Collateral Pool

A collateral pool is a group of assets to which a user has access when executing an allocation, either automatic or manual. A collateral pool definition is used to create a collateral pool instance. A collateral pool instance is a list of assets, quantities and attributes (collateral positions). A collateral pool definition is defined by:

| • | an identifier (id/version/name/description) |

| • | a set of collateral sources |

| • | a pricing environment |

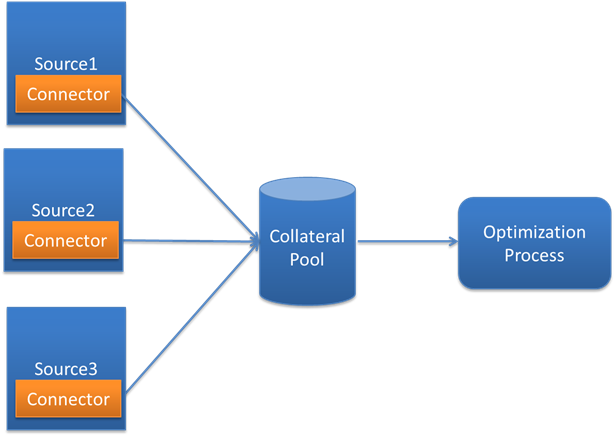

The Collateral Pool functionality consists of three main components: a Source, a Connector and the pool itself.

The connector is responsible for importing assets to a source. A Source is a list of Connectors and as well as a set of rules to provide a set of securities as output. For example, the securities can come from a CSV file if they are managed outside of the Calypso system, or from the inventory if they are managed within Calypso. You are free to define your own connectors. The Pool consists of the securities available in the different sources that are selected.

The Collateral Pool functionality is part of the Collateral Module.

1. Collateral Pool Setup

Below are the steps necessary to configure a collateral pool.

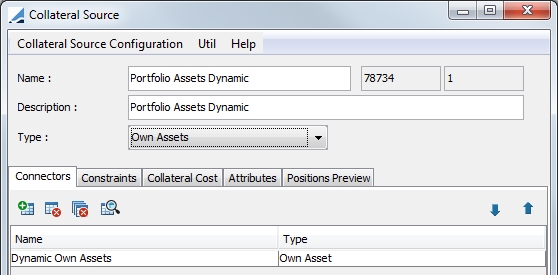

Step 1 - A source must first be created. To open the Collateral Source configuration window, from Collateral Manager, select Window > Configuration > Collateral Source from Collateral Manager.

Select a Source Type.

Step 2 - Define a Connector for the source. Choose from your defined connectors. Connector choices vary depending on selected Source Type.

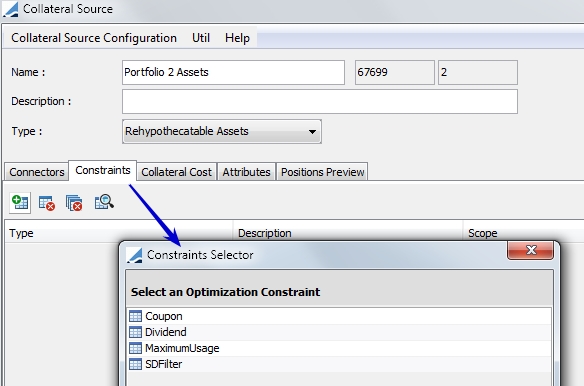

Step 3 - You may then define constraints that apply to all of the securities of this source. The definition of constraints is not mandatory.

Additional constraints can be defined in the Collateral.Pool.Constraint domain value.

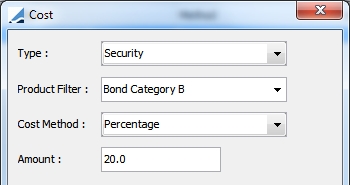

Step 4 - Collateral Cost modifies the optimization cost. It tells the optimizer the extra cost of the collateral. You must define how to configure this extra cost for each source using a static data filter.

This is also not mandatory.

The options for selection are Cash, Security or Source. The Source option allows any asset within the source to share a single cost, as well as allowing individual additional costs on assets within the Collateral Source.

