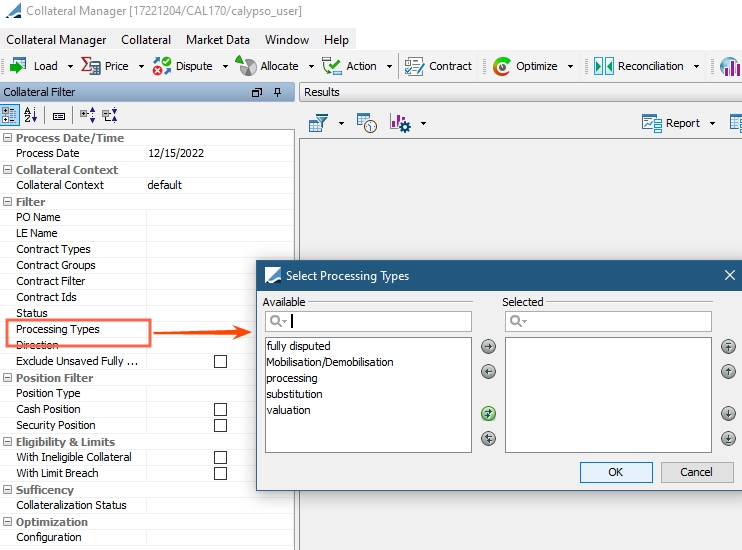

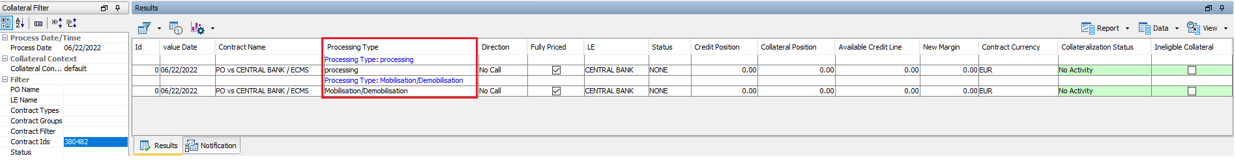

Mobilisation/Demobilisation should be chosen as a Processing Type in the Collateral Manager Filter.

2.3 Credit Line Calculation

Credit Line is calculated as the difference between the collateral value of all assets that are available and eligible as per the ECB eligible asset list and the value of the transactions open with the NCB.

Whenever this credit line becomes negative (under collateralization), ECMS issues a margin call to the counterparty which needs to bring additional eligible collateral or to reduce its credit line. If the counterparty doesn’t resolve the insufficiency by itself the NCB is allowed to directly debit the cash counterparty account.

It’s possible within ECMS to setup a Maximum Credit Line. This can be done either by the counterparty or the NCB. If a Maximum Credit Line has been set, then any collateral over the Maximum Credit Line in value will not be considered in the Credit Line calculation.

The Maximum Credit Line value is displayed at the margin call entry level in the Result panel of Collateral Manager and in the standalone Margin Call Entry Report.

For credit line calculation purposes, four fields are used:

• Net Balance (renamed as Credit Position) returns the exposure amount against the central bank.

• Total Previous Margin (renamed as Collateral Position) returns the valuation of the collateral available in the pool account. It returns the sum of the Contract Values available in the Netted Position. Note that if an asset is ineligible its contract value can be computed as 0 based on a setup on the margin call contract (standard functionality).

• Maximum Credit Line returns the current Maximum Credit Line, if set on the contract.

• Global Required Margin (renamed as Available Credit Line)

For ECMS contract, the following formula is used to compute the Global Required Margin:

If “Maximum Credit Line” is not equal to 0, Global Required Margin = Constituted Margin = Margin Required – (-1) * Min(ABS(Total Previous Margin), ABS(Maximum Credit Line))

If “Maximum Credit Line” is equal to 0 (or null), Global Required Margin = Constituted Margin = Margin Required –Total Previous Margin (Standard calculation)