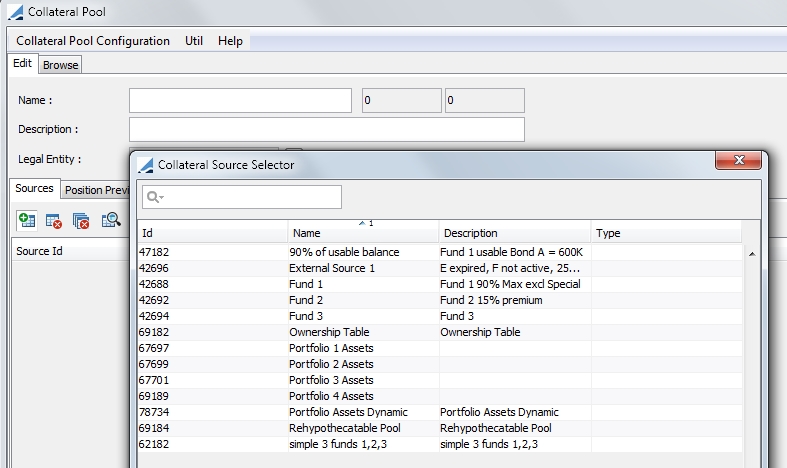

Step 5 - Once the source information has been created, the pool can be defined. From Collateral Manager, select Window > Configuration > Collateral Pool.

In the Source panel, you are able to select from the sources defined previously.

Step 6 - In the Position Preview panel, select pricer configuration details for the pool and preview the pool positions. From this panel, you are also able to price the positions, check market data, add, remove or edit positions. Attributes that pertain to the pool can be specified in the Attributes panel. The

You may create as many collateral pools as you wish.

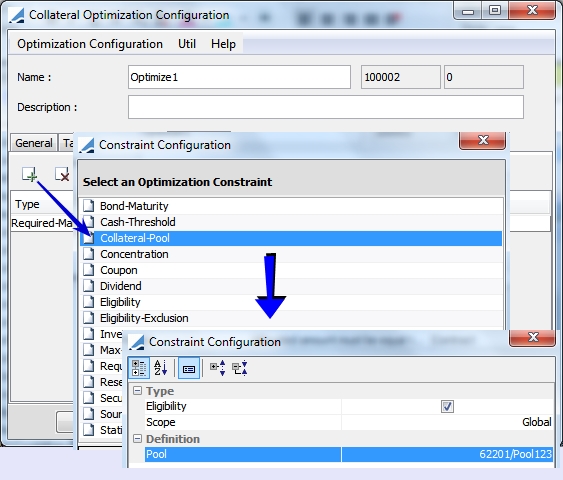

Step 7 - Replace the Inventory constraint from your Optimization Configuration with a Collateral-Pool constraint. Select Windows > Configuration > Optimization Configuration to display the Optimization Configuration window.

2. Collateral Source Configuration Window

The Collateral Source Configuration window contains a source Type field as well as five panels, which are described below.

2.1 Source Type

The Type field is used to designate the source type to be used. The available options are:

| • | Fund Ownership - This source analyzes the Fund Ownership Table which contains information about each Fund’s ownership in other funds. It will determine, for a given fund, which funds it has an ownership in and will populate the source with a percentage of each asset within those funds. When a fund utilizes assets from another fund, the system tracks the initial, used and available quantities of these assets. |

The Ownership Connector defined on this source allows the user to define how many levels to “look-through” to determine if a fund only has access to funds in which it has a direct ownership, or whether it should also look-through to sub funds. For example, if Fund 1 owns 10% of Fund 2 and Fund 2 owns 50% of fund 3, then Fund 1 can, in theory, have access to 5% of Fund 3’s assets. Define 1 level to only look at Fund 2’s assets. Define 2 levels to also look at Fund 3’s assets.

The Ownership Table used in the Connector for this source references the Ownership Ratio that is defined in the Fund window. Refer to Asset Management documentation for details on this window.