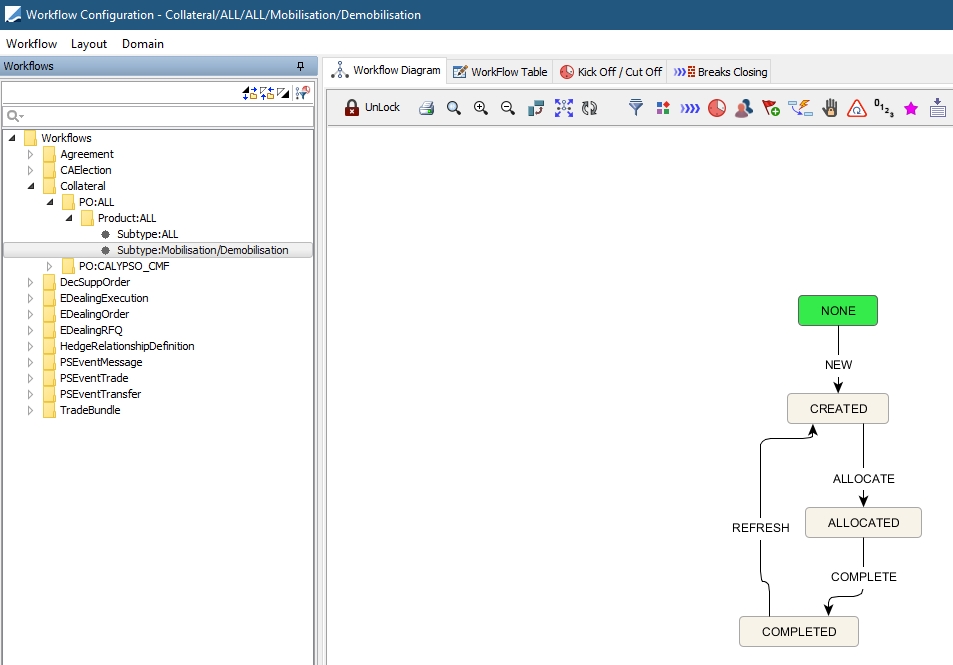

2.4 Workflow

A separate workflow is available for Mobilisation/Demobilisation entry types.

2.5 Allocation Process

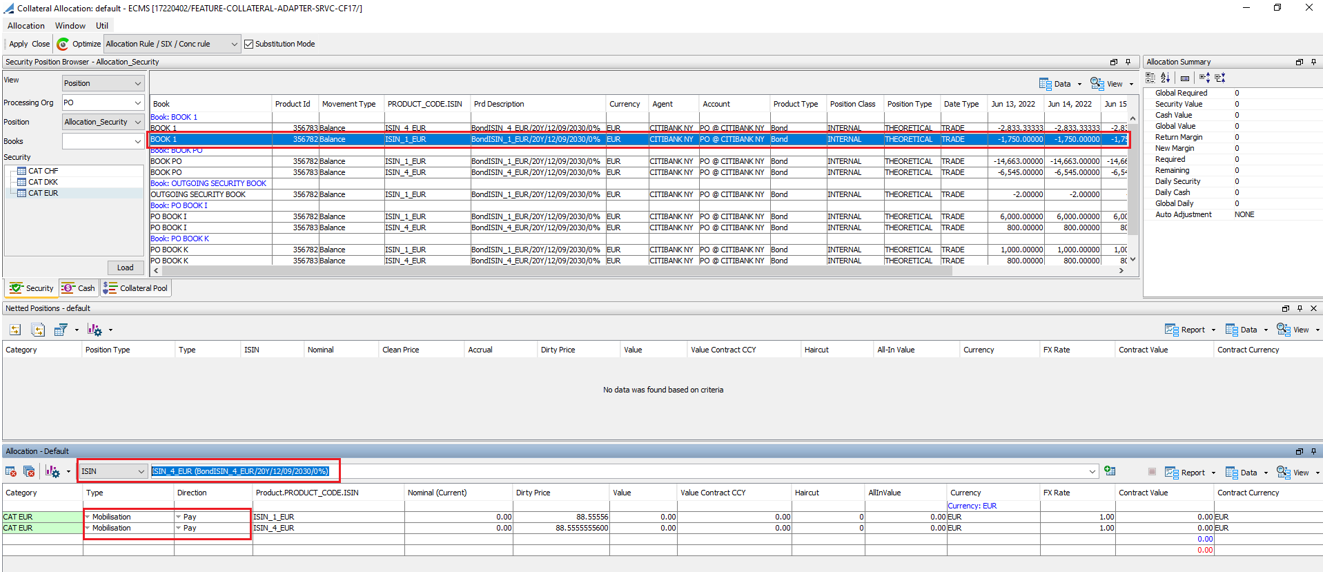

When the Mobilisation or Demobilisation allocations are booked using the Execute collateral workflow rule, a margin call trade is crated like any other type of allocation. The allocation type is propagated to the margin call trade in the Trade Attributes.

Mobilisation of Collateral

When initiating a Mobilisation of collateral, an allocation is created in the Allocation window from either the security browser or the quick entry field.

Allocation fields default as follows:

• Direction defaults to Pay (payment from PO to the Central Bank)

• Type defaults to Mobilisation

• Other fields default like regular allocations including valuation fields and eligibility

Demobilisation of Collateral

When initiating a Demobilisation of collateral, an allocation is created in the Allocation window from the Netted Position panel, allocation fields default as follows:

• Direction defaults to Receive (collateral return from the central bank to the PO)

• Type must be defaulted to Demobilisation

• Other fields default like regular allocations including valuation and eligibility