This is a dynamic Source Type, which means that this source needs to be defined only once in the system. When this source is added to a Collateral Pool, the system will determine the available assets for this source by fetching the assets for the Legal Entity tied to the Collateral Pool.

| • | Rehypothecatable Assets – This source looks for contracts which have received rehypothecatable assets. It then looks at underlying funds which have computed a Rehypothecation Ratio on these contracts and will determine how much of that rehypothecatable collateral is available for a given fund to pledge towards other obligations on other contracts. |

This is a dynamic Source Type, which means that this source needs to be defined only once in the system. When this source is added to a Collateral Pool, the system will determine the available assets for this source by fetching the assets for the Legal Entity tied to the Collateral Pool.

When using this source, to view the breakdown of netted Margin Call positions, the domain value breakdownNettedMarginCallPositions must be set to True. Note: This is a useful view for other sources as well.

| • | Own Assets – This source is an inventory of one or more trading book positions. |

This is a dynamic Source Type, which means that this source needs to be defined only once in the system. When this source is added to a Collateral Pool, the system will determine the available assets for this source by fetching the assets for the Legal Entity tied to the Collateral Pool.

| • | Other |

| • | External Assets |

2.2 Connectors

A connector is responsible for importing assets to a source. Click  to configure a connector. The available connectors vary depending on the Source Type selected.

to configure a connector. The available connectors vary depending on the Source Type selected.

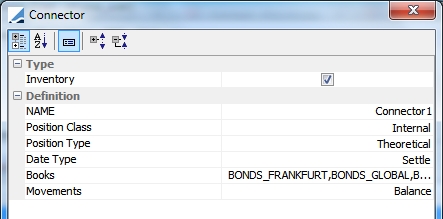

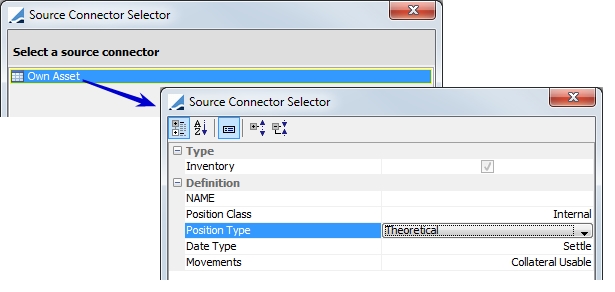

Own Asset Connector

This connector is used with the Own Assets Source Type.

|

Field |

Description |

|---|---|

|

NAME |

Enter a name for the connector |

|

Position Class |

Position class filter will always be Internal |

|

Position Type |

This can be any position defined in the Inventory Position such as Actual, Not Settled, Theoretical, etc... |

|

Date Type |

Date type used for the positions in this connector. Available, Booking, Settle or Trade Date |

|

Movements |

This will always be Collateral Usable |

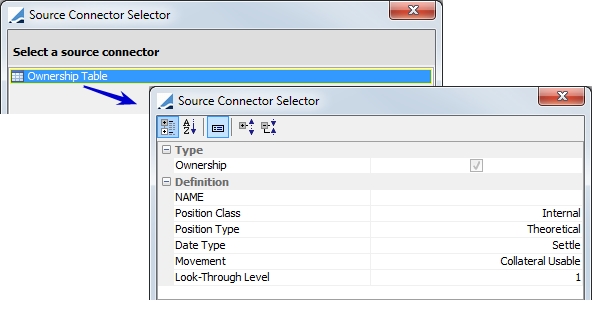

Connector Ownership Table

This connector is used with the Fund Ownership Source Type.

|

Field |

Description |

|---|---|

|

NAME |

Enter a name for the connector |

|

Position Class |

Position class filter will always be Internal |

|

Position Type |

This can be any position defined in the Inventory Position such as Actual, Not Settled, Theoretical, etc... |

|

Date Type |

Date type used for the positions in this connector. Available, Booking, Settle or Trade Date |

|

Movement |

This will always be Collateral Usable |

|

Look-Through Level |

Specify the number of levels to "look through" to determine if a fund only has access to funds in which it has a direct ownership or whether it should also look through to sub funds. For example, if Fund 1 owns 10% of Fund 2 and Fund 2 owns 50% of fund 3, then Fund 1 can, in theory, have access to 5% of Fund 3's assets. Define 1 level to only look at Fund 2's assets. Define 2 levels to also look at Fund 3's assets. |

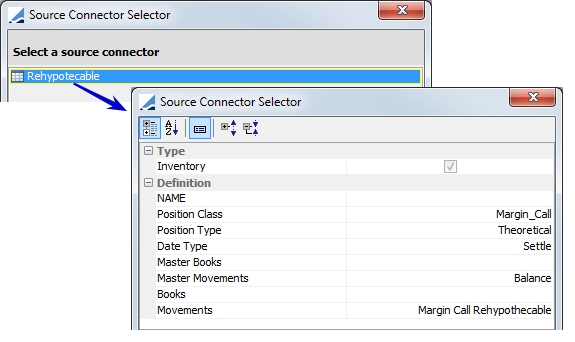

Connector Rhypothecable

This connector is used with the Rhypothecable Assets Source Type.

|

Field |

Description |

|---|---|

|

NAME |

Enter a name for the connector |

|

Position Class |

Position class filter will always be Margin_Call |

|

Position Type |

This can be any position defined in the Inventory Position such as Actual, Not Settled, Theoretical, etc... |

|

Date Type |

Date type used for the positions in this connector. Available, Booking, Settle or Trade Date |

|

Master Books |

Select |

|

Books |

|

|

Movement |

This will always be Collateral Margin Call Rehypothecable |

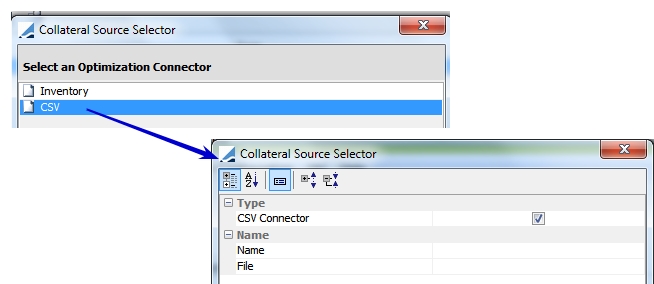

Inventory & CSV Connectors

The Inventory and CSV connectors are used with both the External Assets and Other Source Types.

|

Field |

Description |

|---|---|

|

Name |

Enter a name for the CSV connector |

|

File |

Select the name of the CSV file |

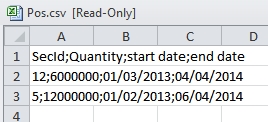

Example of CSV file:

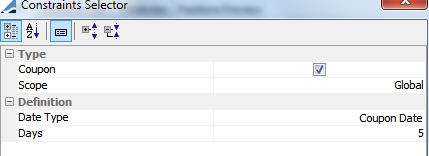

2.3 Constraints

This panel allows you to define constraints that apply to the securities of this source. The designation of constraints is not mandatory.

|

Constraint |

Description |

|---|---|

|

Coupon |

Do not use a position if a coupon payment is to occur in the next 'x' number of days.

Date Type: select Coupon Date or Record Date Days: If a coupon payment is to occur under the designated number of days, the security is not used as part of the collateral source. These are business days, using the security holiday calendar. |

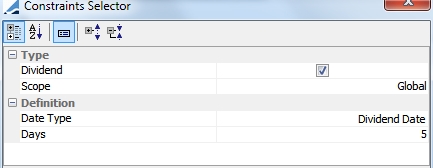

|

Dividend |

Do not use a position if a dividend payment is to occur in the next 'x' number of days.

Date Type: Date type description, Coupon Date or Record Date Days: If a dividend payment is to occur under the designated number of days, the security is not used as part of the collateral source. These are business days, using the security holiday calendar. |

|

MaximumUsage |

This limits a position usage to a designated maximum percentage. |

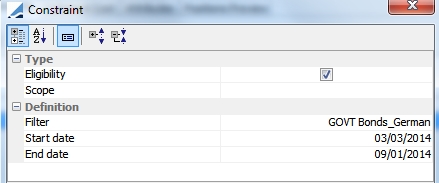

|

SDFilter |

Do not use a position if a security belongs to a designated static data filter.

Filter: Select the desired static data filter Start date: Exclude positions if a security matches a static data filter after the start date. The start date is compared against the value date of the margin call entry. End date: Exclude positions if a security matches a static data filter before the end date. The end date is compared against the value date of the margin call entry. |

|

Volatility |

Exclude a security when the volatility is lower than the minimum authorized, based on the security's holiday calendar. Enter the minimum number of days needed between the value date and the end date of the security. |

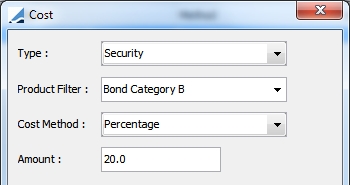

2.4 Collateral Cost

This panel allows you to specify an extra optimization cost for the collateral issued by this source. The Source option allows any asset within the source to share a single cost, as well as allowing individual additional costs on assets within the Collateral Source.

The collateral source will provide what is the extra optimization cost for the collateral issued by this source.

The cost will be defined by several methodologies:

| • | Percentage (add 2% to the collateral cost) |

| • | Add (add x basis point to the collateral cost) |

| • | Override (set the collateral cost to x) |

| • | No Modification |

The collateral cost will be defined by security category

2.5 Attributes

Attributes are information that you can put on your pool or on your sources, such as a custom rule. They are not used by Calypso, but they may be used in client custom code.

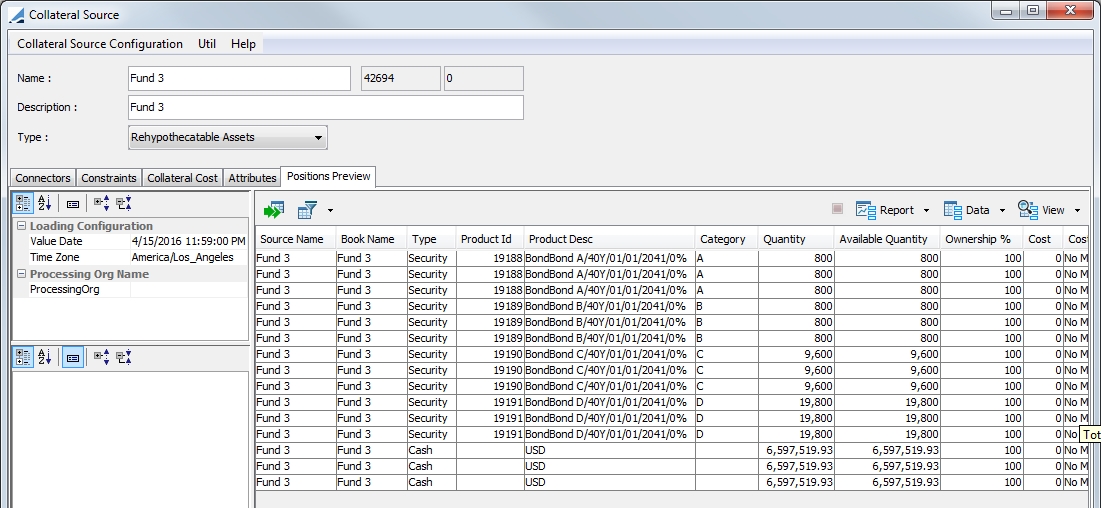

2.6 Positions Preview

This panel provides a preview of the positions which are included in this source as well as the ability to configure the display of this information.

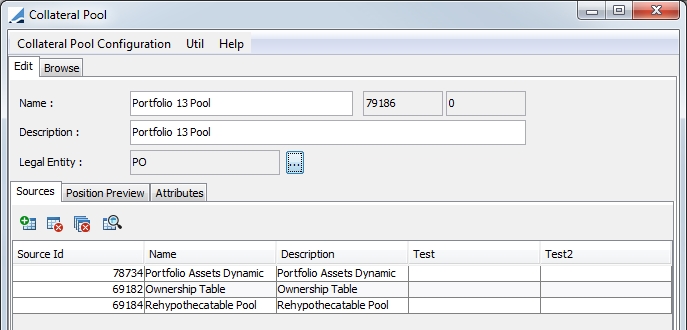

3. Collateral Pool Configuration Window

Below is a description of the panels in the Collateral Pool Configuration window.

Enter the Name and Description of the Collateral Pool. The Legal Entity designation is used when allocating collateral, indicating which Collateral Pool to fetch when allocating to an Exposure Group.

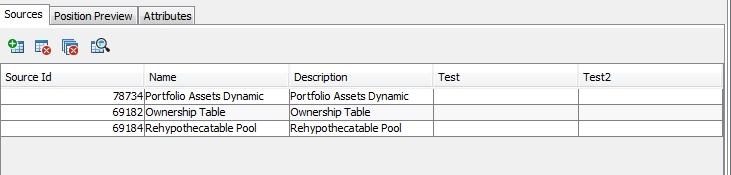

3.1 Sources

From this panel, you are able to select the source or sources for the Collateral Pool. You are also able to select a source and click the edit button  to display the Source Configuration window and directly edit the source.

to display the Source Configuration window and directly edit the source.

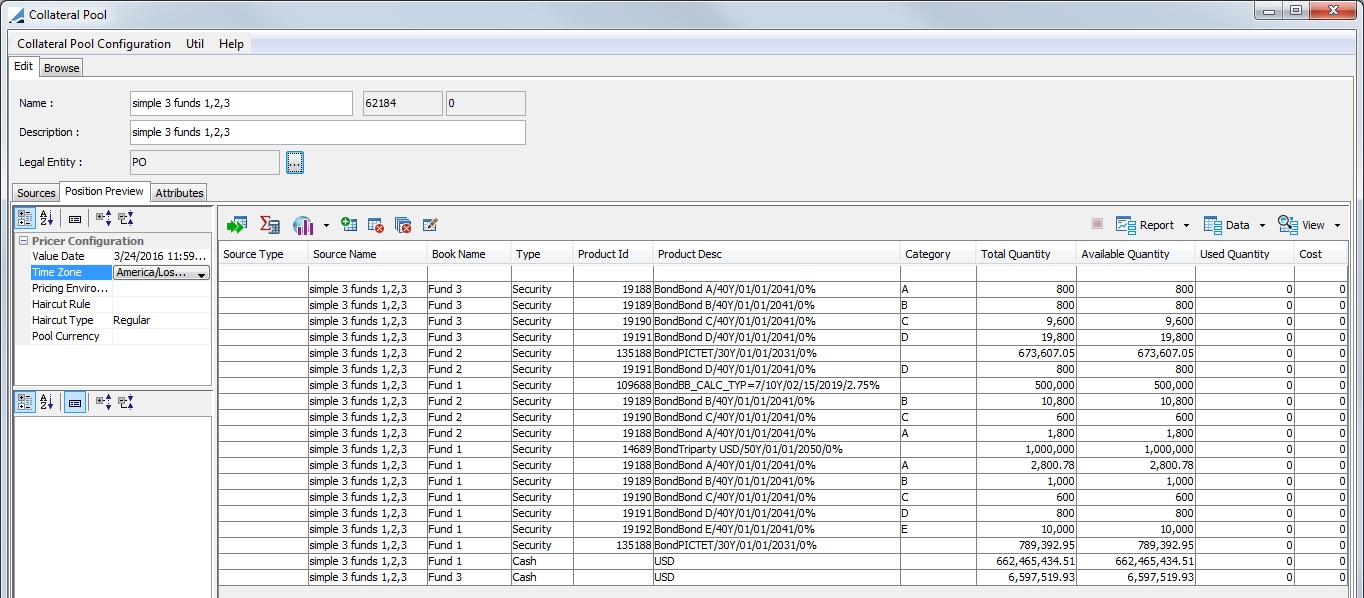

3.2 Position Preview

This panel allows you to display a preview of the positions which are included in this Collateral Pool as well as configure the display of this information.

3.3 Attributes

Attributes are information that you can put on your pool or on your sources, such as a custom rule. They are not used by Calypso, but they may be used in client custom code.